CNCB(00998)

Search documents

中信银行焦作分行优化支付服务 提升支付便利性

Huan Qiu Wang· 2025-10-23 03:05

Core Viewpoint - The event highlighted the collaboration between CITIC Bank's Jiaozuo branch and the People's Bank of China to enhance payment services for foreign visitors in China during the 12th China Jiaozuo International Tai Chi Competition and the 2025 Yuntai Mountain Tourism Festival [1] Group 1: Payment Services Enhancement - The bank conducted promotional activities at foreign currency exchange points and competition venues to inform foreign visitors about various payment tools and services, including QR code payments and mobile banking [1] - A consultation desk was set up outside the opening ceremony venue to provide multilingual payment service guides to foreign athletes, tourists, and staff, detailing commonly used payment methods in China [1] - The initiative aims to optimize payment services and improve convenience, addressing the diverse payment needs of different groups to stimulate consumption and economic growth [1] Group 2: Future Commitment - The bank plans to continue its commitment to enhancing payment services, aligning with the national goal of serving the public through improved payment solutions, thereby supporting high-quality regional economic development [1]

中信银行长沙分行落地同业客户首笔代销信银理财产品业务

Chang Sha Wan Bao· 2025-10-22 11:21

Core Viewpoint - CITIC Bank's Changsha branch has successfully launched a wealth management product through Hunan Bank, marking its first wealth management agency business in the Hunan market, which will help diversify non-interest income and strengthen integrated operations with key regional peers [1] Group 1 - The collaboration with Hunan Bank, a key peer client in the region, is significant due to its leading asset scale and wealth management clientele in Hunan [1] - The project took three years from initiation to implementation, highlighting CITIC Bank's commitment to deepening relationships with key client groups [1] - The Changsha branch effectively coordinated critical steps such as agreement signing, system integration, and product approval, earning high recognition from partners for its quality service [1] Group 2 - The next phase for CITIC Bank's Changsha branch is to aim for the goal of becoming a "leading wealth management bank," focusing on deepening integrated operations with peer clients [1] - The bank plans to enhance cooperation depth and breadth in wealth management agency business with regional key clients and accelerate the rollout of agency business with Changsha Bank and provincial associations [1] - This initiative is expected to inject stronger momentum into the bank's transformation in financial market business and high-quality development [1]

股份制银行板块10月22日涨0.78%,中信银行领涨,主力资金净流出3.55亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-22 08:19

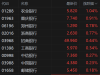

证券之星消息,10月22日股份制银行板块较上一交易日上涨0.78%,中信银行领涨。当日上证指数报收于3913.76,下跌0.07%。深证成指报收于 12996.61,下跌0.62%。股份制银行板块个股涨跌见下表: | 代码 | 名称 | 收盘价 | 涨跌幅 | 成交量(手) | 成交额(元) | | --- | --- | --- | --- | --- | --- | | 66109 | 中信银行 | 7.93 | 2.32% | 73.80万 | 5.81亿 | | 601916 | 浙商银行 | 3.11 | 2.30% | 318.89万 | 9.83亿 | | 600015 | 华夏银行 | 6.96 | 1.46% | 88.65万 | 6.14亿 | | 601818 | 光大银行 | 3.50 | 1.45% | 431.86万 | 15.04亿 | | 601166 | 兴业银行 | 20.40 | 1.19% | 105.30万 | 21.43亿 | | 000001 | 平安银行 | 11.52 | 0.79% | 83.37万 | 9.58亿 | | 600016 | 民生银行 | 4 ...

跨境金融添动力 中信银行郑州分行助企“扬帆远航”

Huan Qiu Wang· 2025-10-22 06:55

Core Viewpoint - Citic Bank's Zhengzhou branch has successfully opened a cross-border RMB guarantee for a cable manufacturing company, facilitating the company's international cooperation opportunities and demonstrating the bank's commitment to supporting the real economy through financial services [1] Group 1: Financial Services - The bank has developed a specialized cross-border RMB financial service plan tailored to the company's international business needs, aiding its expansion into overseas markets [1] - Citic Bank emphasizes a service philosophy of "professional, fast, and flexible," aiming to create a comprehensive cross-border financial service system that includes a full range of foreign exchange products [1] Group 2: Support for Export Enterprises - The bank actively collaborates with various channels, including CITIC Insurance, to enhance services for import and export trade, cross-border settlements, foreign exchange transactions, and exchange rate risk management [1] - The Zhengzhou branch plans to continue focusing on customer-centric services and leverage its expertise in foreign exchange to provide innovative financial solutions for enterprises looking to expand internationally [1]

