螺旋桨

Search documents

三瑞智能以价换量增长可持续性遭拷问 研发费用率下滑分红1.7亿后再募7.7亿

Chang Jiang Shang Bao· 2025-12-28 23:35

Core Viewpoint - Sanrui Intelligent Technology Co., Ltd. has successfully passed the IPO review and is expected to become the "first stock of drone power systems" in China, despite concerns over the sustainability of its performance growth due to significant price reductions in its core products [1][3]. Group 1: Company Performance - Sanrui Intelligent has been deeply engaged in the drone and robot power system sector for over a decade, showing impressive financial performance with revenues of 3.62 billion yuan, 5.34 billion yuan, 8.31 billion yuan, and 4.36 billion yuan from 2022 to the first half of 2025 [3]. - The company achieved a net profit attributable to shareholders of 1.13 billion yuan, 1.72 billion yuan, 3.33 billion yuan, and 1.6 billion yuan during the same period, indicating a strong growth trend [3]. - The company holds a 7.1% market share in the global civil drone electric power system market (excluding batteries) in 2024, ranking second after DJI [3]. Group 2: Pricing and Competition - The average selling price of Sanrui's drone motors has decreased from 295 yuan per unit to 110.40 yuan per unit over three and a half years, representing a decline of 62.57% [4]. - The price of the robot power system motors also fell from 1,455.31 yuan per unit in 2022 to 615.26 yuan per unit in the first half of 2025, a drop of over 57% [4]. - The company has adopted a "price for volume" strategy in response to intensified competition, leading to concerns about the sustainability of this growth model [3][4]. Group 3: Research and Development - Sanrui's R&D expense ratio has declined to 4.27%, contrasting with its high growth and profitability, raising market skepticism about its commitment to innovation [6]. - The company spent 1.86 million yuan on R&D in the first half of 2025, which is significantly lower than its competitors [6]. - As of the first half of 2025, Sanrui holds 368 domestic patents, with only 45 being invention patents, indicating a relatively weak core technology patent barrier [6]. Group 4: Financial Health - As of June 2025, Sanrui's debt-to-asset ratio is only 12.33%, significantly lower than the industry average, and it has maintained positive operating cash flow from 2022 to 2024 [7]. - The company has a total of 683 million yuan in cash and trading financial assets, nearly matching the total amount it aims to raise through the IPO [7]. - Despite having sufficient funds for business development and R&D, the company plans to raise 769 million yuan, which raises questions about the rationale behind this fundraising [8]. Group 5: Production Capacity - Of the funds raised, 258 million yuan is intended for the "R&D center and headquarters construction project," while 407 million yuan is allocated for expanding production capacity, despite underutilization of existing capacity [9]. - In 2024, the utilization rate of the electronic speed controller production capacity was only 44.97%, even though it is expected to rise to 87.08% in the first half of 2025, which remains below industry averages [9].

