电路板

Search documents

粤开市场日报-20260226

Yuekai Securities· 2026-02-26 07:43

证券研究报告 | 策略点评 2026 年 02 月 26 日 投资要点 分析师:孟之绪 执业编号:S0300524080001 电话: 邮箱:mengzhixu@ykzq.com 投资策略研究 粤开市场日报-20260226 今日关注 指数涨跌情况:今日 A 股主要指数涨跌不一。截止收盘,沪指微跌 0.01%,收 报 4146.63 点;深证成指涨 0.19%,收报 14503.79 点;创业板指跌 0.29%, 收报 3344.98 点;科创 50 指数涨 0.85%,收报 1485.86 点。总体上,全天个 股涨跌互现,Wind 数据显示,全市场 2481 只个股上涨,2866 只个股下跌, 130 只个股收平。沪深两市今日成交额合计 25384 亿元,较上个交易日放量 759 亿元。 行业涨跌情况:今日申万一级行业涨少跌多,通信、电子、国防军工、机械 设备、钢铁等行业领涨,涨幅分别为 2.84%、1.98%、1.52%、1.41%、1.33%, 房地产、传媒、非银金融、商贸零售、食品饮料等行业领跌,跌幅分别为 2.25%、 1.45%、1.42%、1.22%、1.20%。 概念板块涨跌情况:今日涨幅居前 ...

A股午评:沪指、创业板指收跌,深指飘红,近3000只个股下跌

Xin Lang Cai Jing· 2026-02-26 04:15

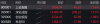

26日,A股三大指数开盘涨跌不一,随后集体翻绿,临近午盘深指翻红。截至午间收盘,沪指跌 0.08%,深证成指涨0.28%,创业板指跌0.39%。全市半日成交额1.65万亿,近3000只个股下跌。 | L | | w A股 | | | | --- | --- | --- | --- | --- | | A股 | 港股 美股 | 全球 商品 | 外汇 | 汁 三 | | 已为您生成昨日市场智评 | | | | 查看 | | 内地股票 △ ◎ | | | | | | 行情 | | 资金净流入 | 涨跌分布 | | | 上证指数 | | 深证成指 | 科创综指 | | | 4144.08 | | 14516.11 | 1830.23 | | | -3.15 -0.08% | | +40.25 +0.28% | +10.51 +0.58% | | | 万得全A | | 创业板指 | 北证50 | | | 6912.53 | | 3341.74 | 1551.46 | | | +12.54 +0.18% -13.08 -0.39% | | | +4.26 +0.28% | | | 沪深300 | | 中证500 | 中证 ...

ETF午评 | 沪指微跌0.08%,电力板块领涨,电网ETF、电网设备ETF均涨3%

Xin Lang Cai Jing· 2026-02-26 04:14

油气股走低,标普油气ETF嘉实跌2.8%。房地产板块回调,地产ETF、房地产ETF银华分别跌2.74%和 2.71%。汽车股飘绿,港股汽车ETF、港股通汽车ETF富国分别跌2.38%和2.09%。 格隆汇2月26日|上证指数午盘跌0.08%,创业板指跌0.39%。AI应用、锂电池、金融科技、光伏、黄 金、创新药概念股走弱,房地产、保险行业跌幅靠前。电路板、超硬材料、特高压题材活跃。 ETF方面,ESGETF午盘尾盘异动拉升6.28%。存储芯片板块继续拉升,中韩半导体ETF涨4.82%。AI硬 件板块走强,5GETF博时、通信ETF华夏和通信ETF分别涨3.28%、2.79%和2.49%。电网板块逆势上 涨,电网ETF、电网设备ETF均涨3%。机械板块走高,科创机械ETF嘉实、工业母机ETF涨2.94%、 2.48%。 MACD金叉信号形成,这些股涨势不错! ...

