QUNXING(002575)

Search documents

群兴玩具(002575) - 江苏经权律师事务所关于 广东群兴玩具股份有限公司2025年第一次临时股东大会的法律意见书

2025-11-06 10:45

江苏经权律师事务所 关于 广东群兴玩具股份有限公司 2025 年第一次临时股东大会的 法律意见书 二〇二五年十一月 江苏经权律师事务所 江苏经权律师事务所 关于 广东群兴玩具股份有限公司 2025 年第一次临时股东大会的 法律意见书 致:广东群兴玩具股份有限公司 江苏经权律师事务所(以下简称"本所")接受广东群兴玩具股份有限公司 (以下简称"公司")的委托,为公司 2025 年第一次临时股东大会(以下简称"本 次股东大会")出具法律意见书。本所指派律师参加了本次股东大会,并根据《中 华人民共和国公司法》(以下简称"《公司法》")、《中华人民共和国证券法》(以 下简称"《证券法》")、《上市公司股东大会规则》(以下简称"《股东大会规则》") 等中国(为出具本法律意见书之目的,不包括香港特别行政区、澳门特别行政区 及台湾地区)现行有关法律法规、规范性文件以及《广东群兴玩具股份有限公司 章程》(以下简称"《公司章程》")的规定,就本次股东大会的相关事宜出具本法 律意见书。 本所律师仅依据法律意见书出具日前已经发生或存在的事实,就本次股东大 会的召集和召开程序、出席本次股东大会人员的资格及召集人资格、本次股东大 会表 ...

群兴玩具(002575) - 2025年第一次临时股东大会决议公告

2025-11-06 10:45

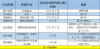

证券代码:002575 证券简称:群兴玩具 公告编号:2025-044 广东群兴玩具股份有限公司 2025年第一次临时股东大会决议公告 本公司及董事会全体成员保证信息披露的内容真实、准确、完整,没有虚假记载、 误导性陈述或重大遗漏。 特别提示: 1、本次股东大会无增加、否决或变更议案的情形。 2、本次股东大会不涉及变更以往股东大会已通过的决议。 3、本次股东大会以现场投票与网络投票相结合的方式召开。 一、会议召开和出席情况 广东群兴玩具股份有限公司(以下简称"公司")2025年第一次临时股东大会 以现场投票与网络投票相结合的方式召开。 (一)会议召开情况 1、会议召开的时间: (1)现场会议召开时间:2025年11月6日(星期四)14:00。 (2)网络投票时间: 通过深圳证券交易所交易系统进行网络投票的具体时间为:2025年11月6日9:15 至9:25、9:30至11:30、13:00至15:00。 通过深圳证券交易所互联网投票系统投票的具体时间为:2025年11月6日 9:15-15:00期间的任意时间。 2、会议召开地点:江苏省苏州市苏州工业园区星港街168号,托尼洛兰博基尼 书苑酒店,凝香阁。 出席 ...

群兴玩具(002575) - 第六届董事会第一次会议决议公告

2025-11-06 10:45

证券代码:002575 证券简称:群兴玩具 公告编号:2025-045 广东群兴玩具股份有限公司 第六届董事会第一次会议决议公告 本公司及董事会全体成员保证信息披露的内容真实、准确、完整,没有虚假记载、 误导性陈述或重大遗漏。 一、董事会会议召开情况 广东群兴玩具股份有限公司(以下简称"公司")第六届董事会第一次会议 于2025年11月6日在公司会议室以现场和通讯相结合的方式召开。会议通知于近 日以通讯和专人送达方式发出。根据《公司章程》等有关规定,经与会董事一致 同意,推举董事张金成先生为本次会议主持人。本次会议应出席董事6人,实际 出席董事6人,公司高级管理人员列席了会议。本次会议的召开符合《公司法》 及《公司章程》的有关规定。 二、董事会会议审议情况 经与会董事认真审议,本次会议采用记名投票表决的方式通过了如下决议: 1、审议通过了《关于选举公司董事长的议案》 表决情况:6票同意,0票反对,0票弃权。 (3)选举赵世君先生、张金成先生、林海先生为第六届董事会提名委员会 委员,其中林海先生担任召集人。 表决情况:6票同意,0票反对,0票弃权。 公司董事会一致同意选举张金成先生为公司第六届董事会董事长,任期 ...

