JRCB(002807)

Search documents

晨会纪要:2025年第184期-20251030

Guohai Securities· 2025-10-30 01:02

Group 1: Coal Industry Insights - In Q3 2025, the proportion of coal stocks in actively managed funds decreased to 0.30%, indicating a low level of investment in the coal sector, which is at its lowest since 2008 [4][5][6] - Coal prices have been recovering, with the price of thermal coal reaching 770 RMB/ton by October 24, 2025, marking a new high for the year [6] - The coal mining industry is expected to maintain upward price trends due to seasonal demand and supply constraints from production regulations, with long-term price increases driven by rising operational costs and regulatory pressures [6] Group 2: Easy Point Technology - In Q3 2025, Easy Point Technology reported a revenue of 9.8 billion RMB, a year-on-year increase of 46.8%, driven by the growth of its programmatic advertising platform [10] - The company’s gross margin decreased to 13.06%, primarily due to rising traffic acquisition costs and increased R&D and sales expenses [10][11] - The programmatic advertising platform has seen significant growth, with daily ad requests reaching 220 billion, and the company is investing heavily in R&D to enhance its service capabilities [11][12] Group 3: Amway Corporation - Amway reported a revenue of 16.79 billion RMB in the first three quarters of 2025, a year-on-year decrease of 6.8%, with net profit declining by 19.2% [14][15] - The company is optimizing its product structure and expanding into emerging markets, with a focus on maintaining strong relationships with global clients like Nike and Adidas [17] - Despite challenges, Amway is seeing improvements in its operational performance, particularly in its Vietnam operations [16][18] Group 4: Nanjing Bank - Nanjing Bank achieved a revenue of 419.49 billion RMB in Q3 2025, reflecting an 8.79% year-on-year growth, with net profit increasing by 8.06% [19][20] - The bank's total assets reached 2.96 trillion RMB, a 14.31% increase from the previous year, with a notable growth in corporate loans [20] - The bank's non-performing loan ratio improved to 0.83%, indicating a strengthening of its asset quality [21] Group 5: Linglong Tire - Linglong Tire reported a revenue of 181.61 billion RMB in the first three quarters of 2025, a 13.87% increase, although net profit fell by 31.81% due to rising raw material costs [22][24] - The company’s tire production and sales volumes increased, with a focus on expanding its global footprint through its "7+5" strategy [27][28] - Linglong Tire is positioned as a leader in the domestic market and is actively pursuing international expansion, including a significant investment in Brazil [27][29] Group 6: Wuxi Bank - Wuxi Bank's revenue grew by 3.87% year-on-year in the first three quarters of 2025, with a net profit increase of 3.78% [30][31] - The bank's loan growth exceeded 10%, with a significant increase in corporate loans, indicating strong demand for financing [31] - The non-performing loan ratio remained stable at 0.78%, reflecting effective risk management practices [32] Group 7: China Aluminum - China Aluminum reported a revenue of 1,765 billion RMB in the first three quarters of 2025, with a net profit increase of 20.65% [33][34] - The company benefited from lower costs and rising prices for aluminum and alumina, contributing to improved profitability [34][35] - Production volumes for key products increased, supporting the overall positive performance of the company [34] Group 8: Jin Zai Food - Jin Zai Food achieved a revenue of 18.08 billion RMB in the first three quarters of 2025, with a slight increase of 2.05%, while net profit declined by 19.51% [37][38] - The company’s Q3 revenue growth of 6.55% indicates a recovery in its core product lines, although profitability remains under pressure due to increased costs [38][39] - Jin Zai Food is focusing on quality and new product development to enhance its market position [39] Group 9: China Coal Energy - China Coal Energy reported a revenue of 1,105.8 billion RMB in the first three quarters of 2025, a decrease of 21.2%, with net profit down by 14.6% [40][41] - The company’s Q3 performance improved due to rising coal prices and cost reductions, with a notable increase in profit margins [41] - The coal production and sales volumes showed resilience despite price pressures, indicating operational efficiency [41]

