互联网服务

Search documents

聚焦主业显效 网宿科技前三季度净利润同比增长43.6%

Yang Guang Wang· 2025-10-28 08:22

Financial Performance - In the first three quarters of 2023, the company achieved operating revenue of 3.492 billion yuan, with third-quarter revenue of 1.141 billion yuan, reflecting a quarter-on-quarter growth of 2.3% [1] - The net profit attributable to shareholders for the first three quarters was 616 million yuan, representing a year-on-year increase of 43.6% [1] - The non-deductible net profit for the same period was 348 million yuan, showing a year-on-year growth of 14.73% [1] Product Development and Innovation - The company launched a new edge AI real-time interactive voice product, integrating global edge node networks, ultra-low latency real-time communication (RTC) technology, and full-stack AI capabilities [2] - The edge AI platform empowers key sectors such as IoT, broadcasting, healthcare, and AI technology, enhancing user experience and operational efficiency [2] - Specific applications include a smart control solution for massage chair manufacturers, improving performance by 60%, and an intelligent customer service system for a leading pharmaceutical retailer, reducing manual verification costs by 40% and increasing patient trust by 50% [2] Security and Digital Transformation - The company is focusing on proactive security measures across various sectors, including smart manufacturing, education, media, entertainment, and government [3] - Utilizing SASE capabilities, the company restructured global office networks for notable clients, enhancing collaboration and establishing a zero-trust architecture for content security [3] - Future plans include continuing to focus on industry needs, particularly in AI, to provide smarter, safer, and more efficient digital services, thereby enabling digital transformation across various industries [3]

30%抽成利润高,苹果服务年收入有望首破1000亿美元

Feng Huang Wang· 2025-10-28 07:33

Core Insights - Apple's service business is projected to exceed $100 billion for the first time in fiscal year 2025, reaching an estimated $108.6 billion, representing a year-on-year growth of approximately 13% [1] - The service segment, which includes iCloud, Apple Pay, and AppleCare, is becoming a crucial growth driver for Apple as iPhone sales stabilize [1] - Analysts predict that the service business could account for 25% of Apple's total revenue, contributing up to 50% of its profits due to high user engagement with products like Apple Pay and iCloud [1] Regulatory Challenges - Apple's service business faces legal scrutiny, including antitrust lawsuits from the U.S. Department of Justice and complaints from users in China regarding its App Store practices [3][4] - A recent ruling in the UK found that Apple abused its market power in app distribution and in-app payment systems, potentially leading to compensation claims of up to £1.5 billion [4] Future Growth Prospects - Despite legal challenges, analysts expect Apple's service business to grow significantly, potentially making up over 30% of total revenue by the end of the decade, with sales projected to reach $175 billion [5] - The overall revenue for Apple in fiscal year 2025 is estimated at $415 billion, with iPhone sales contributing about half of that figure [5] Profitability Metrics - The service business boasts a high gross margin of approximately 75%, compared to 40% for iPhones, contributing to an overall increase in Apple's gross margin from 38% in 2020 to around 47% this year [6]

