仿制药

Search documents

华海药业跌2.01%,成交额1.15亿元,主力资金净流出1630.42万元

Xin Lang Cai Jing· 2025-10-23 02:00

Core Viewpoint - Huahai Pharmaceutical's stock has experienced a decline in recent trading sessions, with a notable drop of 21.55% over the past 20 days, indicating potential concerns regarding its financial performance and market sentiment [1][2]. Financial Performance - For the first half of 2025, Huahai Pharmaceutical reported a revenue of 4.516 billion yuan, a year-on-year decrease of 11.93%, and a net profit attributable to shareholders of 409 million yuan, down 45.30% year-on-year [2]. - The company has cumulatively distributed 2.989 billion yuan in dividends since its A-share listing, with 1.016 billion yuan distributed over the past three years [3]. Stock Market Activity - As of October 23, Huahai Pharmaceutical's stock price was 18.53 yuan per share, with a market capitalization of 27.744 billion yuan. The stock has seen a year-to-date increase of 5.16% but has declined by 6.79% in the last five trading days [1]. - The company has appeared on the "龙虎榜" (a trading board for stocks with significant trading activity) twice this year, with the most recent appearance on September 9, where it recorded a net buy of -531.01 million yuan [1]. Shareholder Information - As of September 19, the number of shareholders for Huahai Pharmaceutical increased by 28.47% to 67,300, while the average circulating shares per person decreased by 22.16% to 21,624 shares [2]. - Major shareholders include China Europe Medical Health Mixed Fund, which increased its holdings by 12.23 million shares, and Hong Kong Central Clearing Limited, which reduced its holdings by 4.92 million shares [3]. Business Overview - Huahai Pharmaceutical, established on February 28, 2001, and listed on March 4, 2003, specializes in the research, production, and sales of various dosage forms of generic drugs, biological drugs, innovative drugs, and specialty raw materials [1]. - The company's revenue composition includes 61.86% from finished drug sales, 36.75% from raw materials and intermediates, 0.78% from other sources, and 0.62% from technical services [1].

上海宣泰医药科技股份有限公司自愿披露 关于公司产品西格列汀二甲双胍缓释片获得美国FDA批准文号的公告

Zhong Guo Zheng Quan Bao - Zhong Zheng Wang· 2025-10-21 10:42

Core Viewpoint - Shanghai Xuantai Pharmaceutical Technology Co., Ltd. has received Tentative Approval from the U.S. FDA for its abbreviated new drug application (ANDA) for Sitagliptin Metformin Extended-Release Tablets, indicating that the product meets all generic drug review requirements [1][2]. Group 1: Drug Information - Drug Name: Sitagliptin Metformin Extended-Release Tablets [1] - ANDA Number: 212869 [1] - Dosage Form: Tablet [1] - Specifications: 50/500mg, 50/1000mg [1] - Initial Approval: The drug was developed by Merck Sharp & Dohme and was approved in the U.S. in February 2012 for improving blood sugar control in adults with type 2 diabetes [1]. - Market Inclusion: The product will be included in the national medical insurance directory in 2024 and has already been commercialized in the domestic market [1]. - Patent Status: The fixed-dose combination formulation is still under patent protection, with only the original product available in the U.S. market [1]. - Market Potential: The sales of the original product in the U.S. are expected to exceed $1.7 billion in 2024 [1]. Group 2: Company Impact - Tentative Approval Significance: The Tentative Approval from the FDA is a positive step for the company, allowing it to expand its sales scale in the U.S. market and enrich its product portfolio [2]. - Future Steps: The company will actively pursue the final approval from the FDA to gain the qualification for marketing the product in the U.S. [2]. - Sales Uncertainty: The specific sales performance may be influenced by various factors such as market conditions and channel expansion, leading to uncertainty in the company's short-term operational performance [2].