文娱用品板块11月3日涨1.23%,明月镜片领涨,主力资金净流出474.54万元

Zheng Xing Xing Ye Ri Bao· 2025-11-03 08:47

Market Overview - The entertainment products sector increased by 1.23% on November 3, with Mingyue Lens leading the gains [1] - The Shanghai Composite Index closed at 3976.52, up 0.55%, while the Shenzhen Component Index closed at 13404.06, up 0.19% [1] Top Performers - Mingyue Lens (301101) closed at 43.94, up 6.39% with a trading volume of 75,400 shares and a transaction value of 324 million yuan [1] - Helen Piano (300329) closed at 18.25, up 5.43% with a trading volume of 120,500 shares and a transaction value of 217 million yuan [1] - Qunxing Toys (002575) closed at 6.40, up 3.39% with a trading volume of 326,400 shares and a transaction value of 207 million yuan [1] Underperformers - Jinling Sports (300651) closed at 22.13, down 5.43% with a trading volume of 151,700 shares [2] - Yuanfei Pets (001222) closed at 23.00, down 4.29% with a trading volume of 56,300 shares [2] - Zhejiang Nature (605080) closed at 24.48, down 1.45% with a trading volume of 20,800 shares [2] Capital Flow - The entertainment products sector experienced a net outflow of 4.75 million yuan from institutional investors, while retail investors saw a net inflow of 3.32 million yuan [2][3] - Major stocks like Guangbo Co. (002103) had a net inflow of 24.48 million yuan from institutional investors, while Mingyue Lens (301101) had a net inflow of 16.28 million yuan [3]

智通A股限售解禁一览|11月3日

智通财经网· 2025-11-03 01:03

Core Viewpoint - On November 3, a total of 12 listed companies will have their restricted shares unlocked, with a total market value of approximately 8.307 billion yuan [1] Summary by Category Restricted Share Unlocking Details - Yunding Technology (Stock Code: 000409) will unlock 153 million shares from a private placement of A-shares [1] - China Unicom (Stock Code: 600050) will unlock 250 million shares related to equity incentive restrictions [1] - Ningbo Yunsheng (Stock Code: 600366) will unlock 5.857 million shares from equity incentives [1] - Changrun Co., Ltd. (Stock Code: 603201) will unlock 387,500 shares from equity incentives [1] - Lingda Co., Ltd. (Stock Code: 300125) will unlock 630,000 shares from equity incentives [1] - Wanda Information (Stock Code: 300168) will unlock 1.2701 million shares from equity incentives [1] - Qunxing Toys (Stock Code: 002575) will unlock 7.2 million shares from equity incentives [1] - Lushan New Materials (Stock Code: 603051) will unlock 391,200 shares from equity incentives [1] - Hongbo Pharmaceutical (Stock Code: 301230) will unlock 4.8251 million shares from pre-issue restrictions [1] - Oppein Home (Stock Code: 603551) will unlock 60,000 shares from equity incentives [1] - Yihe Jiaye (Stock Code: 301367) will unlock 2.34362 million shares from pre-issue restrictions [1] - Ruina Intelligent (Stock Code: 301129) will extend the lock-up period for 8.8992 million shares [1]

A股算力租赁跨界:有梦想照进现实也有一戳就破的泡沫|焦点

Tai Mei Ti A P P· 2025-10-31 04:44

Core Insights - The recent failure of Qunxing Toys in the computing power rental sector marks another setback for traditional companies attempting to diversify into this field, highlighting the challenges faced by many A-share companies in pursuing new growth avenues amidst stagnating core businesses [1][2]. Industry Overview - The surge in generative AI since 2024 has led to an exponential increase in demand for computing power, creating a rapidly growing market that many A-share companies are eager to enter as they seek new growth opportunities [2][10]. - A diverse range of companies, from toy manufacturers to construction firms, have announced their entry into the computing power rental business, driven primarily by the need to overcome growth bottlenecks in their core operations [2][3]. Company Examples - Qunxing Toys reported a nearly 500% year-on-year revenue increase in 2024 but still faced significant losses, prompting its entry into the computing power sector through a planned acquisition of a computing service provider [2]. - Hainan Huatie, previously focused on construction equipment rental, announced a significant investment of 10 billion in computing power and secured a contract worth nearly 3.7 billion, indicating a strong push for transformation [3]. - Lianhua Holdings, despite facing losses in its computing power business, managed to achieve a breakeven point in the first half of 2025, although it still contends with rising interest expenses [7]. Market Reactions - The capital market has responded positively to announcements related to computing power, with stock prices of companies involved in this sector experiencing significant increases following such news [4][6]. - However, as the initial excitement wanes, a clear differentiation is emerging among companies based on their actual performance and the sustainability of their computing power ventures [6][11]. Future Outlook - The computing power rental market is projected to grow at a compound annual growth rate of 53% over the next three years, with the market size expected to reach 1,346 EFlops by 2027, supported by national strategic initiatives [10][12]. - Despite the promising outlook, the industry presents high barriers to entry, including the need for stable supply chains, strong operational capabilities, and effective financial management [11][12].

