资负共振

Search documents

股价浮盈计入当期利润,保险股三季报的“虚”与“实”

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 12:33

Core Viewpoint - The surge in profits for listed insurance companies in China is primarily driven by a significant increase in investment income due to a favorable capital market environment and the impact of new accounting standards, which amplify profit volatility [1][4][6]. Group 1: Performance Highlights - The CSI 300 index rose by 17.9% in Q3, leading to a profit increase of 40%-70% for major insurance companies like China Life and New China Life [1][2]. - China Life expects a net profit of approximately CNY 156.79 billion to CNY 177.69 billion for the first three quarters of 2025, an increase of about CNY 52.26 billion to CNY 73.17 billion year-on-year [2]. - New China Life anticipates a net profit of CNY 29.99 billion to CNY 34.12 billion, reflecting a year-on-year increase of CNY 9.31 billion to CNY 13.44 billion [2]. Group 2: Investment Strategies - Insurance companies are increasing their equity investments significantly, with the stock allocation reaching CNY 3 trillion by the end of Q2, an 8.92% increase from Q1 and a 47.57% increase from the previous year [2][3]. - The proportion of stocks in the total investment assets of major listed insurance companies rose to 9.3% in H1 2025, the highest in nearly a decade [3]. - The expansion of long-term stock investment trials has allowed insurance companies more flexibility in equity asset allocation, with the approved trial scale increasing from CNY 50 billion to CNY 162 billion [3]. Group 3: Accounting Standards Impact - The new accounting standards implemented in 2023 have led to increased profit volatility, as more assets are classified under fair value measurement, directly affecting current profits [4][5]. - Under the new standards, fluctuations in the market value of trading financial assets are now reflected in current profits, contrasting with the previous standards where unrealized gains did not impact profits unless sold [5]. - The proportion of trading financial assets classified under fair value through profit or loss (FVTPL) is notably high among major insurers, with New China Life and China Life at 81.2% and 77.4%, respectively [6]. Group 4: Market Outlook and Challenges - The sustainability of the current profit growth is questioned, as it heavily relies on capital market performance, which may not be consistent [6][8]. - Analysts express differing views on future performance, with some expecting premium growth to remain around 10%, while others caution that investment income, being cyclical and volatile, may not support high growth rates [8][9]. - The insurance industry is experiencing a "differentiation + volatility" trend, with varying performance among companies under similar market conditions [8][9]. Group 5: Product Strategy and Risk Management - Insurance companies are optimizing their product structures by increasing the sales of dividend insurance and reducing reliance on interest-sensitive life insurance [7]. - Non-auto insurance is expected to benefit from the implementation of a new regulatory framework, potentially reducing the combined cost ratio for related companies by 0.2-0.9 percentage points [7]. - Smaller insurance companies are exploring differentiated survival strategies, such as optimizing capital structures and enhancing capital management capabilities through digitalization [10].

港股异动丨内险股集体上涨 中国人寿涨超4% 中国平安涨超2%

Ge Long Hui· 2025-10-21 01:52

Group 1 - The core viewpoint of the article highlights a collective rise in Hong Kong insurance stocks, with China Life leading the gains at over 4% [1] - Major insurance companies such as China Life, New China Life, and PICC have announced significant profit increases, with net profit growth exceeding 40% year-on-year, and China Life leading with a projected increase of 50% to 70% [1] - The strong performance in equity investments is identified as a key driver behind the net profit growth of these companies [1] Group 2 - Several brokerage firms maintain an optimistic outlook on the insurance sector, anticipating a "double hit" in valuation and performance due to "asset-liability resonance" [1] - Continuous policy support from multiple departments encourages insurance capital to enter the market as long-term funds, promoting the establishment of a long-term assessment mechanism [1]

