家具制造

Search documents

邮储银行广东龙川县支行用精准服务激活县域经济发展动能

Zheng Quan Ri Bao Zhi Sheng· 2025-10-25 17:10

Core Insights - Postal Savings Bank of China in Longchuan County is leveraging financial innovation to address the financing challenges in agriculture, thereby stimulating local economic development [1][3] Group 1: Agricultural Financing Innovations - The bank has developed a unique assessment model for oil tea plantations, allowing for a credit limit of 4 million yuan for a company based on the potential yield and market conditions [2] - The bank's support has enabled the expansion of oil tea plantations from 2,000 acres to 5,000 acres, resulting in a 50% annual increase in online sales of derived products [2][3] - By September 2025, the bank has provided over 120 million yuan in credit to 20 oil tea enterprises and 26 cooperatives, supporting an annual output value exceeding 1 billion yuan [2][3] Group 2: Support for Technological Innovation - The bank's "Science and Technology Credit Loan" has facilitated a company in the high-end equipment manufacturing sector to secure a 50 million yuan credit line, enabling significant advancements in production capacity and patent development [4][5] - The company’s production capacity increased from 8,000 tons to 12,000 tons, and product quality improved significantly after receiving the loan [5] Group 3: Assistance for Small and Micro Enterprises - The bank has implemented a rapid approval process for small and micro enterprises, reducing loan approval times from 15 days to 7 days, which has been crucial for companies needing to capitalize on market opportunities [6][7] - By September 2025, the bank has provided over 230 million yuan in credit to 26 small and micro enterprises, contributing to a 25% increase in their survival rates and creating over 3,000 jobs [7] Group 4: Overall Impact on Local Economy - The bank's approach emphasizes becoming a growth partner for enterprises and a supportive entity for farmers, thereby enhancing the overall quality of economic development in the region [7]

新一代电动沙发究竟有何不同?顾家家居革新电动沙发舒适体验

Bei Jing Shang Bao· 2025-10-25 11:19

Core Insights - The article highlights the launch of Kuka Home's new generation of electric sofas, which aims to reshape industry perceptions by addressing long-standing issues of functionality and design [1][11][15] Product Innovation - Kuka Home introduced three flagship products: Cloud Comfort JD.6016, Hertz Zero Gravity Pro KG.172B, and Smart Zone ZX.0088, emphasizing self-developed patented technology and user-centric design [1][11] - The Cloud Comfort JD.6016 features the K-TRON® Space Z function frame, which allows for a maximum extension of 180 cm even when placed against a wall, addressing height and stability issues that have plagued the industry [3][5] User Experience Enhancement - The new electric sofas are designed to meet diverse user needs, transforming them from mere seating into a "home comfort center" that accommodates relaxation, cleaning, and more [6][10] - The zero-gravity experience offered by the new sofas is tailored to modern consumers' desire for deep relaxation, with specific angle designs that reduce spinal pressure and promote blood circulation [8][10] Industry Standards and Differentiation - Kuka Home's approach includes a ten-year warranty on the function frame and key components, a significant upgrade from the typical 3-5 year warranty in the industry, reflecting confidence in product quality [13] - The company emphasizes a shift from traditional product development focused on features to a model that starts with deep user need analysis, ensuring that each product addresses specific consumer pain points [13][15] Market Positioning - Kuka Home aims to redefine the value perception of electric sofas, moving beyond the notion of them being mere upgrades to traditional sofas, and instead focusing on a comprehensive upgrade in technology, experience, and quality [15]

