Midea Group(000333)

Search documents

美的被罚500万?京东卷入“二选一”;炒黄金期货赚14亿辞职?报警;雷军年涨1960亿;00后用打印机造250万假币|| 大件事

Sou Hu Cai Jing· 2025-10-29 10:44

Group 1: Midea and JD.com Controversy - The rumor that Midea Group was fined 5 million yuan by JD.com for violating "choose one from two" requirements is false, according to insiders close to both companies [2][5] - There are indications of platform manipulation as numerous media outlets and self-media have spread this misinformation [2] - JD.com had indeed issued a fine to Midea Group, but it was later canceled due to public pressure and Midea's defense [5] Group 2: JD.com's Pricing Strategy - During the Double 11 shopping festival, JD.com implemented strict pricing strategies, including prohibiting brands from offering discounts or mentioning lower prices on other platforms [6] - Merchants found in violation of these rules could face fines ranging from 5 million to tens of millions of yuan, depending on the number of infractions [6] Group 3: Wealth Rankings and Economic Trends - The 2025 Hurun Rich List shows that Zhong Shanshan, founder of Nongfu Spring, has become the richest person in China with a wealth of 530 billion yuan, marking a 56% increase [8][12] - Zhang Yiming, founder of ByteDance, saw his wealth grow by 1.2 trillion yuan, driven by advancements in AI, placing him second with 470 billion yuan [9][12] - The list reflects a shift in economic trends, with new faces primarily from industrial products, health, and consumer goods sectors, while real estate figures are declining [13][14] Group 4: Meike Home's Financial Struggles - Meike Home has reported continuous losses exceeding 1.6 billion yuan over the past three years, with a loss of 88 million yuan in the first half of this year [16][18] - The company's cash flow has significantly declined, with a net cash flow from operating activities dropping by 84.57% [17] - Meike Home is closing stores to cope with financial pressures, reducing its number of stores from 141 in 2023 to 111 in 2024 [17] Group 5: Gold Market Speculation - A rumor circulated about a former chief analyst at Guohai Securities making a significant profit from gold futures trading, which was later denied as false [19][25] - The gold market has seen substantial price increases, with the main futures contract rising over 28% from late August to mid-October [26]

美的集团(00300.HK)10月29日耗资1.27亿元回购171.18万股A股

Ge Long Hui· 2025-10-29 10:22

Group 1 - The core point of the article is that Midea Group announced a share buyback plan, intending to repurchase 1.71 million A-shares at a cost of RMB 127 million [1] - The buyback will occur on October 29, 2025, with a price range of RMB 73.52 to 74.41 per share [1]

美的集团10月29日耗资约1.27亿元回购171.18万股A股

Zhi Tong Cai Jing· 2025-10-29 10:20

Core Viewpoint - Midea Group announced a share buyback plan, intending to repurchase approximately 1.71 million A-shares at a cost of about 127 million yuan by October 29, 2025 [1] Group 1 - The company plans to spend around 127 million yuan for the buyback [1] - The total number of shares to be repurchased is approximately 1.71 million [1] - The buyback is scheduled to be completed by October 29, 2025 [1]

美的集团(00300)10月29日耗资约1.27亿元回购171.18万股A股

智通财经网· 2025-10-29 10:15

Core Viewpoint - Midea Group announced a share buyback plan, intending to repurchase approximately 1.27 billion yuan worth of A-shares, totaling 1.7118 million shares, on October 29, 2025 [1] Group 1 - The total expenditure for the share buyback is approximately 1.27 billion yuan [1] - The number of A-shares to be repurchased is 1.7118 million [1]

科力尔:公司已与海康威视等多家国内外知名企业建立了稳定的合作关系

Zheng Quan Ri Bao· 2025-10-29 09:47

Core Insights - The company has established stable partnerships with several well-known domestic and international enterprises, including Hikvision, Dahua Technology, Roborock, Panasonic, Midea, Xiaomi, and DJI [2] - In addition to serving existing clients, the company has made significant progress in developing new customers this year, successfully partnering with multiple industry-leading firms and achieving bulk supply [2] - Overall shipment performance of the company is reported to be good [2]