险企三季报集体“预喜”,投资收益成业绩增长最强引擎

Huan Qiu Wang· 2025-10-20 06:44

Core Viewpoint - The performance of listed insurance companies is showing a positive trend, with major players like China Life, New China Life, and PICC Property & Casualty reporting significant profit increases, driven primarily by strong equity investments [1][3]. Group 1: Performance Highlights - China Life leads the market with a projected net profit increase of 50% to 70%, while other major insurers also report over 40% growth in net profit [1]. - The recovery of the A-share market since 2025 has provided substantial returns for insurance investment portfolios, significantly boosting investment income [1]. - Insurers are actively increasing their equity investments and strategically positioning themselves in new productivity sectors, contributing to notable growth in investment returns [1]. Group 2: Operational Strengths - The insurance sector is experiencing robust performance on the liability side, with steady operational management and structural optimization supporting profit growth [1]. - Despite a lack of widespread monthly premium data, available figures indicate overall growth in premium scale, with a shift towards dividend insurance and floating income products in response to reduced preset interest rates [1]. - The property insurance sector is also seeing significant improvements in underwriting profits through quality enhancement and efficiency measures [1]. Group 3: Future Outlook - Multiple brokerage firms maintain an optimistic outlook for the insurance sector, anticipating a "double hit" in valuation and performance due to "asset-liability resonance" [3]. - Continued policy support, including encouragement for insurance capital to enter the market and the establishment of long-term assessment mechanisms, is expected to bolster industry development [3]. - As of the second quarter of 2025, the total investment in stocks by life and property insurance companies has exceeded 3 trillion yuan, marking a significant increase and a high proportion of stock investments [3].

最高预增70%!中国人寿,报喜!

Zheng Quan Shi Bao· 2025-10-19 14:49

Core Viewpoint - The insurance industry in China is experiencing a positive trend in performance, with several listed insurance companies, including China Life, announcing significant profit increases for the first three quarters of 2025, driven by improved investment returns and effective management strategies [1][2][4]. Group 1: Performance Announcements - China Life expects a net profit of approximately CNY 156.79 billion to CNY 177.69 billion for the first three quarters of 2025, representing an increase of CNY 52.26 billion to CNY 73.17 billion compared to the same period in 2024, with a year-on-year growth of 50% to 70% [2]. - New China Life Insurance anticipates a net profit of CNY 29.99 billion to CNY 34.12 billion for the same period, with an expected increase of CNY 9.31 billion to CNY 13.44 billion, translating to a year-on-year growth of 45% to 65% [3]. - PICC P&C expects a net profit growth of 40% to 60% for the first three quarters of 2025 [3]. Group 2: Key Drivers of Performance - The primary reasons for the profit increases include a focus on value creation, effective asset-liability management, and enhanced investment capabilities, leading to improved investment returns [2][4]. - The recovery of the stock market has allowed insurance companies to increase their equity investments, significantly boosting investment income compared to the previous year [2][4]. - New China Life emphasized the importance of optimizing asset allocation and increasing high-quality assets to withstand low-interest-rate challenges, contributing to long-term profitability [4]. Group 3: Market Trends and Regulatory Environment - The overall performance of the A-share market has been positive, with the CSI 300 index showing a cumulative increase of 12.88%, which has positively impacted the investment returns of insurance companies [8]. - Recent regulatory policies are expected to further enhance the development prospects of the insurance industry, including support for dividend-type long-term health insurance and the implementation of the "reporting and operation integration" policy for non-auto insurance [10].

最高预增70%!中国人寿,报喜!

券商中国· 2025-10-19 12:47

Core Viewpoint - The insurance industry is experiencing a positive trend in performance, with multiple companies reporting expected profit increases for the third quarter of 2025, driven by improved investment returns and effective management of both assets and liabilities [1][2][11]. Group 1: Performance Announcements - China Life announced an expected net profit of approximately 156.79 billion to 177.69 billion yuan for the first three quarters of 2025, representing an increase of about 52.26 billion to 73.17 billion yuan compared to the same period in 2024, with a year-on-year growth of 50% to 70% [4]. - New China Life Insurance projected a net profit of 29.99 billion to 34.12 billion yuan for the same period, an increase of 9.31 billion to 13.44 billion yuan, reflecting a year-on-year growth of 45% to 65% [5]. - PICC P&C Insurance expects a net profit growth of 40% to 60% for the third quarter [5]. Group 2: Reasons for Performance Improvement - The main reasons for the performance increase include a significant rise in investment income and effective management of insurance liabilities, with companies focusing on enhancing the value and quality of their insurance products [6][11]. - China Life emphasized its commitment to value creation and efficiency improvement, alongside a robust investment strategy that has led to a substantial increase in investment returns [4]. - New China Life highlighted its focus on optimizing asset allocation and enhancing the quality of its insurance offerings, which has contributed to its profit growth [6]. Group 3: Market Trends and Conditions - The overall performance of the A-share market has been positive, with the CSI 300 index achieving a cumulative increase of 12.88%, which has significantly boosted the investment income expectations for insurance companies [12]. - The insurance sector is benefiting from favorable policies, including the revival of dividend-type health insurance products and the implementation of the "reporting and operation integration" policy for non-auto insurance, which is expected to enhance industry growth prospects [14].