新纪录!5300亿元,中国首富,是他

中国基金报· 2025-10-28 07:30

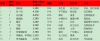

Core Insights - Zhong Shanshan has become the richest person in China for the fourth time, with a wealth of 530 billion RMB, setting a new record for the wealth of a Chinese billionaire [2][3] - Lei Jun from Xiaomi has seen a wealth increase of 196 billion RMB, making him the "wealth growth king" among listed entrepreneurs, primarily benefiting from the growth of Xiaomi's automotive sector and breakthroughs in high-end smartphones [2][3] Wealth Rankings - The top five wealth rankings include: 1. Zhong Shanshan - 530 billion RMB (56% increase) [3] 2. Zhang Yiming - 470 billion RMB (34% increase) [3] 3. Ma Huateng - 465 billion RMB (48% increase) [3] 4. Zeng Yuqun - 330 billion RMB (65% increase) [3] 5. Lei Jun - 326 billion RMB (151% increase) [3] Overall Wealth Trends - The total wealth of listed entrepreneurs approaches 30 trillion RMB, with 1,434 entrepreneurs having wealth exceeding 5 billion RMB, reflecting a year-on-year growth of 31% [4] - The significant increase in the number of billionaires is attributed to a substantial recovery in the stock market [4] Industry Performance - Six major industries have shown notable wealth growth among entrepreneurs: - **New Energy Vehicles**: Benefiting from favorable policies and global market demand, Lei Jun and Zeng Yuqun have seen significant wealth increases [6] - **Consumer Electronics**: Driven by the popularity of short videos and sustained global demand for smart hardware, new entrants like Liu Jingkang and Wang Tao have made substantial gains [6] - **New Consumption**: The emergence of new models and emotional consumption has led to significant wealth increases for entrepreneurs like Wang Ning from Pop Mart [6] - **AI Industry**: Entrepreneurs like Chen Tianshi have seen wealth growth of nearly 150 billion RMB [6] - **Biopharmaceuticals**: Notable wealth increases among several entrepreneurs in the innovative drug sector [8] - **Securities Services**: Wealth growth due to the stock market recovery, with significant increases for companies like Dongfang Caifu and Tonghuashun [8] Regional Insights - The Yangtze River Delta region has 483 entrepreneurs on the list, accounting for 34% of the total, while the Guangdong-Hong Kong-Macau Greater Bay Area has 363, making up 25% [10] - The top three cities for listed entrepreneurs are Shanghai, Shenzhen, and Beijing, with significant increases in the number of entrepreneurs from these cities due to the stock market recovery and industry concentration [10][11]

新纪录!5300亿元,中国首富,是他

Zhong Guo Ji Jin Bao· 2025-10-28 07:29

Core Insights - The Hu Run Research Institute's "2025 Hu Run Rich List" reveals that Zhong Shanshan of Nongfu Spring has become China's richest person for the fourth time, with a wealth of 530 billion RMB, setting a new record for the wealthiest individual in China [1][3] - Lei Jun of Xiaomi Group saw a wealth increase of 196 billion RMB, ranking fifth on the list, primarily benefiting from the growth of Xiaomi's automotive sector and the high-end breakthrough in mobile phones [1][6] Wealth Distribution - The total wealth of listed entrepreneurs approaches 30 trillion RMB, with 1,434 individuals having wealth exceeding 5 billion RMB, marking a year-on-year growth of 31% [3] - The top five wealthiest individuals are: 1. Zhong Shanshan - 530 billion RMB (56% increase) 2. Zhang Yiming - 470 billion RMB (34% increase) 3. Ma Huateng - 465 billion RMB (48% increase) 4. Zeng Yuqun - 330 billion RMB (65% increase) 5. Lei Jun - 326 billion RMB (151% increase) [2] Industry Performance - Six industries showed significant wealth growth among entrepreneurs: new energy vehicles, consumer electronics, new consumption, computing power, biomedicine, and securities services [5][6] - In the new energy vehicle and battery sector, Lei Jun's wealth increased by 196 billion RMB, while Zeng Yuqun of CATL entered the top five with 330 billion RMB [6] - In the consumer electronics sector, the demand for smart hardware and the popularity of short videos contributed to wealth increases for several entrepreneurs, including Liu Jingkang and Pan Yao, who debuted on the list with 38.5 billion RMB [6] Regional Insights - The Yangtze River Delta region has 483 entrepreneurs on the list, accounting for 34%, while the Guangdong-Hong Kong-Macau Greater Bay Area has 363, making up 25% [8] - The top three cities with the highest number of listed entrepreneurs are Shanghai, Shenzhen, and Beijing, with 152, 147, and 146 individuals respectively [9][10][11] - The increase in the number of entrepreneurs in Shanghai and Shenzhen is attributed to the recovery of the A-share market and the concentration of industries such as semiconductors, biomedicine, and AI in these cities [13]