江山欧派前三季度营业收入12.84亿元 净亏损4149.2万元

Huan Qiu Wang· 2025-10-24 02:58

Core Insights - Jiangshan Oupai reported a significant decline in revenue and net profit for Q3 2025, with a revenue of 416 million yuan, down 48.92% year-on-year, and a net loss of approximately 51.58 million yuan [1] - For the first three quarters of 2025, the total revenue was 1.28 billion yuan, a decrease of 43.11% compared to the same period last year, with a net loss of about 41.49 million yuan [1] Revenue Breakdown - The revenue from laminated doors was 615 million yuan, down 51.47% year-on-year [1] - The revenue from solid wood composite doors was 184 million yuan, down 50.77% year-on-year [1] - Cabinet products generated 93 million yuan, down 37.98% year-on-year [1] - Other products accounted for 241 million yuan, down 12.14% year-on-year [1] - Franchise service fees increased to 107 million yuan, up 21.02% year-on-year [1] Reasons for Decline - The decline in net profit is attributed to an overall downturn in the industry, shrinking market demand, and intense competition [1] - Price adjustments on some products led to a decrease in gross margin [1] - Fixed costs such as depreciation and personnel expenses did not decrease in line with the revenue drop [1] - The company also made provisions for asset impairment [1]

江山欧派(603208) - 江山欧派关于2025年前三季度主要经营情况的公告

2025-10-23 10:00

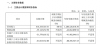

根据上海证券交易所《上市公司行业信息披露指引第十五号——家具制造 (2022 年修订)》的有关规定,江山欧派门业股份有限公司(以下简称"公司) 现将 2025 年前三季度主要经营情况报告如下: | | | 江山欧派门业股份有限公司 关于 2025 年前三季度主要经营情况的公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 注:上述表中数据尾差系四舍五入所致。 二、报告期代理经销商变动情况 2025 年前三季度代理经销商变动情况 | 类型 | 2025 | 年年初数量 | 2025 1-9 | 年 | 月新 | 2025 年 1-9 | | 月取 | 2025 年 | 9 月 30 日数 | | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | | | | (家) | 开拓(家) | | | 消(家) | | | 量(家) | | | 代理经销商 | | 63,170 | | 10,631 | | | 118 | | 73,683 | | | 合 ...

薛凯琪空降老河口付家寨小学,姚基金携手慕思共绘“梦想100分”新图景

Sou Hu Wang· 2025-10-23 09:08

Core Insights - The article highlights the launch of the "Dream 100 Points" charity initiative by Mousse in Hubei, aimed at supporting rural education and promoting children's health through sports and sleep quality [1][3][12] Group 1: Charity Initiative Overview - Mousse has been actively involved in charity since 2014, impacting over 20,000 children across more than 100 rural schools in China [3] - The recent event included the donation of 165 sets of health sleep materials and the organization of professional football classes and friendly matches [3][4] - The initiative received strong support from local government and various social sectors, emphasizing the collaborative effort in enhancing rural education [3][4] Group 2: Collaboration with Yao Foundation - Mousse partnered with Yao Foundation to provide sports resources and enhance the physical education infrastructure in rural schools [3][4] - Yao Foundation has equipped over 40 rural schools in the region with sports equipment and has sent volunteer coaches to guide sports activities, benefiting over 70,000 youth [4] - The collaboration aims to connect quality sleep with children's overall development through a new framework of "charity + sports + education" [5][12] Group 3: Event Highlights - The event featured interactive activities with Mousse's charity ambassador, including a football demonstration and a friendly match, fostering teamwork and excitement among children [7][9] - A special commemorative football was presented by Yao Foundation's Secretary-General as a token of appreciation for Mousse's commitment to charity [5][11] - The school principal expressed hope that the warmth from the initiative would motivate students to excel academically and continue the cycle of giving [10]

乐歌股份:10月23日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-23 08:16

Core Viewpoint - Lege Co., Ltd. announced its third board meeting for the sixth session, discussing adjustments to the expected amount of daily related transactions for 2025, indicating ongoing corporate governance and strategic planning [1] Company Summary - Lege Co., Ltd. reported that its revenue composition for the year 2024 is as follows: 57.26% from the furniture manufacturing sector and 42.74% from warehousing and logistics services [1] - As of the report date, Lege Co., Ltd. has a market capitalization of 5 billion yuan [1]

