HONGMING(301105)

Search documents

鸿铭股份(301105) - 2025 Q3 - 季度财报

2025-10-28 08:10

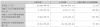

Financial Performance - The company's operating revenue for Q3 2025 was ¥42,318,276.89, a decrease of 15.16% compared to the same period last year[5] - The net profit attributable to shareholders was -¥6,103,215.57, reflecting a significant decline of 475.37% year-on-year[5] - The net profit attributable to shareholders after deducting non-recurring gains and losses was -¥7,266,868.21, a decrease of 728.61% compared to the previous year[5] - The basic earnings per share for the period was -¥0.1221, down 475.94% year-on-year[5] - The company reported a net loss of CNY 9,470,302.90 for Q3 2025, compared to a net profit of CNY 3,816,975.41 in Q3 2024[20] - The gross profit margin decreased significantly, leading to an operating profit of CNY -14,340,276.41, down from CNY 3,747,403.18 in the previous year[20] - Basic earnings per share for Q3 2025 was CNY -0.1886, compared to CNY 0.0784 in the same quarter last year[21] Assets and Liabilities - Total assets at the end of the reporting period were ¥936,402,996.79, a decrease of 1.32% from the end of the previous year[5] - The total assets decreased to CNY 936,402,996.79 from CNY 948,902,010.27, indicating a reduction in overall asset base[18] - Total liabilities decreased to CNY 101,574,469.32 from CNY 105,809,300.89, showing a slight improvement in the company's leverage[18] - The company's equity attributable to shareholders decreased to CNY 834,554,783.83 from CNY 842,781,136.77, reflecting the impact of the net loss[18] Cash Flow - Cash flow from operating activities for the year-to-date was ¥14,724,330.62, down 58.12% compared to the same period last year[10] - Operating cash flow for the current period is ¥14,724,330.62, a decrease of 58.1% from ¥35,162,506.11 in the previous period[22] - Cash inflow from operating activities totaled ¥129,953,745.09, down 27.4% from ¥179,206,005.36 in the previous period[22] - Cash outflow from operating activities is ¥115,229,414.47, a decrease of 20.0% compared to ¥144,043,499.25 in the previous period[22] - Cash inflow from investment activities is ¥785,209,056.16, compared to ¥816,683,244.88 in the previous period, reflecting a decrease of 3.5%[23] - Net cash flow from investment activities is -¥143,944,099.17, significantly lower than -¥5,732,842.71 in the previous period[23] - Total cash and cash equivalents at the end of the period is ¥76,063,224.25, down from ¥79,311,002.49 in the previous period, a decrease of 2.8%[23] - Cash received from investment recovery is ¥781,203,000.00, an increase of 54.3% from ¥506,006,000.00 in the previous period[22] - Cash paid for fixed assets and intangible assets is ¥18,154,155.33, down 62.5% from ¥48,347,887.59 in the previous period[22] - Cash outflow related to financing activities is ¥2,841,075.00, a decrease of 24.2% from ¥3,745,445.00 in the previous period[23] Shareholder Information - Total number of common shareholders at the end of the reporting period is 4,957[12] - The largest shareholder, Jin Jian, holds 34.88% of shares, totaling 17,437,500 shares[12] - The second-largest shareholder, Cai Tiehui, owns 25.50% of shares, amounting to 12,750,002 shares[12] - Total restricted shares held by major shareholders is 33,562,503, with no changes during the period[14] Investments and Expenses - The company reported a significant increase in construction in progress, rising by 4452.38% to ¥6,392,124.02 due to increased investment in ongoing projects[9] - The company experienced a 67.96% increase in trading financial assets, totaling ¥320,394,716.35, attributed to the purchase of wealth management products[9] - The company’s financial expenses decreased by 57.00% to -¥1,401,251.83, due to reduced amounts in structured deposits[10] - Investment income increased by 86.31% to ¥3,245,382.38, driven by higher returns from wealth management products[10] - Research and development expenses increased to CNY 11,079,343.22, up from CNY 9,781,402.59, reflecting a focus on innovation[19] Inventory and Fixed Assets - Cash and cash equivalents decreased from ¥210,805,466.78 to ¥79,677,640.95, a decline of approximately 62.3%[16] - Total current assets decreased from ¥618,205,039.57 to ¥603,437,970.02, a reduction of about 2.2%[16] - Inventory decreased from ¥143,954,849.65 to ¥129,732,023.36, a decline of approximately 9.8%[16] - Long-term equity investments decreased to ¥380,000.00 from ¥380,000.00, indicating no change[16] - Fixed assets decreased from ¥262,333,626.52 to ¥257,222,861.77, a decline of about 1.9%[16] Market Strategy - The company has no new product launches or significant market expansion strategies mentioned in the report[12]

鸿铭股份:截至2025年10月20日公司股东数为5467户

Zheng Quan Ri Bao· 2025-10-21 11:37

Group 1 - The company, Hongming Co., stated that as of October 20, 2025, the number of shareholders will be 5,467 [2]

