办公用房

Search documents

宣亚国际(300612)披露拟购买房产公告,1月26日股价下跌2.51%

Sou Hu Cai Jing· 2026-01-26 14:59

Group 1 - The core point of the article is that XuanYa International (300612) has announced plans to purchase real estate for its marketing technology project, with a total transaction amount of 59.5 million yuan [1] - As of January 26, 2026, XuanYa International's stock closed at 19.04 yuan, down 2.51% from the previous trading day, with a total market capitalization of 3.436 billion yuan [1] - The company plans to use 57.5 million yuan of raised funds to purchase office space in Beijing, along with an additional 2 million yuan from its own funds for parking spaces at the same location [1] Group 2 - The office space being purchased has a total area of 1,379.6 square meters and is located in Chaoyang District, Beijing [1] - The transaction has been approved by the board of directors and does not constitute a related party transaction or a major asset restructuring [1]

汇绿生态(001267.SZ):拟出售部分闲置房产

Ge Long Hui A P P· 2025-12-11 12:09

Core Viewpoint - The company, 汇绿生态, is optimizing its asset structure and improving asset utilization by selling two idle office properties to 宁波伊玛环境科技股份有限公司 for a total price of 12.52 million yuan (including tax) [1] Group 1: Property Sale Details - The properties sold are located in 宁波市鄞州区首南街道四季云顶, with a total area of 805.86 square meters [1] - The transaction is expected to positively impact the company's current net profit by approximately 6.23 million yuan [1] Group 2: Future Sales Considerations - The company has two additional properties pending sale, and it will consider the local second-hand housing market conditions to determine reasonable selling prices [1] - The impact of the pending property sales on the current net profit cannot be estimated at this time due to the lack of determined transaction parties and prices [1]

近三百家公司出售资产 A股公司年末“交易忙”

Zheng Quan Shi Bao· 2025-11-21 03:23

Core Viewpoint - The A-share market is experiencing a surge in asset sales as companies aim to liquidate non-core assets and improve financial performance ahead of year-end [1][2]. Group 1: Asset Sales Trends - Nearly 300 listed companies have announced asset sales since October, significantly higher than in previous quarters, with over 100 being first-time disclosures [1]. - Companies are selling assets to recover cash and enhance profits, with examples including *ST Baoying planning to sell real estate for approximately 86.87 million yuan, expecting a profit impact of about 42 million yuan [2]. - The trend includes divesting low-efficiency assets to focus on core business operations, as seen with Zhujiang Free Trade Group's sale of real estate assets for about 5.518 billion yuan [3]. Group 2: Distressed Asset Sales - Some companies are selling loss-making assets to mitigate losses, such as Songyang Resources, which plans to sell a subsidiary after incurring cumulative losses of about 750 million yuan [4]. - The practice of "1 yuan" or "0 yuan" asset sales has emerged, raising market concerns, with examples including Jinbei Automobile's transfer of a subsidiary valued at -77.36 million yuan for a minimum of 1 yuan [5][6]. - These low-priced transfers often involve negative net assets and may include hidden liabilities, which can improve financial metrics but also raise red flags regarding the company's fundamentals [6][7]. Group 3: Regulatory and Market Reactions - The Shanghai Stock Exchange has begun inquiring about companies engaging in low-priced asset transfers, focusing on their operational viability and asset evaluation [7]. - Concerns exist regarding potential year-end rush transactions aimed at avoiding delisting, although new regulations have made such maneuvers more challenging [7].

东方雨虹再度亏本“卖房”