好盈科技“以价换量”,募投项目产销率尚未打满

Xin Lang Cai Jing· 2025-10-30 07:15

Core Viewpoint - Shenzhen Haoying Technology Co., Ltd. has submitted its application for listing on the Sci-Tech Innovation Board, indicating a significant move in the drone power system manufacturing sector [1] Company Overview - Haoying Technology, established in 2005, has transitioned from aviation model electronic control to drone power systems, with a focus on integrated power systems and eVTOL power systems [2][4] - The company's revenue from drone power systems has grown significantly, with projections showing a rise from 1.77 billion yuan in 2022 to 4.34 billion yuan by mid-2025, accounting for 75.57% of total revenue [2][4] Market Dynamics - The global market for drone power systems (excluding batteries) is expected to grow from approximately 10.31 billion yuan in 2024 to 21.59 billion yuan by 2029, with Haoying Technology holding a market share of 4.12% in 2024 [4] - The company is facing intense competition in a rapidly developing market characterized by low concentration and numerous players [4][7] Pricing Strategy - Haoying Technology has adopted a "price-for-volume" strategy, leading to a significant reduction in product prices, with drone motor prices dropping over 50% since 2023 [1][5] - The average selling price of drone motors decreased from 343.57 yuan to 150.56 yuan, a decline of 56.18% [5] Financial Performance - The company reported revenues of 4.68 billion yuan, 5.46 billion yuan, and 7.38 billion yuan for the years 2022, 2023, and 2024, respectively, with a projected revenue of 5.8 billion yuan for the first half of 2025 [4] - Net profits for the same periods were 818.88 million yuan, 941.81 million yuan, and 1.52 billion yuan, with a projected profit of 1.39 billion yuan for the first half of 2025 [4] Research and Development - R&D expenses have increased, amounting to 321.38 million yuan in 2022 and projected at 376.87 million yuan for the first half of 2025, representing 6.87% to 9.26% of total revenue during the reporting period [4] Competitive Landscape - Haoying Technology is positioned among the top suppliers in the drone power system sector, alongside Sanrui Intelligent, which has a higher market share of 7.1% in 2024 [3][8] - The gross profit margin of Haoying Technology has been consistently lower than that of its competitors, with margins of 44.88% to 47.41% compared to Sanrui Intelligent's 52.60% to 59.79% [7][8] International Expansion - The company is increasing its focus on overseas markets, with international sales growing by 230.1% in the first half of 2025 [10] - The proportion of overseas sales in total revenue has risen from 21.9% in the first half of 2025 to 30.1% in 2022 [10][11] Production Capacity - Haoying Technology's production capacity utilization rates for various products exceeded 100%, indicating strong demand and ongoing expansion efforts [12] - Despite high utilization, the company has not yet achieved full production capacity across all product lines, except for propellers [12] IPO Plans - The company plans to issue up to 19.6 billion yuan in its IPO, with funds allocated for high-end power system projects and R&D upgrades [13]

好盈科技闯关科创板IPO 加速无人机动力系统全国产化

Zheng Quan Shi Bao Wang· 2025-10-24 07:48

Core Viewpoint - Haoying Technology, a leading manufacturer of drone power systems, has initiated its IPO process on the Sci-Tech Innovation Board, aiming to raise 1.96 billion yuan [1][4]. Group 1: Company Overview - Haoying Technology specializes in the research, production, and sales of drone power systems, including integrated power systems, electronic controls, motors, and propellers [4]. - The company is also expanding into electric vertical takeoff and landing (eVTOL) power systems, focusing on self-research and development to achieve domestic production and technological autonomy [4][6]. - The sales model primarily relies on direct sales, supplemented by distribution and trade, with major clients including FALCON, Sanrui Intelligent, and Jimu Robotics [4]. Group 2: Market Position - Haoying Technology holds a leading position in the drone power industry, with a global market share of 4.12% for its drone power products projected for 2024 [5]. - In the competitive arena of racing car (boat) models, the company is the market leader, with a global market share of 23.09% for its power systems in this sector, ranking first worldwide [5]. Group 3: Financial Performance - The company reported revenues of 546 million yuan, 738 million yuan, and 580 million yuan for the years 2023, 2024, and the first half of 2025, respectively, with net profits of 94 million yuan, 152 million yuan, and 139 million yuan during the same periods [6]. - The funds raised from the IPO will be allocated to three projects: the high-end power system smart industrial park (Phase I), the upgrade of the Haoying R&D center, and to supplement working capital [6].

