机场航运

Search documents

看涨回升

第一财经· 2025-10-15 10:44

Market Overview - The A-share market shows a broad upward trend, with the Shanghai Composite Index recovering above the 3900-point mark, driven by emerging industries such as robotics, innovative pharmaceuticals, and data center power supply [4][10] - The ChiNext Index leads the gains among the three major indices, supported by the automotive, consumer electronics, and biopharmaceutical sectors [4] Market Performance - Over 4300 stocks rose today, indicating significant market profitability [5] - Emerging industries and traditional sectors are resonating, with a notable surge in the robotics concept and a collective rebound in innovative pharmaceuticals [5] - The automotive industry chain continues to strengthen, with both complete vehicles and components rising simultaneously [5] Trading Volume - The total trading volume in the two markets decreased by 19.5%, reflecting a "volume contraction rebound" characteristic, while maintaining high market activity [6] - Growth-oriented and cyclical sectors contributed significantly to the trading volume, while previously popular high-valuation sectors showed weaker performance [6] Fund Flow - Institutional investors are actively reallocating, with significant increases in sectors such as chemical pharmaceuticals, consumer electronics, and automotive [8] - Conversely, previously strong sectors like semiconductors and specialized equipment are experiencing sell-offs by major funds [8] - Retail investors remain active, with funds flowing into short-term gain sectors like robotics, innovative pharmaceuticals, and automotive [8] Investor Sentiment - Retail investor sentiment shows a high level of engagement, with a 75.85% participation rate [9] - The sentiment indicates a mix of strategies, with 25.59% of investors increasing their positions and 17.63% reducing them, while 56.78% remain unchanged [14]

沪指收复3900点,汽车整车、机场航运涨幅居前

Guan Cha Zhe Wang· 2025-10-15 08:20

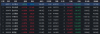

Core Viewpoint - The A-share market experienced a collective rise on October 15, with the Shanghai Composite Index recovering above 3900 points, indicating positive market sentiment and investor confidence [1]. Market Performance - The Shanghai Composite Index increased by 1.22%, closing above 3900 points - The Shenzhen Component Index rose by 1.73% - The ChiNext Index saw a gain of 2.36% - The North China 50 Index climbed by 1.62% - Total trading volume across Shanghai and Shenzhen markets reached 20,904 billion yuan, a decrease of 5,062 billion yuan compared to the previous day - Over 4,300 stocks in the market experienced an increase [1]. Sector Performance - Leading sectors in terms of growth included: - Automotive manufacturing - Airport and shipping - Electric grid equipment - Peek materials - Innovative pharmaceuticals - Automotive parts - Sectors that faced declines included: - Port shipping - Agricultural planting - Lithography machines - Rare earth permanent magnets - Oil and gas extraction [1].

A股收评:沪指重回3900点 全市场超4300只个股上涨

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-15 07:49

Market Overview - The Shanghai Composite Index rose over 1%, reclaiming the 3900-point mark, while the ChiNext Index increased by over 2% [1] - The Shanghai and Shenzhen markets recorded a total trading volume of 2.07 trillion yuan, a decrease of 503.4 billion yuan compared to the previous trading day [1][7] Sector Performance - The robotics sector saw significant activity, with stocks like Wuzhou New Spring and Sanhua Intelligent Control hitting the daily limit [2] - The airport and shipping sector experienced a rebound, with Huaxia Airlines reaching the daily limit [3] - The pharmaceutical sector remained strong throughout the day, with stocks such as Anglikang also hitting the daily limit [4] - The data center power supply concept showed active performance, with Sifang Co. and Jingquanhua achieving two consecutive limits in four days [5] - Conversely, the port and shipping stocks collectively declined, with Nanjing Port and Lianyungang experiencing significant drops [6] Individual Stock Highlights - Northern Rare Earth led in trading volume with 16.62 billion yuan, while other notable stocks included Sunshine Power, Shenghong Technology, Luxshare Precision, and CATL, which also had high trading volumes [8]

