ANKAI(000868)

Search documents

安凯客车Q3实现营收8.54亿元,净亏损为2705.37万元

Ju Chao Zi Xun· 2025-10-25 03:11

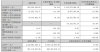

Core Insights - Ankai Bus reported a significant increase in revenue for Q3 2025, achieving 853,520,426.05 yuan, a growth of 56.21% year-on-year, while net profit attributable to shareholders was -27,053,744.71 yuan, a decline of 114.43% [2][3] - For the first nine months of 2025, the company recorded total revenue of 2,445,974,904.30 yuan, up 44.37% year-on-year, but net profit attributable to shareholders was -8,657,978.80 yuan, down 61.56% [2][3] Financial Performance - Revenue growth was primarily driven by an increase in sales volume, while net profit losses were constrained by costs and asset impairment [4] - Basic and diluted earnings per share for Q3 were both -0.03 yuan, a decrease of 192.15% year-on-year [2][3] - The weighted average return on equity was -3.13%, down 111.71 percentage points compared to the same period last year [2][3] Asset and Equity Changes - As of September 30, 2025, total assets amounted to 4,252,962,268.31 yuan, reflecting a growth of 17.55% from the end of the previous year [4] - Shareholders' equity decreased by 0.80% to 851,318,057.96 yuan compared to the end of the previous year [4] Cash Flow and Other Financial Metrics - Cash flow from operating activities showed a significant increase, with sales of goods and services generating cash up by 66.51% year-on-year [9] - The company experienced a 361.96% increase in asset impairment losses, primarily due to higher inventory write-downs [9] - Financial expenses decreased by 94.42%, attributed to increased interest income [9] Changes in Assets and Liabilities - Prepayments increased by 47.69% due to higher material payments, while other receivables decreased by 53.64% due to reduced national subsidies for new energy [5] - Inventory rose by 63.22% due to an increase in stock, and short-term borrowings increased by 62.48% due to more credit borrowings [5]

三季度亏2705万元!安凯客车陷“割裂”局面

Shen Zhen Shang Bao· 2025-10-25 01:41

Core Points - The company reported a revenue of 8.54 billion CNY in Q3, a year-on-year increase of 56.2%, but the net profit loss expanded from 12.62 million CNY to 27.05 million CNY [1] - The main business of the company includes the research, development, manufacturing, sales, and service of buses and automotive parts, focusing on various types of buses including public transport and new energy buses [1] - The financial report indicates that while revenue increased, the net profit continued to show losses, attributed to rising operating costs and significant asset impairment losses [1][2] Financial Summary - For the first three quarters of 2025, the company reported a revenue of 24.46 billion CNY, a 44.37% increase compared to the same period in 2024 [4] - Operating costs rose to 22.50 billion CNY, an increase of 46.22%, primarily due to increased sales volume [2] - Asset impairment losses surged by 361.96% to 24.67 million CNY, mainly due to increased inventory write-downs [2] Market Performance - As of October 24, the company's stock price was 5.75 CNY per share, with a total market capitalization of 54.02 billion CNY [3] - The stock experienced a slight increase of 0.52% on the same day [3] - Key financial metrics include a P/E ratio of 146.83 and a market-to-book ratio of 6.15 [5]

安凯客车(000868) - 2025年第一次临时股东会决议公告

2025-10-24 12:16

证券代码:000868 证券简称:安凯客车 公告编号:2025-048 安徽安凯汽车股份有限公司 2025 年第一次临时股东会决议公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述或者重大遗 漏,并对其内容的真实性、准确性和完整性承担个别及连带责任。 特别提示 1、本次股东会未出现否决议案的情形; 2、本次股东会未涉及变更前次股东会决议的情形。 一、会议召开和出席情况 (一)会议召开情况: 1、现场会议时间:2025 年 10 月 24 日(星期五)下午 15:00 2、网络投票时间:2025 年 10 月 24 日 其中,通过深圳证券交易所交易系统进行网络投票的时间为:2025 年 10 月 24 日 9:15—9:25,9:30—11:30 和 13:00—15:00; 通过深圳证券交易所互联网投票系统进行网络投票的时间为:2025 年 10 月 24 日上午 9:15—下午 15:00 期间的任意时间。 3、现场会议召开地点:合肥市花园大道 568 号公司管理大楼三楼 313 会议 室 4、会议召集人:公司董事会 5、召开方式:现场投票和网络投票相结合 1 6、主持人:公司董事长黄 ...

