电子科技

Search documents

大理市顺音电子科技有限公司成立 注册资本5万人民币

Sou Hu Cai Jing· 2025-10-29 11:18

Group 1 - A new company, Dali Shunyin Electronic Technology Co., Ltd., has been established with a registered capital of 50,000 RMB [1] - The legal representative of the company is Chen Biao [1] - The company's business scope includes sales of audio equipment, security system monitoring services, information system integration services, and various other electronic and consumer products [1] Group 2 - The company is authorized to engage in construction engineering projects, subject to approval from relevant authorities [1] - The business activities are diversified, covering areas such as digital technology services, market marketing planning, and technical consulting [1] - The company operates under a general project framework, allowing it to conduct business activities autonomously with its business license [1]

以“柿”为媒,中国三星助力富平湾里村“人才链、产业链”共振

Xin Hua Wang· 2025-10-29 09:24

Core Insights - The transformation of Waili Village in Shaanxi Province is driven by the return of talent and the collaboration of local and external innovators, focusing on the persimmon industry as a key element for rural revitalization [1][2][6] Talent and Industry Synergy - The local talent, particularly those returning home, plays a crucial role in revitalizing the persimmon industry, infusing it with professional skills and innovative thinking [2][3] - The "sharing village" project by China Samsung has been pivotal in providing resources and support, enabling local leaders like Yang Weina to develop the persimmon industry through standardization and branding efforts [2][6] New Career Opportunities - The rise of new professions in Waili Village is exemplified by individuals like Liu Yaopeng and Chen Chen, who have returned to learn and innovate within the persimmon dyeing and production sectors, showcasing the diverse talents contributing to the industry [3][5] Dual Chain Development - The transformation of Waili Village is characterized by a dual empowerment of the talent chain and the industry chain, creating a virtuous cycle where talent nurtures industry and industry attracts talent [6] - The establishment of a cooperative model supported by China Samsung has effectively integrated resources, enhancing the operational capabilities of local cooperatives and farmers [6] Educational Initiatives - The launch of the "Future School" initiative by China Samsung in nearby villages aims to cultivate rural talent and promote industry-education integration, providing a model for sustainable rural development [7] - The "Future Classroom" in Waili Village serves multiple purposes, including training for local leaders, support for higher education institutions, and educational resources for children, fostering a holistic approach to rural revitalization [7]

安福县弘联电子科技有限公司成立 注册资本10万人民币

Sou Hu Cai Jing· 2025-10-29 04:50

Core Insights - Anfu County Honglian Electronic Technology Co., Ltd. has been established with a registered capital of 100,000 RMB [1] - The legal representative of the company is Yan Yuzhi [1] Business Scope - The company is involved in the manufacturing of wires and cables, which requires approval from relevant authorities to operate [1] - It also engages in the sale of electronic products, fiber optic manufacturing and sales, and the production of optical communication equipment [1] - Additional activities include retail and wholesale of hardware products, import and export of goods, and manufacturing of computer software and hardware [1]

雷军跻身成胡润百富榜前5,身价3260亿|首席资讯日报

首席商业评论· 2025-10-29 04:07

Group 1 - Lei Jun ranks 5th on the Hurun Rich List with a net worth of 326 billion yuan, marking a wealth increase of 196 billion yuan (+151%) from last year, the highest among entrepreneurs this year [2] - Foxconn plans to invest up to 42 billion New Taiwan dollars to expand its cloud computing services platform, focusing on AI computing power [4] - Sany Heavy Industry raised approximately 13.45 billion Hong Kong dollars through an IPO, with a subscription rate of 52.93 times for public offerings and 13.96 times for international offerings [10] Group 2 - The China Securities Regulatory Commission (CSRC) is advancing a new round of capital market reforms, aiming to enhance the inclusiveness and adaptability of the system [6][7] - Meituan announced that social security subsidies for delivery riders will be extended nationwide, benefiting potentially hundreds of thousands of riders [12] - Tesla's chairman urges shareholders to support Elon Musk's nearly 1 trillion yuan compensation plan, emphasizing Musk's critical role in the company's future [13]