文娱用品板块10月30日跌0.33%,浙江正特领跌,主力资金净流出6915.77万元

Zheng Xing Xing Ye Ri Bao· 2025-10-30 08:40

Market Overview - The entertainment products sector experienced a decline of 0.33% on October 30, with Zhejiang Zhengte leading the drop [1] - The Shanghai Composite Index closed at 3986.9, down 0.73%, while the Shenzhen Component Index closed at 13532.13, down 1.16% [1] Stock Performance - Notable gainers included: - Helen Piano (300329) with a closing price of 17.57, up 7.59% and a trading volume of 180,300 shares, totaling 311 million yuan [1] - Source Pet (001222) closed at 24.51, up 2.21% with a trading volume of 66,300 shares, totaling 162 million yuan [1] - Major decliners included: - Zhejiang Zhengte (001238) closed at 49.33, down 3.08% with a trading volume of 8,368 shares, totaling 41.9 million yuan [2] - Huali Technology (301011) closed at 25.65, down 2.88% with a trading volume of 32,400 shares, totaling 83.57 million yuan [2] Capital Flow - The entertainment products sector saw a net outflow of 69.16 million yuan from institutional investors, while retail investors contributed a net inflow of 66.54 million yuan [2] - Specific stock capital flows included: - Morning Light Co. (6688809) had a net inflow of 11.21 million yuan from institutional investors [3] - Source Pet (001222) saw a net inflow of 10.59 million yuan from institutional investors [3] - Zhejiang Zhengte (001238) experienced a net outflow of 0.53 million yuan from institutional investors [3]

群兴玩具:10月27日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-27 15:57

Core Viewpoint - The company, Qunxing Toys, reported its financial performance and held a board meeting to discuss its Q3 2025 report, highlighting its revenue composition and current market valuation [1]. Group 1: Company Financials - For the first half of 2025, Qunxing Toys' revenue composition was as follows: 80.56% from liquor sales, 10.32% from intelligent computing business, and 9.12% from leasing of owned properties and operation services for entrepreneurial parks [1]. - As of the report date, Qunxing Toys had a market capitalization of 3.7 billion yuan [1]. Group 2: Corporate Governance - The fifth session of the 24th board meeting was held on October 27, 2025, combining in-person and remote participation to review the Q3 2025 report proposal [1].

群兴玩具(002575.SZ):前三季度净亏损2135.54万元

Ge Long Hui A P P· 2025-10-27 15:25

Group 1 - The company, Qunxing Toys (002575.SZ), reported a revenue of 281 million yuan for the first three quarters of 2025, representing a year-on-year increase of 22.32% [1] - The net profit attributable to shareholders of the listed company was -21.36 million yuan, indicating a loss [1] - The net profit attributable to shareholders after deducting non-recurring gains and losses was -23.64 million yuan, with a basic earnings per share of -0.04 yuan [1]

群兴玩具前三季度营收2.81亿元同比增22.32%,归母净利润-2135.54万元同比降107.04%,毛利率下降5.27个百分点

Xin Lang Cai Jing· 2025-10-27 13:04

Core Viewpoint - The financial report of Qunxing Toys for the first three quarters of 2025 shows a significant increase in revenue but a substantial decline in net profit, indicating potential challenges in profitability despite revenue growth [1][2]. Financial Performance - The company's revenue for the first three quarters reached 281 million yuan, representing a year-on-year increase of 22.32% [1]. - The net profit attributable to shareholders was -21.36 million yuan, a year-on-year decline of 107.04% [1]. - The non-recurring net profit attributable to shareholders was -23.64 million yuan, down 49.50% year-on-year [1]. - Basic earnings per share stood at -0.04 yuan [1]. Profitability Metrics - The gross profit margin for the first three quarters was 1.85%, a decrease of 5.27 percentage points year-on-year [2]. - The net profit margin was -8.14%, down 2.62 percentage points compared to the same period last year [2]. - In Q3 2025, the gross profit margin improved to 7.90%, an increase of 2.17 percentage points year-on-year [2]. - The net profit margin for Q3 was -4.28%, showing a slight improvement of 0.04 percentage points year-on-year [2]. Expense Analysis - Total operating expenses for the period were 33.55 million yuan, an increase of 2.61 million yuan year-on-year [2]. - The expense ratio was 11.95%, a decrease of 1.53 percentage points compared to the previous year [2]. - Sales expenses surged by 215.03% year-on-year, while management expenses decreased by 8.17% [2]. - Financial expenses increased significantly by 392.62% year-on-year [2]. Shareholder Information - As of the end of Q3 2025, the total number of shareholders was 40,200, an increase of 2,888 or 7.73% from the end of the previous half [2]. - The average market value per shareholder decreased from 140,500 yuan to 123,000 yuan, a decline of 12.41% [2]. Company Overview - Qunxing Toys is located in Suzhou, Jiangsu Province, and was established on September 2, 1996, with its listing date on April 22, 2011 [3]. - The company's main business includes liquor sales (80.56%), intelligent computing services (10.32%), and property leasing and management services (9.12%) [3]. - The company operates in the light industry manufacturing sector, specifically in entertainment products, and is associated with concepts such as blockchain and venture capital [3].