超导

Search documents

浙商早知道-20251030

ZHESHANG SECURITIES· 2025-10-29 23:35

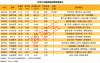

Market Overview - On October 29, the Shanghai Composite Index rose by 0.7%, the CSI 300 increased by 1.19%, the STAR 50 gained 1.18%, the CSI 1000 was up by 1.2%, the ChiNext Index surged by 2.93%, while the Hang Seng Index fell by 0.33% [4][5] - The best-performing sectors on October 29 were power equipment (+4.79%), non-ferrous metals (+4.28%), non-bank financials (+2.08%), basic chemicals (+1.53%), and steel (+1.26%). The worst-performing sectors included banks (-1.98%), conglomerates (-0.56%), food and beverage (-0.56%), textiles and apparel (-0.24%), and light industry manufacturing (-0.22%) [4][5] - The total trading volume for the A-share market on October 29 was 22,906.74 billion yuan, with a net inflow of 2.258 billion Hong Kong dollars from southbound funds [4][5] Key Recommendations - The report recommends Yongding Co., Ltd. (600105) based on its strong growth potential in the optical communication, overseas engineering, and automotive wiring harness sectors, driven by high-temperature superconducting materials and optical chip industries [6] - Despite short-term performance fluctuations mainly due to investment income, the long-term growth potential is supported by high-temperature superconducting materials and optical chip business [6] - The projected revenue for Yongding Co., Ltd. from 2025 to 2027 is 4,587.80 million yuan, 5,063.36 million yuan, and 5,747.82 million yuan, with growth rates of 11.59%, 10.37%, and 13.52% respectively. The net profit attributable to shareholders is expected to be 373.07 million yuan, 191.17 million yuan, and 226.42 million yuan, with growth rates of 507.46%, -48.76%, and 18.44% respectively [6] Important Insights - The strategy report suggests a balanced allocation approach for November, with a market view leaning towards large-cap stocks and value-oriented sectors [8] - The report indicates that the market's feedback mechanism is weakening, and upcoming regulations on public fund performance may further encourage style balance [8] - Key sectors to focus on include brokerage and banking, as well as industries experiencing upward trends such as communications (optical modules), electronics (storage), non-ferrous metals (copper), and basic chemicals [8][9]

超导概念板块领涨,上涨3.45%

Di Yi Cai Jing· 2025-10-29 03:07

Core Viewpoint - The superconducting concept sector leads the market with a rise of 3.45%, indicating strong investor interest and potential growth in this industry [1] Company Performance - Western Superconducting increased by 12.7%, showcasing significant investor confidence and potential for future growth [1] - CITIC Metal rose by 7.88%, reflecting positive market sentiment towards its operations and prospects [1] - Lianchuang Optoelectronics saw an increase of 3.96%, indicating a favorable outlook among investors [1] - Jingda Co. and Xi'an High-tech Institute both experienced gains of over 2%, contributing to the overall positive performance of the sector [1]

“十五五”规划建议发布 更清晰的方向!

Sou Hu Cai Jing· 2025-10-28 23:35

Core Insights - The "14th Five-Year Plan" emphasizes a strategic approach to counter global challenges while focusing on domestic economic stability and growth [1][6][11] Strategic Dimensions - Understanding the complexities and volatility of the current macro external environment is crucial, as traditional globalization principles are changing [1][2] - Concentrating efforts on internal matters is essential to navigate external changes effectively [1][2] Historical Perspective - A historical viewpoint is necessary to recognize China's current position and future trajectory in the global landscape [2] Goal Orientation - The unwavering goal remains the construction of a modern socialist country and the rejuvenation of the Chinese nation, despite global uncertainties [2][4] Problem Orientation - Identifying and addressing existing issues is vital after understanding the broader context [2] Economic Growth and Quality - The plan highlights the importance of both qualitative and quantitative aspects of growth, with a target economic growth rate of around 5% to achieve the status of a moderately developed country by 2035 [4] - Emphasis on improving labor productivity as a key component of quality growth [4] Domestic Market Stability - Enhancing internal stability through a unified domestic market is critical to countering external uncertainties [6] - The establishment of a unified domestic market involves standardizing regulations, infrastructure, and business environments [6] Technological Development - China has made significant advancements in technology, particularly in AI, quantum computing, and nuclear energy, positioning itself to compete with the U.S. [8][10] - The focus on AI+ applications and breakthroughs in quantum computing are seen as pivotal for future growth [9][10] Global Engagement - The "China+N" strategy reflects a shift in global investment patterns, with foreign companies recognizing the importance of the Chinese market [11][12] - Chinese enterprises are increasingly expanding globally, contributing to a new structure in global supply chains [13] Currency Internationalization - The acceleration of the internationalization of the Renminbi is deemed necessary for strengthening China's financial position in global competition [14]

