油气开采

Search documents

这只牛股,尾盘涨停!A股热度榜第一名

Zhong Guo Zheng Quan Bao· 2025-10-22 08:33

Market Overview - On October 22, the three major A-share indices collectively adjusted, with the Shanghai Composite Index down 0.07%, the Shenzhen Component Index down 0.62%, and the ChiNext Index down 0.79%. The total market turnover was 1.69 trillion yuan, a decrease of 202.4 billion yuan compared to the previous trading day [1]. Energy Sector Performance - The energy-related sectors continued to show strength, with deep-sea and deep-earth economy concepts experiencing significant growth. The combustible ice and oil and gas extraction sectors led the gains, with multiple stocks hitting the daily limit [3][4]. - Huanghe Xuanfeng's stock price increased by over 85% year-to-date and surged over 52% in October alone. The company specializes in superhard materials and products, which are widely used in various industries including diamond tool manufacturing and electronics [3]. Deep-Sea and Deep-Earth Developments - During the "14th Five-Year Plan" period, China has made significant advancements in deep-sea and deep-earth exploration. The country's first self-operated deep-water oil field, the Liuhua Oilfield, has achieved record high oil and gas production. Domestic crude oil production from China National Offshore Oil Corporation (CNOOC) has increased to 58.61 million tons, with offshore crude oil production accounting for over 70% of the total increase in the country [6]. - The deep-earth economy is also evolving rapidly, with advancements in drilling technology reducing the time required to reach deeper depths. The successful drilling of the Deep Earth T1 well to 10,910 meters marks a significant milestone [6]. Real Estate Sector Activity - The real estate sector showed active performance, with several stocks such as Yingxin Development achieving a "three consecutive limit" and others like Guangming Real Estate and Tianbao Infrastructure also hitting the daily limit [7]. - According to Zhongtai Securities, the continuous optimization of housing policies in core cities is expected to boost market confidence, leading to a potential stabilization of the industry as policies aimed at stabilizing sales and funding continue to be implemented [9].

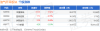

油气开采板块10月22日涨2.06%,中国海油领涨,主力资金净流入1.51亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-22 08:26

Core Insights - The oil and gas extraction sector experienced a 2.06% increase on October 22, with China National Offshore Oil Corporation (CNOOC) leading the gains [1] - The Shanghai Composite Index closed at 3913.76, down 0.07%, while the Shenzhen Component Index closed at 12996.61, down 0.62% [1] Sector Performance - CNOOC (600938) closed at 27.13, up 3.51% with a trading volume of 889,700 shares and a transaction value of 2.384 billion [1] - Blue Flame Holdings (000968) closed at 7.71, up 0.78% with a trading volume of 362,000 shares and a transaction value of 27.6 million [1] - Intercontinental Oil and Gas (600759) closed at 2.50, up 0.40% with a trading volume of 3.3821 million shares and a transaction value of 84.2 million [1] - ST Xinchao (600777) closed at 4.20, down 1.18% with a trading volume of 196,700 shares and a transaction value of 82.394 million [1] Capital Flow - The oil and gas extraction sector saw a net inflow of 151 million from main funds, while retail investors experienced a net outflow of 794.055 million [1] - CNOOC had a main fund net inflow of 248 million, but retail investors saw a net outflow of 144 million [2] - Blue Flame Holdings had a main fund net inflow of 3.2647 million, with retail investors experiencing a net outflow of 5.974 million [2] - ST Xinchao had a main fund net outflow of 8.2383 million, while retail investors had a net inflow of 5.3715 million [2] - Intercontinental Oil and Gas had a main fund net outflow of 92.0383 million, with retail investors seeing a net inflow of 65.3056 million [2]

突发!登顶A股市值第一!2.83万亿巨头比黄金还能涨,今年涨幅高达58%!冲出破净泥潭,股民惊呼:银伟达!

雪球· 2025-10-22 08:08

↑点击上面图片 加雪球核心交流群 ↑ A股三大指数今日集体下跌,截至收盘,上证指数跌0.07%,深证成指跌0.62%,创业板指跌0.79%。全市场全天成交额16903亿元,较上日缩量 2024亿元。全市场超2900只个股下跌。 板块方面,油气、工程机械、风电设备等板块涨幅居前,贵金属、煤炭、电池等板块跌幅居前。 让我们来看一下今天的市场热点。 01 黄金,白银贵金属板块大跌 今天黄金突发下跌,黄金期货,黄金股无一幸免;贵金属板块下跌4.14%。不光A股,昨日现货黄金逼近4082美元,日内跌约6.3%,创2013年4 月以来最大日内跌幅;COMEX黄金跌5.07%。现货白银跌至47.90美元下方,日内跌近8.7%,创2021年2月以来最大盘中跌幅,纽约期银跌至 47.12美元,日内跌约8.3%;COMEX白银跌6.27%。 | V | 贵金属 2727.80 (-117.92 -4.14%) | | | ··· Q. | | --- | --- | --- | --- | --- | | 讨论 | 板块分析 成分股 | | 相关ETF | 资讯 | | 全部(11) | 连板 | 关注度 | 主力资金 | 北向 ...

