文娱用品

Search documents

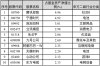

文娱用品板块11月3日涨1.23%,明月镜片领涨,主力资金净流出474.54万元

Zheng Xing Xing Ye Ri Bao· 2025-11-03 08:47

Market Overview - The entertainment products sector increased by 1.23% on November 3, with Mingyue Lens leading the gains [1] - The Shanghai Composite Index closed at 3976.52, up 0.55%, while the Shenzhen Component Index closed at 13404.06, up 0.19% [1] Top Performers - Mingyue Lens (301101) closed at 43.94, up 6.39% with a trading volume of 75,400 shares and a transaction value of 324 million yuan [1] - Helen Piano (300329) closed at 18.25, up 5.43% with a trading volume of 120,500 shares and a transaction value of 217 million yuan [1] - Qunxing Toys (002575) closed at 6.40, up 3.39% with a trading volume of 326,400 shares and a transaction value of 207 million yuan [1] Underperformers - Jinling Sports (300651) closed at 22.13, down 5.43% with a trading volume of 151,700 shares [2] - Yuanfei Pets (001222) closed at 23.00, down 4.29% with a trading volume of 56,300 shares [2] - Zhejiang Nature (605080) closed at 24.48, down 1.45% with a trading volume of 20,800 shares [2] Capital Flow - The entertainment products sector experienced a net outflow of 4.75 million yuan from institutional investors, while retail investors saw a net inflow of 3.32 million yuan [2][3] - Major stocks like Guangbo Co. (002103) had a net inflow of 24.48 million yuan from institutional investors, while Mingyue Lens (301101) had a net inflow of 16.28 million yuan [3]

源飞宠物跌4.29%,成交额1.31亿元,后市是否有机会?

Xin Lang Cai Jing· 2025-11-03 07:40

Core Viewpoint - The article discusses the performance and business operations of Wenzhou Yuanfei Pet Toy Co., Ltd, highlighting its focus on pet products and the impact of currency depreciation on its overseas revenue. Company Overview - Wenzhou Yuanfei Pet Toy Co., Ltd specializes in the research, production, and sales of pet supplies and pet food, with main products including pet snacks, leashes, toys, dry food, and wet food [2][7] - The company was established on September 27, 2004, and went public on August 18, 2022 [7] - As of September 30, 2025, the company reported a revenue of 1.281 billion yuan, a year-on-year increase of 37.66%, and a net profit of 130 million yuan, up 8.75% year-on-year [7] Revenue and Market Position - The company's overseas revenue accounts for 85.78% of total revenue, benefiting from the depreciation of the Chinese yuan [3] - The main revenue sources are pet snacks (52.09%), leashes (24.77%), staple food (9.79%), other products (7.72%), and toys (5.64%) [7] - The company has established production bases in Cambodia to enhance global capacity and reduce labor costs [3] Stock Performance - On November 3, the stock price of Yuanfei Pet fell by 4.29%, with a trading volume of 131 million yuan and a market capitalization of 4.39 billion yuan [1] - The average trading cost of the stock is 24.15 yuan, with current price fluctuations between resistance at 24.70 yuan and support at 21.21 yuan [6] Institutional Holdings - As of September 30, 2025, the number of shareholders decreased by 10.74% to 13,600, while the average circulating shares per person increased by 53.27% to 7,888 shares [7][8] - New institutional shareholders include Caitong New Vision Mixed A and Haitong Growth Value Mixed A, while some previous shareholders have reduced their holdings [8]

文娱用品板块10月31日涨1.04%,广博股份领涨,主力资金净流出7319.78万元

Zheng Xing Xing Ye Ri Bao· 2025-10-31 08:41

Market Overview - The entertainment products sector rose by 1.04% on October 31, with Guangbo Co., Ltd. leading the gains [1] - The Shanghai Composite Index closed at 3954.79, down 0.81%, while the Shenzhen Component Index closed at 13378.21, down 1.14% [1] Individual Stock Performance - Guangbo Co., Ltd. (002103) closed at 9.60, up 3.34% with a trading volume of 175,900 shares and a turnover of 167 million yuan [1] - Other notable performers included: - Gaole Co., Ltd. (002348) at 4.40, up 3.04% [1] - Shifeng Culture (002862) at 18.00, up 2.80% [1] - Quanyun Laser (300220) at 15.54, up 2.71% [1] - Tianyuan Pet (301335) at 30.00, up 2.67% [1] Capital Flow Analysis - The entertainment products sector experienced a net outflow of 73.2 million yuan from institutional investors, while retail investors saw a net inflow of 106 million yuan [2][3] - The capital flow for individual stocks showed: - Jinling Sports (300651) had a net inflow of 13.37 million yuan from institutional investors [3] - Guangbo Co., Ltd. (002103) saw a net inflow of 10.09 million yuan [3] - Shifeng Culture (002862) had a net inflow of 2.65 million yuan [3]

