加密货币

Search documents

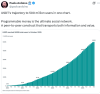

今年利润预计150亿美元,利润率高达99%,用户数超5亿,估值5000亿美元!“稳定币老大”Tether“春风得意”

Hua Er Jie Jian Wen· 2025-10-25 01:48

Core Insights - Tether Holdings Ltd. is attracting global capital due to its impressive profitability and market dominance, with an expected profit nearing $15 billion this year and potential financing discussions that could value the company at $500 billion [1][3][5] Financial Performance - Tether's profit margin is an astonishing 99%, driven by high-interest income from its substantial reserve assets, primarily consisting of cash and short-term U.S. Treasury securities [5][6] - The company reported a profit of approximately $13 billion last year, benefiting from the high-interest rate environment [5][6] Market Position and User Base - Tether's USDT currently has a market circulation value of about $183 billion, holding approximately 60% of the entire stablecoin market [5] - The number of "real users" of Tether has surpassed 500 million, representing about 6.25% of the global population, indicating its extensive global influence [1][7] Financing and Valuation - Tether is in negotiations to raise up to $20 billion by selling about 3% of its shares, which could elevate its valuation to around $500 billion, placing it among the world's top unicorn companies [3][6] - Major investment firms, including SoftBank and Ark Investment Management, have shown interest in participating in this financing round, which could enhance Tether's mainstream applications in technology and finance [6][7] Business Expansion - Tether plans to re-enter the U.S. market later this year with a new stablecoin project named USAT, aiming to leverage favorable policies towards cryptocurrencies [7] - The company is diversifying its investment portfolio, including a notable investment in Juventus Football Club, where it holds 11.5% of the shares and has proposed two board candidates to represent fans [7]

美股三大指数齐创新高

Xin Lang Cai Jing· 2025-10-24 23:56

Market Overview - All three major indices reached record closing highs due to moderate inflation data, leading investors to believe the Federal Reserve can continue its rate-cutting path, boosting the U.S. economy and supporting higher stock valuations [1] - The Dow Jones Industrial Average rose by 1.01% to 47,207.12 points, the S&P 500 increased by 0.79% to 6,791.69 points, and the Nasdaq Composite climbed by 1.15% to 23,204.87 points [3] Inflation Data - The U.S. Consumer Price Index (CPI) for September increased by 3% year-over-year and 0.3% month-over-month, slightly below economists' expectations of 3.1% and 0.4% respectively; the core CPI, excluding food and energy, rose by 3% year-over-year and 0.2% month-over-month, also lower than market expectations [6] - The CPI report was delayed due to the ongoing U.S. government shutdown, with warnings that inflation data may not be released next month [6] Federal Reserve Expectations - Following the CPI data release, traders increased bets that the Federal Reserve would cut rates in its remaining meetings this year, with the probability of a December rate cut rising from approximately 91% to 98.5% [7] - Major bank stocks strengthened, with JPMorgan Chase, Wells Fargo, and Citigroup all rising about 2% [7] Stock Performance - Major technology stocks saw gains, with Nvidia up 2.25%, Microsoft up 0.59%, Apple up 1.25%, Google up 2.70%, and Amazon up 1.41%; however, Tesla fell by 3.40% [8] - The Nasdaq Golden Dragon China Index increased by 0.27%, with Alibaba up 1.63% and JD.com up 0.03% [8] Company News - AMD and IBM both reached historical highs, with AMD rising by 7.63% and IBM by 7.88%, following IBM's announcement of running quantum computing algorithms on AMD chips [10] - Morgan Stanley plans to allow institutional clients to use Bitcoin and Ethereum as collateral for loans, indicating Wall Street's increasing integration into the cryptocurrency ecosystem [13] - JD Logistics announced plans to purchase 3 million robots, 1 million unmanned vehicles, and 100,000 drones over the next five years to enhance its logistics supply chain [14]

