ANDON HEALTH(002432)

Search documents

九安医疗(002432.SZ)累计回购1.84%股份 耗资3.43亿元

智通财经网· 2025-11-03 08:50

Core Viewpoint - Jiuan Medical (002432.SZ) announced a share buyback plan, indicating a strategic move to enhance shareholder value and confidence in the company's future prospects [1] Summary by Categories Company Actions - The company has repurchased a total of 8.541 million shares, which represents 1.84% of its current total share capital [1] - The total amount spent on the share buyback is 343 million yuan, excluding transaction fees [1]

九安医疗(002432) - 关于回购公司股份的进展公告

2025-11-03 08:45

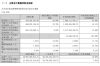

证券代码:002432 证券简称:九安医疗 公告编号:2025-088 天津九安医疗电子股份有限公司 关于回购公司股份的进展公告 本公司及董事会全体成员保证信息披露的内容真实、准确和 完整,没有虚假记载、误导性陈述或重大遗漏。 天津九安医疗电子股份有限公司(以下简称"公司")于2025年10月13日召 开了第六届董事会第二十七次会议,审议并通过了《关于公司回购股份方案的议 案》。本次回购资金来源为公司自有资金及回购专项贷资金,回购的资金总额不 低于3亿元人民币(含)且不超过6亿元人民币(含),回购股份的价格为不超过 人民币53.5元/股(含),具体回购数量以回购期限届满时实际回购的股份数量为 准。具体回购方案详见公司2025年10月14日在《证券时报》和巨潮资讯网 (http://www.cninfo.com.cn)披露的《关于回购公司股份方案暨取得股票回购专 项贷款承诺函的公告》(公告编号:2025-075)。 根据《上市公司股份回购规则》《深圳证券交易所上市公司自律监管指引第 9号—回购股份》等相关规定,公司在回购期间应当在每个月的前3个交易日内公 告截至上月末的回购进展情况。现将公司回购股份进展情况公告 ...

天津自贸区概念下跌2.70%,主力资金净流出11股

Zheng Quan Shi Bao Wang· 2025-10-30 09:39

Group 1 - The Tianjin Free Trade Zone concept declined by 2.70%, ranking among the top declines in the concept sector, with companies like Saixiang Technology hitting the limit down [1] - Major stocks within the Tianjin Free Trade Zone concept that experienced significant declines include HNA Technology, Jintou City Development, and Bohai Chemical [1] - The net outflow of main funds from the Tianjin Free Trade Zone concept reached 276 million yuan, with 11 stocks experiencing net outflows, and 5 stocks seeing outflows exceeding 10 million yuan [2] Group 2 - HNA Technology had the largest net outflow of main funds at 113 million yuan, followed by Saixiang Technology and Jiuan Medical with net outflows of 107 million yuan and 2.52 million yuan respectively [2] - The stocks with the highest net inflows included Youfa Group, Tianjin Port, and Haitai Development, with inflows of 19.56 million yuan, 11.50 million yuan, and 5.79 million yuan respectively [3] - The trading performance of key stocks in the Tianjin Free Trade Zone concept showed significant volatility, with Saixiang Technology down by 10% and HNA Technology down by 5.92% [2][3]

2024 年度 A 股上市公司自由现金流量创造力(FCF Top 99)报告

Jing Ji Guan Cha Wang· 2025-10-29 05:38

Group 1 - The report on the Free Cash Flow (FCF) Top 99 for A-share listed companies in 2024 was led by a team from Tsinghua University and published on October 28, 2025 [2][3] - The concept of high-quality development for enterprises is defined as the ability to continuously generate free cash flow and cash value added [3][4] - The report emphasizes that the ability to create cash value is the only standard for assessing whether a listed company creates shareholder value [4][5] Group 2 - The 2024 FCF Top 99 list includes companies that have been evaluated based on their ability to generate free cash flow over a long-term window, specifically from their IPO or reverse merger year to the end of 2024 [19][20] - The report highlights the increasing attention from capital markets and investors towards the free cash flow generation capabilities of listed companies, with various indices and funds being launched based on this metric [7][8] - The report calls for improved disclosure practices regarding free cash flow and cash value added in annual reports, as well as enhancements to the cash flow statement [8][9] Group 3 - The 2024 FCF Top 99 list includes notable companies such as Focus Media, Kweichow Moutai, and Chongqing Beer, with their respective FCFOE values indicating their cash flow generation efficiency [10][24] - The report identifies new entrants and dropouts from the FCF Top 99 list, with reasons for changes in rankings based on compliance with established standards and performance metrics [25][26][27] - The report provides a detailed analysis of the trends in FCFOE among the listed companies, indicating shifts in performance across various sectors [33][34]