A股午评:沪指涨0.21%突破4000点大关!福建板块再度大面积涨停

Ge Long Hui· 2025-10-28 03:41

Core Viewpoint - The A-share market showed a mixed performance with the Shanghai Composite Index rising by 0.21% to 4005.44 points, while the Shenzhen Component Index and the ChiNext Index increased by 0.52% and 1.35% respectively, indicating a positive sentiment in the market despite a decrease in trading volume [1] Market Performance - The three major indices of A-shares opened lower but rebounded, with the Shanghai Composite Index up 0.21%, Shenzhen Component Index up 0.52%, and ChiNext Index up 1.35% [1] - The total trading volume in the Shanghai and Shenzhen markets reached 135.95 billion yuan, a decrease of 21.65 billion yuan compared to the previous day [1] - Over 3000 stocks in the market experienced an increase in price [1] Sector Performance - The Fujian sector saw significant gains following a favorable article on cross-strait relations, with stocks like Dahua Intelligent and Pingtan Development hitting the limit up for four consecutive trading days, and Fujian Cement and Haixia Innovation achieving two consecutive limit ups [1] - The superconducting concept and battery sectors also showed strength in the market [1] - Conversely, sectors such as coal mining and processing, gold, and wind power equipment experienced the largest declines [1]

好盈科技IPO拟募资19.6亿,250亿估值行业龙头海辰储能再战港交所

Sou Hu Cai Jing· 2025-10-27 13:23

New Listings - During the period from October 21 to October 27, one company was listed on the Shanghai Stock Exchange main board and one on the Shenzhen Stock Exchange main board [2] - ChaoYing Electronics specializes in the research, production, and sales of printed circuit boards (PCBs), primarily for automotive electronics. The stock price surged by 397.60% on the first day of trading, closing at 83.01 CNY per share, a 386.01% increase from the issue price of 17.08 CNY, with a total market capitalization of approximately 36.3 billion CNY [3] - Marco Polo focuses on the research, production, and sales of building ceramics. The stock price increased by 128.80% on the first day, closing at 27.52 CNY per share, a 100.15% increase from the issue price of 13.75 CNY, with a total market capitalization of approximately 32.9 billion CNY [4] Companies Passing Review - From October 21 to October 27, two companies passed the review on the Shanghai Stock Exchange's Sci-Tech Innovation Board, and one on the Shenzhen Stock Exchange main board [5] - Jianxin Superconducting is engaged in the research, production, and sales of core components for medical MRI equipment, with its products accounting for about 50% of the cost of MRI equipment [6] - Muxi Co., Ltd. focuses on the independent research and development of high-performance GPU chips and computing platforms, primarily for AI training and inference, as well as general computing and graphics rendering [6] New Stock Applications - During the period from October 21 to October 27, one company submitted a listing application on the Shanghai Stock Exchange's Sci-Tech Innovation Board, while no companies submitted applications on the Shenzhen Stock Exchange [9] - HaoYing Technology is a comprehensive service provider for commercial big data, specializing in the research, production, and sales of drone power systems, with products also used in competitive vehicles [10][11] New Listings in Hong Kong - From October 21 to October 27, two companies were listed on the Hong Kong Stock Exchange main board [13] - JuShuiTan is the largest e-commerce SaaS ERP provider in China, with a market share of 24.4%. The stock price rose by 23.86% on the first day, closing at 34.96 HKD per share, a 14.25% increase from the issue price of 30.60 HKD, with a total market capitalization of approximately 14.9 billion HKD [14] - GuangHeTong is a wireless communication module provider, with its stock price dropping by 11.72% on the first day, closing at 19.96 HKD per share, a 7.16% decrease from the issue price of 21.50 HKD, with a total market capitalization of approximately 26.0 billion HKD [14] Companies Submitting Applications in Hong Kong - From October 20 to October 27, eight companies submitted listing applications on the Hong Kong Stock Exchange main board [20] - YuWang Bio is the largest supplier and exporter of human tetanus antitoxin in China, with a market share of 66.8% in terms of revenue for 2024 [39] - BiHua Co., Ltd. is a comprehensive chemical group focusing on technological innovation and green low-carbon development, with a leading position in several chemical products [26] - XieChuang Data is a data intelligence application software company, recognized as the second-largest domestic smart storage device manufacturer by revenue in 2024 [29] - ZhongWei Co., Ltd. specializes in new energy materials, focusing on the research and development of battery materials [33] - HeHui Optoelectronics is an AMOLED semiconductor display panel manufacturer, ranked third globally in large-size AMOLED panel shipments [36] - HaiChen Energy is a global new energy technology company, ranked third in the global energy storage market by lithium-ion battery shipments in 2024 [42]