好盈科技科创板IPO已受理 为行业内领先的无人机动力系统专业制造商

Zhi Tong Cai Jing· 2025-10-23 23:24

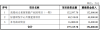

Core Viewpoint - Shenzhen Haoying Technology Co., Ltd. has submitted its IPO application to the Shanghai Stock Exchange's Sci-Tech Innovation Board, aiming to raise 1.96 billion yuan [1] Company Overview - Haoying Technology is a leading manufacturer of drone power systems, focusing on the R&D, production, and sales of integrated power systems, electronic controls, motors, and propellers [1] - The company emphasizes self-research across the entire technology stack and is advancing high-end power technologies for heavy-lift drones and large eVTOLs [1] - The company has a strong market position, ranking in the first tier among third-party suppliers, with a projected global market share of 4.12% for its drone power products in 2024 [1] Competitive Landscape - The low-altitude economy is thriving, with a competitive landscape characterized by low market concentration and numerous participants in the drone power market [1] - The drone power sector is talent and technology-intensive, integrating multiple disciplines such as electronic science, computer science, software engineering, electrical engineering, electromagnetics, solid mechanics, and fluid mechanics [1] Performance in Model Racing - In the model racing sector, Haoying Technology is a leading enterprise, with its power products helping racers win 64 championships in top global model car competitions since 2022 [2] - The company holds a global market share of 23.09% in the model racing power system sector for 2024, ranking first worldwide [2] Fund Utilization - The funds raised will be allocated to the following projects: - High-end power system smart industrial park project (Phase I): 1.33 billion yuan - Haoying R&D center upgrade project: 485 million yuan - Working capital supplement: 160 million yuan - Total investment for these projects is approximately 1.97 billion yuan [2] Financial Performance - Revenue and net profit figures for Haoying Technology are as follows: - 2022: Revenue of 468 million yuan, net profit of 81.89 million yuan - 2023: Revenue of 546 million yuan, net profit of 94.18 million yuan - 2024: Revenue of 738 million yuan, net profit of 152 million yuan - 2025 (Jan-Jun): Revenue of 580 million yuan, net profit of 139 million yuan [2][3] - The company's total assets and equity have shown significant growth from 2022 to 2025, with total assets reaching approximately 953 million yuan by mid-2025 [3] - The company maintains a healthy financial position with a debt-to-asset ratio of 22.88% as of mid-2025 [3]

三瑞智能冲击“民用无人机电机”第一股:IPO前分红1.7亿元

Feng Huang Wang· 2025-09-29 01:37

Core Viewpoint - Sanrui Intelligent Technology Co., Ltd. is preparing for an IPO on the Shenzhen Stock Exchange's ChiNext board, aiming to become the first publicly listed company in the civil drone motor sector [2][3]. Company Overview - Established in 2009, Sanrui Intelligent specializes in the manufacturing of drone and robot power systems, focusing on the research, production, and sales of electric power systems for drones and robots [2]. - According to a Frost & Sullivan industry report, Sanrui is projected to hold a 7.1% market share in the global civil drone electric power system market in 2024, ranking second globally after DJI [2]. Financial Performance - The company plans to raise approximately 769 million yuan through the IPO, with funds allocated to three projects: expansion of drone and robot power systems, construction of a research center and headquarters, and upgrades to information technology and smart warehousing [3]. - Revenue figures for the years 2022, 2023, and 2024 are reported as 361 million yuan, 533 million yuan, and 831 million yuan, respectively, with net profits of 100 million yuan, 161 million yuan, and 320 million yuan after excluding non-recurring gains [3]. Pricing Trends - The average selling price of the motors has been declining, with prices dropping from 295 yuan per unit in 2022 to 148 yuan per unit in 2024, and further down to 110.4 yuan in the first half of 2025, representing a 62.57% decrease from 2022 [4]. - The price of robot power system motors also decreased significantly, from 1,455.31 yuan per unit in 2022 to 615.26 yuan per unit [4]. Export and Market Risks - The company has seen rapid growth in revenue and net profit, but faces challenges such as international trade tensions, fluctuations in raw material prices, and declining prices of core products [5]. - Export revenue for the years 2022, 2023, 2024, and the first half of 2025 was 235 million yuan, 382 million yuan, 426 million yuan, and 213 million yuan, respectively, with a significant portion of exports going to Europe and Asia [5]. - The company has been affected by increased tariffs on imports to the U.S. since 2025, which has raised procurement costs for customers and weakened competitiveness in the U.S. market [5]. Tax Benefits - Sanrui is recognized as a national high-tech enterprise, benefiting from a reduced corporate income tax rate of 15% and other tax incentives, which contributed to tax savings of 16.18 million yuan, 28.84 million yuan, 46.99 million yuan, and 24.49 million yuan during the reporting period [6]. - The proportion of tax benefits to total profit was 12.13%, 14.28%, 12.04%, and 13.01% for the respective years [6]. Dividend Policy - The company declared cash dividends of 130 million yuan in 2023 and 40 million yuan in 2025, totaling 170 million yuan [7]. Future Outlook - Sanrui acknowledges potential risks related to macroeconomic changes, unfavorable adjustments in industrial policies, and challenges in technology development and customer acquisition, particularly concerning the market penetration of new products [8].