A股收评:三大指数集体收跌 两市成交额萎缩至1.67万亿

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-22 07:20

Market Performance - The market experienced a weak fluctuation throughout the day, with all three major indices showing a decline by the end of trading: Shanghai Composite Index down 0.07%, Shenzhen Component Index down 0.62%, and ChiNext Index down 0.79% [1] Sector Performance - The deep earth economy concept stocks showed strength, with ShenKai Co., Petrochemical Machinery, and CITIC Heavy Industries achieving three consecutive trading limit ups [2] - Hubei state-owned assets concept stocks continued to perform well, with Wuhan Holdings and others advancing to two consecutive trading limit ups [3] - Oil and gas stocks surged in the afternoon, with Beiken Energy hitting the trading limit up [4] - The banking sector performed strongly against the trend, with Agricultural Bank of China reaching a historical high [5] - In contrast, battery stocks collectively weakened, with Tianji Co. and Tianci Materials experiencing significant declines [6] Trading Volume - The total trading volume in the Shanghai and Shenzhen markets was 1.67 trillion yuan, indicating a further contraction in trading volume, down 224.8 billion yuan compared to the previous trading day [7] Individual Stock Performance - In terms of individual stocks, Cambrian Technologies-U had the highest trading volume at 19.8 billion yuan, followed by Zhongji Xuchuang, Xinyi Sheng, Sanhua Intelligent Control, and Industrial Fulian with significant trading volumes [8]

深地经济概念股全天走强

财联社· 2025-10-22 07:19

Market Overview - The A-share market experienced weak fluctuations today, with all three major indices showing a rebound before retreating [1] - The total trading volume in the Shanghai and Shenzhen markets was 1.67 trillion, a decrease of 206 billion compared to the previous trading day, marking the first drop below 1.7 trillion since August 5 [1][6] Sector Performance - Market hotspots were concentrated in deep earth economy and Hubei state-owned assets, with stocks like ShenKai Co., Petrochemical Machinery, and CITIC Heavy Industries showing strong performance [1] - Oil and gas stocks surged in the afternoon, with Beiken Energy hitting the daily limit [1] - The banking sector performed well, with Agricultural Bank of China reaching a historical high [1] - Conversely, battery stocks collectively weakened, with Tianji Co. and Tianci Materials experiencing significant declines [1][2] Index Performance - At the close, the Shanghai Composite Index fell by 0.07%, the Shenzhen Component Index decreased by 0.62%, and the ChiNext Index dropped by 0.79% [3][4] - The number of rising stocks was 2,280, while 2,965 stocks declined, with 72 stocks hitting the daily limit [5]

收评:三大指数集体收跌 两市成交额仅1.67万亿

Mei Ri Jing Ji Xin Wen· 2025-10-22 07:15

Market Overview - The market experienced a weak fluctuation throughout the day, with all three major indices showing a rebound before retreating [1] - The total trading volume in the Shanghai and Shenzhen markets was 1.67 trillion, a decrease of 224.8 billion compared to the previous trading day [1] Sector Performance - The market's focus was on sectors such as deep earth economy and Hubei state-owned assets, with deep earth economy concept stocks performing strongly [1] - Notable stocks included Shenke Co., Shihua Machinery, and CITIC Heavy Industries, which achieved three consecutive trading limit increases [1] - Hubei state-owned assets continued to show strength, with Wuhan Holdings and other stocks reaching two consecutive trading limit increases [1] - Oil and gas stocks surged in the afternoon, with Beiken Energy hitting the trading limit [1] - The banking sector showed resilience, with Agricultural Bank of China reaching a historical high [1] Declining Sectors - Battery stocks collectively weakened, with Tianji Co. and Tianci Materials experiencing significant declines [1] - Sectors with notable gains included oil and gas, engineering machinery, and wind power equipment, while precious metals, coal, and battery sectors saw significant losses [1] Index Performance - By the end of the trading day, the Shanghai Composite Index fell by 0.07%, the Shenzhen Component Index decreased by 0.62%, and the ChiNext Index dropped by 0.79% [1]

