BANK OF QINGDAO(002948)

Search documents

青岛银行:前三季度实现归母净利润39.92亿元,同比增长15.54%

Cai Jing Wang· 2025-10-29 05:23

Core Insights - Qingdao Bank reported a net profit attributable to shareholders of 3.992 billion yuan for the first three quarters of 2025, an increase of 537 million yuan, or 15.54% year-on-year [1] - The bank's total operating income reached 11.013 billion yuan, up by 527 million yuan, or 5.03% year-on-year [1] - The annualized weighted average return on equity improved to 13.16%, an increase of 0.48 percentage points compared to the previous year [1] Financial Performance - As of September 30, 2025, total assets amounted to 765.571 billion yuan, an increase of 75.608 billion yuan, or 10.96% from the end of the previous year [1] - Total liabilities reached 718.417 billion yuan, up by 73.354 billion yuan, or 11.37% year-on-year [1] - Customer loans totaled 375.298 billion yuan, an increase of 34.608 billion yuan, or 10.16% from the end of the previous year, with a year-on-year increase of 3.571 billion yuan [1] - Customer deposits amounted to 481.727 billion yuan, up by 49.703 billion yuan, or 11.50% year-on-year, with a year-on-year increase of 7.573 billion yuan [1] Regulatory Indicators - The non-performing loan ratio stood at 1.10%, a decrease of 0.04 percentage points from the end of the previous year [2] - The provision coverage ratio improved to 269.97%, an increase of 28.65 percentage points year-on-year [2] - The core tier 1 capital adequacy ratio was 8.75%, down by 0.36 percentage points from the end of the previous year [2] - The overall capital adequacy ratio was 13.14%, a decrease of 0.66 percentage points compared to the previous year [2]

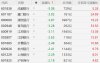

A股银行股集体下跌:成都银行跌5%,浦发银行跌超3%

Ge Long Hui A P P· 2025-10-29 04:03

Group 1 - The A-share market saw a collective decline in bank stocks, with Chengdu Bank dropping by 5% and several others, including Xiamen Bank, Shanghai Pudong Development Bank, and Qingdao Bank, falling over 3% [1] - Specific declines included Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank, all experiencing drops exceeding 2% [1] Group 2 - Chengdu Bank's market capitalization is reported at 72.9 billion, with a year-to-date increase of 5.28% despite the recent decline of 5.08% [2] - Xiamen Bank has a market capitalization of 18.1 billion, with a year-to-date increase of 24.69%, but it fell by 3.92% today [2] - Shanghai Pudong Development Bank's market capitalization stands at 396.7 billion, with a year-to-date increase of 19.25%, experiencing a decline of 3.87% [2] - Qingdao Bank's market capitalization is 29.2 billion, with a year-to-date increase of 33.50%, and it dropped by 3.28% [2] - Jiangsu Bank has a market capitalization of 194.5 billion, with a year-to-date increase of 13.38%, and it fell by 3.11% [2] - Other banks like Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank also reported declines, with respective market capitalizations of 11.8 billion, 36.4 billion, 114.4 billion, 133.3 billion, and 82.1 billion [2]

青岛银行(002948):盈利维持高增,资产质量向好:——青岛银行(002948.SZ)2025年三季报点评

EBSCN· 2025-10-29 03:53

Investment Rating - The report maintains a "Buy" rating for Qingdao Bank [1]. Core Views - Qingdao Bank's revenue for the first three quarters of 2025 reached 11 billion yuan, a year-on-year increase of 5%, while net profit attributable to shareholders was 4 billion yuan, up 15.5% year-on-year. The weighted average return on equity (ROAE) was 13.16%, an increase of 0.48 percentage points year-on-year [3][4]. Summary by Sections Financial Performance - Revenue growth was impacted by a decline in non-interest income, but profit maintained a double-digit growth. The year-on-year growth rates for revenue, pre-provision profit, and net profit attributable to shareholders were 5%, 7.6%, and 15.5%, respectively, showing a decline compared to the first half of 2025 [4]. - Net interest income grew by 12% year-on-year, while non-interest income saw a decline of 10.7% [4]. Asset Quality - As of the end of Q3 2025, the non-performing loan (NPL) ratio was 1.1%, and the attention rate was 0.55%, indicating stable asset quality [9]. - The bank's provision coverage ratio improved to 270%, reflecting strong risk compensation capabilities [9]. Capital Adequacy - The core tier 1 capital adequacy ratio stood at 8.75%, with total capital adequacy at 13.14% as of Q3 2025, indicating stable capital levels [9][28]. Profitability Forecast - The report forecasts earnings per share (EPS) for 2025-2027 to be 0.84, 0.91, and 0.97 yuan, respectively, with corresponding price-to-book (PB) ratios of 0.73, 0.66, and 0.60 [10][11].

青岛银行股价跌5.01%,长城基金旗下1只基金重仓,持有16.72万股浮亏损失4.35万元

Xin Lang Cai Jing· 2025-10-29 02:26

10月29日,青岛银行跌5.01%,截至发稿,报4.93元/股,成交2.01亿元,换手率1.29%,总市值286.94亿 元。 资料显示,青岛银行股份有限公司位于山东省青岛市崂山区秦岭路6号,成立日期1996年11月15日,上 市日期2019年1月16日,公司主营业务涉及公司银行业务、零售银行业务和资金业务等。主营业务收入 构成为:公司银行业务47.29%,金融市场业务26.27%,零售银行业务21.87%,未分配项目及其他 4.57%。 从基金十大重仓股角度 数据显示,长城基金旗下1只基金重仓青岛银行。长城量化小盘股票A(007903)三季度减持1.8万股, 持有股数16.72万股,占基金净值比例为1.07%,位居第九大重仓股。根据测算,今日浮亏损失约4.35万 元。 长城量化小盘股票A(007903)基金经理为雷俊。 截至发稿,雷俊累计任职时间10年314天,现任基金资产总规模39.09亿元,任职期间最佳基金回报 178.52%, 任职期间最差基金回报-89.53%。 风险提示:市场有风险,投资需谨慎。本文为AI大模型自动发布,任何在本文出现的信息(包括但不 限于个股、评论、预测、图表、指标、理论、任何形 ...

