券商业绩增长

Search documents

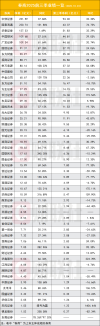

透视上市券商三季报:业绩高歌猛进,自营、投行拉开差距

Di Yi Cai Jing· 2025-11-02 11:09

Core Insights - The securities industry in China has experienced significant performance growth in 2023, driven by an active A-share market and robust trading activities [1][2]. Group 1: Overall Performance - In the first three quarters of 2023, 42 listed securities firms achieved a total revenue of 419.56 billion yuan and a net profit attributable to shareholders of 169.05 billion yuan, with a net profit growth rate exceeding 60% [1][2]. - All listed securities firms, except for Western Securities, reported increased revenue and profit during this period [2][3]. Group 2: Leading Firms - The top three firms by revenue and net profit are CITIC Securities, Guotai Junan, and Huatai Securities, with revenues of 55.81 billion yuan, 45.89 billion yuan, and 27.13 billion yuan, respectively [2][4]. - Eleven firms reported revenues exceeding 10 billion yuan, with five firms achieving net profits over 10 billion yuan [2][3]. Group 3: Business Segments - Brokerage business revenues increased across the board, with all 42 listed firms reporting growth in brokerage fees, with the smallest increase being over 40% [5]. - CITIC Securities and Guotai Junan reported brokerage fee revenues of 10.94 billion yuan and 10.81 billion yuan, respectively, with growth rates of 52.9% and 142.8% [5][6]. Group 4: Proprietary Trading - Proprietary trading contributed significantly to the overall performance, with six firms reporting proprietary income exceeding 10 billion yuan [6]. - CITIC Securities' proprietary income reached 31.60 billion yuan, accounting for approximately 57% of its total revenue [6]. Group 5: Investment Banking - The investment banking segment showed a mixed performance, with 42 firms generating a total of 25.15 billion yuan in fees, a year-on-year increase of over 20% [7]. - Six firms, including CITIC Securities and China International Capital Corporation, reported investment banking fees exceeding 1 billion yuan [7][8]. - Some smaller firms experienced significant declines in investment banking revenues, with Zhongyuan Securities and Pacific Securities reporting decreases of over 60% [8].

长江证券2025年前三季度业绩亮眼,多项指标显著增长

Mei Ri Jing Ji Xin Wen· 2025-11-01 10:45

Core Insights - The operating performance of Changjiang Securities significantly improved in the first three quarters of 2025, with multiple indicators reaching the highest levels since its listing or ranking among the top securities firms [1][3] Financial Performance - In the first three quarters of 2025, the company's operating revenue was 8.49 billion yuan, ranking 15th among listed securities firms, with a year-on-year increase of 77%, placing it second in growth among peers [1] - The net profit attributable to shareholders reached 3.37 billion yuan, ranking 13th among listed securities firms, with a year-on-year growth of 135%, ranking 7th in growth [1] Financial Condition - As of the third quarter of 2025, the company's net assets reached 41.69 billion yuan, the highest level since its listing, with a year-on-year growth of 10% [3] Operational Efficiency - The weighted average return on equity for the first three quarters of 2025 ranked first among listed securities firms, increasing by 5.21 percentage points to 9.23%, improving by 19 positions year-on-year [3] Business Segments - The brokerage business showed significant revenue contributions, with net income from brokerage fees increasing by 59%, ranking 14th among listed securities firms [3] - The scale of funds lent in credit business ranked 13th among listed securities firms, improving by 3 positions year-on-year [3] - Investment business revenue surged by 290%, ranking first in growth among listed securities firms [3]

全业务线复苏 上市券商前三季度业绩劲增

Zheng Quan Ri Bao· 2025-10-31 15:52

Core Insights - The overall performance of A-share listed securities firms in the first three quarters of the year showed strong growth, with total operating income reaching 421.42 billion yuan, a year-on-year increase of 42.57%, and net profit attributable to shareholders reaching 169.29 billion yuan, up 62.48% [1] Group 1: Performance Highlights - 42 out of 43 listed securities firms reported year-on-year growth in both operating income and net profit [1] - Leading firms such as CITIC Securities and Guotai Junan achieved significant revenue, with CITIC Securities reporting 55.81 billion yuan in operating income, a 32.7% increase, and net profit of 23.16 billion yuan, up 37.86% [2] - Guotai Junan's operating income reached 45.89 billion yuan, a remarkable 101.6% increase, with net profit soaring to 22.07 billion yuan, up 131.8% [2] Group 2: Mergers and Acquisitions Impact - Mergers and acquisitions have been pivotal for securities firms to overcome growth bottlenecks, with firms like Guolian Minsheng and Guotai Junan showing over 100% growth in operating income [3] - Guolian Minsheng's net profit surged by 345.3%, reaching 1.76 billion yuan, while Huaxi Securities and Guohai Securities also reported net profit increases exceeding 200% [3] Group 3: Business Segment Performance - All five core business segments (brokerage, investment banking, asset management, proprietary trading, and credit) experienced growth, indicating a comprehensive recovery across the industry [4] - Brokerage business net income reached 111.78 billion yuan, a 74.64% increase, with Guolian Minsheng leading with a 293.05% growth rate [4] - Proprietary trading, the largest income source for securities firms, generated 186.86 billion yuan, up 43.83%, with CITIC Securities leading at 31.60 billion yuan [5]