121只创业板股最新筹码趋向集中

Zheng Quan Shi Bao Wang· 2025-10-20 02:45

Summary of Key Points Core Viewpoint - The number of shareholders in 245 ChiNext stocks has decreased as of October 10, with 121 stocks showing a decline, and 4 stocks experiencing a drop of over 10% compared to the previous period [1]. Group 1: Shareholder Changes - ST Meichen has the largest decline in shareholder numbers, with a decrease of 18.26% to 58,149 shareholders, and has seen a cumulative drop of 3.10% in stock price since the concentration of shares began [1][3]. - Hengshuai Co. reported a decrease of 11.32% in shareholder numbers to 8,956, with a cumulative stock price drop of 18.46% [1][3]. - Huazi Technology's shareholder count fell by 10.73% to 34,461, with a stock price decline of 4.24% [1][3]. Group 2: Continuous Shareholder Decline - A total of 53 ChiNext stocks have shown a continuous decline in shareholder numbers for more than three consecutive periods, with some stocks experiencing declines for up to nine periods [1]. - Fengshang Culture has seen a cumulative decline of 43.74% in shareholder numbers over nine periods, while Hongming Co. has decreased by 35.20% over eight periods [2][3]. Group 3: Market Performance - The average decline for concentrated stocks since October 1 is 4.89%, with notable increases in stocks like Anlian Ruishi (up 13.07%), Chen'an Technology (up 12.79%), and Hongming Co. (up 8.71%) [2]. - Industries with the most concentrated stocks include machinery, computers, and electronics, with 21, 19, and 17 stocks respectively [2]. Group 4: Fund Flow - As of October 17, 37 concentrated stocks have attracted leveraged funds, with significant increases in financing balances for stocks like Boke Testing (up 26.58%), Senhe Co. (up 20.67%), and Huakang Clean (up 20.12%) [2].

鸿铭股份连亏2年半 2022年上市募5亿东莞证券保荐

Zhong Guo Jing Ji Wang· 2025-10-14 06:45

Core Viewpoint - Hongming Co., Ltd. reported a significant decline in revenue and net profit for the first half of 2025, indicating financial challenges ahead [1][2]. Financial Performance Summary - The company achieved operating revenue of 92.699 million yuan in the first half of 2025, a decrease of 13.35% compared to the same period last year [1][2]. - The net profit attributable to shareholders was -3.329 million yuan, down from 4.980 million yuan in the previous year [1][2]. - The net profit after deducting non-recurring gains and losses was -5.962 million yuan, compared to 4.016 million yuan in the same period last year [1][2]. - The net cash flow from operating activities was 12.561 million yuan, a decline of 57.46% year-on-year [1][2]. Future Projections - For 2023 and 2024, the projected operating revenues are 175 million yuan and 201 million yuan, respectively [2]. - The expected net profits attributable to shareholders for 2023 and 2024 are -16.773 million yuan and -9.770 million yuan, showing an improvement of 41.75% year-on-year [3]. - The net profit after deducting non-recurring gains and losses for 2024 is projected to be -14.631 million yuan, a 16.46% improvement from 2023 [3]. - The net cash flow from operating activities is expected to increase significantly to 37.678 million yuan in 2024, a 96.24% increase compared to 2023 [3]. Company Background - Hongming Co., Ltd. was listed on the Shenzhen Stock Exchange on December 30, 2022, issuing 12.5 million shares at a price of 40.50 yuan per share [4]. - The total funds raised from the initial public offering amounted to 50.625 million yuan, with a net amount of 42.754 million yuan after expenses [4]. - The company planned to use the raised funds for the headquarters project, including production, marketing, and research centers [4].

鸿铭股份10月10日获融资买入180.20万元,融资余额3738.66万元

Xin Lang Zheng Quan· 2025-10-13 01:25

Group 1 - On October 10, Hongming Co., Ltd. experienced a stock price increase of 1.39% with a trading volume of 46.17 million yuan [1] - The financing data for Hongming on the same day showed a financing purchase amount of 1.80 million yuan and a financing repayment of 3.39 million yuan, resulting in a net financing outflow of 1.59 million yuan [1] - As of October 10, the total balance of margin trading for Hongming was 37.39 million yuan, which accounts for 5.39% of its market capitalization and is above the 90th percentile level over the past year [1] Group 2 - As of September 30, the number of shareholders for Hongming was 4,957, a decrease of 6.15% from the previous period, while the average circulating shares per person increased by 6.56% to 3,316 shares [2] - For the first half of 2025, Hongming reported a revenue of 92.70 million yuan, a year-on-year decrease of 13.35%, and a net profit attributable to the parent company of -3.33 million yuan, a year-on-year decrease of 166.86% [2] Group 3 - Since its A-share listing, Hongming has distributed a total of 50 million yuan in dividends [3]

鸿铭股份:截至2025年9月30日公司股东数为4957户

Zheng Quan Ri Bao· 2025-10-09 10:10

Core Insights - Hongming Co., Ltd. stated on October 9 that the number of shareholders is expected to reach 4,957 by September 30, 2025 [2] Company Summary - The company is actively engaging with investors through interactive platforms [2] - The projected increase in shareholders indicates potential growth in investor interest and market participation [2]