光大证券晨会速递-20251030

EBSCN· 2025-10-30 00:33

Group 1: Macro and Market Insights - The report outlines three quantitative indicators from the "14th Five-Year Plan" that provide a clear roadmap for economic development over the next five years: steady improvement in total factor productivity, significant increase in household consumption rate, and maintaining economic growth within a reasonable range [1] - The A-share and Hong Kong stock markets are expected to continue strong performance, with a monthly stock selection for November 2025 including companies like Sunking Electronics and Tencent Holdings [1] Group 2: High-end Manufacturing Industry - The year 2026 is anticipated to be a breakthrough year for humanoid robots, with strong optimism for the humanoid robot industry [2] - The liquid cooling industry is expected to see increased penetration driven by improvements in power density and reductions in PUE [2] - The PCB equipment industry is projected to maintain high prosperity as manufacturers accelerate the expansion of high-end PCB capacity [2] - Solid-state battery materials are seeing continuous R&D achievements, with equipment orders expected to increase due to market demand [2] - Recommendations include companies like Ampere Dragon and Giant Star Technology [2] Group 3: Non-ferrous Metals Industry - In Q3 2025, the proportion of non-ferrous metal heavy stocks held by active equity funds increased to 5.72%, with notable increases in copper and tin holdings [3] - Investment suggestions highlight that supply supports price increases for copper, aluminum, and rare earths, while precious metals benefit from a weakened US dollar and a rate cut cycle [3] - Recommended stocks include Zijin Mining and Western Mining [3] Group 4: Banking Sector Insights - China Merchants Bank reported a steady increase in net interest income and a significant rise in wealth management income, with a revenue growth rate improving by 1.2 percentage points quarter-on-quarter [5] - Qingdao Bank achieved a revenue of 11 billion yuan in the first three quarters, a 5% year-on-year increase, with a net profit growth of 15.5% [6] - Jiangyin Bank's revenue reached 3.2 billion yuan, growing by 6.2% year-on-year, with a net profit increase of 13.4% [7] - China Bank's revenue growth was 2.7%, with a positive trend in profitability and asset quality [8] - Chengdu Bank reported a revenue of 17.8 billion yuan, a 3% increase, with a net profit growth of 5% [9] Group 5: Chemical and Petrochemical Sector - Jiufeng Energy's Q3 performance was impacted by short-term disturbances, leading to a slight downward adjustment in profit forecasts for 2025-2027 [10] - Yangnong Chemical reported steady growth in pesticide raw material sales, with a positive outlook for the industry [11] - Satellite Chemical's profit forecasts were adjusted downward due to rising ethane prices, but the company is expected to maintain growth [12] Group 6: Food and Beverage Sector - Ganyuan Foods reported a revenue of 1.533 billion yuan in the first three quarters, a decrease of 4.53% year-on-year, with a significant drop in net profit [22] - Lihai Foods showed strong sales momentum in core customers, with a bright outlook for its cream business [23] - Haitian Flavor Industry achieved a revenue of 21.63 billion yuan in the first three quarters, with a slight adjustment in profit forecasts [24] - Yanjinpuzi reported a revenue increase of 14.67% year-on-year, with a notable rise in net profit [25] Group 7: Home Appliance and New Energy Sector - Shun'an Environment is transitioning from a leader in refrigeration components to a benchmark in refrigeration and new energy vehicle thermal management components, with a target price set at 20.39 yuan [21]

江阴银行(002807):Q3营收归母净利润同比稳健提升,净息差回升:——江阴银行(002807):2025年三季度点评

Guohai Securities· 2025-10-29 14:03

Investment Rating - The investment rating for Jiangyin Bank is "Buy" (maintained) [1] Core Views - Jiangyin Bank's Q3 2025 revenue increased by 6.17% year-on-year, while net profit attributable to shareholders rose by 13.38%, supported by significant growth in bond investment income [5] - The bank's total assets grew steadily, with corporate loans performing exceptionally well, and the non-performing loan ratio improved [5] - The net interest margin has rebounded, indicating a positive trend in asset quality [5] Summary by Sections Financial Performance - In Q3 2025, Jiangyin Bank achieved operating revenue of 3.203 billion yuan, up 6.17% year-on-year, with a growth rate increase of 4.84 percentage points compared to the same period last year [5] - The net profit attributable to shareholders reached 1.278 billion yuan, reflecting a year-on-year increase of 13.38%, with a growth rate increase of 6.59 percentage points compared to the previous year [5] - Investment income surged by 53.71% to 9.319 billion yuan, significantly contributing to overall profitability [5] Asset Quality and Growth - As of the end of Q3 2025, Jiangyin Bank's total assets amounted to 208 billion yuan, representing a 3.90% increase from the end of 2024 [5] - Customer deposits totaled 165.1 billion yuan, up 8.73% year-on-year, while total loans reached 132 billion yuan, increasing by 6.31% [5] - Corporate loans specifically grew by 9.92% to 95.2 billion yuan [5] Profitability and Forecast - The net interest margin for the first three quarters of 2025 was 1.56%, an increase of 2 basis points from the first half of 2025 [5] - The non-performing loan ratio improved to 0.85%, down 1 basis point from the first half of 2025, with a provision coverage ratio of 371.91% [5] - Revenue forecasts for 2025-2027 are 4.233 billion, 4.540 billion, and 4.893 billion yuan, with year-on-year growth rates of 6.84%, 7.25%, and 7.78% respectively [7]