新华保险(601336):2025年前三季度业绩预增公告点评:投资收益持续向好,利润增长提速

GUOTAI HAITONG SECURITIES· 2025-10-14 13:54

Investment Rating - The report maintains an "Accumulate" rating for the company with a target price of 77.49 CNY, corresponding to a 2025 P/EV of 0.85 times [6][13]. Core Insights - The company is expected to see a significant increase in net profit attributable to shareholders for the first three quarters of 2025, projected to grow by 45%-65% year-on-year, primarily driven by continued high growth in investment income [2][13]. - The report highlights that the improvement in profitability is expected to be supported by a resonance between assets and liabilities, leading to sustained growth in value [13]. - The company is actively optimizing its asset allocation structure, which is anticipated to enhance investment returns, benefiting from a recovering capital market and improved equity asset yields [13]. Financial Summary - The company's projected financial performance shows a substantial increase in operating revenue from 71,547 million CNY in 2023 to 173,350 million CNY in 2025, reflecting an 85% increase in 2024 and a 31% increase in 2025 [4][14]. - Net profit attributable to shareholders is expected to rise from 8,712 million CNY in 2023 to 38,992 million CNY in 2025, marking a 201% increase in 2024 and a 49% increase in 2025 [4][14]. - The earnings per share (EPS) is projected to increase significantly, reaching 12.50 CNY in 2025, up from 8.41 CNY in 2024 [4][14]. Investment Drivers - The report identifies two main drivers for the anticipated growth in investment income: the recovery of the Chinese capital market and the company's proactive asset allocation strategy [13]. - The report notes that the company's core equity allocation (stocks and funds) is at 18.6%, which is ahead of its listed peers, indicating a strong positioning in the market [13]. - The expected growth in new business value (NBV) is projected at 52.8% year-on-year for the first three quarters of 2025, driven by both demand and supply-side factors [13].

新华保险(601336):资负共振,推动业绩延续向好

HUAXI Securities· 2025-08-29 12:34

Investment Rating - The investment rating for the company is "Buy" [1] Core Views - The company reported a significant increase in revenue and net profit for the first half of 2025, with operating income reaching 70.041 billion yuan, up 26.0% year-on-year, and net profit attributable to shareholders at 14.799 billion yuan, up 33.5% [2] - The company's new business value (NBV) showed remarkable growth of 58.4% year-on-year, reaching 6.182 billion yuan, driven by rapid growth in first-year premium income and improved business quality [3] - The total investment return rate has significantly improved, with total investment income of 45.288 billion yuan, up 43.3% year-on-year, and an annualized total investment return rate of 5.9%, up 1.1 percentage points [4] Summary by Sections Financial Performance - For H1 2025, the company achieved operating revenue of 700.41 billion yuan, a year-on-year increase of 26.0%, and a net profit of 147.99 billion yuan, up 33.5% [2] - The company's net assets attributable to shareholders decreased by 13.3% year-on-year to 834.07 billion yuan, with a weighted average ROE of 15.93%, an increase of 4.72 percentage points year-on-year [2] New Business Value - The NBV reached 6.182 billion yuan, reflecting a year-on-year growth of 58.4%, primarily due to a rapid increase in first-year premium income [3] - The first-year premium income for long-term insurance was 39.622 billion yuan, up 113.1% year-on-year, with first-year regular premium income at 25.528 billion yuan, up 64.9% [3] Investment Returns - The company's investment assets totaled 1.71 trillion yuan, an increase of 5.1% from the previous year [4] - The annualized comprehensive investment return rate was 6.3%, a decrease of 0.2 percentage points year-on-year, while the net investment return was 234.60 billion yuan, up 9.2% year-on-year [4] Profit Forecast - The company maintains its profit forecast, expecting revenues of 132.6 billion yuan in 2025, with net profits of 26.238 billion yuan and EPS of 8.41 yuan [5] - The projected NBV for 2025 is 6.675 billion yuan, with corresponding PEV ratios of 0.76 for 2025 [5]