亨迪药业:非布司他片获药品注册证书

Xin Lang Cai Jing· 2025-10-21 07:58

Core Viewpoint - The company has received approval from the National Medical Products Administration for the registration of Febuxostat tablets, which are intended for the long-term treatment of hyperuricemia and gout patients, marking a significant step in expanding its product line [1] Group 1: Product Registration - The registration of Febuxostat tablets is classified as a Class 4 chemical drug, equivalent to passing the consistency evaluation of generic drug quality and efficacy [1] - This approval allows the company to sell the drug in the domestic market, enhancing its product offerings [1] Group 2: Market Considerations - Future sales of the product may be influenced by national policies, market demand, and competition from similar drugs, indicating potential uncertainties in its market performance [1]

靠仿制药年入超4亿元,海西新药登陆港交所

Bei Jing Shang Bao· 2025-10-20 09:09

Core Viewpoint - Haixi New Drug officially listed on the Hong Kong Stock Exchange on October 20, opening at HKD 102 per share, a rise of 18.06% from the issue price of HKD 86.4. The company's performance heavily relies on the national volume-based procurement (VBP) plan, with over 90% of revenue from this channel from 2022 to 2024, raising concerns about sustainability and profitability due to price pressures [1][5][6]. Group 1: Financial Performance - Revenue from 2022 to 2024 is projected to be approximately CNY 212.465 million, CNY 316.633 million, and CNY 466.683 million, respectively, with profits of about CNY 68.981 million, CNY 117.454 million, and CNY 136.079 million [4][5]. - The company’s net profit margin is expected to decline by 7.9 percentage points in 2024 compared to 2023, resulting in a net profit margin of 29.2% [5][6]. Group 2: Dependency on Procurement - Haixi New Drug's revenue is highly dependent on a few products, with over 90% of revenue from procurement channels in 2022, 2023, and 2024. The combined revenue contribution from Anbili® and Haihuitong® is 81.3%, 79.9%, and 72.2% for the respective years [5][6]. - The prices of key products have significantly decreased due to procurement, with Haihuitong® dropping from an average price of CNY 3.56 to CNY 2.19, a decline of 38.48% [5][6]. Group 3: Innovation Pipeline - The company is attempting to develop a "second growth curve" through its pipeline of innovative drugs, currently having four drugs in development targeting oncology, ophthalmology, and respiratory diseases [7][8]. - The innovative drug C019199 is in I/II clinical stages, with plans for a Phase III trial in late 2025, but faces intense competition from similar drugs globally [8]. - R&D expenditures are projected to increase from CNY 34.82 million in 2022 to CNY 67.525 million in 2024, but this may still be insufficient to support the high costs associated with innovative drug development [8][9]. Group 4: Market Perception and Challenges - The first-day performance of Haixi New Drug reflects short-term market recognition of its generics business and innovative drug potential, but long-term challenges include reducing reliance on procurement channels and accelerating the R&D process [9].

人福医药跌2.09%,成交额3.55亿元,主力资金净流出4797.97万元

Xin Lang Zheng Quan· 2025-10-17 06:08

Core Viewpoint - Renfu Pharmaceutical's stock has experienced a decline of 10.67% year-to-date, with a notable drop of 2.09% on October 17, 2023, reflecting ongoing challenges in the market [1]. Financial Performance - For the first half of 2025, Renfu Pharmaceutical reported revenue of 12.064 billion yuan, a decrease of 6.20% year-on-year, while net profit attributable to shareholders increased by 3.92% to 1.155 billion yuan [2]. - Cumulative cash dividends since the company's A-share listing amount to 3.113 billion yuan, with 1.779 billion yuan distributed over the past three years [3]. Shareholder and Market Activity - As of June 30, 2025, the number of shareholders increased to 50,100, with an average of 30,825 circulating shares per person, a slight decrease of 0.54% [2]. - On October 17, 2023, the stock price was reported at 20.60 yuan per share, with a trading volume of 355 million yuan and a turnover rate of 1.11% [1]. - Major shareholders include Hong Kong Central Clearing Limited, holding 43.5739 million shares, a decrease of 9.1957 million shares from the previous period [3].