被特朗普赦免的赵长鹏啥来头 个人财富6000亿 其四川情人何一更传奇

Sou Hu Cai Jing· 2025-10-24 23:43

Core Viewpoint - Zhao Changpeng, once a prominent figure in the cryptocurrency world, has returned to prominence through a controversial pardon from Trump, highlighting the murky intersection of money and power in the crypto industry [1][43][49] Group 1: Zhao Changpeng's Journey - Zhao Changpeng's rise began with significant personal risk, selling his assets to invest in Bitcoin, which he later leveraged to become a major player in the crypto market [3][7][9] - His founding of Binance in 2017, which raised $15 million through token issuance, was marked by aggressive strategies that prioritized user acquisition over regulatory compliance [13][15] - Despite reaching a net worth of nearly $100 billion during the Bitcoin boom in 2021, his wealth was built on practices that led to Binance being labeled a "money laundering tool" [18][20] Group 2: Legal Troubles and Pardon - In 2023, Zhao faced serious legal challenges from the U.S. SEC, resulting in a $55 million personal fine and a four-month prison sentence, while Binance was fined $4.3 billion [20][22] - Following his release, Zhao relocated Binance to the UAE, continuing operations in a regulatory gray area [22][49] - Trump's pardon is viewed as a transaction of mutual benefit, with Zhao allegedly providing financial support to Trump's family business in exchange for his release [46][49] Group 3: He Yi's Role - He Yi, a key figure in Zhao's success, transitioned from various jobs to become a co-founder of Binance, leveraging her marketing skills to significantly grow the platform's user base [25][29][37] - After Zhao's imprisonment, He Yi took charge, implementing strategies that increased Binance's user count by one million, demonstrating her capability in crisis management [38][40] - Their relationship is characterized by mutual benefit, with He Yi gaining power and influence while Zhao relies on her marketing prowess to stabilize Binance [35][37] Group 4: Industry Implications - The events surrounding Zhao and He Yi reflect broader issues within the cryptocurrency industry, including regulatory challenges and the potential for exploitation of legal loopholes [1][49] - The partnership between Zhao and Trump underscores the intertwining of politics and business in the crypto space, raising questions about the integrity of regulatory frameworks [43][46] - The reliance on gray market practices and political connections poses risks for the sustainability of their business model, suggesting that future regulatory actions could have severe consequences [51]

美股三大指数齐创新高

财联社· 2025-10-24 23:38

Market Overview - The three major indices reached historical closing highs due to moderate inflation data, leading investors to believe that the Federal Reserve can maintain its rate-cutting path, thereby boosting the U.S. economy and supporting higher stock valuations [1] - As of the close, the Dow Jones Industrial Average rose by 1.01% to 47,207.12 points, the S&P 500 increased by 0.79% to 6,791.69 points, and the Nasdaq Composite climbed by 1.15% to 23,204.87 points [3] Inflation Data - The U.S. Consumer Price Index (CPI) for September showed a year-on-year increase of 3% and a month-on-month rise of 0.3%, slightly below economists' expectations of 3.1% and 0.4% respectively; the core CPI, excluding food and energy, also came in lower than expected [6] - The CPI report was delayed due to the ongoing U.S. government shutdown, with warnings that inflation data may not be released next month [7] Federal Reserve Expectations - Following the CPI data release, traders increased their bets on the Federal Reserve cutting rates in the remaining two meetings of the year, with the probability of a December rate cut rising from approximately 91% to 98.5% [8] - Market expectations for further rate cuts are driving bank stocks higher, with major banks like JPMorgan, Wells Fargo, and Citigroup all seeing around a 2% increase [9] Stock Performance - Major tech stocks saw gains, with Nvidia up 2.25%, Microsoft up 0.59%, and Apple up 1.25%; however, Tesla experienced a decline of 3.40% [10] - Chinese concept stocks mostly rose, with the Nasdaq Golden Dragon China Index increasing by 0.27% [10] Company News - AMD and IBM both reached historical highs, with AMD rising by 7.63% and IBM by 7.88%; IBM announced successful operation of quantum computing algorithms on AMD chips, marking a significant step towards commercialization [12] - Morgan Stanley plans to allow institutional clients to use Bitcoin and Ethereum as collateral for loans, indicating a shift towards integrating cryptocurrencies into traditional finance [15] - Eli Lilly announced the acquisition of Adverum Biotechnologies, with a focus on gene therapy, offering a potential maximum payout of $12.47 per share based on performance milestones [16] - WeRide and Uber launched Robotaxi public operations in Riyadh, marking a milestone in autonomous vehicle deployment [17] - JD Logistics plans to purchase 3 million robots, 1 million unmanned vehicles, and 100,000 drones over the next five years to enhance its logistics supply chain [18]

摩根大通:年底前允许机构用比特币、以太坊作贷款抵押

Sou Hu Cai Jing· 2025-10-24 22:43

本文由 AI算法生成,仅作参考,不涉投资建议,使用风险自担 【摩根大通年底前将允许机构用比特币和以太坊作贷款抵押】10月25日消息,摩根大通集团计划在今年 年底前,允许机构客户把持有的比特币和以太坊用作贷款抵押品。这一举措标志着华尔街融入加密货币 生态体系的速度正在加快。 ...

43 亿罚款交了!4 个月牢坐了!赵长鹏突然被特朗普赦免。网友:羊毛薅完放出来再长长?