三瑞智能IPO获受理 低空经济概念股有望扩容

Sou Hu Cai Jing· 2025-07-17 10:27

Core Viewpoint - The rapid development of the low-altitude economy has significantly boosted the revenue and performance of Sanrui Intelligent Technology Co., Ltd. (hereinafter referred to as "Sanrui Intelligent") [1] Group 1: Company Overview - Sanrui Intelligent is a leading manufacturer of drone and robot power systems, recently submitted an IPO application to the ChiNext board, which has been accepted [1] - The company focuses on the research, production, and sales of electric power systems for drones and robots, which are critical components for the continuous development of these industries [2][3] Group 2: Financial Performance - From 2022 to 2024, Sanrui Intelligent achieved operating revenues of 362 million, 534 million, and 831 million yuan, with year-on-year growth rates of 47.61% and 55.77% for the latter two years [5] - The net profits for the same period were 131 million, 172 million, and 333 million yuan, with growth rates of 52.29% and 93.36% for the last two years [5] Group 3: Revenue Structure - Over 80% of Sanrui Intelligent's revenue comes from drone power systems, while robot power systems currently contribute less than 10% [3] - In 2024, the revenue from electric motors, the company's core product, is projected to reach 462 million yuan, accounting for 55.72% of total revenue [4] Group 4: Market Presence - Sanrui Intelligent's products are exported to over 100 countries and regions, with foreign sales accounting for 65.16%, 71.78%, and 51.38% of total revenue during the reporting period [5][6] - The company has established partnerships with notable clients in the drone industry, including Aerospace Electronics and Leica Geosystems [2] Group 5: R&D and Competitive Position - Sanrui Intelligent's R&D expenses for 2024 are projected to be lower than some comparable companies, but it holds a higher number of authorized patents [9][10] - The company's gross profit margins are significantly higher than those of comparable companies, with rates of 52.60%, 55.99%, and 59.79% over the reporting period [10][11]

涉及健康安全、绿色环保、养老适老等,一批重要国家标准发布

news flash· 2025-07-02 07:13

Group 1: Elderly and Child Care - A total of 7 national standards were released for home-based elderly meal services, rehabilitation aids in elderly care institutions, and convenient services on medical insurance platforms, addressing the needs of elderly care and medical security [2] - 9 national standards were introduced to enhance product packaging safety, particularly for children, including requirements to prevent children from opening packaging [2] - 4 national standards were established to improve the aging-friendly features of products and enhance anti-counterfeiting technology [2] Group 2: Daily Life - 2 national standards were published for oral hygiene products, focusing on calcium silicate and toothpaste abrasion testing methods to protect public oral health [3] - 3 financial service national standards were introduced, including a unique product identification code and descriptions of banking services, supporting financial security and high-level financial openness [3] - 2 national standards were released for emergency management and urban power service continuity guidelines, enhancing emergency response capabilities and promoting resilient city construction [3] Group 3: Emerging Industries - 7 national standards were published in areas such as artificial intelligence, information technology, and the Internet of Things, providing technical support for digital service capabilities [4] - 5 national standards were established for data centers and cybersecurity technologies, facilitating deeper interconnectivity in the digital economy [4] - 2 national standards were introduced for electric earth-moving machinery safety and battery swap systems, aiding the green transformation of traditional industries [4] Group 4: Transportation and Energy - 12 national standards were released for waterway passenger transport services, road traffic signs, fuel consumption evaluation methods for passenger cars, and automotive maintenance, providing technical support for transportation safety [5] - 14 national standards were published for ship soft ladders, propellers, and buoyancy materials for submersibles, enhancing quality and efficiency in the shipbuilding industry [5] - 2 national standards for ethanol gasoline and its blending components were introduced, ensuring the stability of fuel quality [5]

