先进制造业升级

Search documents

烟台市政协十四届五次会议即将启幕

Qi Lu Wan Bao· 2026-01-17 13:50

在报到现场,委员们在工作人员的指引下,有条不紊地完成信息核对、签到登记、领取会议材料等流程。随后,委员们一边熟悉会议安排,一边交流彼此 关注的热点问题,对会议充满了期待。 会议期间,委员们将围绕全市经济社会发展重点工作和群众关心的热点问题,开展深度协商、参政议政。记者从报到现场了解到,此次参会,委员们带来 的提案聚焦绿色低碳高质量发展、先进制造业升级、人工智能普及、文旅消费新热点等多个领域。 委员们纷纷表示,将以高度的责任感履职尽责,在会议期间积极建言献策,为烟台建设绿色低碳高质量发展示范城市注入政协智慧与力量。 据悉,烟台市政协十四届五次会议将于1月18日开幕,1月21日闭幕。 齐鲁晚报.齐鲁壹点闫丽君于洋王琳 本周末,烟台正式进入2026年"两会时间"。1月17日下午,肩负着全市人民的期盼与重托,参加烟台市政协十四届五次会议的政协委员陆续抵达报到处。 ...

大摩闭门会-邢自强-Laura-Wang-2026开年宏观策略谈-纪要

2026-01-05 15:43

Summary of Key Points from Conference Call Records Industry Overview - **Geopolitical Landscape**: The global geopolitical situation is evolving, with a continued depreciation of the US dollar expected. The Chinese yuan may experience a mild appreciation against the dollar, but potential impacts on exports and deflation should be monitored [1][2][5]. - **Chinese Technology Innovation**: China's technological capabilities are improving, particularly in AI-related hardware and software, as well as domestic computing power replacements. This trend is expected to attract both domestic and international investors, benefiting A-shares and Hong Kong IPO financing [1][2][8]. - **Consumer Stimulus Policies**: The government is implementing targeted consumer stimulus policies, with an estimated 300 billion RMB allocated for the first quarter, primarily aimed at durable consumer goods. If consumption and employment do not meet expectations, the stimulus may expand to include service sector consumption vouchers [1][2][3]. Real Estate Market - **Real Estate Relief Measures**: Relief measures in the real estate sector will focus on inventory reduction and mortgage interest rate subsidies. Initial trials will be conducted in select cities, with the potential for expansion based on effectiveness [3][4]. Fiscal Policy - **Fiscal Policy Focus**: The fiscal policy in the first half of the year will emphasize the early issuance of local special bonds, targeting urban renewal, underground infrastructure, green transformation, smart grid storage, and AI computing infrastructure. Mid-term fiscal spending may increase by approximately 0.5% of GDP (around 700 billion RMB) to support technology applications and real estate relief [4][11]. Economic Growth Projections - **GDP Growth Expectations**: The actual GDP growth for China in 2025 is projected to be around 4.8%, with exports maintaining a mid-to-high single-digit growth rate. However, nominal GDP growth is expected to be lower than actual GDP growth, reflecting cautious private sector performance [1][16][17]. Stock Market Outlook - **Stock Market Trends**: The outlook for the Chinese stock market in 2026 is relatively optimistic, despite some volatility at the end of 2025. The market's performance will depend on the continuation of macroeconomic trends and appropriate policy support [7][8][15]. - **Investor Sentiment**: Factors influencing the stock market include macroeconomic data, corporate earnings, liquidity conditions, market valuation levels, and changes in investor sentiment. Recent positive developments in the IPO market, particularly for GPU-related companies, have increased market activity [9][10]. Currency and Investment - **Renminbi Strength**: The recent strengthening of the renminbi is attributed to a trade surplus exceeding 1 trillion USD and the central bank's allowance for a moderate appreciation. However, the broader context of US dollar depreciation and geopolitical uncertainties remains significant [5][6][19]. - **Foreign Investment in Chinese Stocks**: The appreciation of the renminbi against the dollar is favorable for foreign investors in Chinese stocks, making RMB-denominated assets more attractive [13][14][15]. AI Hardware Market - **AI Hardware Development**: The future of the AI hardware sector is optimistic, with significant demand expected for AI semiconductors. The approval of NVIDIA's export of H200 chips to China is anticipated to positively impact the Chinese AI computing chip market [20][23]. Automotive Industry Trends - **Automotive Market Dynamics**: The automotive industry is expected to face challenges and opportunities in globalization. Exports are projected to increase by 12% by 2026, but there are risks associated with traditional vehicle exports and potential trade barriers in developed markets [25][27]. - **New Energy Vehicle Development**: Key focuses for new energy vehicle technology development include smart driving and AI integration, with expectations for significant penetration of advanced driving technologies by 2030 [28][29].