江阴银行(002807):净利息收入增速回正,盈利延续双位数高增:——江阴银行(002807.SZ)2025年三季报点评

EBSCN· 2025-10-29 12:42

Investment Rating - The report maintains an "Accumulate" rating for Jiangyin Bank (002807.SZ) with a current price of 4.80 yuan [1]. Core Views - Jiangyin Bank's net interest income has returned to positive growth, and profitability continues to show double-digit high growth. For the first three quarters of 2025, the bank achieved revenue of 3.2 billion yuan, a year-on-year increase of 6.2%, and a net profit attributable to shareholders of 1.28 billion yuan, up 13.4% year-on-year [3][4]. Financial Performance Summary - Revenue, pre-provision profit, and net profit growth rates for the first three quarters were 6.2%, 10.9%, and 13.4%, respectively, with declines of 4.3, 3.8, and 3.2 percentage points compared to the first half of the year [4]. - The annualized weighted average return on equity (ROAE) was 9.05%, an increase of 0.5 percentage points year-on-year [3]. Income Structure Summary - Net interest income and non-interest income growth rates for the first three quarters were 1.2% and 17.7%, respectively, with changes of +1.4 and -12.5 percentage points compared to the first half of 2025 [4]. - Non-interest income accounted for 33.2% of total revenue, with a year-on-year increase of 17.7% [7]. Asset and Liability Management Summary - As of the end of the third quarter of 2025, the bank's interest-bearing assets and loans grew by 4.5% and 8.6% year-on-year, respectively, showing slight acceleration compared to the second quarter [5]. - The bank's deposit growth remained stable, with a year-on-year increase of 12.4% in deposits [6]. Risk Management Summary - The non-performing loan (NPL) ratio was 0.85%, with a slight decrease from the previous quarter [8]. - The bank's capital adequacy ratios were robust, with the core tier one capital ratio at 13.77% [8]. Profitability Forecast and Valuation Summary - The report forecasts earnings per share (EPS) for 2025-2027 to be 0.91, 0.98, and 1.05 yuan, respectively, with corresponding price-to-book (PB) ratios of 0.58, 0.53, and 0.49 [9][10].

农商行板块10月29日跌1.59%,江阴银行领跌,主力资金净流入7863.93万元

Zheng Xing Xing Ye Ri Bao· 2025-10-29 08:41

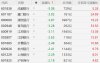

Core Points - The rural commercial bank sector experienced a decline of 1.59% on October 29, with Jiangyin Bank leading the drop [1] - The Shanghai Composite Index closed at 4016.33, up 0.7%, while the Shenzhen Component Index closed at 13691.38, up 1.95% [1] Group 1: Stock Performance - Ruifeng Bank (601528) closed at 5.51 with no change in price [1] - Qingnong Commercial Bank (002958) closed at 3.21, down 0.93% [1] - Changshu Bank (601128) closed at 6.92, down 1.14% [1] - Sunong Bank (603323) closed at 5.17, down 1.34% [1] - Zijin Bank (601860) closed at 2.87, down 1.37% [1] - Yunnan Agricultural Commercial Bank (601077) closed at 6.86, down 1.44% [1] - Wuxi Bank (600908) closed at 6.05, down 1.47% [1] - Zhangjiagang Bank (002839) closed at 4.42, down 1.56% [1] - Shanghai Agricultural Commercial Bank (601825) closed at 8.52, down 2.07% [1] - Jiangyin Bank (002807) closed at 4.80, down 2.83% [1] Group 2: Capital Flow - The rural commercial bank sector saw a net inflow of 78.64 million yuan from main funds, while retail funds experienced a net outflow of 10.52 million yuan [2] - Speculative funds had a net outflow of 68.12 million yuan [2]

江阴银行前三季度净利润12.78亿元,同比增长13.38%

Jin Rong Jie· 2025-10-29 08:24

Core Insights - Jiangyin Bank reported a total operating income of 3.204 billion yuan for the first three quarters of 2025, representing a year-on-year growth of 6.17% [1] - The net profit attributable to shareholders reached 1.278 billion yuan, with a year-on-year increase of 13.38%, outpacing revenue growth [1] - The bank's total assets as of September 2025 amounted to 208.042 billion yuan, a growth of 3.90% from the beginning of the year [1] Financial Performance - The net profit after excluding non-recurring gains and losses was 1.229 billion yuan, reflecting a year-on-year growth of 14.94% [1] - The bank's total deposits increased by 13.247 billion yuan to 165.073 billion yuan, marking an 8.73% growth [1] - Total loans grew by 7.828 billion yuan to 131.957 billion yuan, with a growth rate of 6.31% [1] Asset Quality - The non-performing loan ratio decreased to 0.85%, down by 0.01 percentage points from the beginning of the year, significantly lower than the industry average [1] - Normal loans accounted for 97.97% of total loans, an increase of 0.05 percentage points, while the proportion of attention-class loans fell to 1.18%, a decrease of 0.04 percentage points [1] Interest Margin and Capital Adequacy - In a challenging interest margin environment, Jiangyin Bank's net interest margin stabilized at 1.56%, with a net interest spread of 1.39%, up by 2 basis points from the previous half [2] - The bank's provision coverage ratio stood at 371.91%, and the capital adequacy ratio was 14.92%, both meeting regulatory standards [2]