招商证券三季报营利双增,两融业务规模上限提至2500亿元

Sou Hu Cai Jing· 2025-10-31 07:37

Core Insights - The core viewpoint of the article highlights the strong performance of China Merchants Securities in the third quarter of 2025, with significant growth in revenue and net profit, despite a decline in cash flow from operating activities due to reduced net inflows from margin financing and agency trading [2][3][9]. Financial Performance - For the first three quarters of 2025, the company achieved operating revenue of 18.244 billion yuan, a year-on-year increase of 27.76%, and a net profit attributable to shareholders of 8.871 billion yuan, up 24.08% [3]. - In the third quarter alone, operating revenue reached 7.723 billion yuan, reflecting a remarkable year-on-year growth of 64.89%, while net profit attributable to shareholders was 3.686 billion yuan, increasing by 53.45% [3]. Business Segments - The brokerage business showed particularly strong performance, with net income from commissions and fees reaching 8.264 billion yuan in the first three quarters, a substantial year-on-year increase of 63.49%. The net income from brokerage fees alone was 6.600 billion yuan, up 79.67% [5]. Asset and Margin Financing - As of the end of the third quarter of 2025, the total assets of China Merchants Securities amounted to 745.632 billion yuan, representing a growth of 3.39% compared to the end of 2024 [5]. - The company announced an increase in the upper limit of its margin financing and securities lending business from 150 billion yuan to 250 billion yuan, with the additional 100 billion yuan accounting for approximately 13.41% of the total assets as of the third quarter [6]. Margin Financing Data - By the end of the third quarter, the amount of funds lent by the company reached 129.279 billion yuan, a 35.27% increase from 95.573 billion yuan at the end of 2024, nearing the previous upper limit of 150 billion yuan [9]. - However, the expansion of margin financing has negatively impacted cash flow, with net cash flow from operating activities for the first three quarters at -16.335 billion yuan, a decrease of 121.38% year-on-year [9].

券商三季报排位大洗牌:国信证券跃升2位,招商证券掉队降4名

Xin Lang Zheng Quan· 2025-10-31 04:05

Core Insights - The third quarter performance of 50 A-share listed securities firms shows that all achieved profitability, but only 32 firms experienced both revenue and net profit growth, indicating a recovery in the industry beyond traditional brokerage and proprietary trading businesses [1][3]. Revenue Performance - CITIC Securities led the revenue rankings with 55.815 billion yuan, followed by Guotai Junan at 45.892 billion yuan, creating a significant gap with other firms [1]. - Huatai Securities, GF Securities, and China Galaxy ranked third, fourth, and fifth, with revenues of 27.129 billion yuan, 26.164 billion yuan, and 22.751 billion yuan respectively [1]. Net Profit Rankings - The top ten securities firms by net profit for the first three quarters are CITIC Securities, Guotai Junan, Huatai Securities, China Galaxy, GF Securities, Guoxin Securities, Dongfang Caifu Securities,招商证券, Shenwan Hongyuan, and CITIC Construction Investment [3]. - CITIC Securities achieved a net profit of 23.159 billion yuan, while Guotai Junan followed closely with 22.074 billion yuan [3]. Year-on-Year Changes - The top ten firms saw slight changes in rankings compared to the previous year, with Huatai Securities and CITIC Construction Investment dropping one position, and招商证券 falling four places [3]. - Notably, Guoxin Securities improved by two positions, while China Galaxy, GF Securities, Shenwan Hongyuan, and Zhongjin Company each moved up one position [3]. Performance of Smaller Firms - Smaller securities firms demonstrated stronger performance resilience, with 12 firms doubling their net profit year-on-year, including Guolian Minsheng and Huaxi Securities [5]. - Guolian Minsheng's net profit surged by 345.3%, while Huaxi Securities increased by 316.89% compared to the previous year [5]. Business Segment Performance - The significant growth in the securities industry is attributed to the recovery of market conditions, with brokerage business fees reaching 112.785 billion yuan, a 72.24% increase year-on-year [6]. - Investment banking revenue also showed signs of recovery, with a total of 28.294 billion yuan, reflecting a 37.52% year-on-year growth [6]. - Asset management revenue saw a slight increase of 2.32%, totaling 33.305 billion yuan [6].