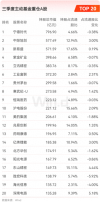

公募三季报持仓洗牌:科技股“七雄”霸榜,茅台失宠,ST华通成黑马

Hua Xia Shi Bao· 2025-10-30 13:16

Core Viewpoint - The report highlights significant shifts in the holdings of actively managed equity funds in the third quarter of 2025, with a notable rise in technology stocks and a decline in traditional consumer stocks like Kweichow Moutai [3][4][6]. Group 1: Fund Holdings Overview - As of September 2025, the total assets under management in the public fund industry reached 35.85 trillion yuan, a quarter-on-quarter increase of 6.30% [3]. - The top three holdings of actively managed equity funds are dominated by technology companies, with CATL reclaiming the top position, surpassing Tencent Holdings [3][4]. - Kweichow Moutai's total market value held by active equity funds decreased to 29.958 billion yuan, down from 30.616 billion yuan in the previous quarter, dropping from third to seventh place among top holdings [3][6]. Group 2: Technology Sector Performance - The technology sector emerged as the primary focus for public fund investments, with seven out of the top ten holdings being technology-related companies [4]. - Notable performers include Xinyi Technology and Zhongji Xuchuang, both of which ranked among the top three heavyweights [4]. - The current market trend indicates a strong and sustained interest in technology stocks, driven by China's economic transformation towards a hard-tech model [4][5]. Group 3: Challenges in Traditional Consumer Sector - The traditional consumer sector, particularly the liquor industry, is facing significant challenges, with 59.7% of liquor companies reporting a decrease in operating profits [6][7]. - The white liquor market is undergoing a deep adjustment phase due to policy changes, consumption structure transformation, and intense competition [6][7]. - The overall sales volume in the liquor industry is expected to decline by over 20% year-on-year, reflecting macroeconomic fluctuations and slow recovery in consumer spending [7][8]. Group 4: Fund Manager Strategies - The top five stocks with increased holdings include Zhongji Xuchuang, Industrial Fulian, ST Huatuo, Dongshan Precision, and Hanwha Technology, all of which are technology companies [9][10]. - Conversely, the top stocks with reduced holdings include Shenghong Technology and Haiguang Information, with significant sell-offs attributed to internal management's actions [11]. - Despite CATL being the top holding, it also appears on the list of reduced holdings, indicating a complex strategy among institutional investors [11].

金信基金:站稳4000点再出发

Zhong Guo Jing Ji Wang· 2025-10-30 00:48

Group 1 - The Shanghai Composite Index has risen 0.70% and surpassed the 4000-point mark, indicating a recovery in investor confidence regarding the macroeconomic environment [2][3] - The surge in the new energy sector, particularly in photovoltaic and energy storage stocks, is attributed to signs of a bottoming cycle in the industry, with both supply-side and demand-side factors contributing to this growth [1][2] - The third-quarter performance of leading companies in the new energy sector exceeded expectations, triggering an overall rebound in the sector [1][2] Group 2 - The economic recovery is supported by significant growth in industrial output and GDP, with industrial value-added increasing by 6.5% year-on-year in September, and GDP growing by 5.2% in the first three quarters [2][3] - The "14th Five-Year Plan" emphasizes technological self-reliance and advanced manufacturing, positioning these areas as key drivers for economic growth over the next five years [2][3] - The capital market is expected to benefit from the listing and financing of quality technology companies, as well as increased investments from institutional funds [2][3] Group 3 - The A-share market's upward trend is supported by economic recovery, policy enhancements, and improved US-China relations, with the technology sector acting as a core driver for market growth [3] - Investors are encouraged to focus on long-term trends in sectors such as semiconductor equipment, AI computing, high-end manufacturing, and new energy, which align with national strategies and exhibit performance elasticity [3]

金信基金市场点评:站稳4000点再出发

Xin Lang Ji Jin· 2025-10-29 09:47

Group 1: Market Performance - The Shanghai Composite Index rose by 0.70%, surpassing the 4000-point mark, while the ChiNext Index increased by 2.93% and the North Star 50 surged by 8.41%, marking the largest single-day gain in nine months [1] - The surge in the new energy sector, particularly in photovoltaic and energy storage stocks, was driven by signs of an industry cycle bottoming out and strong demand exceeding expectations [1][2] Group 2: Economic Indicators - In September, the industrial added value above designated size grew by 6.5% year-on-year, accelerating by 1.3 percentage points compared to the previous value; GDP growth for the first three quarters was 5.2%, with consumption and manufacturing investment as key drivers [2] - The profits of industrial enterprises above designated size increased by 3.2% year-on-year in the first three quarters, marking the highest cumulative growth rate since August of the previous year [2] Group 3: Policy and Strategic Outlook - The "14th Five-Year Plan" emphasizes technological self-reliance and advanced manufacturing upgrades, indicating that the deep integration of technology and industry will be a primary engine for economic growth in the next five years [2] - The capital market is expected to benefit from the listing and financing of quality technology companies, as well as increased investments from industrial capital and institutional funds [2] Group 4: Investment Strategy - Investors are encouraged to focus on sectors aligned with national strategies and industry trends, such as semiconductor equipment and materials, AI computing power and applications, high-end manufacturing, and new energy storage and lithium batteries [3]