大股东减持

Search documents

兴业科技:大股东减持886.65万股,减持计划实施完毕

Xin Lang Cai Jing· 2026-02-27 09:56

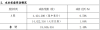

兴业科技公告称,大股东春宏投资减持计划实施完毕。2025年披露减持预披露公告,计划减持不超 886.65万股,占总股本3%。截至2026年2月26日收盘,以集中竞价交易减持295.55万股,占比1%,均价 14.51元/股;以大宗交易减持591.1万股,占比2%,均价12.73元/股。减持后,春宏投资持股降至2259.75 万股,占比7.65%。此次减持未违规,未致公司控制权变更,不影响公司治理及经营。 ...

吴晓求:当前最重要的任务是用法律约束“埋雷”现象

Xin Lang Cai Jing· 2026-01-15 04:18

Core Viewpoint - The forum emphasizes the need for reform and development in China's capital market, particularly addressing issues like major shareholder reductions and the importance of legal frameworks to prevent market risks [1][5]. Group 1: Major Shareholder Reduction - The discussion highlights the need to critically assess whether major shareholder reductions are a problem, suggesting that market stagnation cannot be solely attributed to this issue [3][7]. - Reforms initiated during the split share structure reform and further regulations in 2024 have clarified the conditions under which major shareholders can reduce their holdings, transitioning from "necessary conditions" to "sufficient conditions" [3][7]. - Despite significant reductions by major shareholders, the market continues to grow, indicating that other factors are at play [3][7]. Group 2: Market Reform and Growth - The speaker stresses that the most critical aspect of the Chinese market is reform, particularly enhancing the asset side to boost growth and attract continuous capital inflow [3][7]. - There are many misconceptions in the market, and addressing these through reform is essential for sustainable growth [3][7]. Group 3: Challenges for Small Investors - In the AI era, small investors in China face structural challenges, with some reports indicating that investors have not made profits even at market levels around 4100 points, suggesting a lack of independent investment capability [3][7]. - The availability of diverse investment tools, such as ETFs, is highlighted as a beneficial option for investors, often outperforming individual investors [3][7]. Group 4: Market Safety and Legal Framework - The phenomenon of "hidden risks" in the capital market is noted, where many listed companies may have motives to conceal risks, and intermediaries may assist in this behavior [4][8]. - The current priority is to implement legal measures to deter the motives and actions that lead to these hidden risks, marking a significant area for institutional reform [4][8].

吴晓求:不能简单认为市场停滞与大股东减持有关

Xin Lang Cai Jing· 2026-01-15 04:12

Core Viewpoint - The forum emphasizes the need for reform and development in China's economy, particularly in the context of the upcoming 2026 challenges and opportunities [1][5]. Group 1: Reform and Development - Wu Xiaoqiu highlights the importance of addressing the issue of major shareholder reductions, suggesting that it should not be simplistically linked to market stagnation [3][7]. - The reforms initiated during the split share structure reform and the specific regulations established in 2024 regarding major shareholder reductions are aimed at enhancing market growth [3][7]. - The focus should be on reforming the asset side to boost growth potential and attract continuous capital inflow [3][7]. Group 2: Investment Strategies - In the AI era, structural challenges are faced by small investors in China, with some still not making profits at the 4100-point mark, indicating a lack of independent investment capability [3][7]. - The creation of diverse assets and tools, particularly ETFs, is presented as a favorable option for investors, often outperforming individual investors [3][7]. - The notion of "making everyone profitable" is viewed as a slogan rather than a practical reality, with a more realistic approach being the investment in ETFs to increase the number of profitable investors [3][7]. Group 3: Market Safety and Regulation - The phenomenon of "hidden risks" in China's capital market is serious, with many listed companies having motives and behaviors that contribute to this issue, often aided by intermediary institutions [4][8]. - Ensuring market safety requires legal measures to deter the motives and actions that lead to "hidden risks," marking a critical area for institutional reform [4][8].

通富微电拟不超44亿定增 控股股东正拟套现近6年募60亿

Zhong Guo Jing Ji Wang· 2026-01-11 23:17

Core Viewpoint - Tongfu Microelectronics (002156.SZ) plans to raise up to 440 million yuan through a private placement of A-shares, with proceeds allocated to various capacity enhancement projects and working capital needs [1][2]. Group 1: Fundraising Details - The total amount to be raised is capped at 440 million yuan, which will be used for projects including storage chip packaging capacity enhancement (80 million yuan), automotive and emerging application packaging capacity enhancement (105.5 million yuan), wafer-level packaging capacity enhancement (69.5 million yuan), high-performance computing and communication packaging capacity enhancement (62 million yuan), and replenishing working capital and repaying bank loans (123 million yuan) [2]. - The total investment for these projects amounts to approximately 468.55 million yuan, indicating that the company will cover the difference through other means [2]. Group 2: Issuance Mechanism - The issuance will adopt a competitive pricing method, with the price set at no less than 80% of the average trading price over the 20 trading days prior to the pricing date [3]. - The number of shares to be issued will not exceed 30% of the company's total shares prior to the issuance, amounting to a maximum of 455,279,073 shares [3]. Group 3: Shareholding Structure - As of September 30, 2025, the total share capital of the company is 1,517,596,912 shares, with the actual controller holding 19.79% of the shares. Post-issuance, this percentage is expected to decrease to 15.22% if the maximum number of shares is issued [4]. - The issuance plan stipulates that any single subscriber and their affiliates cannot collectively subscribe for more than 10% of the total shares prior to the issuance, ensuring that control of the company remains unchanged [4]. Group 4: Historical Context - The company has raised a total of approximately 5.965 billion yuan over the past six years through various fundraising activities [7].