Zhong Guo Jing Ying Bao· 2025-11-14 15:05

Core Viewpoint - Dongfang Yuhong (002271.SZ) has announced a plan to sell part of its real estate assets, which is expected to result in a loss of approximately 25.81 million yuan. This marks the second asset disposal plan within a short period, indicating ongoing challenges in asset management and financial recovery for the company [2][8]. Summary by Sections Asset Sale Details - The company plans to sell a total of 61 real estate properties, including 11 properties located in Miyun District, Beijing, which were acquired this year. The total area of these properties exceeds 1,490 square meters [3]. - The 11 properties in Miyun were purchased to settle debts with downstream clients, with 10 of them acquired in July 2023 [3][4]. - Additionally, 50 properties located in Jianggan District, Hangzhou, are also up for sale, all purchased on December 1, 2021, comprising 38 office units and 12 apartments [3]. Financial Implications - The total sale price for the assets is approximately 18.49 million yuan, which is less than 42% of the corresponding book value. The expected loss from this transaction is 25.81 million yuan [5][6]. - The original book value of the assets is about 52.39 million yuan, with an impairment provision of approximately 8.09 million yuan, resulting in a net book value of around 44.30 million yuan [6]. Market Context - The average selling price for the properties in Miyun is below 10,000 yuan per square meter, significantly lower than the average listing price of around 22,000 yuan per square meter in the area [5][6]. - The company justifies the pricing based on market conditions, asset location, and the need for quick cash recovery, indicating a strategic shift in asset management [7]. Historical Context - This is not the first instance of Dongfang Yuhong selling assets at a loss; a previous sale in October 2023 also resulted in a loss of approximately 23.46 million yuan, which was over 10% of the company's audited net profit for the last fiscal year [8][9]. - The company has been actively selling assets to improve its financial structure and recover funds, as evidenced by a decrease in its debt-to-asset ratio from 55.57% in 2019 to 43.39% in 2024, although it rose to 50.22% in the first three quarters of 2025 [9].

东方雨虹拟出售北京及杭州物业,预亏2580万元!其中北京的10套资产买入不到5个月,公司称折损符合市场惯例

Mei Ri Jing Ji Xin Wen· 2025-11-13 06:31

Core Viewpoint - Oriental Yuhong plans to sell properties in Beijing and Hangzhou, expecting a loss of 25.81 million yuan, which is over 10% of its audited net profit for the last fiscal year [1][4] Group 1: Asset Sale Details - The company intends to sell part of its real estate holdings, including 10 properties in Beijing and 13 in Hangzhou, to improve asset liquidity and financial structure [1][3] - The 10 properties in Beijing were purchased less than 5 months ago, indicating a rapid turnover of assets [2][3] - The sale includes 3 shops and 8 office spaces in Beijing, totaling 1,492.05 square meters, with the majority acquired in July 2023 [5] Group 2: Financial Impact - The expected loss from the asset sale is 25.81 million yuan, with the original value of the assets being approximately 52.39 million yuan and a net book value of about 44.30 million yuan after impairment [3][4] - The company has previously recorded a total asset disposal gain of 173,700 yuan from other sales [4] Group 3: Market Context - The decision to sell is part of a strategic adjustment due to weak market demand and liquidity in the real estate sector, which has seen declining transaction volumes in recent years [4] - Other companies in the A-share market, such as Aerospace Software and Shanghai Phoenix, have also announced property sales, indicating a broader trend among listed firms [4]

上周济南新建商品住宅网签量627套,成交均价14194.46元/㎡

Sou Hu Cai Jing· 2025-10-23 09:38

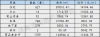

Summary of Key Points Core Viewpoint - The real estate market in Jinan has shown activity with the issuance of 23 pre-sale permits and a total of 1,398 units approved for pre-sale, indicating ongoing development in the sector [1]. Group 1: Pre-sale Permits and New Construction - A total of 23 pre-sale permits were issued during the week of October 13-19, approving 1,398 units and approximately 12.1 million square meters for pre-sale [1]. - New residential property transactions (net signed) reached 1,759 units, covering around 12.5 million square meters [1]. - There was one land supply and four land transactions during the same period [1]. Group 2: Weekly Transaction Data - The weekly net signed volume for new residential properties included 627 units in residential, 14 in office, 92 in commercial, and 746 in parking spaces, totaling 1,759 units with an average price of 11,636.78 yuan per square meter [2]. - The total area for new residential properties signed was approximately 124,946.4 square meters [2]. Group 3: Regional Breakdown of New Residential Transactions - The top five districts for new residential property transactions included Lixia District with 54 units, Shizhong District with 51 units, and Huaiyin District with 66 units, among others [3]. - The average price per square meter varied across districts, with Lixia District at 22,689.39 yuan and Shizhong District at 19,475.65 yuan [3]. Group 4: Details of Pre-sale Licenses - Specific projects receiving pre-sale licenses included the "Cai Shi Guarantee Housing Project" with 72 units and an area of 7,503.94 square meters in Licheng District [4]. - Other notable projects included "Yin Feng Jiu Xi Cheng" with 132 units and an area of 12,837.7 square meters in Lixia District [4]. Group 5: Land Supply and Transactions - The land supply and transaction data indicate ongoing development activity, with one land supply and four successful transactions reported [1].

