CTD(003040)

Search documents

楚天龙今日大宗交易折价成交50.5万股,成交额934.25万元

Xin Lang Cai Jing· 2025-10-27 08:53

Summary of Key Points Core Viewpoint - On October 27, Chutianlong executed a block trade of 505,000 shares at a price of 18.5 yuan, which represents a discount of 12.07% compared to the market closing price of 21.04 yuan, with a total transaction value of 9.3425 million yuan, accounting for 1.88% of the total trading volume for the day [1]. Group 1: Trade Details - The block trade involved a total of 505,000 shares at a price of 18.5 yuan per share [1]. - The total transaction value was 9.3425 million yuan [1]. - The trade represented 1.88% of the total trading volume on that day [1]. Group 2: Transaction Breakdown - The trade was executed through multiple brokerage firms, including Wanzhi Securities and Guolian Minsheng Securities [2]. - Specific transaction volumes included 150,000 shares for 2.775 million yuan, 110,000 shares for 2.035 million yuan, and 135,000 shares for 2.4975 million yuan [2]. - The trades were conducted at the same price of 18.5 yuan per share across different brokerage firms [2].

楚天龙涨2.68%,成交额4.88亿元,近3日主力净流入-1186.25万

Xin Lang Cai Jing· 2025-10-27 07:31

Core Viewpoint - The company, Chutianlong, is actively expanding its business in electronic identification, mobile payment, digital currency, and smart governance, leveraging its technological expertise and industry partnerships to capture emerging market opportunities. Group 1: Business Developments - The company has developed electronic identification products and technologies, facilitating identity recognition and authentication services, and has completed product testing with industry clients [2] - The company has accumulated technology in mobile payment, including NFC, digital identity, and embedded software security, applicable across various sectors such as finance and social security [2] - The company plans to build an eSIM management platform and provide cross-border settlement solutions in collaboration with banks, capitalizing on the legalization of virtual asset trading in Hong Kong and the Belt and Road initiative [2][3] - The company is collaborating with the People's Bank of China and various commercial banks to promote the digital RMB ecosystem [3] Group 2: Financial Performance - For the first half of 2025, the company reported revenue of 457 million yuan, a year-on-year decrease of 4.83%, and a net profit attributable to shareholders of -39.77 million yuan, a decline of 213.07% [8] - The company has distributed a total of 231 million yuan in dividends since its A-share listing, with 167 million yuan in the last three years [8] Group 3: Market Activity - On October 27, the company's stock rose by 2.68%, with a trading volume of 488 million yuan and a turnover rate of 5.08%, bringing the total market capitalization to 9.702 billion yuan [1] - The main capital inflow for the day was 6.9195 million yuan, with a net inflow of 287.6 million yuan over the past two days [4][5] - The average trading cost of the stock is 22.57 yuan, with the current price approaching a resistance level of 21.58 yuan, indicating potential for upward movement if the resistance is broken [6]

A股异动丨中央定调6大未来产业之一!量子科技股走强,国盾量子涨超10%

Ge Long Hui A P P· 2025-10-27 02:53

Core Insights - The A-share market has seen a collective surge in quantum technology stocks, with notable increases in companies such as GuoDun Quantum and DaHua Intelligent [1][2] - The Central Committee of the Communist Party of China has proposed the development of emerging pillar industries, including quantum technology, as part of the 15th Five-Year Plan, which is expected to create several trillion-yuan markets [1] Company Performance - GuoDun Quantum (688027) rose by 10.54%, with a market capitalization of 47.6 billion and a year-to-date increase of 55.18% [2] - DaHua Intelligent (002512) increased by 10.09%, with a market cap of 5.462 billion and a year-to-date rise of 3.59% [2] - HengBao Co. (002104) reached a 9.99% increase, with a market cap of 15.8 billion and a year-to-date surge of 232.75% [2] - Other notable performers include GuangKu Technology (300620) up 5.85%, GuangXun Technology (002281) up 5.19%, and KeDa GuoChuang (300520) up 4.95% [2] Industry Trends - The proposed 15th Five-Year Plan emphasizes the acceleration of strategic emerging industries such as quantum technology, bio-manufacturing, hydrogen energy, and nuclear fusion, which are expected to become new economic growth points [1] - The plan aims to lay a forward-looking foundation for future industries, potentially reshaping China's high-tech sector over the next decade [1]

楚天龙股份有限公司关于控股股东部分股份解除质押的公告

Shang Hai Zheng Quan Bao· 2025-10-21 19:39

Core Viewpoint - The announcement details the partial release of share pledges by the controlling shareholder of Chutianlong Co., Ltd., indicating a stable financial situation and manageable pledge risks for the company [1][2]. Group 1: Share Pledge Information - The controlling shareholder, Wenzhou Xianghongwan Enterprise Management Co., Ltd., has released part of its pledged shares [1]. - As of October 20, 2025, Wenzhou Xianghongwan and its concerted party hold a total of 227.43 million shares in the company [1]. Group 2: Financial Stability and Risk Management - Wenzhou Xianghongwan and its concerted party have a good credit status and sufficient financial capacity to repay, indicating that the pledge risk is controllable [2]. - The total number of pledged shares is relatively low compared to the total shares held, and there are no risks of forced liquidation or transfer that would adversely affect the company's operations and governance [2]. Group 3: Documentation - The announcement includes references to documents such as the share freeze details from China Securities Depository and Clearing Co., Ltd., and the notice of partial share pledge release from Wenzhou Xianghongwan [3].