揭秘涨停丨超导和煤炭板块多股涨停

Zheng Quan Shi Bao Wang· 2025-10-23 10:52

Group 1: Stock Performance - On October 23, 2023, 24 stocks had closing limit orders exceeding 100 million yuan, with top three being Yingxin Development, Zhujiang Piano, and Guangtian Group, with order volumes of 1.96 million, 1.08 million, and 630,800 shares respectively [2] - Zhujiang Piano's limit order amount reached 668 million yuan, while Yingxin Development and other stocks also had significant limit order amounts above 200 million yuan [2] Group 2: Company Strategies - Zhujiang Piano is focusing on a strategic plan termed "one insistence, three transformations," aiming to operate existing cultural tourism projects while actively expanding into new business areas [3] - The company successfully acquired the operational rights for the Bai Shui Zhai Scenic Area, planning to develop a core space layout that includes Bai Shui Xian Waterfall Scenic Area, Shima Long Music Town, and Pai Tan Sports Park [3] Group 3: Industry Trends - In the superconducting sector, stocks like Guolan Testing and Dongfang Tantalum experienced limit increases, with Guolan Testing focusing on inspection services for high-end cables used in nuclear power and fusion applications [4] - The coal mining and processing sector saw stocks such as Shanxi Coking Coal and Yunmei Energy also hitting limit increases, with Yunmei Energy's 2024 capacity utilization projected at 94.51% for its 2 million ton coking project [5] Group 4: Market Activity - Four stocks on the Dragon and Tiger list had net purchases exceeding 50 million yuan, with Keda Guokuan leading at 139 million yuan [7] - Institutional participation was notable in stocks like Happy Blue Sea and Yunhan Chip City, with net purchases of 74.15 million yuan and 56.01 million yuan respectively [7]

揭秘涨停 | 超导和煤炭板块多股涨停

Zheng Quan Shi Bao· 2025-10-23 10:34

Core Insights - The stock market saw significant activity on October 23, with 24 stocks having closing limit orders exceeding 1 billion yuan, indicating strong investor interest [1][3]. Group 1: Stock Performance - The top three stocks by closing limit order volume were Yingxin Development, Zhujiang Piano, and Guangtian Group, with limit order volumes of 1.96 million, 1.08 million, and 0.63 million shares respectively [2]. - Zhujiang Piano's limit order amount reached 668 million yuan, while Yingxin Development and Shikang Machinery also showed strong performance with limit orders exceeding 470 million yuan and 356 million yuan respectively [3][4]. Group 2: Company Strategies - Zhujiang Piano is a comprehensive enterprise focusing on pianos, musical instruments, and cultural tourism, and it plans to expand into new business areas while enhancing existing projects [3]. - The company successfully acquired the operational rights to the Bai Shui Zhai scenic area, aiming to develop a cultural and tourism hub [3]. Group 3: Sector Highlights - The superconducting concept stocks, including Guolan Testing and Dongfang Tantalum, saw notable gains, with Guolan Testing focusing on high-end cable technology for nuclear and superconducting applications [5]. - In the coal mining sector, companies like Shanxi Coking Coal and Yunnan Coal Energy reported strong performances, with Yunnan Coal Energy's project achieving a 94.51% capacity utilization rate [6][7]. Group 4: Emerging Trends - The short drama gaming sector is gaining traction, with companies like Haikan Co. and Huanrui Century actively engaging in interactive entertainment projects [9]. - The stock market also witnessed significant net purchases from institutional investors in companies like Huanrui Century and Yunhan Chip City, indicating strong institutional interest [11].