安凯客车(000868) - 安凯客车2025年第一次临时股东会见证法律意见书

2025-10-24 12:16

上海锦天城(合肥)律师事务所 关于 安徽安凯汽车股份有限公司 2025 年第一次临时股东会 律师见证法律意见书 地址:中国安徽省合肥市蜀山区潜山路 111 号华润大厦 B 座 1901-1905、24 层 电话:0551-65790988 传真:0551-65790908 邮编:230601 上海锦天城(合肥)律师事务所 法律意见书 致:安徽安凯汽车股份有限公司 根据《中华人民共和国公司法》(以下简称"《公司法》")、《中华人民 共和国证券法》(以下简称"《证券法》")、《上市公司股东会规则》(以下 简称"《股东会规则》")以及《深圳证券交易所上市公司股东会网络投票实施 细则》和《安徽安凯汽车股份有限公司公司章程》(下称"《公司章程》")的 有关规定,上海锦天城(合肥)律师事务所(以下简称"本所")接受安徽安凯 汽车股份有限公司(以下简称"公司")委托,指派本所李静、肖婉婷律师(以 下简称"本所律师")出席公司 2025 年第一次临时股东会会议,并就本次股东 会的召集和召开程序、出席会议人员及会议召集人资格、审议事项以及表决方式、 表决程序、表决结果等相关事项依法进行见证。 本所律师已审查了公司提供的召开本次 ...

安凯客车(000868) - 2025 Q3 - 季度财报

2025-10-24 12:10

Revenue and Profitability - Revenue for Q3 2025 reached ¥853,520,426.05, an increase of 56.21% compared to the same period last year[5] - The company reported a 44.37% increase in total revenue for the first nine months of 2025, amounting to ¥2,445,974,904.30[9] - Total operating revenue for the current period reached ¥2,445,974,904.30, a significant increase of 44.4% compared to ¥1,694,235,739.09 in the previous period[17] - Net profit attributable to shareholders was -¥27,053,744.71, a decrease of 114.43% year-on-year[5] - Net profit for the current period was -¥19,933,740.41, compared to -¥12,513,070.56 in the previous period, indicating a deeper loss[19] - The total comprehensive income for the current period was -¥20,139,265.58, compared to -¥12,664,525.80 in the previous period, indicating a worsening financial position[19] Cash Flow and Financial Position - Cash flow from operating activities showed a net outflow of -¥34,433,072.54, a decline of 83.47% compared to the previous year[5] - The net cash flow from operating activities was -¥34,433,072.54, an improvement from -¥208,354,615.36 in the previous period[20] - Net cash flow from investment activities was -$37.95 million, a decrease from $105.15 million in the previous period[21] - Total cash inflow from financing activities increased to $62.50 million, up from $22.00 million[21] - The net cash flow from financing activities was $22.00 million, significantly higher than $6.69 million in the prior period[21] - The ending balance of cash and cash equivalents was $371.57 million, compared to $178.64 million at the end of the previous period[21] Assets and Liabilities - Total assets increased to ¥4,252,962,268.31, reflecting a growth of 17.55% from the end of the previous year[5] - The total liabilities increased to ¥3,366,124,518.07, up from ¥2,712,936,633.58, reflecting a growth of 24.1%[16] - The total equity attributable to shareholders of the parent company decreased to ¥851,318,057.96 from ¥858,223,948.47, a decline of 0.9%[16] - Current assets total CNY 3,196,344,872.47, up from CNY 2,545,783,307.54[15] - Accounts receivable increased to CNY 1,269,422,119.46 from CNY 1,012,369,827.51[15] - Accounts payable rose to CNY 1,452,443,769.39 from CNY 1,234,086,409.89[15] Inventory and Borrowings - Inventory levels rose by 63.22% to ¥373,969,334.95, primarily due to an increase in stock[8] - Short-term borrowings increased by 62.48% to ¥162,605,999.99, attributed to an increase in credit borrowings[8] - Inventory has risen to CNY 373,969,334.95, compared to CNY 229,123,518.29 previously[15] - Short-term borrowings increased to CNY 162,605,999.99 from CNY 100,076,388.89[15] Shareholder Information - The total number of common shareholders at the end of the reporting period is 48,894[11] - Anhui Jianghuai Automobile Group holds 41.61% of shares, totaling 390,949,132 shares[11] - The company has no preferred shareholders as of the reporting period[13] - The top ten shareholders do not have any related party relationships or concerted actions[12] Expenses and Impairments - Total operating costs amounted to ¥2,505,414,780.50, up 39.9% from ¥1,788,290,642.62 in the prior period[18] - The company experienced a 361.96% increase in asset impairment losses, totaling ¥24,666,022.25, mainly due to increased inventory write-downs[9] - Research and development expenses for the current period were ¥77,297,650.65, slightly up from ¥75,411,836.58 in the previous period[18] Earnings Per Share - The company reported a basic and diluted earnings per share of -¥0.01, consistent with the previous period[19]