晨光股份(603899):传统主业跌幅收窄,科力普单季收入增速超预期,看好持续恢复

ZHONGTAI SECURITIES· 2025-10-31 06:31

Investment Rating - The report maintains a "Buy" rating for the company, indicating an expected relative performance increase of over 15% compared to the benchmark index within the next 6 to 12 months [4][10]. Core Views - The company has shown signs of recovery in its traditional core business, with a narrowing decline in revenue. The office direct sales segment (KeliPu) has exceeded expectations with a revenue growth of 17.3% in Q3 2025, driven by new contracts with major state-owned enterprises and government clients [5][6]. - The report highlights a positive outlook for the company's transformation efforts, which are expected to gradually release performance improvements. The company is shifting from functional products to a combination of "function + emotion" products, enhancing its IP strategy [5][6]. Summary by Sections Financial Performance - In Q3 2025, the company reported revenue of 6.52 billion yuan, a year-on-year increase of 7.5%, and a net profit attributable to shareholders of 390 million yuan, up 0.6% year-on-year. The net profit margin was 6.2%, down 0.4 percentage points [4][5]. - The traditional core business (including online sales) generated revenue of 2.54 billion yuan in Q3 2025, reflecting a year-on-year decline of 3.6%. In the first half of 2025, this segment's revenue was 3.90 billion yuan, down 7.2% year-on-year, indicating a narrowing decline [5][6]. Business Segments - KeliPu's revenue in Q3 2025 reached 3.56 billion yuan, marking a year-on-year increase of 17.3%. The first half of 2025 saw revenue of 6.13 billion yuan, a slight increase of 0.15% year-on-year, indicating a recovery in growth [6]. - The lifestyle store segment (including Jiumu miscellaneous store) reported Q3 2025 revenue of 410 million yuan, up 6.6% year-on-year, with a first-half revenue of 780 million yuan, reflecting a 7.0% increase year-on-year. The operational status of this segment remains stable [6]. Future Outlook - The company is expected to achieve net profits attributable to shareholders of 1.45 billion yuan, 1.66 billion yuan, and 1.93 billion yuan for the years 2025 to 2027, respectively. The earnings per share (EPS) are projected to be 1.58 yuan, 1.81 yuan, and 2.09 yuan for the same period [4][6].

康力源涨2.04%,成交额1934.64万元,主力资金净流入4.31万元

Xin Lang Cai Jing· 2025-10-31 03:37

Core Viewpoint - Kangliyuan's stock price has shown significant volatility, with a year-to-date increase of 47.60%, while recent trading activity indicates mixed investor sentiment [2]. Group 1: Stock Performance - As of October 31, Kangliyuan's stock price rose by 2.04% to 40.93 CNY per share, with a trading volume of 19.34 million CNY and a turnover rate of 2.79% [1]. - The stock has experienced a 2.63% increase over the last five trading days and a 3.80% increase over the last 20 days, but a decline of 4.61% over the last 60 days [2]. Group 2: Financial Performance - For the period from January to September 2025, Kangliyuan reported a revenue of 388 million CNY, a year-on-year decrease of 17.78%, while the net profit attributable to shareholders was 56.71 million CNY, reflecting a year-on-year increase of 32.44% [2]. - Since its A-share listing, Kangliyuan has distributed a total of 62.00 million CNY in dividends [3]. Group 3: Shareholder Information - As of September 30, 2025, the number of shareholders in Kangliyuan decreased by 18.84% to 7,984, while the average number of circulating shares per person increased by 23.21% to 2,133 shares [2]. - The largest circulating shareholder is the Nuoan Multi-Strategy Mixed A fund, holding 351,500 shares as a new investor [3]. Group 4: Company Overview - Kangliyuan, established on May 15, 1998, and listed on June 14, 2023, is based in Pizhou City, Jiangsu Province, focusing on the research, development, manufacturing, and sales of diversified and customized fitness equipment [2]. - The company's revenue composition is primarily from indoor products (90.41%), followed by outdoor products (8.45%) and other categories (1.14%) [2].

明月镜片(301101):积极推进产品智能化

Tianfeng Securities· 2025-10-31 02:29

Investment Rating - The report upgrades the investment rating to "Buy" with a target price not specified [5] Core Views - The company demonstrates strong resilience in operations despite external market pressures, with a focus on optimizing product matrix and advancing smart technology [5] - The company has successfully launched new high-end products, including the Tianji series, which enhances its competitive edge in the high-end lens market [3] - The company has established itself as the exclusive optical partner for Xiaomi's AI glasses, contributing to significant revenue growth in this segment [4] Financial Performance Summary - In Q3 2025, the company achieved revenue of 230 million yuan, a year-on-year increase of 14.6%, and a net profit of 50 million yuan, up 11.6% year-on-year [1] - For the first three quarters of 2025, total revenue reached 630 million yuan, reflecting a 7.4% year-on-year growth, while net profit was 150 million yuan, up 8.8% year-on-year [1] - The company's main business growth rate improved in Q3, indicating robust business model stability and market competitiveness [1] Product Strategy Summary - The company maintains growth in its major products, with the PMC Ultra Bright series seeing a 53.7% revenue increase in Q3 2025 compared to the same period last year [2] - The "Easy Control" series generated sales of 50.8 million yuan in Q3 2025, a 10.5% year-on-year increase, with cumulative sales for the first three quarters reaching 132 million yuan, up 8.5% year-on-year [2] - The newly upgraded 1.74 series product received positive consumer feedback, with sales increasing by 112.4% year-on-year in Q3 2025 [2] Market Positioning Summary - The company is positioned as a leading domestic brand in the lens market, focusing on high-end product development to meet market demands [3] - The partnership with Xiaomi enhances the company's visibility and credibility in the smart wearable technology sector [4]