上交所上市委:健信超导首发获通过

Zheng Quan Shi Bao Wang· 2025-10-21 10:07

Core Viewpoint - Ningbo Jianxin Superconductor Technology Co., Ltd. has received approval for its initial public offering (IPO) on the Sci-Tech Innovation Board of the Shanghai Stock Exchange [1] Company Summary - The company is referred to as "Jianxin Superconductor" and is focused on advanced superconductor technology [1]

A股收评:三大指数集体下挫,沪指跌近2%失守3900点,深证、创业、科创及北证50跌逾3%,银行,贵金属板块逆势走强!成交额1.95万亿放量57亿,4800股下跌

Ge Long Hui· 2025-10-17 07:18

Market Overview - Major A-share indices collectively declined, with the Shanghai Composite Index falling by 1.95% to 3839 points, the Shenzhen Component Index down by 3.04%, and the ChiNext Index decreasing by 3.36% [1][2] - The total market turnover reached 1.95 trillion yuan, an increase of 57 billion yuan compared to the previous trading day, with nearly 4800 stocks declining [1] Index Performance - Shanghai Composite Index: 3839.31, down 76.92 points (-1.96%) [2] - Shenzhen Component Index: 12688.99, down 397.42 points (-3.04%) [2] - ChiNext Index: 1363.81, down 52.76 points (-3.72%) [2] - Kweichow Moutai Index: 4513.69, down 104.73 points (-2.27%) [2] - CSI 500 Index: 7017.42, down 214.12 points (-2.96%) [2] Sector Performance - The power equipment sector saw significant declines, with Zhongheng Electric (002364) hitting the daily limit down [3] - The MLCC sector also weakened, with Hongyuan Electronics (603267) dropping over 8% [3] - Superconducting concepts weakened, with Jingda Co. (600577) nearing the daily limit down [3] - High-pressure fast charging and wireless charging sectors showed poor performance, with Igor (002922) hitting the daily limit down [3] - The precious metals sector was active as international gold prices reached new highs, with Hunan Silver leading the gains [3] - Gas stocks rose, with Guo Xin Energy hitting the daily limit up [3] - A few sectors, including aviation and childcare services, recorded increases [3]

A股收评:指数下挫!沪指失守3900点,深证、创业、科创及北证指数均跌逾3%,全市场近4800股下跌

Ge Long Hui· 2025-10-17 07:09

Market Overview - Major A-share indices collectively declined, with the Shanghai Composite Index falling by 1.95% to 3839 points, the Shenzhen Component down by 3.04%, and the ChiNext Index decreasing by 3.36% [1] - The total market turnover reached 1.95 trillion yuan, an increase of 57 billion yuan compared to the previous trading day, with nearly 4800 stocks declining [1] Sector Performance - The power equipment sector experienced a significant drop, with Zhongheng Electric hitting the daily limit down [1] - The MLCC sector also fell, with Hongyuan Electronics dropping over 8% [1] - Superconducting concepts weakened, with Jingda Co. nearing the daily limit down [1] - High-pressure fast charging and wireless charging sectors showed weak performance, with Igor hitting the daily limit down [1] - The controllable nuclear fusion sector declined, with Yingliu Co. hitting the daily limit down [1] - Other sectors with notable declines included wheel hub motors, photovoltaic equipment, liquid cooling concepts, and AI smartphones [1] Contrasting Performance - In contrast, the international gold price reached a new high, leading to a rise in the precious metals sector, with Hunan Silver leading the gains [1] - Gas stocks saw an increase, with Guo New Energy hitting the daily limit up [1] - A few sectors, including aviation airports and childcare services, recorded gains [1]