粤开市场日报-20251217

Yuekai Securities· 2025-12-17 07:52

Market Overview - The A-share market showed a general upward trend today, with the Shanghai Composite Index rising by 1.19% to close at 3870.28 points, the Shenzhen Component Index increasing by 2.4% to 13224.51 points, the ChiNext Index up by 3.39% to 3175.91 points, and the STAR 50 Index gaining 2.47% to 1325.33 points [1] - Overall, 3623 stocks rose while 1634 stocks fell, with 198 stocks remaining flat. The total trading volume in the Shanghai and Shenzhen markets reached 181.11 billion yuan, an increase of 87 billion yuan compared to the previous trading day [1] Industry Performance - Among the Shenwan first-level industries, the leading sectors included telecommunications, non-ferrous metals, electronics, basic chemicals, and power equipment, with respective gains of 5.07%, 3.03%, 2.48%, 2.15%, and 2.09%. The only sectors that experienced declines were agriculture, forestry, animal husbandry, and fishery, national defense and military industry, and coal, with losses of 0.54%, 0.20%, and 0.11% respectively [1] Concept Sector Performance - The top-performing concept sectors today included optical modules (CPO), lithium mining, lithium battery electrolytes, optical communication, liquid cooling servers, optical chips, lithium extraction from salt lakes, selected rare metals, copper-clad laminates, copper industry, high-speed copper connections, selected industrial metals, stock trading software, and circuit boards. In contrast, sectors such as Hainan Free Trade Port, cross-strait integration, satellite internet, commercial aerospace, and satellite navigation experienced pullbacks [2]

粤开市场日报-20251209

Yuekai Securities· 2025-12-09 07:55

Market Overview - The A-share market saw most indices decline today, with the Shanghai Composite Index down by 0.37% closing at 3909.52 points, and the Shenzhen Component Index down by 0.39% at 13277.36 points. The ChiNext Index, however, increased by 0.61% to close at 3209.60 points. Overall, there were 1305 stocks that rose while 4057 stocks fell, with a total trading volume of 19040 billion yuan, a decrease of 1327 billion yuan from the previous trading day [1][10]. Industry Performance - Among the Shenwan first-level industries, the sectors that performed well included comprehensive, communication, and electronics, with increases of 3.45%, 2.23%, and 0.78% respectively. Conversely, industries such as non-ferrous metals, steel, real estate, and coal experienced declines, with decreases of 3.03%, 2.47%, 2.10%, and 1.62% respectively [1][10]. Concept Sector Performance - The concept sectors that saw the highest gains today included copper-clad laminates, optical modules (CPO), cultivated diamonds, circuit boards, high transfer, superhard materials, dairy industry, NVIDIA supply chain, high-speed copper connections, silicon energy sources, initial public offerings, consumer electronics OEM, ice and snow tourism, lithography machines, and Moore Threads [2].

粤开市场日报-20251201

Yuekai Securities· 2025-12-01 07:54

Market Overview - The A-share market saw all major indices rise today, with the Shanghai Composite Index increasing by 0.65% to close at 3914.01 points, the Shenzhen Component Index rising by 1.25% to 13146.72 points, the STAR Market 50 Index up by 0.72% to 1336.76 points, and the ChiNext Index gaining 1.31% to 3092.50 points [1][14] - Overall, 3396 stocks rose while 1868 stocks fell, with a total trading volume of 18739 billion yuan, an increase of 2881 billion yuan compared to the previous trading day [1] Industry Performance - Among the Shenwan first-level industries, the top gainers included non-ferrous metals (up 2.85%), telecommunications (up 2.81%), electronics (up 1.58%), commercial retail (up 1.41%), and social services (up 1.35%). The only sectors that declined were agriculture, forestry, animal husbandry, and fishery (down 0.43%), environmental protection (down 0.23%), and real estate (down 0.06%) [1][14] Concept Sectors - The leading concept sectors with significant gains today included smart speakers, MCU chips, ice and snow tourism, photolithography machines, selected industrial metals, the Internet of Things, TWS headphones, GPUs, the SMIC industrial chain, rare earths, circuit boards, 6G, AI wearable devices, selected shipping, and AI mobile phones [2][11]