券商三季报放榜:国联民生、华西证券、国海证券等净利翻倍

Xin Lang Zheng Quan· 2025-10-31 04:01

Core Insights - The performance of 50 A-share listed securities firms in the third quarter of 2025 shows that all firms achieved profitability, but only 32 firms experienced "double growth" in both operating revenue and net profit, indicating a recovery in the industry [1][3] Revenue Performance - CITIC Securities led the revenue rankings with 55.815 billion yuan, followed by Guotai Junan with 45.892 billion yuan, showing a significant gap from other firms [1] - Huatai Securities, GF Securities, and China Galaxy ranked third, fourth, and fifth, with revenues of 27.129 billion yuan, 26.164 billion yuan, and 22.751 billion yuan respectively [1] Net Profit Analysis - The top ten securities firms by net profit for the first three quarters are CITIC Securities, Guotai Junan, Huatai Securities, China Galaxy, GF Securities, Guoxin Securities, Dongfang Caifu Securities,招商证券, Shenwan Hongyuan, and CITIC Construction Investment [3] - CITIC Securities achieved a net profit of 23.159 billion yuan, while Guotai Junan followed closely with 22.074 billion yuan, with the top ten firms collectively accounting for over 60% of the total net profit of all 50 listed firms [3] Year-on-Year Comparison - Compared to the previous year, there were slight changes in the rankings of the top ten firms, with Huatai Securities and CITIC Construction Investment dropping one position each, and招商证券 dropping four positions [3] Performance of Smaller Firms - Smaller securities firms demonstrated stronger performance resilience, with 12 firms doubling their net profit year-on-year, including Guolian Minsheng, Huaxi Securities, Guohai Securities, and Xiangcai Securities [5] - Guolian Minsheng's net profit surged by 345.3%, while Huaxi Securities saw an increase of 316.89% [5] Business Segment Growth - The significant growth in the securities industry is attributed to the recovery of market conditions, with brokerage business becoming a key driver of performance [6] - In Q3 2025, the total brokerage commission income of 44 comparable A-share listed securities firms reached 112.785 billion yuan, a substantial increase of 72.24% year-on-year [6] - The investment banking business also showed signs of recovery, with net income from investment banking reaching 28.294 billion yuan, up 37.52% year-on-year [6]

2万亿券商再增一家

财联社· 2025-10-31 02:35

Core Viewpoint - The securities industry is experiencing a significant increase in performance, with a notable rise in profitability and market activity as of the third quarter of 2025 [2][6]. Performance Overview - As of October 30, 2025, 52 securities firms reported a total net profit of 183.78 billion yuan for the first three quarters, marking a year-on-year increase of 61.25%. The net profit for the third quarter alone reached 70.36 billion yuan, up 59.08% year-on-year and 26.45% quarter-on-quarter [2][6]. - Among the top-performing firms, five achieved net profits exceeding 10 billion yuan: CITIC Securities (23.16 billion yuan), Guotai Junan (22.07 billion yuan), Huatai Securities (12.73 billion yuan), China Galaxy (10.97 billion yuan), and GF Securities (10.93 billion yuan) [5][6]. Brokerage Income - The brokerage business has seen a substantial increase, with net income from brokerage activities totaling 111.78 billion yuan, reflecting a year-on-year growth of 74.64% [10][12]. - The top three firms in brokerage income are CITIC Securities (10.94 billion yuan), Guotai Junan (10.81 billion yuan), and GF Securities (6.98 billion yuan) [12]. Proprietary Trading - Proprietary trading income reached 186.86 billion yuan, with a year-on-year increase of 43.83%. A total of 37 firms reported positive growth in this area [14][15]. - CITIC Securities led in proprietary trading income with 31.60 billion yuan, followed by Guotai Junan (20.37 billion yuan) and China Galaxy (12.08 billion yuan) [15]. Investment Banking - The investment banking sector is recovering, with net income from investment banking activities totaling 25.15 billion yuan, a year-on-year increase of 23.46% [17][18]. - CITIC Securities topped the investment banking income chart with 3.69 billion yuan, followed by CICC (2.94 billion yuan) and Guotai Junan (2.63 billion yuan) [18]. Asset Management - The asset management business is gradually improving, with net income amounting to 33.25 billion yuan, reflecting a modest year-on-year growth of 2.77% [20][21]. - The leading firms in asset management income include CITIC Securities (8.70 billion yuan), GF Securities (5.66 billion yuan), and Guotai Junan (4.27 billion yuan) [21]. Margin Financing - Margin financing activities have surged, with net interest income totaling 33.91 billion yuan, a year-on-year increase of 54.52%. Several firms have raised their margin financing limits in response to increased demand [23].

