BNMC(601011)

Search documents

宝泰隆10月23日获融资买入7503.75万元,融资余额2.19亿元

Xin Lang Zheng Quan· 2025-10-24 01:21

Core Viewpoint - Baotailong's stock price increased by 3.91% on October 23, with a trading volume of 1.44 billion yuan, indicating strong market interest despite a net financing outflow [1] Financing Summary - On October 23, Baotailong had a financing buy-in of 75.04 million yuan and a financing repayment of 129 million yuan, resulting in a net financing outflow of 54.45 million yuan [1] - As of October 23, the total financing and securities lending balance for Baotailong was 220 million yuan, with the financing balance accounting for 2.86% of the circulating market value, which is above the 80th percentile of the past year [1] - The securities lending data showed no shares were sold or repaid on October 23, with a remaining quantity of 269,500 shares and a securities lending balance of 1.08 million yuan, also above the 90th percentile of the past year [1] Business Performance - For the first half of 2025, Baotailong reported operating revenue of 357 million yuan, a year-on-year decrease of 55.99%, while the net profit attributable to shareholders increased by 151.62% to 98.88 million yuan [2] - The company's main business revenue composition includes raw coal (28.60%), washed coal (22.92%), and heat and electricity (21.68%), with new materials contributing only 1.70% [1] Shareholder Information - As of June 30, 2025, Baotailong had 93,200 shareholders, a decrease of 7.51% from the previous period, with an average of 20,558 circulating shares per shareholder, an increase of 8.12% [2] - The top ten circulating shareholders include several coal ETFs, with notable increases in holdings, indicating growing institutional interest [3]

焦炭板块10月23日涨6.18%,陕西黑猫领涨,主力资金净流入5.74亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-23 08:27

Core Insights - The coke sector experienced a significant increase of 6.18% on October 23, with Shaanxi Black Cat leading the gains [1] - The Shanghai Composite Index closed at 3922.41, up 0.22%, while the Shenzhen Component Index closed at 13025.45, also up 0.22% [1] Sector Performance - Shaanxi Black Cat (601015) closed at 4.57, with a rise of 10.12% and a trading volume of 854,600 shares, amounting to a transaction value of 382 million yuan [1] - Shanxi Coking Coal (600740) closed at 4.59, up 10.07%, with a trading volume of 1,742,800 shares and a transaction value of 779 million yuan [1] - Yunnan Coal Energy (600792) closed at 5.14, increasing by 10.06%, with a trading volume of 620,400 shares and a transaction value of 307 million yuan [1] - Antai Group (600408) closed at 3.19, up 10.00%, with a trading volume of 2,097,600 shares and a transaction value of 640 million yuan [1] - Baotailong (601011) closed at 3.99, with a rise of 3.91% and a trading volume of 3,600,700 shares [1] - Meijin Energy (000723) closed at 5.09, increasing by 3.67%, with a trading volume of 2,192,400 shares [1] - Yunwei Co. (600725) closed at 3.85, down 1.03%, with a trading volume of 686,100 shares [1] Capital Flow - The coke sector saw a net inflow of 574 million yuan from main funds, while retail funds experienced a net outflow of 312 million yuan [1] - The main fund inflows for Shanxi Coking Coal were 173 million yuan, accounting for 22.28% of the total, while retail funds saw a net outflow of 76.96 million yuan [2] - Shaanxi Black Cat had a main fund inflow of 160 million yuan, representing 41.84%, with retail funds experiencing a net outflow of 83.59 million yuan [2] - Antai Group recorded a main fund inflow of 129 million yuan, making up 20.12%, while retail funds had a net outflow of 68.87 million yuan [2] - Meijin Energy had a main fund inflow of 120 million yuan, accounting for 10.84%, with retail funds seeing a net outflow of 98.20 million yuan [2] - Yunwei Co. had a slight main fund outflow of 10.83 million yuan, while retail funds saw a net inflow of 89.10 million yuan [2]