程序员的那些事· 2025-10-24 14:17

当地时间 2025 年 10 月 23 日,美国总统特朗普赦免了币安创始人赵长鹏。 "羊毛薅完了,放羊出来再长长毛" " 43 亿美金,撸完羊毛,再放出来 " "43 亿美元买张 4 个月体验卡,这大概是史上最贵的同情了" 白宫发言人莱维特表示,"特朗普总统行使宪法赋予的权力赦免赵长鹏,他是在拜登政府对加密货币发动战争 期间被起诉的"。 特朗普称赵长鹏遭到了拜登政府的 "迫害",并补充称自己 "从未见过赵长鹏",但 "很多人都说他没犯任何错, 应众多有影响力人士的请求,我赦免了他"。 赵长鹏随后发文称,对获得赦免 "深表感激",称特朗普 "维护了美国对公平、创新与正义的承诺",并表示将尽 一切努力帮助美国成为 "全球加密货币之都",推动 Web3 在全球的发展。 赵长鹏于 2023 年 11 月与美国政府达成认罪协议,承认未能在币安落实有效的反洗钱措施,同意辞去币安首 席执行官职务,但得以保留公司控股权。 作为认罪协议的一部分,币安支付了 43 亿美元的罚款,赵长鹏本人也同意支付 5000 万美元罚款。2024 年, 赵长鹏入狱服刑 4 个月。 网友留言 1、 裁裁裁!亚洲最大 IT 外包公司裁员 19755 ...

美国9月CPI数据公布后,比特币涨至111745.9美元

Ge Long Hui· 2025-10-24 13:49

【免责声明】本文仅代表作者本人观点,与和讯网无关。和讯网站对文中陈述、观点判断保持中立,不对所包含内容 的准确性、可靠性或完整性提供任何明示或暗示的保证。请读者仅作参考,并请自行承担全部责任。邮箱: news_center@staff.hexun.com (责任编辑:贺翀 ) 美国9月CPI数据公布后,比特币涨至111745.9美元,过去24小时内涨2.66%;以太坊涨至4001.74美 元,过去24小时内涨4.04%。 ...

周杰伦投资比特币翻车?加密市场的“双重”陷阱:一边是熟人挖坑,一边是币价“蹦极”

Hua Xia Shi Bao· 2025-10-24 13:35

Core Insights - The incident involving Jay Chou and his friend Cai Weize highlights the risks associated with "familiar investment" in the cryptocurrency market, particularly in the context of a significant Bitcoin investment dispute [2][4] - The increasing frequency of cryptocurrency-related scandals has raised concerns about investor losses and the disruption of economic order, emphasizing the need for rational investment behavior [2][6] Investment Risks - The case of a friend, Cao, who lost money in a cryptocurrency investment due to a lack of transparency and accountability from his acquaintance, illustrates the potential pitfalls of trusting friends with investments [5] - Legal experts indicate that investments in virtual currencies are not protected under Chinese law, making any losses incurred through such investments non-recoverable [6][7] Market Volatility - Bitcoin has experienced extreme price fluctuations, with a record high of $126,080 followed by a rapid decline, reflecting the speculative nature and uncertainty of the cryptocurrency market [9][10] - The recent volatility has resulted in significant losses for investors, with over 164,000 liquidations occurring in a single day, highlighting the risks associated with high-leverage trading [9][10] Regulatory Environment - The Chinese government has classified virtual currency trading as illegal financial activity, which poses additional risks for investors engaging in such practices [7][8] - Legal frameworks emphasize that contracts related to cryptocurrency investments may be deemed invalid, further complicating recovery efforts for investors [6][7] Recommendations for Investors - Experts recommend that investors conduct thorough due diligence, including verifying project legitimacy and team credentials, and avoiding high-return promises [8] - A cautious investment strategy, such as small-scale testing and diversification, is advised to mitigate risks associated with cryptocurrency investments [8]

美国9月CPI数据公布后,比特币涨至111745.9美元,过去24小时内涨2.66%

Mei Ri Jing Ji Xin Wen· 2025-10-24 12:35

美国9月CPI数据公布后,比特币涨至111745.9美元,过去24小时内涨2.66%;以太坊涨至4001.74美元, 过去24小时内涨4.04%。 ...

加密货币跻身主流资产 摩根大通(JPM.US)计划接纳其为贷款抵押品

Zhi Tong Cai Jing· 2025-10-24 11:36

Group 1 - JPMorgan Chase plans to allow institutional clients to use Bitcoin and Ethereum as collateral for loans by the end of the year, indicating a significant integration of cryptocurrencies into the financial system [1] - The plan will be implemented globally and will involve third-party custodians to hold the pledged tokens, building on JPMorgan's previous acceptance of cryptocurrency-related exchange-traded funds as collateral [1] - This expansion reflects the rapid incorporation of cryptocurrencies into the core architecture of the financial system, with Bitcoin prices rising and regulatory restrictions being eased under the Trump administration [1] Group 2 - Jamie Dimon, CEO of JPMorgan, has shifted his stance on cryptocurrencies, no longer viewing them as marginal investments but rather as assets comparable to stocks, bonds, and gold [1] - Other Wall Street firms, such as Morgan Stanley, State Street, Bank of New York Mellon, and Fidelity, are also actively engaging in the digital asset space, with plans to offer cryptocurrency services [2] - Regulatory adjustments have enabled firms like BlackRock to accept Bitcoin from investors and convert it into shares of exchange-traded funds tracking the cryptocurrency [2]