2025广东企业500强名单公布!腾讯、比亚迪等上榜前10名

Nan Fang Du Shi Bao· 2025-10-29 08:16

Core Insights - The Guangdong Enterprise 500 Strong list for 2025 has been released, showcasing significant changes in rankings and performance metrics of leading companies in the region [1][2]. Group 1: Rankings and Performance - The total revenue of the Guangdong Enterprise 500 Strong reached 19.36 trillion yuan, with a growth rate of 3.36% compared to the previous year [2]. - The top 10 companies in the 2025 Guangdong Enterprise 500 Strong are: Ping An Insurance, China Resources Group, Huawei, Southern Power Grid, BYD, Tencent, Foxconn, China Merchants Bank, Midea Group, and GAC Group [2]. - Huawei moved up one position to rank third, while Southern Power Grid dropped to fourth. BYD and Tencent swapped places, with BYD at fifth and Tencent at sixth. Vanke fell out of the top 10, now ranked eleventh, while Midea Group entered the top 10 at ninth [1][2]. Group 2: Regional Distribution - Shenzhen leads with 216 companies on the list, achieving a cumulative revenue exceeding 1 trillion yuan and a net profit of 863.7 billion yuan [4]. - Guangzhou follows with 120 companies, including major firms like Southern Power Grid and GAC Group, reflecting a balanced presence of service and manufacturing sectors [4]. - Other cities like Foshan, Dongguan, and Huizhou also show stable performances with notable companies in manufacturing [5]. Group 3: Profit Trends - The total net profit of the Guangdong Enterprise 500 Strong shows a trend of recovery and stabilization, reversing a two-year decline, with a growth rate of 2.06% for 2025 [6]. Group 4: Industry Insights - The service and manufacturing sectors remain the dual engines of Guangdong's economy, with strong performances in finance, insurance, supply chain, and real estate [9]. - The manufacturing sector is concentrated in electronics, automotive, home appliances, and new energy, with companies like Huawei, BYD, and Foxconn demonstrating Guangdong's strength in high-end and smart manufacturing [9]. - There is a notable increase in companies within the new energy and electronic information sectors, indicating ongoing investment in green transformation and technological innovation [9]. Group 5: R&D Investment - The scientific research and technical services industry leads in R&D investment, accounting for 18.99% of its revenue, followed by the manufacturing sector with a 4.08% R&D investment ratio [10].

图解公募基金三季度重仓股

Ge Long Hui A P P· 2025-10-29 07:55

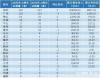

Core Insights - The top ten holdings of public funds for Q3 2025 include Ningde Times, Tencent Holdings, New Yi Sheng, Zhong Ji Xu Chuang, Alibaba-W, Luxshare Precision, Industrial Fulian, Zijin Mining, SMIC, and Kweichow Moutai [1][3] - Compared to the end of Q2 2025, Zhong Ji Xu Chuang and Industrial Fulian have entered the top ten holdings, while Midea Group and Xiaomi Group-W have exited [1] Public Fund Holdings - As of the end of Q3 2025, the total market value of public funds reached 35.85 trillion yuan, an increase of 6.30% from the previous quarter, with the A-share market value held by public funds exceeding 7 trillion yuan [3] - The top ten stocks held by public funds and their respective market values (in billion yuan) are: - Ningde Times: 758.81, 4.28% of circulating shares - Tencent Holdings: 699.38, 1.26% - New Yi Sheng: 560.70, 17.31% - Zhong Ji Xu Chuang: 558.13, 12.51% - Alibaba-W: 500.97, 1.62% - Luxshare Precision: 370.44, 7.88% - Industrial Fulian: 363.43, 2.77% - Zijin Mining: 340.18, 4.35% - SMIC: 290.86, 6.67% - Kweichow Moutai: 283.72, 1.57% [3][4] Active Fund Holdings - The top 20 active fund holdings in A-shares for Q3 2025 include: - Ningde Times: 796.90 billion yuan, 4.66% - Zhong Ji Xu Chuang: 577.49 billion yuan, 12.94% - New Yi Sheng: 571.59 billion yuan, 17.65% [4] - The top stocks with increased holdings include Zhong Ji Xu Chuang (100.30 billion yuan increase) and Industrial Fulian (50.94 billion yuan increase) [5] Passive Fund Holdings - The top 20 passive fund holdings in A-shares for Q3 2025 include: - Ningde Times: 1,273.84 billion yuan, 7.45% - Kweichow Moutai: 936.92 billion yuan, 5.18% - Zhong Ji Xu Chuang: 533.19 billion yuan, 11.95% [10] - The top stocks with increased holdings include New Yi Sheng (189.52 billion yuan increase) and Zhong Ji Xu Chuang (137.75 billion yuan increase) [9] Changes in Holdings - The top stocks with the largest reductions in holdings include: - Shenghong Technology: -99.62 billion yuan - Haiguang Information: -89.49 billion yuan - Midea Group: -64.91 billion yuan [7] - Notable reductions also include Ningde Times (-38.26 billion yuan) and Industrial Fulian (-27.23 billion yuan) [7][11]