鸿铭股份盘中创历史新高

Zheng Quan Shi Bao· 2025-09-25 02:44

Group 1 - The stock price of Hongming Co., Ltd. reached a historical high, with a current price of 44.08 yuan, up 1.08%, and a total market capitalization of 2.204 billion yuan [1] - The mechanical equipment industry, to which Hongming belongs, has an overall increase of 0.34%, with 361 stocks rising and 206 stocks declining [1] - The latest margin trading data shows a margin balance of 39.9559 million yuan, with a recent increase of 126,600 yuan, reflecting a growth of 0.32% [1] Group 2 - As of September 20, the number of shareholders in Hongming decreased to 5,282, a decline of 810 shareholders or 13.30% from the previous period [1] - The company's semi-annual report indicates a total revenue of 92.6997 million yuan for the first half of the year, a year-on-year decrease of 13.35%, and a net loss of 3.3293 million yuan, a year-on-year decline of 166.86% [1] - The basic earnings per share for the company is reported at -0.0666 yuan [1]

最新股东户数揭秘:这93股股东户数连降三期

Zheng Quan Shi Bao Wang· 2025-09-23 10:08

Core Insights - The article highlights a trend of decreasing shareholder accounts among 498 companies, indicating a concentration of shares, with 93 companies experiencing a decline for three consecutive periods or more [1][2] Group 1: Shareholder Account Trends - 93 companies have seen a continuous decrease in shareholder accounts for over three periods, with some like ST Huawen and Guotou Fengle experiencing declines for 13 and 10 periods respectively, with reductions of 15.38% and 15.73% [1] - The latest data shows significant declines in shareholder accounts for companies such as Hongming Co., ST Qingyan, and Shenzhou Taiyue, with decreases of 13.30%, 11.03%, and 10.27% respectively [1][2] Group 2: Market Performance - Among the companies with declining shareholder accounts, 15 have seen their stock prices rise, while 78 have experienced declines, with notable increases for ST Qingyan (45.91%), Hongming Co. (13.56%), and Jerey Co. (12.21%) [2] - 10.75% of the companies with decreasing shareholder accounts outperformed the Shanghai Composite Index, with ST Qingyan, Honghe Technology, and Dongfang Tantalum achieving excess returns of 37.02%, 10.51%, and 7.65% respectively [2] Group 3: Industry and Institutional Interest - The industries with the highest concentration of companies experiencing declining shareholder accounts include machinery, basic chemicals, and pharmaceuticals, with 14, 10, and 8 companies respectively [2] - In terms of institutional interest, 14 companies with declining shareholder accounts were surveyed by institutions in the past month, with Donggang Co., Dongfang Tantalum, and Dalian Heavy Industry receiving the most attention [2]

鸿铭股份最新股东户数环比下降13.30%

Zheng Quan Shi Bao Wang· 2025-09-22 10:17

Group 1 - The number of shareholders for Hongming Co., Ltd. decreased to 5,282 as of September 20, representing a decline of 810 shareholders or 13.30% compared to the previous period [2] - This marks the sixth consecutive period of decline in the number of shareholders for the company [2] - The closing price of the stock was 42.34 yuan, down 0.28%, with a cumulative increase of 3.47% since the concentration of shares began [2] Group 2 - The latest margin trading data shows a total margin balance of 36.97 million yuan as of September 19, with a decrease of 2.86 million yuan or 7.18% since the concentration of shares began [2] - The company's semi-annual report indicates that it achieved operating revenue of 92.70 million yuan in the first half of the year, a year-on-year decrease of 13.35% [2] - The net profit for the same period was -3.33 million yuan, reflecting a year-on-year decline of 166.86%, with basic earnings per share at -0.0666 yuan [2]

广东鸿铭智能股份有限公司关于选举职工代表董事的公告

Shang Hai Zheng Quan Bao· 2025-09-15 20:54

Group 1 - The company announced the election of Xia Yongyang as the employee representative director of the third board of directors, effective until the board's term ends [1][3] - The election was conducted in accordance with the Company Law and the company's articles of association, ensuring compliance in the board's operation [1] - After the election, the total number of directors who are also senior management or employee representatives will not exceed half of the total number of directors [1] Group 2 - Xia Yongyang, born in 1968, has a background in business management and has held various managerial positions in different companies before joining Hongming [3][4] - He has no shares in the company and does not have any relationships with major shareholders or management, ensuring independence [4] - Xia has not faced any penalties from regulatory bodies and meets all qualifications to serve as a director [4] Group 3 - The company held its second extraordinary general meeting on September 15, 2025, with a total of 33 participants representing 67.2296% of the voting shares [9] - The meeting adopted a combination of on-site and online voting methods, complying with relevant laws and regulations [8][9] - Several resolutions were passed, including amendments to the company's articles of association and various management rules, with overwhelming support from shareholders [13][15][21]