私募投资基金

Search documents

投资私募100万只剩55万,法院发布白皮书警示投资者

Yang Zi Wan Bao Wang· 2025-12-29 13:01

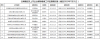

Core Viewpoint - The Nanjing Jianye Court has released a white paper on the adjudication of private equity fund cases, highlighting the court's efforts to guide the private fund industry towards standardized development through judicial rulings [1]. Group 1: Overview of Private Equity Fund Development - Jianye District has become a key financial center in Nanjing, gathering over 600 registered private equity funds and managers, with a total registered scale exceeding 250 billion yuan [3]. - To ensure high-quality development of the regional financial industry, the Jianye Court's Financial Tribunal was established on January 26, 2022, to handle commercial contract disputes and tort liability disputes related to fund managers, custodians, sales institutions, and other fund service entities [3]. Group 2: Case Handling Statistics and Characteristics - From 2022 to 2025, the Financial Tribunal has accepted 179 cases related to private equity fund disputes, with 138 cases concluded [4]. - The main characteristics of the cases include: 1. Distinct identities of the parties involved, with 80% of plaintiffs being individual investors with varying risk awareness and investment experience, while defendants include a diverse range of entities such as fund managers and sales institutions [4]. 2. High incidence of disputes during the exit phase, indicating that risks are present throughout the entire process of fundraising, investment, management, and exit [4]. 3. An increase in cases involving both civil and criminal liabilities, complicating fact-finding and judicial procedures [4]. Group 3: Recommendations for Improvement - The court recommends strengthening source governance measures and enhancing regulatory effectiveness throughout the process, emphasizing the importance of management and sales responsibilities and adherence to fiduciary duties [5]. - There is a call to improve risk awareness and guide investors towards rational rights protection [5]. Group 4: Typical Case Example - A case was highlighted where a fund manager knowingly promoted a fund to an unqualified investor, resulting in a court ruling that the fund management company must compensate the investor over 240,000 yuan for losses incurred [6].

金溢科技:共同投资设立基金备案完成

Xin Lang Cai Jing· 2025-11-21 09:59

Core Viewpoint - The company has completed the registration process for a private equity investment fund, with a total committed capital of RMB 100 million, focusing on sectors such as intelligent connected vehicles, low-altitude economy, and smart terminals [1] Group 1 - The company, in collaboration with Shenzhen Dandai Qixin, Shenzhen Guarantee Group Co., Ltd., Shenzhen Huitong Jinkong Fund Investment Co., Ltd., and Dandai Venture Capital, has established the Shenzhen Dandai Jinli Venture Capital Partnership (Limited Partnership) [1] - The company has committed RMB 50 million as a limited partner, representing 50% of the total committed capital of the partnership [1] - The fund has successfully obtained the Private Equity Fund Registration Certificate [1]

浙数文化参投基金进展:完成首期付款720万元并收到备案证明

Sou Hu Cai Jing· 2025-11-05 02:45

Group 1 - The company Zhejiang Shuju Culture announced the establishment of a new investment fund focused on healthcare and advanced technology, with a total investment of 1.8 million yuan from its subsidiary Hangzhou Bianfeng Network Technology, accounting for 8.65% of the fund's total contributions [2] - The fund has completed its first payment of 7.2 million yuan and has received the private investment fund registration certificate, officially completing the registration on November 3, 2025 [2] - Zhejiang Shuju Culture, founded in July 1992, has a registered capital of approximately 12.68 billion yuan and operates in the digital culture and technology industries, with 63 affiliated companies [2] Group 2 - The company's revenue for 2022, 2023, 2024, and the first half of 2025 was 5.186 billion yuan, 3.078 billion yuan, 3.097 billion yuan, and 1.414 billion yuan, showing year-on-year growth rates of 69.27%, -40.65%, 0.61%, and 0.09% respectively [3] - The net profit attributable to shareholders for the same periods was 490 million yuan, 663 million yuan, 512 million yuan, and 377 million yuan, with year-on-year growth rates of -5.21%, 34.91%, -22.84%, and 156.26% respectively [3] - The company's asset-liability ratios for the same periods were 16.89%, 16.72%, 11.00%, and 11.10% [3]

激智科技:关于与专业投资机构共同投资设立基金的进展公告

Zheng Quan Ri Bao Zhi Sheng· 2025-11-03 11:07

Core Viewpoint - The company, Jizhi Technology, announced its plan to invest in a private equity fund, indicating a strategic move to enhance its investment portfolio and capitalize on potential growth opportunities in the market [1] Group 1: Investment Details - The company intends to jointly establish the Ningbo Caozhi Star Jizhi Venture Capital Partnership (Limited Partnership) with several partners, including Ningbo Caozhi Star Private Fund Management Co., Ltd. and others [1] - The total scale of the fund is set at 50.2 million RMB, with the company planning to invest 25 million RMB of its own funds into the fund [1] - The fund has completed the necessary registration procedures with the Asset Management Association of China and has obtained the Private Investment Fund Registration Certificate [1]