九安医疗(002432) - 关于2024年员工持股计划锁定期届满的提示性公告

2025-10-28 10:52

证券代码:002432 证券简称:九安医疗 公告编号:2025-087 天津九安医疗电子股份有限公司 关于2024年员工持股计划锁定期届满的提示性公告 本公司及董事会全体成员保证信息披露的内容真实、准确和 完整,没有虚假记载、误导性陈述或重大遗漏。 天津九安医疗电子股份有限公司(以下简称"公司"或"本公司")2024 年员工持股计划的锁定期已于 2025 年 10 月 28 日届满。根据中国证券监督管理 委员会(以下简称"中国证监会")《关于上市公司实施员工持股计划试点的指导 意见》以及《深圳证券交易所上市公司自律监管指引第 1 号——主板上市公司规 范运作》等相关规定,现将公司本次员工持股计划锁定期届满情况公告如下: 一、本次员工持股计划的基本情况 公司于 2024 年 8 月 16 日召开第六届董事会第十三次会议、第六届监事会第 十次会议,审议通过了《关于<天津九安医疗电子股份有限公司 2024 年员工持股 计划草案>及其摘要的议案》《关于<天津九安医疗电子股份有限公司 2024 年员 工持股计划管理办法>的议案》及《关于提请股东大会授权董事会办理 2024 年员 工持股计划有关事项的议案》,上述议案业经 ...

九安医疗:三联检产品稳定销售,四联检产品接近临床尾声

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-28 00:36

Core Viewpoint - The company, Jiuan Medical, has successfully launched its respiratory virus triple detection product for consumer sales and is expanding its market presence through various online and offline channels [1] Group 1 - The respiratory virus triple detection product is now in regular sales on the consumer end, covering platforms such as Amazon, CVS, and Walmart [1] - The company is nearing the end of clinical trials for its quadruple detection product, which tests for influenza A, influenza B, COVID-19, and respiratory syncytial virus [1] - The company aims to accelerate patient recruitment to expedite the product launch, leveraging the high incidence of respiratory diseases during the winter season [1]

九安医疗20251027

2025-10-27 15:22

Summary of Jiuan Medical Conference Call Company Overview - **Company**: Jiuan Medical - **Industry**: Medical Devices and Healthcare Key Points Sales and Product Performance - Sales of COVID-19 antigen test kits increased in Q3 2025, transitioning to a regular product line [2][3] - Home medical devices, such as blood pressure monitors, ranked first in sales on Amazon, indicating strong market competitiveness [2][3] Diabetes Care Initiatives - The diabetes care model has been implemented in 50 cities and over 400 hospitals in China, managing 360,000 diabetes patients [2][5] - Quarterly fees from diabetes management services are steadily increasing, improving patient control rates [2][5] - An AI team has been established to enhance diabetes care through smart interactions and data standardization [2][5][8] Financial Performance - Asset management revenue exceeded 1 billion CNY, with profits reaching 1.57 billion CNY in the first three quarters of 2025 [2][6] - The company has established a 5 billion CNY mother fund for investments in AI and technology innovation [2][6] Clinical Trials and Product Development - Clinical trials for continuous glucose monitors (CGM) are set to begin in Q4 2025 in China, with plans for the U.S. market to follow [2][8][12] - R&D investments in AIoT focus on building AI teams and CGM development, aiming to enhance diabetes care efficiency [2][8] Asset Allocation Strategy - The company maintains a diversified asset allocation strategy, including U.S. Treasury bonds, corporate credit bonds, and equities, targeting an annual compound return of around 8% [4][10] - The actual return for 2024 is projected at approximately 9%, with a target range of 6% to 10% for 2025 [4][10] Market Expansion and Competition - Jiuan Medical is preparing for U.S. market entry with a focus on patent protection and competitive strategies [11] - The company has built a significant patient flow through existing brand products, laying the groundwork for future product launches [11] New Product Launches - The company is developing a four-in-one respiratory test product, currently in clinical trials, with plans to leverage the iHealth brand for more OTC products in the U.S. market [19][20] Future Growth and Strategic Goals - Core strategies include expanding product offerings in the U.S. and promoting diabetes care services with AI technology [20][21] - The company aims to achieve profitability in its diabetes care business, targeting 1,000 CNY per patient annually in China and 1,000 USD in the U.S. [16] New Retail Business - The new retail business unit is not a strategic focus but must achieve profitability, currently contributing a low single-digit percentage to overall revenue [17] AI Development and Applications - Increased R&D investment in AI over the past two years, primarily focused on diabetes management [18] Geopolitical Considerations - The company has adopted a dual strategy for production in response to geopolitical uncertainties, with manufacturing in Los Angeles and outsourcing in Vietnam to mitigate tariff impacts [15][16] Additional Insights - The company is exploring AI applications beyond diabetes management, aiming to enhance overall healthcare efficiency [18]