舒泰神涨2.01%,成交额2.72亿元,主力资金净流出1189.21万元

Xin Lang Cai Jing· 2025-10-16 01:47

Core Viewpoint - Shuyou Shen's stock price has seen significant fluctuations, with a year-to-date increase of 399.19%, but recent performance shows mixed results, indicating potential volatility in the market [1][2]. Company Overview - Shuyou Shen (Beijing) Biopharmaceutical Co., Ltd. was established on August 16, 2002, and went public on April 15, 2011. The company primarily engages in the research, production, and sales of biological products and some chemical drugs [1]. - The main revenue sources for the company are: 59.17% from injectable mouse nerve growth factor (Sutai), 33.19% from compound polyethylene glycol electrolyte powder, and 7.63% from other products [1]. Financial Performance - For the first half of 2025, Shuyou Shen reported operating revenue of 126 million yuan, a year-on-year decrease of 31.14%, and a net profit attributable to shareholders of -24.64 million yuan, a year-on-year decrease of 619.70% [2]. - The company has cumulatively distributed 771 million yuan in dividends since its A-share listing, with no dividends paid in the last three years [3]. Shareholder Information - As of June 30, 2025, the number of shareholders increased by 29.20% to 31,700, while the average circulating shares per person decreased by 22.60% to 14,327 shares [2]. - New institutional shareholders include several funds, with notable holdings such as 15.72 million shares by Xingquan Helun Mixed A and 8.81 million shares by Xingquan Commercial Model Mixed A [3]. Market Activity - On October 16, Shuyou Shen's stock rose by 2.01% to 36.99 yuan per share, with a trading volume of 272 million yuan and a turnover rate of 1.66%, resulting in a total market capitalization of 17.673 billion yuan [1]. - The stock has appeared on the daily trading leaderboard seven times this year, with the most recent occurrence on June 9, where it recorded a net buy of -54.65 million yuan [1].

东阳光药业盐酸芬戈莫德胶囊国内首仿过评,原研药垄断局面被打破

Ge Long Hui· 2025-10-14 10:32

Core Insights - Guangdong Dongyangguang Pharmaceutical has received approval for the first domestic generic version of FingoMod (Fingolimod Hydrochloride Capsules) in China, marking a significant milestone as the first oral immunosuppressant for the company [1][8] - FingoMod, originally developed by Novartis and approved in the U.S. in September 2010, is the first oral treatment for relapsing forms of multiple sclerosis and has been included in China's first batch of urgently needed clinical drugs [5][8] - The global sales of FingoMod were impressive, exceeding $3.3 billion in 2018, with projected sales of over $500 million in 2024 [5] Company Overview - Dongyangguang Pharmaceutical is one of the early entrants in the FingoMod market, having initiated the project in July 2011 and submitted applications in China, the U.S., and the EU [8] - The company has successfully registered 18 products, with seven of them being the first to pass the evaluation process, including FingoMod, which breaks the original manufacturer's monopoly [11] Market Context - The approval of FingoMod comes at a time when only one other product, an import from India, is in the review stage, indicating a unique market position for Dongyangguang [11] - FingoMod was included in the National Medical Insurance Negotiation Directory in 2020 and is now part of the 2024 National Medical Insurance Regular Directory [5]