新华保险(601336):2025 年中报业绩点评:资负共振,盈利增长亮眼

GUOTAI HAITONG SECURITIES· 2025-08-29 06:34

Investment Rating - The report maintains a "Buy" rating for the company with a target price of 77.49 CNY per share [6][13]. Core Insights - The company's net profit for the first half of 2025 increased by 33.5% year-on-year, primarily driven by improved investment returns [13]. - The net asset value decreased by 13.3% compared to the beginning of the year, mainly due to the impact of declining interest rates and negative effects from the assessment methods of insurance contract liabilities [13]. - The new business value (NBV) grew significantly by 58.4% in the first half of 2025, attributed to a rapid increase in new single premiums, which rose by 100.5% year-on-year [13]. - The company’s annualized net investment return rate was 3.0%, slightly down by 0.2 percentage points year-on-year, while the annualized total investment return rate improved to 5.9%, up by 1.1 percentage points year-on-year [13]. Financial Summary - For 2023, the company is projected to have a revenue of 71,547 million CNY, with a net profit of 8,712 million CNY [4]. - The earnings per share (EPS) for 2025 is estimated at 8.65 CNY, reflecting a growth trajectory [14]. - The return on equity (ROE) is expected to be 27% in 2024 and stabilize at 28% from 2025 to 2027 [4][14]. - The company’s total assets are projected to reach 1,861,048 million CNY by 2025, with total liabilities of 1,764,056 million CNY [14][15]. Investment Structure - The investment asset portfolio reached 1.71 trillion CNY in the first half of 2025, marking a 5.1% increase from the beginning of the year [13]. - The company’s investment structure includes 56.4% in debt-type investments and 15.2% in equity-type investments for 2023 [15].

方正富邦吴昊:资负双端共振 保险板块基本面回暖

Zhong Guo Jing Ji Wang· 2025-08-29 06:12

Core Insights - The A-share market has shown strong performance, with the insurance selective index rising by 3.51% and the insurance theme index increasing by 2.64% as of August 29 [1] - Recent half-year reports from listed insurance companies indicate significant improvements in premium income and investment returns, highlighting the "dual engine" of insurance companies [1] Group 1: Premium Income - New China Life Insurance reported a premium income of 121.26 billion yuan for the first half of 2025, a year-on-year increase of 22.7%, with first-year premium income from long-term insurance rising by 113.1% [1] - China Life Insurance collected 525.09 billion yuan in premiums in the first half of the year, equivalent to 1.44 billion yuan per day, marking a 7.3% year-on-year growth, the highest in five years [2] - China Ping An's total premium income from property insurance reached 144 billion yuan, while life and health insurance premiums totaled 301 billion yuan, amounting to 445 billion yuan in total [2] - China Pacific Insurance achieved an insurance service income of 280.25 billion yuan, with original premium income increasing by 6.4% to 2,454.63 billion yuan [2] Group 2: Investment Returns - New China Life reported an annualized total investment return rate of 5.9%, an increase of 1.1% year-on-year, benefiting from optimized equity asset structure and market opportunities [2] - China Ping An's comprehensive investment return rate was 3.1%, up by 0.3% year-on-year, while China Life adjusted its asset allocation by reducing fixed-income assets and increasing equity assets [2] - The insurance sector's price-to-earnings ratio stands at 7.94 times, which is 30.98% lower than the average over the past decade, indicating strong investment value [2]

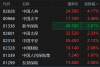

保险板块强势拉升 中国太保、新华保险等涨超5%

Zheng Quan Shi Bao Wang· 2025-08-14 03:36

Group 1 - The insurance sector experienced significant gains on the 14th, with China Pacific Insurance and New China Life Insurance rising over 5%, while Ping An Insurance and China Life Insurance increased by more than 3% [1] - In the Hong Kong market, Sunshine Insurance surged over 8%, and China Pacific Insurance rose nearly 7%, with New China Life Insurance and China Life Insurance both increasing over 5% [1] - Year-to-date, insurance capital has been actively acquiring shares, with Ping An Insurance purchasing 1.7414 million shares of China Pacific Insurance at an average price of HKD 32.0655 per share, totaling over HKD 55.83 million, resulting in a 5.04% stake in China Pacific Insurance [1] Group 2 - The insurance industry has received positive news on the liability side, with the predetermined interest rate for life insurance being lowered from 2.5% to 2% [2] - Short-term effects of the interest rate cut may lead to a temporary halt in certain products, while long-term benefits include encouraging insurance companies to optimize product structures and increase the development of dividend and universal insurance products [2] - The ongoing relaxation of policies for insurance capital entering the market has led to frequent acquisitions of bank stocks by insurance companies, which is expected to enhance investment returns and strengthen the stability of the investment side of insurance companies [2]