九安医疗(002432) - 002432九安医疗投资者关系管理信息20251027

2025-10-27 12:56

Group 1: Business Strategy and Investment - The company has established a dual business model focusing on medical health operations and large asset allocation investments, aiming for stable profits and cash flow [2][3] - The asset allocation strategy is inspired by Yale University's endowment model, targeting a long-term return of 6%-10% per year [3] - As of mid-2025, the company's private equity assets accounted for 12.6% of its total assets, with significant investments in hard technology and healthcare sectors [3][4] Group 2: Product Development and Market Expansion - The company plans to launch a four-in-one respiratory test product, currently in clinical trials, to address seasonal respiratory diseases [5] - The three-in-one test product has achieved stable sales in the consumer market, with a focus on expanding sales channels [8] - The company is actively developing AIoT diabetes management tools, aiming to enhance chronic disease management through technology [12][23] Group 3: Financial Performance and Shareholder Value - The company has conducted five share buyback programs since 2021, totaling approximately ¥2.88 billion, with a sixth program currently underway [7][20] - As of Q3 2025, the company reported a revenue of ¥3.04 billion, a 17.8% increase from the previous quarter, driven by iHealth products and internet medical services [24][25] - The company has committed to distributing at least 30% of its cumulative net profit as dividends over the next three years [20][21] Group 4: Market Challenges and Future Outlook - The company faces challenges in the U.S. market due to tariff issues, but has established overseas production capabilities to mitigate these impacts [29] - The diabetes care service model has expanded to approximately 50 cities and 424 hospitals, managing over 366,000 patients in China [10][22] - The company anticipates significant growth in the diabetes care market, with a target of managing 1 million patients within three years [22]

九安医疗前三季营收“腰斩” 净利却逆势增长16.11%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 12:46

Core Insights - The core observation is that despite a significant decline in revenue, Jiuan Medical has managed to achieve a growth in net profit, indicating a fundamental shift in its profit structure [1][3]. Financial Performance - Jiuan Medical reported a revenue of 1.069 billion yuan for the first three quarters, a year-on-year decrease of 48.89% [2][4]. - The net profit attributable to shareholders was 668.89 million yuan, reflecting a year-on-year increase of 16.11% [2][5]. - The company experienced a negative cash flow of 34.07 million yuan, a decline of 104.90% compared to the previous year [4]. - Investment income reached 937 million yuan, up 84.99% year-on-year, contributing significantly to the net profit growth [5][6]. Business Transformation - Jiuan Medical is transitioning from a reliance on traditional medical device sales to a dual business model that includes both healthcare operations and large asset investment [6][7]. - The company is focusing on expanding its internet healthcare and chronic disease management sectors, particularly through a new diabetes care model [7][8]. - The firm has increased its investment in research and development, with management expenses rising by 26.66% and R&D expenses by 25.91% [5][6]. Investment Strategy - Jiuan Medical has engaged in significant investments in various sectors, including technology and healthcare, and has established partnerships with venture capital firms [8][9]. - The company has launched a new venture capital fund with a total scale of 701 million yuan, aiming to make financial investments [10]. - Jiuan Medical's investment activities are primarily conducted through its wholly-owned subsidiary, Jiuan Hong Kong, focusing on long-term returns in emerging technology fields [8][9].

今日,开幕!潘功胜、李云泽、吴清将作主题演讲

Zheng Quan Shi Bao Wang· 2025-10-27 00:19

Group 1: Financial Events and Policies - The 2025 Financial Street Forum Annual Meeting is taking place from October 27 to 30 in Beijing, with key speeches from the Governor of the People's Bank of China, the head of the Financial Regulatory Administration, and the Chairman of the China Securities Regulatory Commission [2][3] - The People's Bank of China will conduct a 900 billion yuan Medium-term Lending Facility (MLF) operation on October 27, with a one-year term [3][5] - The State Council's report on financial work emphasizes the need for a moderately loose monetary policy to support the real economy and create a favorable financial environment [3] Group 2: Company Earnings Reports - WuXi AppTec reported a net profit of 12.076 billion yuan for the first three quarters, a year-on-year increase of 84.84% [4] - Cambridge Technology's net profit for the first three quarters increased by 70.88% year-on-year [5] - Weicai Technology achieved a net profit of 202 million yuan for the first three quarters, marking a 226.41% year-on-year growth [5] - Guosheng Financial Holdings reported a net profit of 242 million yuan for the first three quarters, up 191.21% year-on-year [6] - Shen Shen Fang A's net profit surged by 2791.57% year-on-year for the first three quarters, reaching 14.5 million yuan [6] - Several companies, including Morning Light Biotechnology and Wen Tai Technology, reported significant year-on-year profit increases of 385.3% and 265.09%, respectively [6][12] Group 3: Company Losses and Declines - Jing Sheng Machinery reported a net profit decline of 69.56% for the first three quarters [9] - China Shenhua's net profit decreased by 10% year-on-year, amounting to 39.052 billion yuan [8] - Health Yuan and Ping An Bank experienced net profit declines of 1.83% and 3.5%, respectively, for the first three quarters [8]