54岁马化腾财富攀升至4650亿元,年增1500亿元涨幅48%,排名稳居第三

Xin Lang Zheng Quan· 2025-10-28 07:14

Core Insights - The 2025 Hurun Rich List shows that Tencent's founder, Ma Huateng, has a net worth of 465 billion RMB, an increase of approximately 150 billion RMB from the previous year, representing a growth rate of 48% [1][2] Company Overview - Ma Huateng, aged 54, remains in the 3rd position on the list, with Tencent's main business focusing on internet services, including social media, gaming, and fintech [1][2] - Tencent's wealth growth is attributed to its diverse portfolio in internet services, which has seen significant performance improvements over the past year [1][2] Wealth Ranking - Ma Huateng's wealth increased from 315 billion RMB in 2024 to 465 billion RMB in 2025, maintaining his ranking from the previous year [2] - The top three positions in the 2025 Hurun Rich List are held by: 1. Zhong Teng Teng - 530 billion RMB 2. ByteDance's founder - 470 billion RMB 3. Ma Huateng - 465 billion RMB [2]

42岁张一鸣最新财富为4700亿元,比上年增加1200亿元增长率34%,排名比去年下降1位居第2

Xin Lang Zheng Quan· 2025-10-28 07:07

Core Insights - ByteDance's founder Zhang Yiming's wealth increased to 470 billion RMB, a rise of 120 billion RMB or 34% from the previous year, although he dropped from the first to the second position in the Hurun Rich List, overtaken by Zhong Shanshan [1][2] Company Performance - ByteDance's revenue exceeded 650 billion RMB in the first half of the year, reflecting a year-on-year growth of 25%, with 75% of revenue coming from the Chinese market and over 60% from TikTok's overseas income [1] - The AI assistant "Doubao" under ByteDance reached 157 million monthly active users by August 2025, ranking first in the domestic market [1] Market Position - ByteDance is recognized as the largest unicorn in China and the second largest globally, following Elon Musk's SpaceX [1]

2025胡润百富榜发布:钟睒睒5300亿四度蝉联中国首富,雷军财富暴涨1960亿成“增长王”

Guan Cha Zhe Wang· 2025-10-28 07:06

Core Insights - The 2025 Hurun China Rich List reveals significant wealth growth among top entrepreneurs, with the founder of Nongfu Spring, Zhong Shanshan, topping the list for the fourth time with a net worth of 530 billion RMB, marking a record high [1][4] - ByteDance's Zhang Yiming, last year's richest, saw his wealth increase by 120 billion RMB, placing him second with 470 billion RMB, while Tencent's Ma Huateng ranked third with a wealth increase of 150 billion RMB, totaling 465 billion RMB [1][3] - The list indicates a total of 1,434 individuals with wealth exceeding 5 billion RMB, a 31% increase from last year, and a total wealth close to 30 trillion RMB, reflecting a 42% growth [3][6] Group 1: Wealth Growth and Rankings - Zhong Shanshan's wealth increased by 190 billion RMB, while Zhang Yiming's grew by 120 billion RMB, and Ma Huateng's by 150 billion RMB [1][3] - The threshold for the top ten increased by 60 billion RMB to 225 billion RMB, with an average age of 62 years, which is three years younger than last year [3][4] - New entrants in the top ten include Lei Jun of Xiaomi and the Li Shufu family of Geely, with Lei Jun's wealth increasing by 196 billion RMB, marking a 151% growth [3][7] Group 2: Industry Insights - The food and beverage sector, represented by Zhong Shanshan, showed strong performance, with Nongfu Spring's stock price rising by 80% over the past year [6][7] - The technology sector also saw significant contributions, with Xiaomi's stock surging by 177%, contributing to Lei Jun's wealth increase [7] - The report highlights a shift in wealth concentration, with a notable decline in real estate entrepreneurs, indicating a changing landscape in the Chinese economy [6][8]