A股煤炭股逆势走强,云煤能源、郑州煤电等多股涨停

Ge Long Hui A P P· 2025-10-23 02:34

Group 1 - The A-share market saw a strong performance in coal stocks, with several companies hitting the daily limit up [1] - Notable companies that experienced significant gains include Shaanxi Black Cat, Yunnan Coal Energy, Shanghai Energy, Zhengzhou Coal Electricity, Dayou Energy, and Liaoning Energy, all reaching the daily limit [1] - Other companies such as Baotailong and Shanxi Coking Coal rose over 6%, while Pingmei Shares increased by 5% [1] Group 2 - Shaanxi Black Cat (601015) had a price increase of 10.12% with a total market capitalization of 9.334 billion and a year-to-date increase of 36.83% [2] - Yunnan Coal Energy (600792) rose by 10.06%, with a market cap of 5.705 billion and a year-to-date increase of 37.43% [2] - Shanghai Longyuan (600508) increased by 10.04%, with a market cap of 10.1 billion and a year-to-date increase of 8.65% [2] - Zhengzhou Coal Electricity (600121) saw a 10.02% increase, with a market cap of 6.823 billion and a year-to-date increase of 29.33% [2] - Dayou Energy (600403) rose by 10.01%, with a market cap of 23.1 billion and a remarkable year-to-date increase of 228.91% [2] - Liaoning Energy (600758) increased by 10.00%, with a market cap of 6.253 billion and a year-to-date increase of 38.54% [2] - Baotailong (601011) rose by 6.51%, with a market cap of 7.835 billion and a year-to-date increase of 35.88% [2] - Shanxi Coking Coal (600740) increased by 6.00%, with a market cap of 11.3 billion and a year-to-date increase of 10.28% [2] - Pingmei Shares (601666) saw a 5.02% increase, with a market cap of 22.2 billion but a year-to-date decrease of 3.81% [2] - Hengyuan Coal Electricity (600971) rose by 3.79%, with a market cap of 8.868 billion and a year-to-date decrease of 16.40% [2]

宝泰隆股价涨5.21%,国泰基金旗下1只基金位居十大流通股东,持有2083.38万股浮盈赚取416.68万元

Xin Lang Cai Jing· 2025-10-23 02:16

Group 1 - The core point of the news is the performance and financial details of Baotailong New Materials Co., Ltd., which saw a stock price increase of 5.21% to 4.04 CNY per share, with a trading volume of 639 million CNY and a market capitalization of 7.739 billion CNY [1] - Baotailong's main business includes coal mining, washing and processing, coking, chemical production, power generation, heating, new energy, and new materials, with revenue contributions from various segments: raw coal (28.60%), clean coal (22.92%), slack coal (22.61%), heating and electricity (21.68%), new materials (1.70%), and others [1] - The company was established on June 24, 2003, and went public on March 9, 2011, indicating a long-standing presence in the market [1] Group 2 - Among the top shareholders, Guotai Fund's Guotai Zhongzheng Coal ETF (515220) increased its holdings by 4.3641 million shares in Q2, now holding 20.8338 million shares, which is 1.09% of the circulating shares [2] - The Guotai Zhongzheng Coal ETF has a current scale of 4.217 billion CNY and has achieved a year-to-date return of 4.62%, ranking 4003 out of 4218 in its category [2] - The fund manager, Wu Zhonghao, has been in charge for 3 years and 270 days, with the best fund return during his tenure being 69.7% and the worst being -11.81% [3]