云南10家企业拟上市

Sou Hu Cai Jing· 2025-10-13 14:10

Group 1: Capital Market Overview - As of the end of August, Yunnan Province has 39 listed companies, including 15 on the Shanghai Stock Exchange, 22 on the Shenzhen Stock Exchange, and 2 on the Beijing Stock Exchange, with a total share capital of 69.381 billion shares and a total market value of 867.224 billion yuan [1] - There are 10 companies in the province that are in the process of preparing for listing [1] Group 2: Financing Situation - By the end of August, 4 listed companies in Yunnan announced refinancing plans, and 2 companies are undergoing major asset restructuring [2] - In the New Third Board market, 1 company was delisted in August, leaving a total of 45 companies listed, including 14 in the innovation layer and 31 in the basic layer [2] Group 3: Bond Issuance and Financing - In August, Yunnan enterprises issued 1 new corporate bond through the exchange market, amounting to 1 billion yuan, bringing the total number of corporate bonds issued this year to 24, totaling 20.962 billion yuan [5] - The total outstanding corporate bonds in the region is 119, amounting to 88.488 billion yuan, and there are 31 outstanding asset-backed securities totaling 6.661 billion yuan [5] Group 4: Securities and Futures Market - The trading volume in the Yunnan securities market in August was 761.351 billion yuan, with stock trading accounting for 474.561 billion yuan and public fund trading at 25.091 billion yuan [6] - The total trading volume for the year in the securities market reached 4,495.956 billion yuan, with customer assets amounting to 567.633 billion yuan [6] - In the futures market, the trading volume in August was 314.75 billion yuan, with a total of 24,616.7 billion yuan for the year [6] Group 5: Private Investment Funds - As of the end of August, there are 61 registered private fund managers in Yunnan, with 152 funds filed and a total management scale of 97.245 billion yuan [7]

星帅尔:拟与上电科基金、上电科共同投资设立基金,基金规模1亿元

Xin Lang Cai Jing· 2025-10-13 13:53

Core Viewpoint - The company has signed a partnership agreement with Shanghai Electric Science Research Institute and Shanghai Electric Investment Fund Management Co., Ltd. to establish a private investment fund with a total scale of 100 million yuan [1] Group 1: Investment Details - The fund will be named Shanghai Electric Science and Technology Xing Shuai Er Private Investment Fund Partnership (Limited Partnership) [1] - The company will contribute 90 million yuan, holding 90% of the partnership shares [1] - The investment aims to expand investment and communication channels, explore business cooperation and development opportunities, improve capital efficiency, and achieve investment returns [1]

概伦电子参与投资基金完成备案及工商变更登记

Xin Lang Cai Jing· 2025-09-24 12:47

Group 1 - The core point of the article is that Shanghai Gaolun Electronics Co., Ltd. has participated in the establishment of a private investment fund, Shanghai Linke Xunlun Venture Capital Partnership, and has registered as a limited partner with a commitment of up to 250 million yuan [1] - The investment fund's total capital has increased from 1 billion yuan to approximately 1.337 billion yuan, with Gaolun Electronics contributing about 192.7 million yuan, representing 14.41% of the total [1] - The company acknowledges the long investment cycle and low liquidity of the fund, which may lead to risks such as underperformance and difficulties in timely exit, and it will closely monitor the progress to mitigate these risks [1]

广州广合科技股份有限公司关于与专业投资机构共同投资设立基金的进展公告

Shang Hai Zheng Quan Bao· 2025-09-19 18:27

Group 1 - The company, Guangzhou Guanghe Technology Co., Ltd., has signed a partnership agreement to establish the "Jiupai Hongtao Emerging Industry Venture Capital Fund (Suzhou) Limited Partnership" with several professional investment institutions, committing RMB 30 million, which accounts for 33.31% of the total capital contribution of the partnership [2][3] - The fund has completed the private investment fund registration process with the Asset Management Association of China and has obtained the Private Investment Fund Registration Certificate, with the registration date being September 17, 2025 [3] - The company acknowledges that the investment in the fund may face a long investment recovery period and certain uncertainties regarding returns due to the characteristics of equity investment funds, which are influenced by various factors such as macroeconomic conditions and industry policies [3]

北京昭衍新药研究中心股份有限公司关于与专业投资机构合作参与投资设立基金的进展公告

Shang Hai Zheng Quan Bao· 2025-08-28 19:58

Group 1 - The company, Beijing Zhaoyan New Drug Research Center Co., Ltd., has approved an investment of up to 20 million RMB to participate in the establishment of the Huaxia Zhiyuan Venture Capital Fund [1][2] - The fund is managed by Huaxia Equity Investment Fund Management (Beijing) Co., Ltd., which serves as the general partner and fund manager [1] - The fund has completed the private investment fund registration with the Asset Management Association of China and obtained the Private Investment Fund Registration Certificate on August 27, 2025 [3] Group 2 - The fund's name is Huaxia Zhiyuan Venture Capital Fund (Beijing) Partnership (Limited Partnership) [3] - The custodian of the fund is Ping An Bank Co., Ltd. [3] - The registration code for the fund is SASP05 [3]

中微公司: 2025年第二次临时股东大会会议资料

Zheng Quan Zhi Xing· 2025-06-20 11:16

Group 1 - The company is holding its second extraordinary general meeting of shareholders in 2025 to ensure the rights of all shareholders and maintain order during the meeting [1][2] - Only shareholders, their proxies, company directors, supervisors, senior management, and invited personnel are allowed to attend the meeting, while other unrelated individuals may be refused entry [1][2] - Shareholders and their proxies must arrive 20 minutes before the meeting to sign in and present necessary identification documents [1][2] Group 2 - The meeting will announce the number of shareholders present and the total voting rights held before allowing any latecomers to participate in voting [2] - Shareholders have the right to speak, inquire, and vote during the meeting, but must adhere to the agenda and time limits for speaking [2][3] - The meeting will utilize both on-site and online voting methods, with specific time slots designated for each [4][5] Group 3 - The agenda includes the establishment of a private equity fund and related party transactions, with a proposed fundraising scale of RMB 1.5 billion [5][6] - The fund will focus on investments in the semiconductor and strategic emerging sectors, with the company planning to contribute up to RMB 735 million [5][6] - The proposal has been approved by the company's board and is now subject to shareholder voting [6]