A股银行股集体下跌:成都银行跌5%,浦发银行跌超3%

Ge Long Hui A P P· 2025-10-29 04:03

Group 1 - The A-share market saw a collective decline in bank stocks, with Chengdu Bank dropping by 5% and several others, including Xiamen Bank, Shanghai Pudong Development Bank, and Qingdao Bank, falling over 3% [1] - Specific declines included Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank, all experiencing drops exceeding 2% [1] Group 2 - Chengdu Bank's market capitalization is reported at 72.9 billion, with a year-to-date increase of 5.28% despite the recent decline of 5.08% [2] - Xiamen Bank has a market capitalization of 18.1 billion, with a year-to-date increase of 24.69%, but it fell by 3.92% today [2] - Shanghai Pudong Development Bank's market capitalization stands at 396.7 billion, with a year-to-date increase of 19.25%, experiencing a decline of 3.87% [2] - Qingdao Bank's market capitalization is 29.2 billion, with a year-to-date increase of 33.50%, and it dropped by 3.28% [2] - Jiangsu Bank has a market capitalization of 194.5 billion, with a year-to-date increase of 13.38%, and it fell by 3.11% [2] - Other banks like Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank also reported declines, with respective market capitalizations of 11.8 billion, 36.4 billion, 114.4 billion, 133.3 billion, and 82.1 billion [2]

江阴农商行前三季度实现归母净利润12.78亿元 同比增长13.38%

Bei Jing Shang Bao· 2025-10-28 11:35

Core Insights - Jiangyin Rural Commercial Bank reported a revenue of 3.204 billion yuan for the first three quarters of 2025, representing a year-on-year growth of 6.17% [2] - The net profit attributable to shareholders reached 1.278 billion yuan, with an increase of 13.38% [2] - The net interest margin stood at 1.56%, while the net profit margin was 1.39%, both showing a quarter-on-quarter increase of 2 basis points compared to the first half of the year [2] Business Scale - As of the end of the reporting period, the total deposits of Jiangyin Rural Commercial Bank amounted to 165.073 billion yuan, an increase of 13.247 billion yuan, reflecting a growth rate of 8.73% since the beginning of the year [2] - The total loans reached 131.957 billion yuan, with an increase of 7.828 billion yuan, marking a growth rate of 6.31% from the start of the year [2] Asset Quality - As of the end of September, the non-performing loan ratio was 0.85%, a decrease of 0.01 percentage points from the beginning of the year [2] - The provision coverage ratio was reported at 371.91%, and the capital adequacy ratio stood at 14.92% [2]

江阴农商行拟中期分红 每10股派发现金红利1元

Bei Jing Shang Bao· 2025-10-28 11:35

Group 1 - The company announced a profit distribution plan that requires approval from the shareholders' meeting before implementation [1] - The proposed cash dividend is set at RMB 1.0 per 10 shares (including tax), with no capital reserve fund conversion or bonus shares issued [3] - As of September 30, 2025, the company has issued 2.461 billion shares, leading to a proposed cash dividend of RMB 246 million (including tax), which represents 19.25% of the net profit attributable to the parent company in the consolidated financial statements [3]

江阴农商行拟中期分红,每10股派发现金红利1元

Bei Jing Shang Bao· 2025-10-28 11:08

Core Viewpoint - Jiangyin Rural Commercial Bank announced a profit distribution plan for the first half of 2025, proposing a cash dividend of RMB 1.0 per 10 shares, subject to shareholder approval [1] Summary by Sections Dividend Distribution - The bank plans to distribute profits based on a total share capital of 2.461 billion shares, resulting in a proposed cash dividend of RMB 246 million (before tax) [1] - The proposed cash dividend represents 19.25% of the net profit attributable to the parent company in the consolidated financial statements [1] Approval Process - The profit distribution proposal is pending approval from the bank's shareholders' meeting before implementation [1] - Any changes in the total share capital between the announcement date and the dividend record date will lead to an adjustment in the total dividend amount while maintaining the per-share distribution ratio [1]