湖北武汉出台“汉八条”楼市新政 购买新建商业办公用房可申请落户

Zhong Guo Jing Ying Bao· 2025-09-30 04:43

Core Viewpoint - Wuhan has introduced eight specific measures, referred to as "Han Eight Measures," to promote stable and healthy development in the real estate market, aiming to boost housing consumption [1][3]. Group 1: Policy Measures - The measures include increasing housing provident fund loan limits and enhancing subsidies for rigid housing demand [3]. - Support for purchasing commercial and office properties has been intensified, allowing individuals to apply for household registration upon purchasing new commercial properties [3][4]. - From October 1, 2025, to June 30, 2026, a 50% subsidy on the actual paid deed tax will be provided for buyers of new commercial and office properties [3][4]. Group 2: Housing Provident Fund Adjustments - The maximum housing provident fund loan limit for dual contributors' families is set at 1.5 million yuan, while for single contributors, it is 1.2 million yuan [4]. - The repayment ability calculation for housing provident fund loans will adjust the repayment ratio from 35% to 40% [4]. - During the specified period, properties currently for sale will not count towards the loan limit for families applying for housing provident fund loans [4]. Group 3: Subsidies for First-Time Homebuyers - From October 1 to December 31, 2025, families purchasing their first new commercial housing in designated areas will receive a loan interest subsidy of 1% of the initial loan amount, capped at 20,000 yuan, distributed over two years [4].

武汉鼓励买商办房可落户

Jing Ji Guan Cha Wang· 2025-09-30 02:19

Core Viewpoint - Wuhan's government has introduced new policies to support the stable and healthy development of the real estate market, particularly focusing on commercial and office properties [1] Group 1: Policy Measures - The policy allows individuals purchasing newly built commercial and office properties to apply for "one household per property" residency based on their property ownership certificate [1] - Eligible spouses and children can also relocate with the primary buyer [1] - Local districts will develop additional measures related to children's education based on specific circumstances [1] Group 2: Financial Incentives - From October 1, 2025, to June 30, 2026, buyers of newly constructed commercial and office properties will receive a subsidy covering 50% of the paid deed tax [1]

武汉:调整优化购房落户手续

Mei Ri Jing Ji Xin Wen· 2025-09-30 02:11

Core Viewpoint - The Wuhan Municipal Housing and Urban Renewal Bureau has announced new policies to promote the stable and healthy development of the real estate market, including adjustments to the procedures for purchasing homes and settling in the city [1] Group 1: Policy Adjustments - The new policy allows individuals purchasing new commercial, office, or mixed-use properties in Wuhan to apply for household registration with the property registration certificate, following the "one house, one household" principle [1] - Eligible spouses and children can also settle in the city alongside the primary applicant [1] Group 2: Local Implementation - Districts are encouraged to develop measures for children's school enrollment based on local educational resources and conditions [1]

美降息前夕,中国楼市这波操作释放重要信号

Sou Hu Cai Jing· 2025-09-18 00:53

Core Viewpoint - The recent policy change by China's State Administration of Foreign Exchange allows foreign individuals to purchase real estate in China more easily, potentially revitalizing the real estate market and attracting foreign investment [3][5][10] Group 1: Policy Changes - The new policy permits foreign funds to purchase non-self-use residential properties and allows for the foreign exchange settlement to occur before obtaining the property registration certificate [5][8] - This marks a significant shift from the previous restrictions that had been in place for over a decade, indicating a response to the changing dynamics of the real estate market in China [3][5] Group 2: Market Impact - The policy is expected to inject new capital into the real estate market, potentially accelerating the stabilization of property prices [7][10] - There is speculation that this could lead to increased demand for properties, particularly in first-tier and new first-tier cities, as well as for commercial real estate [10] Group 3: Future Considerations - The actual impact of the policy remains to be seen, as foreign investors will still need to comply with local regulations regarding property purchases [8][10] - The policy adjustment may also align with the anticipated interest rate cuts by the Federal Reserve, which could lead to capital outflows from the U.S. and create opportunities for foreign investment in China's real estate market [8][10]