券商集体迎来业绩高歌猛进,5家净利破百亿,12家翻倍

Feng Huang Wang· 2025-10-31 01:28

Core Insights - The securities industry is experiencing a significant performance boost, with a notable increase in profitability and market activity as of October 30, 2025 [1] Financial Performance - The total net profit of 52 securities firms for the first three quarters of 2025 reached 183.78 billion yuan, marking a year-on-year increase of 61.25% [1] - In Q3 alone, the net profit totaled 70.36 billion yuan, reflecting a year-on-year increase of 59.08% and a quarter-on-quarter increase of 26.45% [1] Leading Firms - Five firms reported net profits exceeding 10 billion yuan: CITIC Securities (23.16 billion yuan), Guotai Junan (22.07 billion yuan), Huatai Securities (12.73 billion yuan), China Galaxy (10.97 billion yuan), and GF Securities (10.93 billion yuan) [5] - Twelve firms achieved a net profit growth of over 100%, with Guolian Minsheng leading at 345.30% [6] Business Segments - Brokerage income surged by 74.64% year-on-year, totaling 111.78 billion yuan across 42 comparable firms [10] - Proprietary trading income reached 186.86 billion yuan, up 43.83% year-on-year, with 88.1% of firms reporting positive growth [13] - Investment banking revenue increased by 23.46% year-on-year, totaling 25.15 billion yuan, with 64.29% of firms showing positive growth [16] Asset Management - Asset management income showed a modest recovery, totaling 33.25 billion yuan, with a year-on-year increase of 2.77% [19] Market Trends - The total assets of CITIC Securities and Guotai Junan both surpassed 2 trillion yuan, with CITIC's assets at 2.03 trillion yuan, up 18.45% year-on-year, and Guotai's at 2.009 trillion yuan, up 91.7% [8]

券商集体迎来业绩高歌猛进,5家净利破百亿,12家翻倍,2万亿券商再增一家

Xin Lang Cai Jing· 2025-10-31 00:01

Core Insights - The securities industry is experiencing a significant performance boost, with a notable increase in profitability and market activity as of October 30, 2025 [1] Financial Performance - The total net profit of 52 securities firms for the first three quarters of 2025 reached CNY 183.78 billion, marking a year-on-year increase of 61.25% [1] - In Q3 alone, the net profit totaled CNY 70.36 billion, reflecting a year-on-year increase of 59.08% and a quarter-on-quarter increase of 26.45% [1] Individual Firm Performance - Five firms reported net profits exceeding CNY 10 billion: CITIC Securities (CNY 23.16 billion), Guotai Junan (CNY 22.07 billion), Huatai Securities (CNY 12.73 billion), China Galaxy (CNY 10.97 billion), and GF Securities (CNY 10.93 billion) [5] - Twelve firms achieved a net profit growth of over 100%, with Guolian Minsheng leading at 345.30% [6] Business Segments - Brokerage income surged by 74.64% year-on-year, totaling CNY 111.78 billion across 42 comparable firms [10] - Proprietary trading income reached CNY 186.86 billion, up 43.83% year-on-year, with 88.1% of firms reporting positive growth [13] - Investment banking revenue increased by 23.46% year-on-year, totaling CNY 25.15 billion, with 64.29% of firms showing positive growth [16] Market Trends - The overall market activity has positively impacted brokerage and proprietary trading businesses, leading to substantial revenue increases [10][13] - The IPO market is showing signs of recovery, contributing to the resurgence of investment banking revenues [16] Asset Management - Asset management revenues grew modestly by 2.77% year-on-year, totaling CNY 33.25 billion, with only 35.71% of firms reporting positive growth [19] Interest Income - Interest income related to credit business reached CNY 33.91 billion, reflecting a year-on-year increase of 54.52% [22]

国信证券:2025年前三季度净利润约91.37亿元,同比增加87.28%

Mei Ri Jing Ji Xin Wen· 2025-10-30 23:16

Group 1 - The core viewpoint of the article highlights the strong financial performance of Guosen Securities in Q3 2023, with significant year-on-year growth in revenue and net profit [1] - Guosen Securities reported a revenue of approximately 19.203 billion yuan for the first three quarters of 2025, representing a year-on-year increase of 69.41% [1] - The net profit attributable to shareholders of the listed company was about 9.137 billion yuan, showing an increase of 87.28% year-on-year [1] - The basic earnings per share reached 0.85 yuan, reflecting a substantial increase of 107.32% compared to the previous year [1] Group 2 - As of the report, Guosen Securities has a market capitalization of 145.7 billion yuan [2]