东阳光在宜昌成立数智科技公司 注册资本1亿

Xin Lang Cai Jing· 2025-10-28 06:25

Group 1 - Yichang Dongyangguang Digital Technology Co., Ltd. has been established with a registered capital of 100 million RMB [1] - The legal representative of the company is Hu Laiwen [1] - The company's business scope includes industrial internet data services, internet data services, internet security services, and cloud computing equipment technology services [1] Group 2 - Dongyangguang (stock code: 600673) holds 100% ownership of the newly established company [1]

《2025胡润百富榜》出炉:深圳富豪数反超北京

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-28 06:09

Group 1 - The 2025 Hurun Rich List features 1,434 entrepreneurs with wealth exceeding 5 billion RMB, a 31% increase from last year, with total wealth nearing 30 trillion RMB, up 42% [1][6] - The top three wealthiest entrepreneurs are Zhong Shanshan (5,300 billion RMB), Zhang Yiming (4,700 billion RMB), and Ma Huateng (4,650 billion RMB) [3][5] - There are 376 new faces on the list, a sevenfold increase from last year, with the top newcomers being Xu Gaoming and Xu Dongbo from Laopu Gold, with a wealth of 695 billion RMB [1][3] Group 2 - The distribution of entrepreneurs' residences shows a "3+2+3" pattern, with Shanghai, Shenzhen, and Beijing leading in density, and for the first time, Beijing is surpassed by Shanghai and Shenzhen [2] - Shanghai has 152 listed entrepreneurs, an increase of 40 from last year, while Shenzhen has 147, up 39, and Beijing has 146, up 31 [2] - The A-share market recovery has significantly contributed to the wealth increase of entrepreneurs in Shanghai and Shenzhen, which are hubs for industries like semiconductors, biomedicine, gaming, and AI [2][6] Group 3 - The wealthiest entrepreneurs in Shenzhen include Zhang Zhihong, Wang Chuanfu, and Wang Tao, with a combined wealth of 29,030 billion RMB [14] - Among the 147 Shenzhen entrepreneurs, 81 experienced wealth growth, with notable increases from DJI's Wang Tao and others, while only 8 saw declines [14] - The new entrants from Shenzhen include 40 individuals, with Liu Jingkang and Pan Yao leading at 385 billion RMB [14]

2025胡润百富榜发布!71岁钟睒睒反超张一鸣,以5300亿元第四次登顶

Sou Hu Cai Jing· 2025-10-28 05:40

Core Insights - The 2025 Hurun Rich List was released by Hurun Research Institute, marking the 27th consecutive year since its inception in 1999, with the wealth calculation deadline set for September 1, 2025 [1] - The list shows that Zhong Shanshan of Nongfu Spring, Zhang Yiming of ByteDance, and Ma Huateng of Tencent occupy the top three positions [1] Group 1: Wealth Rankings - Zhong Shanshan ranks first with a wealth of 530 billion RMB, marking a 56% increase [2] - Zhang Yiming is second with 470 billion RMB, experiencing a 34% increase [2] - Ma Huateng holds the third position with 465 billion RMB, reflecting a 48% increase [2] - The threshold for the top ten increased by 60 billion RMB to 225 billion RMB [3] Group 2: Wealth Growth - Zhong Shanshan's wealth increased by 190 billion RMB, setting a new record for the wealth of a Chinese billionaire [3] - Zhang Yiming's wealth grew by 120 billion RMB, driven by advancements in AI business [6] - Ma Huateng's wealth rose by 150 billion RMB, supported by growth in gaming, advertising, and fintech sectors [10] - Lei Jun of Xiaomi saw the largest increase in wealth, up by 196 billion RMB, attributed to the explosive growth of Xiaomi's automotive business [12][14] Group 3: New Entrants and Trends - The list features 1,434 individuals with wealth exceeding 5 billion RMB, a 31% increase from the previous year [3] - There are 41 billionaires with wealth exceeding 100 billion RMB, an increase of 15 individuals [3] - The average age of the top ten billionaires is 62, which is three years younger than last year [3] - The number of new entrants to the list reached 376, seven times higher than the previous year [14]