楚天龙:关于控股股东部分股份解除质押的公告

Zheng Quan Ri Bao· 2025-10-21 15:18

Core Viewpoint - Chutianlong announced the release of a portion of shares pledged by its controlling shareholder, Wenzhou Xianghongwan Enterprise Management Co., Ltd., totaling 3.65 million shares [2] Group 1 - The controlling shareholder has informed the company about the release of share pledges [2] - The number of shares released from pledge is 3.65 million [2]

楚天龙:温州翔虹湾本次解除质押股份数量为365万股

Mei Ri Jing Ji Xin Wen· 2025-10-21 11:07

Group 1 - The company, Chutianlong, announced on October 21 that it received a notification from its controlling shareholder, Wenzhou Xianghongwan Enterprise Management Co., Ltd., regarding the release of part of its pledged shares [1] - The number of shares released from pledge amounts to 3.65 million shares [1]

楚天龙(003040) - 关于控股股东部分股份解除质押的公告

2025-10-21 10:45

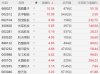

截至公告披露日,上述股东及其一致行动人所持公司股份质押情况如下: 单位:万股 | | | | | | | 已质押股份情况 | | 未质押股份情况 | | | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | | 股东名称 | 持股 | 持股比 | 累计 | 合计占 | 合计占 | 已质押 | 占已 | 未质押 | 占未 | | | | | 被质 | 其所持 | 公司总 | 股份限 | 质押 | 股份限 | 质押 | | | 数量 | 例 | 押数 | 股份比 | 股本比 | 售和冻 | 股份 | 售和冻 | 股份 | | | | | 量 | 例 | 例 | 结、标 | 比例 | 结数量 | 比例 | | | | | | | | 记数量 | | | | | 温州翔虹 湾及一致 行动人*1 | 22,743.0299 | 49.32% | 2,730 | 12.00% | 5.92% | 0 | 0.00% | 0 | 0.00% | | 合计 | 22,743.0299 | 49.32% | 2,730 | 12.00% | 5.92% | ...

楚天龙控股股东部分股份解除质押

Xin Lang Cai Jing· 2025-10-21 10:42

Core Viewpoint - The announcement from Chutianlong indicates that its controlling shareholder, Wenzhou Xianghongwan, has partially lifted the pledge on its shares, which reflects a positive development in the shareholder's financial situation [1] Group 1: Share Pledge Details - The number of shares released from pledge is 3.65 million, accounting for 1.74% of the shares held by the controlling shareholder and 0.79% of the total share capital of the company [1] - The pledge was initiated on June 30, 2023, and will be lifted on October 20, 2025, with Guojin Securities as the pledgee [1] Group 2: Shareholding Status - As of the announcement date, Wenzhou Xianghongwan and its concerted parties hold a total of 227.43 million shares, with 27.3 million shares pledged, representing 12.00% of their holdings and 5.92% of the company's total share capital [1] - The financial condition of the controlling shareholder is reported to be good, indicating that the pledge risk is manageable [1]

7天6板,600403,最新人气王!国内首款eSIM手机将发售,多家A股公司已抢先布局

Zheng Quan Shi Bao Wang· 2025-10-20 10:45

Core Insights - eSIM technology is entering a new commercial phase in China, with major telecom operators officially launching eSIM services for mobile phones, marking a significant shift in the industry [2][3] - The adoption of eSIM is expected to expand beyond mobile phones into various sectors, including consumer electronics and the Internet of Things (IoT), driven by technological advancements and policy support [3][4] Industry Developments - Apple has announced the launch of the iPhone Air, the first eSIM-only phone in China, set to be released on October 22 [2] - Domestic brands like OPPO and vivo are quickly following suit, with OPPO already launching an eSIM-compatible model and others expected to release their versions soon [2][3] - eSIM technology is anticipated to enhance device capabilities, such as waterproofing and shock resistance, while also allowing for multiple SIM profiles [3] Market Performance - eSIM concept stocks have shown strong performance, with an average increase of 42.42% year-to-date, significantly outperforming the Shanghai Composite Index [5] - Six stocks in the eSIM sector have seen gains exceeding 50%, including Hengbao Co., Dongxin Peace, and Meige Intelligent [5] - Despite the overall positive trend, some stocks have experienced significant pullbacks, with several dropping over 30% from their year-to-date highs [8] Company Strategies - Several A-share companies are actively investing in eSIM technology, including Unisoc, which has launched multiple eSIM products, and Eastcompeace, which has developed an embedded operating system for eSIM management [4] - Megmeet has established a mature eSIM solution and is producing large volumes of 4G/5G chips, while Chutianlong has received product approval from China Unicom for its eSIM offerings [4] Future Projections - GSMA Intelligence forecasts that by the end of 2025, global eSIM smartphone connections will reach 1 billion, and by 2030, this number is expected to rise to 6.9 billion, representing 76% of total smartphone connections [3]

楚天龙:公司积极参与各大运营商主导的eSIM标准制定、技术原型验证与国产化工作

Zheng Quan Ri Bao Wang· 2025-10-20 09:41

Core Viewpoint - The company is actively involved in the formulation of eSIM standards and the verification of technical prototypes, focusing on enhancing its full-chain service capabilities in eSIM products, remote configuration platforms, and security certification [1] Group 1 - The company is participating in the eSIM standard-setting led by major operators [1] - The company is working on the domestic and international implementation of related businesses, with all tasks progressing smoothly [1] - The company aims to strengthen its service capabilities across the entire eSIM product chain [1]