大连重工:国家新能源产业支持政策有效促进公司风电产品业务的发展

Sou Hu Cai Jing· 2025-06-18 14:51

Group 1 - The national support policies for the new energy industry are positively impacting the company's wind power product business, with the wind power segment accounting for approximately 32.5% of the company's total orders [2] - Over 85% of the wind power orders come from the top 10 domestic wind turbine manufacturers, indicating a strong market position [2] - The company is actively researching industry policies, aligning with customer needs, optimizing product and customer structure, and enhancing management of the wind power segment to drive order growth [2] Group 2 - The national marine economy support policies are providing positive assistance for the company's marine engineering market expansion [2] - The company's related business is primarily focused on shipbuilding and marine engineering, with the order scale for ship crankshafts reaching 700 million yuan this year, showing a year-on-year increase since 2022 [2] - Other marine-related products have an average annual order of about 100 million yuan, which is relatively small in proportion [2]

专家访谈汇总:中船系,谁是盈利最强企业?

阿尔法工场研究院· 2025-04-09 14:13

Group 1: Military and Aerospace Industry Overview - The military informationization is a core support for modern military power development, aiming to enhance combat efficiency and battlefield awareness through information technology [3] - The "14th Five-Year Plan" emphasizes the development of intelligent and informationized weapon systems, with military equipment demand expected to exceed 250 billion yuan by 2025 [3] - The commercial aerospace sector is recognized as a key component of national strategic emerging industries, with a focus on promoting its healthy development as part of building a strong aerospace nation [4] Group 2: Key Players and Market Dynamics - China Shipbuilding Group, formed by the merger of CSIC and CSSC, is the largest shipbuilding group globally, benefiting from the growing demand in the marine economy [2] - Major suppliers in the military informationization sector include Rockwell Collins, Lockheed Martin, and Northrop Grumman globally, while domestic players include China Electronics Technology Group and Aviation Industry Corporation of China [3] - The A-share aerospace and military sector saw significant growth, with a 7.2% increase in national defense budget reaching 1.66 trillion yuan in 2025, marking a golden period for the industry [9] Group 3: Technological Innovations and Trends - The commercial aerospace industry is integrating satellite communication, navigation, and remote sensing technologies into various sectors, driving the rapid development of emerging industries like low-altitude economy and tourism [4] - Companies like SpaceX are leading technological innovations in the global commercial aerospace wave, while Chinese aerospace firms are exploring new development models [4] - The shift from traditional single-satellite development to batch production and low-cost manufacturing in satellite production is crucial for enhancing market competitiveness [4] Group 4: Investment Opportunities - Companies such as AVIC Shenyang Aircraft Corporation and Aerospace Technology are expected to benefit from the concentration of military equipment orders and international trade in high-end equipment [9] - Focus on companies with leading advantages in technology breakthroughs and industrial revolutions, such as AVIC High-Tech in carbon fiber and Guangqi Technology in metamaterials [10] - The integration of military and civilian technologies is creating a dynamic balance between national security and economic development, with significant implications for investment strategies [5][8]