泉果基金孙伟:消费复苏需观察政策实施力度,三季度增配新消费与锂电

Sou Hu Cai Jing· 2025-10-29 09:20

Core Insights - The report from the "泉果消费机遇" fund indicates a significant growth in fund size, reaching 695 million yuan by the end of Q3 2025, up from 61.93 million yuan in Q2 2025, reflecting increasing recognition from investors, including institutions [1][2] - The fund's net value performance shows a 33.00% increase over the past year, outperforming the benchmark of 3.69% [1] Fund Performance and Market Context - The fund has gained favor among institutional investors, with 2.856 million shares held, accounting for 4.96% of total shares [2] - In Q3 2025, major stock indices performed well, with the Shanghai Composite Index rising by 12.73%, Shenzhen Component Index by 29.25%, CSI 300 by 17.90%, and Hang Seng Index by 11.56% [2] - Economic indicators showed steady growth, with industrial added value increasing by 5.7% and 5.2% in July and August respectively, and retail sales growing by 3.7% and 3.4% in the same months [2] Portfolio Adjustments - The fund manager, Sun Wei, indicated a slight increase in equity positions and adjustments in the portfolio structure, focusing on new consumption and lithium battery sectors [3] - The fund increased allocations in personal care, trendy toys, and gaming industries while reducing exposure in closely related sectors [3] - The top ten holdings account for 30.12% of the fund's net asset value, with Tencent Holdings, CATL, and Pop Mart among the largest positions [5] Investment Strategy - As of Q3 2025, the fund's stock position constituted 79.01% of its net assets, with a 24.77% allocation to Hong Kong stocks, showing stability compared to the previous quarter [4][3] - New entries in the top ten holdings include Pop Mart, Alibaba-W, and Tianqi Lithium, while previous holdings like Yanjing Beer and Li Auto have exited the list [3][5]

文娱用品板块10月29日跌0.75%,珠江钢琴领跌,主力资金净流出2931.81万元

Zheng Xing Xing Ye Ri Bao· 2025-10-29 08:41

Core Points - The entertainment products sector experienced a decline of 0.75% compared to the previous trading day, with Pearl River Piano leading the drop [1] - The Shanghai Composite Index closed at 4016.33, up by 0.7%, while the Shenzhen Component Index closed at 13691.38, up by 1.95% [1] Fund Flow Analysis - The entertainment products sector saw a net outflow of 29.3181 million yuan from main funds, while speculative funds had a net inflow of 57.2681 million yuan, and retail investors experienced a net outflow of 27.95 million yuan [2]

文娱用品板块10月28日跌0.61%,珠江钢琴领跌,主力资金净流出1.17亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-28 08:34

Market Overview - The entertainment products sector declined by 0.61% on the previous trading day, with Zhujiang Piano leading the decline [1] - The Shanghai Composite Index closed at 3988.22, down 0.22%, while the Shenzhen Component Index closed at 13430.1, down 0.44% [1] Stock Performance - Notable gainers in the entertainment products sector included: - Helen Piano (300329) with a closing price of 16.52, up 5.22% on a trading volume of 142,400 shares and a turnover of 233 million yuan [1] - Qunxing Toys (002575) closed at 6.28, up 3.63% with a trading volume of 562,400 shares and a turnover of 352 million yuan [1] - Zhujiang Piano (002678) was the biggest loser, closing at 5.52, down 9.95% with a trading volume of 783,000 shares and a turnover of 440 million yuan [2] Capital Flow - The entertainment products sector experienced a net outflow of 117 million yuan from institutional investors, while retail investors saw a net inflow of 90.5 million yuan [2] - The sector's capital flow indicated that: - Qunxing Toys had a net inflow of 30.2 million yuan from institutional investors, but a net outflow of 42.9 million yuan from retail investors [3] - Huali Technology (301011) saw a net inflow of 10.6 million yuan from institutional investors, but also experienced outflows from both retail and speculative investors [3]

创源股份:第三季度净利润为2986.29万元,同比增长34.24%

Xin Lang Cai Jing· 2025-10-28 08:15

Core Insights - The company reported a third-quarter revenue of 605 million yuan, representing a year-on-year growth of 9.34% [1] - The net profit for the third quarter was 29.86 million yuan, showing a year-on-year increase of 34.24% [1] - For the first three quarters, the company achieved a revenue of 1.602 billion yuan, which is a year-on-year growth of 15.63% [1] - The net profit for the first three quarters reached 79.65 million yuan, reflecting a year-on-year increase of 33.44% [1]