沪指重回3900点,机器人多股爆发

21世纪经济报道· 2025-10-15 07:46

Market Overview - The A-share market rebounded, with the Shanghai Composite Index rising by 1.22% to reclaim the 3900-point mark, while the Shenzhen Component Index increased by 1.73% and the ChiNext Index rose by 2.36%. The total trading volume in the Shanghai and Shenzhen markets was 2.07 trillion yuan, a decrease of 503.4 billion yuan compared to the previous trading day [1] - The FTSE China A50 Index futures expanded their gains to 1.77% [3] Gold Market - Spot gold prices rose over 1% during the day, breaking the $4200 per ounce mark multiple times, and closing at $4206.945 per ounce. The price of domestic gold jewelry also increased, with some brands exceeding 1235 yuan per gram, up over 100 yuan per gram since October 1 [3] Sector Performance - The aviation transportation, innovative drugs, robotics, and charging pile sectors saw significant gains, while sectors such as photolithography and rare earths experienced declines [5] - The aviation sector saw a notable surge, with Huaxia Airlines hitting the daily limit, and other major airlines like China National Aviation, China Eastern Airlines, and China Southern Airlines rising over 5%. This was influenced by the announcement of new flight routes and the upcoming winter-spring flight season starting October 26 [6][8] Robotics Sector - The robotics sector showed strong performance, with stocks like Zhenghe Industrial hitting the daily limit and reaching historical highs. The market buzz included rumors of Tesla placing a $685 million order for linear actuators with a Chinese supplier, Sanhua Intelligent Controls [8] - Stocks in the robotics sector, such as Wolong Electric Drive and Beite Technology, saw increases of over 8% and 5%, respectively [9] Innovative Pharmaceuticals - The innovative pharmaceutical sector continued its upward trend, with stocks like Guangsheng Tang rising over 17% and Shutai Shen increasing over 12%. The upcoming European Society for Medical Oncology (ESMO) conference is expected to showcase significant clinical research results, driving market anticipation [10] - In the first eight months of 2025, the number of overseas business development transactions by Chinese innovative pharmaceutical companies reached 83, with a total transaction value of 84.5 billion yuan, reflecting a 62.81% increase compared to the entire year of 2024 [10]

收评:创业板指震荡反弹涨2.36% 汽车板块表现强势

Zhong Guo Jing Ji Wang· 2025-10-15 07:29

Core Insights - The A-share market indices collectively rose, with the Shanghai Composite Index closing at 3912.21 points, up 1.22%, and a total trading volume of 961.55 billion yuan [1] - The Shenzhen Component Index closed at 13118.75 points, up 1.73%, with a trading volume of 1111.31 billion yuan [1] - The ChiNext Index closed at 3025.87 points, up 2.36%, with a trading volume of 488.64 billion yuan [1] Sector Performance - The automotive sector led the gains with a rise of 3.46%, total trading volume of 203.94 million hands, and a net inflow of 2.68 billion yuan [2] - The airport and shipping sector increased by 3.35%, with a trading volume of 129.84 million hands and a net inflow of 1.68 billion yuan [2] - The electric grid equipment sector rose by 3.16%, with a trading volume of 376.60 million hands and a net inflow of 5.13 billion yuan [2] - Conversely, the port shipping sector declined by 1.43%, with a trading volume of 172.13 million hands and a net outflow of 1.11 billion yuan [2] - The small metals sector fell by 0.73%, with a trading volume of 137.17 million hands and a net outflow of 1.62 billion yuan [2] - The agriculture and forestry sector decreased by 0.60%, with a trading volume of 72.54 million hands and a net outflow of 0.50 billion yuan [2]

沪指,重返3900点

财联社· 2025-10-15 07:25

Market Overview - The A-share market rebounded today, with the Shanghai Composite Index rising over 1% to reclaim the 3900-point level, while the ChiNext Index surged over 2% [1] - The total trading volume in the Shanghai and Shenzhen markets reached 2.07 trillion, a decrease of 503.4 billion compared to the previous trading day [1] Sector Performance - The robotics sector saw significant activity in the afternoon, with stocks like Wuzhou New Spring and Sanhua Intelligent Control hitting the daily limit [1] - The airport and shipping sector experienced fluctuations, with Huaxia Airlines reaching the daily limit [1] - The pharmaceutical sector remained strong throughout the day, with multiple stocks such as Anglikang also hitting the daily limit [1] - The data center power supply concept showed active performance, with Sifang Co. and Jingquanhua achieving two consecutive limits in four days [1] - Conversely, the port and shipping stocks collectively declined, with Nanjing Port and Lianyungang experiencing significant drops [1][2] Index Performance - By the end of the trading session, the Shanghai Composite Index rose by 1.22%, the Shenzhen Component Index increased by 1.73%, and the ChiNext Index climbed by 2.36% [3] - Specific closing figures include: Shanghai Composite Index at 3912.21, Shenzhen Component Index at 13118.75, and ChiNext Index at 3025.87 [4]

收评:创业板指震荡反弹涨超2.3%,三市成交额缩量超5000亿元

Xin Lang Cai Jing· 2025-10-15 07:13

Core Viewpoint - The A-share market experienced a collective rise, with major indices showing significant gains, indicating positive market sentiment and investor confidence [1] Market Performance - The Shanghai Composite Index rose by 1.22%, the Shenzhen Component increased by 1.73%, the ChiNext Index surged by 2.36%, and the North China 50 gained 1.62% [1] - The total trading volume across Shanghai, Shenzhen, and Beijing reached 20,904 billion yuan, a decrease of 5,062 billion yuan compared to the previous day [1] - Over 4,300 stocks in the market saw an increase in their prices [1] Sector Performance - Leading sectors included automotive manufacturing, airport and shipping, electric grid equipment, PEEK materials, innovative pharmaceuticals, and automotive parts, all showing notable gains [1] - The automotive sector saw strong performance in the afternoon, with stocks like Zhongtong Bus and Haima Automobile hitting the daily limit, while GAC Group, Qianli Technology, and Hanma Technology also posted significant increases [1] - The airport and shipping sector performed well throughout the day, with Huaxia Airlines hitting the limit and China Eastern Airlines, China Southern Airlines, and China National Aviation leading the gains [1] - The electric grid equipment sector experienced a surge in the afternoon, with stocks such as Heshun Electric, Jinpan Technology, and Xinte Electric reaching the daily limit [1] Declining Sectors - The port and shipping sector faced adjustments, with stocks like Nanjing Port, Ningbo Shipping, and Lianyungang experiencing declines [1] - The photolithography machine concept stocks also retreated, with New Lai Material falling over 10% [1] - Kaimete Gas briefly hit the daily limit down [1]