A股集体高开

第一财经· 2025-10-29 01:44

Group 1 - The core viewpoint of the article highlights the strong performance of the A-share market, with major indices opening higher, indicating positive market sentiment [3][4]. - The Shanghai Composite Index rose by 0.05% to 3990.27, the Shenzhen Component increased by 0.4% to 13484.01, and the ChiNext Index saw a rise of 1.07% to 3263.98 [4]. - Specific sectors such as the circuit board and CPO themes are active, with companies in the Nvidia supply chain, particularly Industrial Fulian, seeing significant gains, rising over 5% to reach a new historical high [5]. Group 2 - The article mentions a collective high opening for computing hardware stocks, with companies like Zhongji Xuchuang, Xinyi Sheng, and Industrial Fulian reaching new highs [2]. - There is a noted adjustment in sectors such as photovoltaic and server concept stocks, indicating a mixed performance across different industry segments [5].

沪指逼近4000点!

Sou Hu Cai Jing· 2025-10-27 08:57

Core Viewpoint - A-shares experienced a strong performance on Monday, reaching a ten-year high with the Shanghai Composite Index peaking at 3999.07 points, closing at 3996.94, up 1.18% [1][2]. Market Performance - The Shanghai Composite Index closed at 3996.94, increasing by 46.63 points or 1.18% - The Shenzhen Component Index rose by 200.22 points, or 1.51%, closing at 13489.40 - The ChiNext Index increased by 62.89 points, or 1.98%, closing at 3234.45 - The CSI 300 Index closed at 4716.02, up 55.34 points or 1.19% - The CSI 500 Index rose by 120.86 points, or 1.67%, closing at 7379.39 - The total number of stocks that rose in the two markets and the Beijing Stock Exchange was 3360, while 1859 stocks fell, and 217 stocks remained flat [2][4]. Sector Performance - The storage chip concept saw a surge in stock prices, with strong performances in consumer electronics, CPO, and circuit board sectors - Active movements were noted in rare earth, nuclear fusion, and coal stocks - Conversely, gaming, Hainan, and oil and gas sectors experienced declines [4].

收盘丨沪指放量涨超1%逼近4000点 存储芯片概念持续爆发

Di Yi Cai Jing· 2025-10-27 07:30

Market Performance - The three major A-share indices experienced a rebound, with the Shanghai Composite Index rising by 1.18% to close at 3996.94 points, reaching a peak of 3999.07 points during the session [1][2] - The Shenzhen Component Index increased by 1.51% to 13489.40 points, while the ChiNext Index rose by 1.98% to 3234.45 points [2] Sector Performance - The storage chip sector saw a significant surge, with stocks like Zhaoyi Innovation hitting the daily limit, alongside strong performances from companies such as Daway Technology and China Electronics Port [2] - Other active sectors included consumer electronics, CPO, circuit boards, rare earths, nuclear fusion, and coal stocks, while gaming, Hainan, and oil and gas sectors faced declines [2] Capital Flow - Main capital inflows were observed in the communication, non-ferrous metals, and public utilities sectors, while there were outflows from battery, banking, and gaming sectors [4] - Notable net inflows were recorded for Industrial Fulian, Shenghong Technology, and Hengbao Co., with net inflows of 1.768 billion, 1.016 billion, and 867 million respectively [5] Institutional Insights - According to Caitong Securities, the Shanghai Composite Index's approach to the 4000-point mark signifies a new, more dynamic phase for the market, driven by policy and restored confidence, although sustained upward momentum requires solid economic fundamentals and improved corporate earnings [6] - Qianhai Rongyue Asset Management suggests that the next resistance level for the Shanghai Composite Index may be around 4100 points [7] - Guocheng Investment indicates that the market's upward trend should be monitored for resistance near 4200 points on the Shanghai Composite Index [8]

金融工程日报:沪指放量收涨再创十年新高,双创指数强势领涨-20251024

Guoxin Securities· 2025-10-24 14:19

- The report does not contain any quantitative models or factors for analysis[1][2][3]