青岛银行(002948.SZ):第三季度净利润同比上升13.90%

Ge Long Hui A P P· 2025-10-28 15:12

格隆汇10月28日丨青岛银行(002948.SZ)公布2025年第三季度报告,营业收入为33.51亿元,同比上升 0.22%;归属于上市公司股东的净利润为9.27亿元,同比上升13.90%;归属于上市公司股东的扣除非经 常性损益的净利润为9.26亿元,同比上升18.75%。 ...

青岛银行(002948.SZ):前三季度归母净利润39.92亿元 同比增加15.54%

Ge Long Hui A P P· 2025-10-28 14:57

格隆汇10月28日丨青岛银行(002948.SZ)发布公告,2025年前三季度,实现营业收入110.13亿元,同比增 加5.03%;归属于母公司股东的净利润39.92亿元,同比增加15.54%;扣除非经常性损益后归属于母公司 股东的净利润39.63亿元,同比增加17.54%;基本每股收益0.65元。 ...

青岛银行前三季度归母净利润同比增长15.54%

Shang Hai Zheng Quan Bao· 2025-10-28 14:47

规模增长方面,截至9月末,青岛银行资产总额7655.71亿元,比上年末增长10.96%;客户贷款总额 3752.98亿元,比上年末增长10.16%;客户存款总额4817.27亿元,比上年末增长11.50%。 青岛银行在报告中表示,报告期内该行积极应对资产收益率下行等经营挑战,扩规模、调结构、降成 本,营业收入增长快于营业支出,带动利润较快增长,实现良好经营业绩。在营业收入方面,扩大贷 款、金融投资等高收益生息资产规模,同时,深入发掘负债成本压降空间,成本率和利息支出均同比下 降,利息净收入稳步增长。 来源:上海证券报·中国证券网 具体来看,2025年前三季度,该行利息净收入81.39亿元,同比增长12.00%;非利息收入28.74亿元,同 比下降10.72%,其中,投资收益和公允价值变动损益合计16.90亿元,同比减少1.52亿元,主要是债券 市场走势弱于上年,虽然进行止盈操作,价差收益增加,但是估值收益减少。 上证报中国证券网讯(记者 马慜)10月28日,青岛银行发布的2025年第三季度报告显示,今年前三季 度实现归属于母公司股东的净利润39.92亿元,同比增长15.54%;营业收入110.13亿元,同比增 ...

青岛银行:关于2025年无固定期限资本债券发行完毕的公告

Zheng Quan Ri Bao Zhi Sheng· 2025-10-28 13:40

Core Viewpoint - Qingdao Bank has successfully issued "Qingdao Bank Co., Ltd. 2025 Non-Fixed Term Capital Bonds" in the national interbank bond market, following approval from the Qingdao Regulatory Bureau of the National Financial Supervision Administration and the People's Bank of China [1] Summary by Category - **Company Announcement** - Qingdao Bank announced the successful issuance of its non-fixed term capital bonds [1] - **Regulatory Approval** - The issuance was approved by relevant regulatory bodies, including the Qingdao Regulatory Bureau and the People's Bank of China [1]

青岛银行前三季度实现营收110.13亿元,同比增长5.03%

Bei Jing Shang Bao· 2025-10-28 12:52

北京商报讯(记者 孟凡霞 周义力)10月28日,青岛银行发布2025年三季度报告。前三季度,该行实现 营收110.13亿元,同比增加5.27亿元,增长5.03%;实现归属于母公司股东的净利润39.92亿元,同比增 加5.37亿元,增长15.54%;加权平均净资产收益率(年化)13.16%,同比提高0.48个百分点。 截至报告期末,青岛银行核心一级资本充足率8.75%,比上年末下降0.36个百分点;资本充足率 13.14%,比上年末下降0.66个百分点。 报告显示,前三季度,该行贷款、存款增加额均超上年同期。截至2025年9月末,该行客户贷款总额 3752.98亿元,增长10.16%,同比多增35.71亿元。客户存款总额4817.27亿元,增长11.50%,同比多增 75.73亿元;占负债总额比例67.05%,比上年末提高0.08个百分点。 资产质量方面,截至2025年9月末,青岛银行不良贷款率1.10%,比上年末下降0.04个百分点;拨备覆盖 率269.97%,比上年末提高28.65个百分点。 ...

青岛银行20亿元无固定期限资本债券发行完毕

Bei Jing Shang Bao· 2025-10-28 12:40

Core Viewpoint - Qingdao Bank has successfully issued a perpetual capital bond with a total scale of RMB 2 billion, approved by regulatory authorities, to supplement its Tier 1 capital [1] Group 1: Bond Issuance Details - The bond issuance was completed on October 28, 2025, after being recorded on October 24, 2025 [1] - The initial coupon rate for the first five years is set at 2.45%, with adjustments every five years thereafter [1] - The bank retains the right to redeem the bond in whole or in part on each interest payment date starting from the fifth year [1] Group 2: Fund Utilization - The funds raised from this bond issuance will be used to supplement the bank's other Tier 1 capital, in accordance with applicable laws and regulatory approvals [1]