公募基金三季度前十大重仓股出炉,宁德时代、中际旭创、工业富联在列

Ge Long Hui· 2025-10-29 07:39

Core Insights - The top ten holdings of public funds for the third quarter of 2025 have been released, featuring companies such as CATL, Tencent, and Alibaba [1] - Compared to the end of the second quarter of 2025, companies like Zhongji Xuchuang and Industrial Fulian have entered the top ten holdings, while Midea Group and Xiaomi have exited [1] Group 1 - The top ten stocks include: CATL, Tencent, New Yisheng, Zhongji Xuchuang, Alibaba-W, Luxshare Precision, Industrial Fulian, Zijin Mining, SMIC, and Kweichow Moutai [1] - Zhongji Xuchuang and Industrial Fulian are new entrants in the top ten holdings of public funds [1] - Midea Group and Xiaomi Group-W have been removed from the top ten holdings [1]

大摩、小摩、贝莱德等9大外资公募持仓出炉!光模块等AI科技成布局热门!

私募排排网· 2025-10-29 07:00

Core Viewpoint - The A-share market has shown a significant recovery this year, with the Shanghai Composite Index surpassing 4000 points, reflecting strong investment interest from foreign public funds, including major players like Morgan Stanley and BlackRock [3] Foreign Fund Holdings - In the third quarter, six foreign public funds increased their stock holdings, with Allianz Fund and Schroders Fund showing remarkable growth rates of 77.10% and 82.03% respectively [5] - Morgan Chase Fund's asset scale reached 213.22 billion, holding 194 stocks with a total market value of approximately 756.73 billion [6] - Morgan Stanley Fund's asset scale was 270.04 billion, with a focus on sectors like pharmaceuticals and AI, achieving an average return of 140.35% for its top twenty holdings [9] Key Stock Performances - The top holdings of Morgan Chase Fund included CATL, which saw a price increase of 45.29% year-to-date, with a total holding value of 3.66 billion [7] - New Yi Sheng, a key stock for Morgan Stanley Fund, experienced a staggering increase of 255.27% this year [10] - The top three holdings of Manulife Fund were all in the computing power industry, with 19 out of 20 stocks showing significant price increases [12] Investment Trends - The recent optimization of the Qualified Foreign Institutional Investor (QFII) system is expected to attract more foreign capital into the Chinese market, enhancing liquidity [3] - BlackRock Fund has notably increased its holdings in CATL, with a total market value of approximately 2.11 billion [15] - Fidelity Fund emphasizes the growth potential of Chinese technology stocks, despite a more diversified current portfolio [20] Market Outlook - The outlook for the A-share market remains optimistic, with expectations of new highs as the market stabilizes [18] - Roadshow Fund has maintained its positions in traditional blue-chip stocks while also focusing on technology stocks [19]

远程甩五菱!长安第三 大通超瑞驰 9月新能源轻客渗透率首破70% | 头条

第一商用车网· 2025-10-29 06:46

Core Viewpoint - The domestic new energy light commercial vehicle market is experiencing fluctuations, with a notable increase in sales and penetration rates, particularly in September 2025, which marked a record month for sales and growth in this segment [1][29]. Sales Performance - In September 2025, the new energy light commercial vehicle market sold 35,500 units, representing a month-on-month increase of 51% and a year-on-year increase of 48% [4][29]. - From January to September 2025, the cumulative sales of new energy light commercial vehicles reached 205,100 units, showing an 18% year-on-year growth [10][23]. Market Penetration - The penetration rate of new energy vehicles in the light commercial vehicle market exceeded 60%, with September 2025 achieving a record penetration rate of 70.12% [8][29]. - The cumulative penetration rate from January to September 2025 was 61.55%, up from 56.37% in the previous year [8][27]. Regional Insights - In the first nine months of 2025, all 31 provincial-level administrative regions in mainland China registered new energy light commercial vehicles, with Guangdong province leading with over 35,700 units [12][14]. - Most provinces experienced growth in new energy light commercial vehicle registrations compared to the previous year, with significant increases in Anhui, Chongqing, and Yunnan [14]. Vehicle Type Distribution - Pure electric vehicles dominated the new energy light commercial vehicle market, accounting for 99.977% of sales from January to September 2025, with negligible presence of hybrid and fuel cell vehicles [16]. Leading Companies - In September 2025, the top-selling companies in the new energy light commercial vehicle market included Yuan Cheng, which sold 8,011 units, followed by Wuling and Changan [18][21]. - The market share of the leading companies in the first nine months of 2025 was as follows: Wuling (21.93%), Yuan Cheng (19.38%), and Changan (12.63%) [27]. Future Outlook - The new energy light commercial vehicle market is expected to maintain its growth momentum, with the potential for continued increases in sales and market penetration [29].