安凯客车:第三季度净亏损2705.37万元

Ge Long Hui· 2025-10-24 12:09

Core Viewpoint - Ankai Bus reported a significant increase in revenue for the third quarter, but also faced substantial net losses, indicating challenges in profitability despite revenue growth [1] Financial Performance - The revenue for the third quarter reached 854 million yuan, representing a year-on-year increase of 56.21% [1] - The net profit for the third quarter was a loss of 27.05 million yuan, a decline of 114.43% compared to the previous year [1] - For the first three quarters, the total revenue was 2.446 billion yuan, showing a year-on-year growth of 44.37% [1] - The net profit for the first three quarters was a loss of 8.658 million yuan, which is a decrease of 61.56% year-on-year [1]

安凯客车涨2.62%,成交额1.02亿元,主力资金净流出360.92万元

Xin Lang Zheng Quan· 2025-10-24 05:53

Core Viewpoint - Ankai Bus has shown a significant increase in stock price and revenue growth, indicating a positive trend in the company's performance and market interest [2][3]. Group 1: Stock Performance - On October 24, Ankai Bus's stock rose by 2.62%, reaching 5.87 CNY per share, with a trading volume of 1.02 billion CNY and a turnover rate of 2.41%, resulting in a total market capitalization of 55.15 billion CNY [1]. - Year-to-date, Ankai Bus's stock price has increased by 15.10%, with a 7.71% rise over the last five trading days, a 1.03% increase over the last 20 days, and a slight decline of 0.84% over the last 60 days [2]. Group 2: Financial Performance - For the first half of 2025, Ankai Bus reported a revenue of 1.592 billion CNY, representing a year-on-year growth of 38.74%, while the net profit attributable to shareholders was 18.396 million CNY, marking a substantial increase of 153.46% [2]. - The company has distributed a total of 154 million CNY in dividends since its A-share listing, with no dividends paid in the last three years [3]. Group 3: Shareholder Information - As of October 20, the number of shareholders for Ankai Bus was 48,400, a decrease of 1.29% from the previous period, with an average of 15,140 circulating shares per shareholder, which is an increase of 1.30% [2]. - Among the top ten circulating shareholders, Yongying Low Carbon Environmental Smart Mixed Fund (016386) is the third largest, holding 17.9027 million shares, a decrease of 15.0028 million shares from the previous period [3].

安凯客车:截至2025年10月20日,公司股东总户数为48434户

Zheng Quan Ri Bao· 2025-10-23 11:43

Core Viewpoint - Ankai Bus announced on October 23 that as of October 20, 2025, the total number of shareholders is 48,434 [2] Summary by Categories - **Company Information** - Ankai Bus has a total of 48,434 shareholders as of October 20, 2025 [2] - **Investor Communication** - The company responded to investor inquiries on its interactive platform regarding shareholder numbers [2]

安凯客车(000868.SZ):无人型机器人相关业务

Ge Long Hui· 2025-10-23 07:13

Core Viewpoint - Ankai Bus (000868.SZ) is actively involved in the development of unmanned robotic technology, indicating a strategic shift towards automation and innovation in its business model [1] Group 1 - The company has communicated its engagement in unmanned robotic business through its investor interaction platform [1]

安凯客车:公司无人型机器人相关业务稳步推进

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-23 07:08

南方财经10月23日电,安凯客车10月23日在互动平台表示,公司无人型机器人相关业务稳步推进。 ...