喜临门10月22日获融资买入563.31万元,融资余额3.40亿元

Xin Lang Cai Jing· 2025-10-23 01:31

Core Viewpoint - The company, Xilinmen, has shown a slight increase in stock price and has low financing and margin trading activity, indicating a cautious market sentiment towards its shares [1]. Financing and Margin Trading - On October 22, Xilinmen's stock price increased by 0.34% with a trading volume of 97.38 million yuan - The financing buy-in amount for the day was 5.63 million yuan, while the financing repayment was 7.94 million yuan, resulting in a net financing outflow of 2.31 million yuan - As of October 22, the total financing and margin trading balance was 340 million yuan, which is 5.27% of the circulating market value and below the 10% percentile level over the past year, indicating low financing activity [1]. - In terms of margin trading, Xilinmen repaid 1,900 shares on October 22 with no shares sold, resulting in a margin balance of 439,200 yuan, also below the 10% percentile level over the past year [1]. Company Overview - Xilinmen Furniture Co., Ltd. is located in Shaoxing, Zhejiang Province, and was established on November 6, 1996, with its stock listed on July 17, 2012 - The company's main business includes the research, production, and sales of mattresses, soft beds, and hotel furniture, with revenue composition as follows: mattresses 60.37%, soft beds and accessories 27.93%, sofas 8.24%, wooden furniture 1.91%, and others 1.55% [1]. Financial Performance - As of June 30, the number of shareholders for Xilinmen was 15,700, a decrease of 1.69% from the previous period - The average number of circulating shares per person was 23,660, a decrease of 0.31% - For the first half of 2025, Xilinmen achieved operating revenue of 4.02 billion yuan, a year-on-year increase of 1.59%, and a net profit attributable to shareholders of 266 million yuan, a year-on-year increase of 14.04% [2]. Dividend Distribution - Since its A-share listing, Xilinmen has distributed a total of 802 million yuan in dividends, with 414 million yuan distributed over the past three years [3]. Institutional Holdings - As of June 30, 2025, Hong Kong Central Clearing Limited has exited the list of the top ten circulating shareholders of Xilinmen [3].

众望布艺:聘任鲍航为公司董事会秘书

Mei Ri Jing Ji Xin Wen· 2025-10-22 11:24

Group 1 - The core point of the article is the announcement of a management change at Zhongwang Fabric, with Yang Yingfan resigning as the board secretary but continuing as the deputy general manager, and Bao Hang being appointed as the new board secretary [1] - For the first half of 2025, Zhongwang Fabric's revenue composition shows that furniture manufacturing accounts for 98.64% of total revenue, while other businesses contribute 1.36% [1] - As of the report date, Zhongwang Fabric has a market capitalization of 2.6 billion yuan [1]

我乐家居:2025年前三季度营收10.55亿元,净利润同比增70.92%

Xin Lang Cai Jing· 2025-10-22 09:11

Core Viewpoint - The company reported a revenue of 1.055 billion yuan for the first three quarters of 2025, reflecting a year-on-year growth of 2.18%, and a net profit of 138 million yuan, which represents a significant increase of 70.92% [1] Financial Performance - For the third quarter, the company achieved a revenue of 386 million yuan, with a net profit of 45.37 million yuan, marking year-on-year growths of 2.84% and 29.20% respectively [1] - The high growth in profitability is attributed to increased revenue from both distribution and direct sales, a higher proportion of high-end orders, and a reduction in various expenses [1] Strategic Initiatives - The company addressed questions regarding its new store layout, differentiation from other brands, technology empowerment, and dividend policy during the earnings call [1]

江山欧派:关于获得发明专利证书的公告

Zheng Quan Ri Bao· 2025-10-21 14:14

Core Viewpoint - Jiangshan Oupai announced the receipt of an invention patent certificate from the National Intellectual Property Administration for a pre-forming device and durability testing method for curved surface samples of decorative films [2] Company Summary - Jiangshan Oupai has received a patent for an innovative device related to decorative films, which may enhance its competitive edge in the market [2]