尤洛卡:公司目前经营状况稳健

Zheng Quan Ri Bao Wang· 2026-01-05 09:13

Core Viewpoint - The major shareholder of Youloka (300099) has conducted its first share reduction since the company's listing in 2010, which is described as a normal financial arrangement rather than a negative outlook on the company's future development [1] Group 1: Shareholder Actions - The share reduction by the major shareholder is the first since the company's IPO in 2010 [1] - The major shareholder had previously increased their stake in the company during the period of 2016 to 2017 [1] - Other senior executives of the company have not reduced their holdings in recent years [1] Group 2: Company Outlook - The company is currently in a stable operational condition [1] - The management team expresses strong confidence in the company's continued development [1] - The company aims to enhance its value to reward all investors' trust [1]

泰国基地明年1月将启用 南微医学对海外市场增长谨慎乐观|直击业绩会

Xin Lang Cai Jing· 2025-12-16 05:59

Core Viewpoint - The company has experienced growth in revenue and net profit in the first three quarters of the year, driven by an increase in overseas sales, and maintains a cautiously optimistic outlook for future overseas market growth [1][2] Group 1: Overseas Market Expansion - The company reported overseas revenue of approximately 1.4 billion yuan, representing a year-on-year increase of 42% [1] - As of the first half of the year, overseas revenue accounted for 58% of total revenue, with market expansion reaching over 90 countries and regions [1] - The company completed the acquisition of 51% of Spanish company CreoMedical S.L.U. in February [1] Group 2: Domestic Business Challenges - The company acknowledged that domestic centralized procurement is gradually being implemented, which poses short-term pressure on profits but may enhance market share in the long term [2] - The company noted a decline in revenue from high-margin products due to intensified price competition, with a 30% year-on-year decrease in domestic sales of microwave ablation products influenced by procurement policies in Heilongjiang [2] Group 3: Shareholder Concerns - Investors expressed concerns regarding the continuous reduction of shares by the major shareholder, Zhongke Investment, which may exert pressure on the stock price and lacks strategic support for the company [2] - The company clarified that the share reduction is a decision made by the shareholder based on personal judgment and emphasized its focus on core business development to maintain market confidence [2]

东百集团:大股东减持部分股份,公司基本面表现保持稳健

Zheng Quan Shi Bao Wang· 2025-12-09 15:24

Core Viewpoint - The major shareholder of Dongbai Group has reduced its stake, but the company's fundamentals remain stable and unaffected by this change [1] Group 1: Shareholder Actions - On December 9, Dongbai Group announced that its controlling shareholder, Fujian Fengqi Investment Co., Ltd., sold 25,951,900 shares through a centralized bidding process [1] - This marks the first reduction in holdings by Fengqi Investment in over a decade, and the shares sold were all unrestricted circulating shares [1] - Despite the reduction, Fengqi Investment continues to be the controlling shareholder of Dongbai Group [1] Group 2: Company Performance - Dongbai Group operates primarily in commercial retail and warehousing logistics, focusing on infrastructure and operational services for consumption and logistics scenarios [1] - For the first three quarters of 2025, the company reported revenue of 1.359 billion yuan, representing a year-on-year increase of 2.34% [1] - The net profit attributable to shareholders reached 88.048 million yuan, reflecting a year-on-year growth of 3.04%, indicating a sustained growth trend in performance [1]

上市次年业绩“变脸”,大股东频频减持,这家公司高价并购引质疑!