沙河市伟祺盛电子科技有限公司成立 注册资本100万人民币

Sou Hu Cai Jing· 2025-10-28 22:18

Core Insights - A new company, Shahe Weiqisheng Electronic Technology Co., Ltd., has been established with a registered capital of 1 million RMB [1] - The legal representative of the company is Hou Xuewei [1] Business Scope - The company operates in various sectors including information technology consulting, sales of non-metallic minerals and products, technical glass products, daily glass products, and fiberglass products [1] - It also engages in the sale of daily necessities, office supplies, furniture, hardware products, building materials, and electronic products [1] - The company is involved in both retail and wholesale activities, as well as import and export of goods [1] - Additional services include technical services, development, consulting, and technology transfer [1]

沙河市锦灿轩电子科技有限公司成立 注册资本100万人民币

Sou Hu Cai Jing· 2025-10-28 22:18

Core Points - A new company named Shahe City Jincanxuan Electronic Technology Co., Ltd. has been established with a registered capital of 1 million RMB [1] - The legal representative of the company is Li Lijuan [1] Business Scope - The company’s business scope includes general projects such as information technology consulting services and information consulting services (excluding licensed information consulting services) [1] - It also engages in technology services, development, consulting, exchange, transfer, and promotion [1] - The company is involved in the sales of non-metallic minerals and products, technical glass products, daily glass products, and various household and office supplies [1] - Additional sales activities include hardware products, building materials, and metal products [1] - The company is authorized to conduct import and export activities, except for projects that require approval [1]

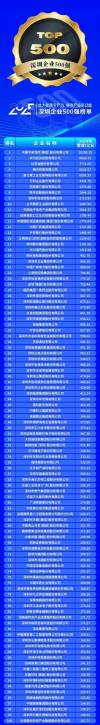

2025深圳企业500强榜单发布:平安、华为、比亚迪位列前三

Sou Hu Cai Jing· 2025-10-28 17:42

Core Insights - The "2025 Shenzhen Top 500 Enterprises List" was officially released, with Ping An Insurance, Huawei Investment, and BYD ranking as the top three, maintaining their leading positions [1][16] - The list is based on the companies' revenue for the fiscal year 2024, and the accompanying report analyzes various dimensions of enterprise development, including scale, operational efficiency, innovation capability, social contribution, and internationalization [1][16] Group 1: Key Characteristics of the Top 500 Enterprises - Overall revenue growth is observed, with 18 companies exceeding 100 billion yuan in revenue, but the average sales profit margin has decreased to 4.86%, down from 5.10% in 2023 [1][2] - The number of companies in the 1-10 billion yuan revenue range has increased to 331, a year-on-year growth of 5.41%, with total revenue in this segment rising by 9.76% [1][2] Group 2: Competitive Landscape - The competition among top enterprises is intensifying, with 97 new entrants making up 19% of the list, and only 22 companies maintaining their previous rankings [2] - The revenue threshold for entering the list has been consistently rising over the past five years, indicating a rapidly evolving competitive landscape [2] Group 3: Private Sector Dynamics - Private enterprises account for 70% of the list, contributing over 45% of total revenue, particularly excelling in high-end medical devices and robotics sectors [2] - The manufacturing sector remains robust, with 207 manufacturing companies on the list showing a revenue growth of 13.82%, although traditional manufacturing faces transformation pressures [2] Group 4: Regional Development - The regional development is categorized into three tiers: Nanshan and Futian as the "core leading tier," Longgang and four other districts as the "growth and challenge tier," and Luohu and three other districts as the "transformation and adjustment tier," highlighting distinct industrial characteristics and collaboration opportunities [2] Group 5: Future Directions - Shenzhen's top 500 enterprises need to focus on enhancing value addition, optimizing innovation workforce allocation, balancing industrial development, and improving overseas business layouts to drive sustainable growth and support the city's economic high-quality development [16]