机场航运板块异动拉升 华夏航空涨停

Xin Lang Cai Jing· 2025-10-15 05:54

Core Viewpoint - The airport and aviation sector experienced a significant surge, with Huaxia Airlines hitting the daily limit, alongside gains from other airlines such as Juneyao Airlines, Air China, and China Eastern Airlines [1] Group 1: Market Movement - The airport and aviation sector saw notable upward movement, particularly with Huaxia Airlines reaching a trading limit [1] - Other airlines, including Juneyao Airlines, Air China, and China Eastern Airlines, also experienced increases in their stock prices [1] Group 2: Industry Developments - The 2025 winter-spring flight schedule will officially commence on October 26 and will last until the last Saturday of March the following year [1] - Several domestic airlines have announced new flight routes, with Huaxia Airlines introducing five new popular routes from Ganzhou to Chongqing, Changzhou, Tianjin, Wenzhou, and Zhoushan for the new season [1]

国庆中秋假期揭阳潮汕国际机场服务旅客25万人次

Sou Hu Cai Jing· 2025-10-09 15:16

Core Insights - During the 8-day "Super Golden Week" from October 1 to 8, 2025, the Jieyang Chaoshan International Airport operated smoothly, showcasing "Chaoshan culture" with various service highlights, achieving record highs in total passenger flow, flight volume, and daily passenger numbers [1] Group 1: Operational Performance - The airport facilitated a total of 1,897 flight takeoffs and landings, serving 250,000 passengers, representing year-on-year increases of 19.7% and 18.6% respectively, both breaking previous records for the "Double Festival" transportation [3] - Peak days for passenger flow were October 1, 2, and 7, with the highest single-day passenger volume reaching 32,687 and flight takeoffs and landings at 245, both setting new records for the same period [3] Group 2: Service Enhancements - The airport coordinated with airlines to optimize capacity, resulting in 272 additional flights, with a focus on increasing routes to major cities such as Beijing, Nanjing, Hangzhou, and popular tourist destinations like Shanghai and Haikou [3] - The airport's route network covered 67 domestic and international destinations, with a total of 77 routes catering to diverse travel needs [3] Group 3: Cultural and Customer Experience - On National Day and Mid-Autumn Festival, the airport hosted events such as dragon dance flash mobs and themed activities to enhance the festive atmosphere, enriching the travel experience for passengers [6] - The airport's terminal featured a bustling Chaoshan specialty street and cultural shops, offering local delicacies like Chaoshan fish balls and fermented bean curd cakes, as well as creative products that reflect regional characteristics, attracting travelers with affordable prices [6]

首都机场迎来出境游高峰!过境免签外籍旅客可享受3天免费寄存

Bei Jing Ri Bao Ke Hu Duan· 2025-09-28 03:24

Core Insights - The capital airport is experiencing a travel peak ahead of the National Day holiday, with a festive theme display titled "Red Boat Carrying Love" symbolizing the country's progress [1] Passenger Traffic and Flight Operations - During the National Day holiday, the capital airport is expected to transport 1.67 million passengers, averaging 208,800 passengers per day, and handle 9,903 flights, averaging 1,238 flights per day [3] - The peak travel demand is anticipated from September 30 to October 2, with an average of 220,000 passengers per day, and October 1 is expected to be the busiest day [3] - Major travel destinations include Shanghai, Chengdu, Guangzhou, Sanya, as well as international cities like Tokyo, Osaka, London, and Seoul [3] - Hainan Airlines anticipates a 10% to 15% year-on-year increase in passenger volume in the Beijing area during the holiday period, with an average of about 160 domestic flights in and out per day [3] Passenger Experience Enhancements - The capital airport will host various experiential activities during the holiday, including a "Flower and Moon Reunion" cultural event on October 5-6, where travelers can create keepsakes under the guidance of intangible cultural heritage practitioners [5] - A month-long "Flying Chinese Style" theme will be launched in select dining and retail outlets starting October 1, featuring special performances and promotions [5] - A new integrated baggage service counter has been introduced, offering seven unique services including baggage packing, storage, and transportation [5] Security and Travel Advisory - Travelers are reminded of regulations regarding carrying power banks on flights, including restrictions on capacity and the requirement for prior approval for certain models [6] - The airport advises passengers to confirm their flight details and arrive early to allow sufficient time for check-in and security procedures, especially during peak hours [6] - Weather conditions such as rain or strong winds may occur during the holiday, prompting travelers to monitor weather updates and flight statuses [7]