Sou Hu Cai Jing· 2025-11-27 00:57

Core Viewpoint - Guangdong Tianyi Ma Information Industry Co., Ltd. (301178.SZ) has disclosed a plan to acquire 98.5632% of Guangdong Xingyun Kaiwu Technology Co., Ltd. for a total consideration of 1.189 billion yuan, marking the largest asset restructuring since its listing in 2021. However, the market response has been negative, with Tianyi Ma's stock price dropping significantly following the announcement [1][3]. Acquisition Details - The acquisition will be financed through a combination of issuing shares and cash, with a total transaction value of 1.189 billion yuan, comprising 582 million yuan in shares and 606 million yuan in cash [3]. - Tianyi Ma plans to issue 21.76 million new shares at a price of 26.76 yuan per share for the share consideration, and up to 4.73 million shares at 32.74 yuan per share for supporting financing [4][5]. Valuation Concerns - The valuation of Xingyun Kaiwu's 100% equity is set at 1.21 billion yuan, reflecting a substantial premium of 649.77%, which raises concerns about the sustainability of such a high valuation without significant future performance growth [6][7]. - Performance commitments have been made by the shareholders of Xingyun Kaiwu, with net profit targets of no less than 90 million yuan, 95 million yuan, and 105 million yuan for the years 2025 to 2027 [7]. Financial Performance - Tianyi Ma's core business focuses on smart city solutions, but it has experienced a decline in performance since its IPO, with revenue dropping from 4.67 billion yuan in 2021 to an estimated 2.24 billion yuan in 2024, and net profit turning negative at -495.53 million yuan [8]. - In contrast, Xingyun Kaiwu is positioned in a rapidly growing sector, providing IoT management services for over 3 million self-service devices, which could significantly enhance Tianyi Ma's revenue post-acquisition [10][11]. Industry Trends - The self-service device sector is experiencing rapid growth, driven by trends such as "unmanned service, instant satisfaction, and small high-frequency transactions," with technologies like 5G and IoT facilitating this expansion [12][13]. - Xingyun Kaiwu has established a nationwide network of smart devices, collaborating with over 10,000 enterprises and 4.5 billion service users, indicating a robust market presence [15]. Shareholder Activity - Recent activities show that several major shareholders of Tianyi Ma have opted to reduce their holdings, raising concerns about insider confidence in the company's future prospects [16][17].

纽威股份1.39亿收购子公司少数股权 评估增值84%大股东高位减持套现

Xin Lang Cai Jing· 2025-11-07 10:20

Core Viewpoint - Niuwei Co., Ltd. plans to acquire 40% of its subsidiary Dongwu Machinery for 139 million yuan, aiming to enhance operational efficiency and resource allocation, making Dongwu a wholly-owned subsidiary [1]. Group 1: Acquisition Details - The acquisition is valued at 139 million yuan, with Dongwu Machinery's equity assessed at 373 million yuan, reflecting an appreciation of 170 million yuan, or 83.89% [1]. - Dongwu Machinery's products are utilized in various demanding industrial sectors, including refining, chemicals, and renewable energy [1]. Group 2: Financial Performance - For the first seven months of 2025, Dongwu Machinery reported revenue of 96.82 million yuan and a net profit of 11.63 million yuan [1]. - In 2024, Dongwu Machinery achieved an annual revenue of 170 million yuan and a net profit of 23.74 million yuan [1]. - Niuwei Co., Ltd. reported a net profit of 1.114 billion yuan for the first three quarters of 2025, indicating a significant performance gap compared to Dongwu Machinery [1]. Group 3: Shareholder Actions - Niuwei Group, the controlling shareholder, reduced its stake by 6.55 million shares (0.84% of total shares) between July 22 and September 10, 2025, and a total of 7.49 million shares (0.97%) from July 18 to October 17, 2025, raising 259 million yuan [2]. - The share price of Niuwei Co., Ltd. doubled within the year, reaching 54.60 yuan per share, with a market capitalization of 42.34 billion yuan as of November 6 [3]. Group 4: Market Implications - The simultaneous occurrence of a high-value acquisition and significant share sell-off by the controlling shareholder raises questions about the rationale behind the acquisition pricing and the future valuation of the company [4]. - The actions of the controlling shareholder during a period of strong performance and high stock prices suggest a complex outlook on the company's future prospects [4].

汇绿生态实控人方套现2.77亿 2021重新上市净利降3年

Zhong Guo Jing Ji Wang· 2025-10-20 03:37

Core Viewpoint - The major shareholder of Huylv Ecological (001267.SZ), Ningbo Huining Investment Co., Ltd., has reduced its stake by 2.40%, bringing its ownership down from 18.51% to 16.11% through a share reduction of 18,846,516 shares, resulting in approximately 277 million yuan in cash proceeds [1][2]. Shareholding Changes - Ningbo Huining sold 4,424,200 shares through centralized bidding, accounting for 0.56% of the total shares, and 14,422,316 shares through block trading, accounting for 1.84% [2]. - The reduction in shareholding was executed between October 15 and October 16, 2025, at a weighted average price of 14.69 yuan per share [1]. Previous Announcements - On June 27, 2025, Huylv Ecological disclosed a plan for Ningbo Huining to reduce its holdings by up to 3% (23,524,939 shares) within a three-month period starting from July 18, 2025 [4]. - The planned reduction included a maximum of 7,841,646 shares through centralized bidding and 15,683,293 shares through block trading [4]. Financial Performance - Huylv Ecological has experienced a decline in net profit for three consecutive years since its relisting in 2021, with revenues decreasing from 8.14 billion yuan in 2020 to 5.87 billion yuan in 2024 [6]. - The net profit attributable to shareholders has also decreased from 899 million yuan in 2020 to 653 million yuan in 2024 [6]. Capital Raising Activities - In 2022, Huylv Ecological conducted a non-public offering of 75,446,428 shares at a price of 4.48 yuan per share, raising approximately 338 million yuan, with a net amount of about 332 million yuan after expenses [7].