共话ESG未来!中智股份亮相ESG中国•创新年会,共促可持续发展

Huan Qiu Wang· 2025-10-28 06:55

Core Insights - The ESG China Innovation Conference 2025 aimed to stimulate ESG innovation among Chinese enterprises and promote the establishment of a Chinese-style ESG system [1][3] Event Overview - The conference was co-hosted by the China Enterprise Reform and Development Research Association and Shougang Group, featuring nearly a thousand leaders and representatives from government, state-owned enterprises, private enterprises, research institutions, and social organizations [2][3] ESG Excellence Report - The "2025 Annual ESG Excellence Practice Report" was released, selecting 36 outstanding practice units from over 213 applicants, including major companies like China National Nuclear Corporation, China Petroleum, and China Mobile [4][6] Recognition of ESG Practices - The selected companies demonstrated significant achievements in environmental governance, social responsibility, and innovative governance systems, proving that ESG is a long-term strategy rather than a short-term burden [6][10] Keynote Speeches - Medtronic's Vice President emphasized the integration of ESG principles into daily operations, focusing on energy conservation, resource recycling, and a green supply chain [6][11] Parallel Sessions - The conference included 15 parallel sessions discussing the localization of ESG strategies and the foundational role of sustainable development talent [7][9] Expert Advisory Board - An ESG expert advisory board was established to provide ongoing theoretical support and practical insights for building China's ESG system [10] Case Studies and Innovations - Various companies shared their ESG practices, highlighting community engagement, waste reduction, and sustainable development strategies [10][12] Corporate Governance and Social Responsibility - Companies like Zhongzhi Group are integrating ESG into their corporate strategies, achieving significant milestones in environmental management and social responsibility [13][14] Recognition and Future Outlook - Zhongzhi Group's brand value reached 11.009 billion yuan, earning accolades such as "Top 100 Enterprises in Shanghai" and "ESG Pioneer Award," reflecting its commitment to sustainable development [15]

麻城市创研芯科技有限公司成立 注册资本8万人民币

Sou Hu Cai Jing· 2025-10-28 04:48

Core Viewpoint - The establishment of Macheng Chuangyan Chip Technology Co., Ltd. indicates a growing interest in the semiconductor and electronic materials sector in China, with a focus on various technological and retail activities [1] Company Overview - Macheng Chuangyan Chip Technology Co., Ltd. has been recently founded with a registered capital of 80,000 RMB [1] - The legal representative of the company is Liu Ying [1] Business Scope - The company’s business scope includes general projects such as: - Research and development of new materials technology - Research and development of electronic special materials - Retail of electronic components and products - Sales of office supplies and daily necessities - Retail of cosmetics and clothing [1] - Additional activities include: - Internet sales (excluding items requiring licenses) - Domestic trade agency - Advertising production and video production services - Import and export agency - Sale of Class II medical devices [1] - The company is also involved in licensed projects, specifically network cultural operations, which require approval from relevant authorities [1]

鸿海大投资 建超级算力中心

Jing Ji Ri Bao· 2025-10-27 23:57

据了解,上述投资主要用于鸿海今年6月初于台北国际电脑展时宣布,与英伟达合作在台湾本土打造最 先进的"AI Factory"超级算力中心,加速台湾在AI领域的研发与应用,当时鸿海即估计投资额约在400多 亿元新台币。 如今鸿海"说到做到",董事会批准相关投资,随银弹到位,业界看好将助益鸿海AI版图扩张,并强化台 湾AI量能。 鸿海(2317)昨(27)日公告,为扩展云端算力服务平台,加速集团三大智能平台发展,董事会通过将 于420亿元新台币的额度内,采购AI算力云端业务营业用资讯设备,以建立AI算力集群暨超算中心。 英伟达执行长黄仁勋表示,携手鸿海打造"AI Factory"超级算力中心,将是台湾AI产业转型的重要核 心,透过与鸿海合作,我们正建构这场全球转型的基础设施。 鸿海董座刘扬伟说,鸿海秉持"分享、合作、共荣"的理念,携手全球标竿客户共同创造全方位智能生 活。 鸿海规划,与英伟达合作打造的AI超级算力中心,将购买1万颗英伟达Blackwell Ultra架构GB300 GPU,建立首期27MW(百万瓦)的超级算力,预定2026上半年启用。 ...