公司互动丨这些公司披露在机器人、深地经济等方面最新情况

Di Yi Cai Jing· 2025-10-22 14:38

Robotics - Dongfang Electric Heat has sent samples of electronic skin to leading robotics companies [1] - Hongjing Optoelectronics has initiated research and development on humanoid robots and has sent samples [1] - Baolong Technology plans to gradually invest resources to expand its business in the robotics field [1] Deep Earth Economy - Boying Special Welding's anti-corrosion and anti-wear welding technology can be applied to oil pipelines in deep earth oil and gas transportation [1] - Baotailong's coal and graphite resources are currently not classified under the "deep earth economy" category [1] Consumer Electronics - Longli Technology's LIPO technology products have achieved mass production in projects such as wristbands and mobile phones [1] Charging and Swapping - Green Energy Smart Charging has technical and business cooperation with CATL in the charging and swapping business [1] - Dazhong Transportation has not yet engaged in the charging and swapping business [1] Other Developments - Huagong Technology has seen bulk shipments of 400G/800G optical modules from overseas equipment and channel vendors [1] - Lingyi Zhi Zao has made bulk shipments of cooling modules for international clients such as AMD [1] - Farah Electronics' capacitors are used in ultra-high voltage transmission and transformation applications [1] - Huate Gas has supplied a small quantity of electronic specialty gases to Xinkai, with a minor business proportion [1] - Benchuan Intelligent's high-end PCB products have achieved small batch applications in CPO-related projects [1] - Fangda Special Steel has not yet collaborated with Huawei on "digital twin" projects related to blast furnaces [1] - Hengdian East Magnetic focuses its energy storage business on household storage, with a small portion of shipments in the European market [1] - Siwei Tuxin and Jianzhizhi Robot have collectively secured 5.85 million sets of intelligent driving solutions from 2024 to the first half of 2025 [1] - iFlytek maintains a good cooperation with Moore Threads in the field of artificial intelligence [1]

石墨电极概念下跌2.34%,主力资金净流出19股

Zheng Quan Shi Bao Wang· 2025-10-22 09:23

Market Performance - The graphite electrode sector declined by 2.34%, ranking among the top losers in the concept sector as of the market close on October 22 [1] - Within the sector, companies such as Baotailong, Zhongke Electric, and Yicheng New Energy experienced significant declines, while Fuan Co., Longjiang Transportation, and Baosteel saw slight increases of 0.30%, 0.28%, and 0.14% respectively [1] Concept Sector Overview - The top-performing concept sectors included combustible ice with a gain of 4.06%, shale gas at 2.29%, and Tianjin Free Trade Zone at 2.03%, while the graphite electrode sector was among the worst performers with a decline of 2.34% [2] - Other declining sectors included the gold concept down by 1.98% and flexible direct current transmission down by 1.41% [2] Capital Flow Analysis - The graphite electrode sector saw a net outflow of 735 million yuan from major funds, with 19 stocks experiencing net outflows and 9 stocks seeing outflows exceeding 30 million yuan [2] - The largest net outflow was from Shanshan Co. at 213 million yuan, followed by Zhongke Electric, Baotailong, and Yicheng New Energy with outflows of 101 million yuan, 83.63 million yuan, and 76.69 million yuan respectively [2] Individual Stock Performance - Shanshan Co. had a decline of 4.16% with a turnover rate of 4.38% and a net outflow of 21.26 million yuan [3] - Zhongke Electric fell by 6.18% with a turnover rate of 12.26% and a net outflow of 10.05 million yuan [3] - Baotailong decreased by 6.34% with a turnover rate of 16.25% and a net outflow of 8.36 million yuan [3]

宝泰隆:公司拥有的煤矿资源和石墨矿资源目前不属于“深地经济”范畴

Zheng Quan Shi Bao Wang· 2025-10-22 08:47

Core Viewpoint - The company Baotailong (601011) stated on October 22 that its coal and graphite mining resources do not fall under the category of "deep earth economy" [1] Group 1 - The company confirmed its ownership of coal and graphite mining resources [1] - The resources mentioned are not classified as part of the "deep earth economy" [1]

焦炭板块10月22日跌2.82%,宝泰隆领跌,主力资金净流出1.63亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-22 08:26