海西新药招股结束 孖展认购资金达3094亿港元 超购3113倍

Zhi Tong Cai Jing· 2025-10-14 07:44

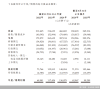

Core Viewpoint - HaiXi Pharmaceutical (02637) has successfully completed its IPO subscription, raising significant interest with an oversubscription of 3113 times the initial public offering amount of HKD 993.6 million [1] Group 1: IPO Details - The company raised HKD 309.4 billion in margin financing from brokers during the subscription period from October 9 to 14 [1] - HaiXi Pharmaceutical plans to issue 11.5 million H-shares, with 10% allocated for public offering at a price range of HKD 69.88 to HKD 86.4 per share [1] - The expected listing date is October 17, with Huatai International and CMB International serving as joint sponsors [1] Group 2: Business Overview - HaiXi Pharmaceutical is a commercial-stage pharmaceutical company engaged in research, development, production, and sales, with a pipeline of innovative drugs under development [1] - The company has a portfolio of generic drugs targeting various diseases, including gastrointestinal, cardiovascular, endocrine, neurological, and inflammatory diseases, with 15 generic drugs approved by the National Medical Products Administration [1] - Four of these generic drugs are included in the national volume-based procurement (VBP) program [1] Group 3: Innovative Drug Pipeline - The innovative drug pipeline includes a cancer drug, an oral medication for wet age-related macular degeneration (wAMD), diabetic macular edema (DME), and retinal vein occlusion (RVO), along with two other drugs in preclinical stages for cancer and respiratory diseases [2] - The most advanced drug, C019199 for osteosarcoma, is set to enter Phase III trials in the second half of this year [2] Group 4: Financial Projections - The company's projected revenues for 2022, 2023, 2024, and the five months ending May 31, 2025, are RMB 212.5 million, RMB 316.6 million, RMB 466.7 million, and RMB 249.2 million, respectively [2] - Corresponding gross profits are projected to be RMB 172.1 million, RMB 263.6 million, RMB 387.2 million, and RMB 209.3 million for the same periods [2] Group 5: Use of Proceeds - Approximately 52% of the net proceeds from the fundraising will be allocated to ongoing research and development to advance the drug pipeline [3] - 23% will enhance research capabilities and seek collaboration opportunities, while 8% will improve commercialization capabilities and expand market influence [3] - The remaining funds will be used for optimizing research and production systems (7%) and for working capital and other general corporate purposes (10%) [3]

京新药业跌2.03%,成交额1.11亿元,主力资金净流出828.41万元

Xin Lang Zheng Quan· 2025-10-14 03:12

Core Viewpoint - Jingxin Pharmaceutical's stock has experienced fluctuations, with a year-to-date increase of 51.26% but a recent decline in the last five and twenty trading days [1][2]. Financial Performance - For the first half of 2025, Jingxin Pharmaceutical reported revenue of 2.017 billion yuan, a year-on-year decrease of 6.20%, and a net profit attributable to shareholders of 388 million yuan, down 3.54% [2]. - The company has distributed a total of 2.11 billion yuan in dividends since its A-share listing, with 801 million yuan distributed over the past three years [3]. Stock Market Activity - As of October 14, the stock price was 18.86 yuan per share, with a market capitalization of 16.239 billion yuan. The trading volume was 111 million yuan, with a turnover rate of 0.80% [1]. - The stock has appeared on the "龙虎榜" (a trading board for stocks with significant trading activity) once this year, with a net buy of 111 million yuan on July 4 [1]. Shareholder Information - As of June 30, 2025, the number of shareholders was 25,700, a slight decrease of 0.11%, with an average of 28,196 circulating shares per shareholder, an increase of 0.11% [2]. - The fifth-largest circulating shareholder is Hong Kong Central Clearing Limited, holding 9.6492 million shares, a decrease of 15.3917 million shares from the previous period [3].

京新药业跌2.04%,成交额1.56亿元,主力资金净流出452.89万元

Xin Lang Cai Jing· 2025-10-13 03:41

Core Viewpoint - Jingxin Pharmaceutical's stock price has experienced fluctuations, with a year-to-date increase of 54.30% but a recent decline in the last five and twenty trading days [1][2]. Financial Performance - For the first half of 2025, Jingxin Pharmaceutical reported revenue of 2.017 billion yuan, a year-on-year decrease of 6.20%, and a net profit attributable to shareholders of 388 million yuan, down 3.54% year-on-year [2]. - The company has cumulatively distributed 2.11 billion yuan in dividends since its A-share listing, with 801 million yuan distributed over the past three years [3]. Stock Market Activity - As of October 13, the stock price was 19.24 yuan per share, with a market capitalization of 16.566 billion yuan. The trading volume was 156 million yuan, with a turnover rate of 1.11% [1]. - The stock has appeared on the "Dragon and Tiger List" once this year, with a net buy of 111 million yuan on July 4 [1]. Shareholder Information - As of June 30, 2025, the number of shareholders was 25,700, a decrease of 0.11% from the previous period, with an average of 28,196 circulating shares per shareholder, an increase of 0.11% [2]. - Hong Kong Central Clearing Limited is the fifth-largest circulating shareholder, holding 9.6492 million shares, a decrease of 15.3917 million shares from the previous period [3].