A股低开高走,沪指午后转涨,创业板指跌幅收窄至0.3%!油气开采、可燃冰等板块涨幅居前

Ge Long Hui· 2025-10-22 06:13

(责任编辑:宋政 HN002) 格隆汇10月22日|沪指午后转涨,创业板指跌幅收窄至0.3%。油气开采、可燃冰等板块涨幅居前。 【免责声明】本文仅代表作者本人观点,与和讯网无关。和讯网站对文中陈述、观点判断保持中立,不对所包含内容 的准确性、可靠性或完整性提供任何明示或暗示的保证。请读者仅作参考,并请自行承担全部责任。邮箱: news_center@staff.hexun.com ...

黄金概念股,集体下挫

财联社· 2025-10-22 03:44

Market Overview - A-shares experienced fluctuations and retreated, with the Shenzhen Component Index and ChiNext Index turning red after briefly rising [1] - The total trading volume in the Shanghai and Shenzhen markets was 1.1 trillion, a decrease of 53.5 billion compared to the previous trading day [1] Sector Performance - The deep earth economy concept continued to show strength, with ShenKai Co. and Petrochemical Machinery achieving three consecutive trading limit ups [3] - The Hubei state-owned assets concept maintained its momentum, with Wuhan Holdings and Hubei Broadcasting advancing to two consecutive trading limit ups [3] - The controllable nuclear fusion concept regained strength, with AnTai Technology and Atlantic both hitting trading limit ups [3] - In contrast, the gold sector experienced a collective pullback, with Hunan Silver hitting the trading limit down [3] - The natural gas sector weakened, with Guo Xin Energy also hitting the trading limit down [3] - Sectors such as engineering machinery, plant-based meat, and wind power saw significant gains, while gold and battery sectors faced notable declines [3] - By the end of the trading session, the Shanghai Composite Index fell by 0.44%, the Shenzhen Component Index dropped by 0.81%, and the ChiNext Index decreased by 0.89% [3]

巴西Bacalhau油田正式投产

Zhong Guo Hua Gong Bao· 2025-10-22 02:29

Core Insights - Equinor and partners have officially commenced production at the Bacalhau oil field in Brazil, marking a significant milestone for the company's largest deepwater development project globally [1] - The Bacalhau project has recoverable reserves exceeding 1 billion barrels of oil equivalent, with a peak production capacity of 220,000 barrels per day [1] - The project is expected to support approximately 50,000 jobs over its 30-year lifecycle and provide long-term economic benefits to Brazil [2] Group 1 - The Bacalhau oil field is located in the Santos Basin, with production starting on October 15 at 22:56 (Rio time) [1] - The project is a joint operation involving Equinor, ExxonMobil Brazil, Petrogal Brazil, and the Brazilian National Petroleum Agency (PPSA) [1] - Equinor's CEO highlighted that Bacalhau represents a new generation of oil and gas projects that combine scale, cost-effectiveness, and low carbon intensity [1] Group 2 - The Bacalhau oil field is situated at a water depth exceeding 2,000 meters and utilizes the most advanced Floating Production Storage and Offloading (FPSO) technology [1] - The FPSO, constructed and operated by MODEC, measures 370 meters in length and 64 meters in width, featuring combined cycle gas turbine technology to reduce carbon emissions [1] - Equinor anticipates that the carbon emissions per barrel of oil equivalent from this project will be approximately 9 kilograms, setting a new low for offshore operations [1]

开评:A股三大指数集体低开 黄金板块大幅低开

Zheng Quan Shi Bao Wang· 2025-10-22 02:23

Core Viewpoint - The A-share market experienced a collective decline, with major indices opening lower, indicating a bearish sentiment in the market [1] Market Performance - The Shanghai Composite Index fell by 0.52% - The Shenzhen Component Index decreased by 0.7% - The ChiNext Index dropped by 0.73% [1] Sector Performance - Sectors that saw gains included oil and gas extraction, natural gas, energy equipment, and engineering machinery - Sectors that faced declines included gold and jewelry, cultivated diamonds, semiconductors, and non-ferrous metals [1] Notable Stock Movements - Gold stocks opened significantly lower, with specific companies such as: - Xiaocheng Technology (300139) down over 9% - Hunan Silver (002716) down over 9% - Zhaojin Gold (000506) down over 9% - Shengda Resources (000603) down over 9% [1]