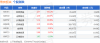

Core Insights - The coke sector experienced a decline of 2.82% on October 22, with Baotailong leading the drop [1] - The Shanghai Composite Index closed at 3913.76, down 0.07%, while the Shenzhen Component Index closed at 12996.61, down 0.62% [1] Sector Performance - Key stocks in the coke sector showed mixed performance, with Yunwei Co. rising by 3.18% to a closing price of 3.89, while other stocks like Yutailong and Shanxi Coking fell by 6.34% and 1.65% respectively [1] - The trading volume for Yunwei Co. was 687,400 shares, with a transaction value of 264 million yuan, while Yutailong had a trading volume of 3,113,100 shares and a transaction value of 1.222 billion yuan [1] Capital Flow - The coke sector saw a net outflow of 163 million yuan from main funds, while retail investors contributed a net inflow of 145 million yuan [1] - Individual stock capital flows indicated that Baotailong had the highest net outflow from main funds at 80.61 million yuan, while Yunwei Co. had a net inflow of 4.28 million yuan from main funds [2]

宝泰隆跌6.82%,沪股通龙虎榜上净卖出2837.75万元

Zheng Quan Shi Bao Wang· 2025-10-21 13:58

Core Viewpoint - The stock of Baotailong (601011) experienced a significant decline of 6.82% on the trading day, with a turnover rate of 21.05% and a trading volume of 1.659 billion yuan, indicating notable market activity and investor sentiment [1][2]. Trading Activity - The stock was listed on the Shanghai Stock Exchange's watchlist due to a daily price deviation of -8.18%, with a net sell-off of 28.3775 million yuan from the Shanghai-Hong Kong Stock Connect [2]. - The top five trading desks accounted for a total transaction volume of 290 million yuan, with buying activity at 115 million yuan and selling activity at 174 million yuan, resulting in a net sell-off of 59.0689 million yuan [2]. - The Shanghai-Hong Kong Stock Connect was both the largest buyer and seller, with buying amounting to 41.0875 million yuan and selling amounting to 69.4649 million yuan, leading to a net sell-off of 28.3775 million yuan [2]. Fund Flow - Over the past six months, the stock has appeared on the watchlist seven times, with an average price increase of 5.76% the day after being listed and an average increase of 9.71% over the following five days [3]. - The stock saw a net outflow of 181 million yuan in principal funds today, with a significant outflow of 150 million yuan from large orders and 30.8359 million yuan from major orders. Over the past five days, the total net outflow reached 201 million yuan [3]. - As of October 20, the margin trading balance for the stock was 313 million yuan, with a financing balance of 312 million yuan and a securities lending balance of 1.1854 million yuan. The financing balance increased by 109 million yuan over the past five days, representing a growth of 53.56%, while the securities lending balance rose by 367,800 yuan, a growth of 44.99% [3]. Financial Performance - According to the semi-annual report released on August 26, the company achieved a revenue of 357 million yuan in the first half of the year, a year-on-year decrease of 55.99%. However, the net profit reached 98.8835 million yuan, reflecting a year-on-year increase of 151.62% [3].

煤炭行业今日跌1.02%,主力资金净流出14.09亿元

Zheng Quan Shi Bao Wang· 2025-10-21 09:04

Market Overview - The Shanghai Composite Index rose by 1.36% on October 21, with 30 industries experiencing gains, led by the communication and electronics sectors, which increased by 4.90% and 3.50% respectively [1] - The coal industry was the biggest loser, declining by 1.02% [1] Capital Flow - The net inflow of capital in the two markets was 27.724 billion yuan, with 17 industries seeing net inflows [1] - The electronics sector had the highest net inflow of capital at 12.028 billion yuan, followed by the communication sector with 5.525 billion yuan [1] Coal Industry Analysis - The coal industry saw a net outflow of capital amounting to 1.409 billion yuan, with 37 stocks in the sector; 11 stocks rose while 25 fell [2] - The top three stocks with the highest net outflow were Zhengzhou Coal Electricity (1.922 billion yuan), Baotailong (1.812 billion yuan), and China Shenhua (1.660 billion yuan) [2] Individual Stock Performance in Coal Sector - New Energy (Xinjie Energy) led the net inflow with 41.5292 million yuan, followed by Jiangtong Equipment and Electric Investment Energy with 21.2444 million yuan and 15.5364 million yuan respectively [2][3] - The stocks with significant net outflows included Zhengzhou Coal Electricity (-192.25 million yuan), Baotailong (-181.26 million yuan), and China Shenhua (-166.04 million yuan) [2][3]