中信银行涨2.06%,成交额3.95亿元,主力资金净流出119.14万元

Xin Lang Zheng Quan· 2025-10-22 06:13

资料显示,中信银行股份有限公司位于北京市朝阳区光华路10号院1号楼6-30层,32-42层,香港九龙柯士 甸道西1号环球贸易广场80层,成立日期1987年4月20日,上市日期2007年4月27日,公司主营业务涉及 公司银行业务、零售银行业务及资金资本市场业务。主营业务收入构成为:公司银行业务46.40%,零 售银行业务38.28%,金融市场业务14.37%,其他业务及未分配项目0.95%。 中信银行所属申万行业为:银行-股份制银行Ⅱ-股份制银行Ⅲ。所属概念板块包括:长期破净、低市盈 率、破净股、中特估、证金汇金等。 截至6月30日,中信银行股东户数11.86万,较上期减少3.64%;人均流通股436219股,较上期增加 4.51%。2025年1月-6月,中信银行实现营业收入0.00元;归母净利润364.78亿元,同比增长2.78%。 分红方面,中信银行A股上市后累计派现1738.41亿元。近三年,累计派现529.97亿元。 责任编辑:小浪快报 10月22日,中信银行盘中上涨2.06%,截至14:04,报7.91元/股,成交3.95亿元,换手率0.12%,总市值 4401.53亿元。 资金流向方面,主力资金净流 ...

港股异动丨内银股普涨,农业银行涨超1%再创新高,录得10连阳

Ge Long Hui· 2025-10-22 01:56

Group 1 - The core viewpoint is that Hong Kong bank stocks are experiencing a bullish trend, with Agricultural Bank of China reaching a new historical high and achieving a 10-day consecutive rise [1] - Morgan Stanley anticipates that after a seasonal adjustment in Q3, there will be good investment opportunities in Q4 and Q1 of the following year for domestic bank stocks [1] - Factors supporting the revaluation of Chinese banking stocks include upcoming dividend distributions, stabilized interest rates, a 500 billion RMB structural financial policy tool, and a more sustainable policy path [1] Group 2 - Agricultural Bank of China saw an increase of 1.04%, reaching a latest price of 5.820 [2] - Other banks also recorded gains, including Chongqing Bank (+0.91%), Zhengzhou Bank (+0.78%), and Zhejiang Bank (+0.77%) [2] - The overall trend indicates a positive performance across various banks, with notable increases in share prices for several institutions [2]

基金风险等级大量上调

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-22 01:23

Core Viewpoint - A significant wave of risk level adjustments in the public fund industry has emerged since September, with nearly 20 fund companies issuing over 20 adjustment announcements, affecting hundreds of products. The adjustments primarily involve raising risk levels, with many previously considered "stable" bond funds and "fixed income+" products being upgraded from R2 (medium-low risk) to R3 (medium risk), and some high-volatility equity funds being raised to R4 (medium-high risk) [1][3][8]. Group 1: Adjustment Trends - Since September, nearly 20 fund companies have issued 22 related announcements, a significant increase compared to previous months, which averaged single-digit announcements [3][4]. - Major fund companies involved in these adjustments include Huazhang Fund, Fuguo Fund, and others, with many products seeing risk level increases [2][3]. - The adjustments are not limited to fund companies; banks and third-party sales channels are also involved in synchronizing these changes [5][6]. Group 2: Regulatory and Market Drivers - The core drivers of the risk level adjustments are regulatory requirements and market changes, particularly the implementation of the "Commercial Bank Agency Sales Business Management Measures" which took effect on October 1 [8][10]. - The new regulations require sales institutions to ensure that product risks match the risk tolerance of clients, leading to a more rigorous assessment of fund products [8][10]. - Market volatility has also contributed to the adjustments, with some funds experiencing significant net value fluctuations, prompting a reassessment of their risk characteristics [8][12]. Group 3: Impact on Investors - The adjustments have direct and profound implications for fund investors, necessitating a reevaluation of their risk tolerance in light of the new risk levels [11][13]. - Investors will receive notifications regarding changes in risk characteristics, prompting them to reassess whether these "more dangerous" funds align with their risk profiles [12][13]. - New subscription and investment plans will be restricted if the adjusted risk levels exceed the investors' assessed risk tolerance, serving as a protective measure [13].

基金风险等级大量上调

21世纪经济报道· 2025-10-22 01:19

Core Viewpoint - A significant wave of risk level reassessment has swept through the public fund industry, with nearly 20 fund companies issuing over 20 adjustment announcements since September, affecting hundreds of products. The adjustments primarily involve raising risk levels, with many previously considered "stable" bond funds and "fixed income+" products being upgraded from R2 (medium-low risk) to R3 (medium risk), and some high-volatility equity funds being raised to R4 (medium-high risk) [1][5][6]. Summary by Sections Adjustment Trends - Since September 2025, the frequency of risk level adjustment announcements in public funds has significantly increased, with major fund companies like Huazhang Fund and Fuguo Fund announcing adjustments for multiple products, primarily raising risk levels [3][5]. - For instance, Huazhang Fund announced on October 20 that 17 of its funds would have their risk levels raised, with bond funds moving from R2 to R3 and several equity funds from R3 to R4 [3][5]. - Fuguo Fund also reported on October 9 that 28 out of 31 funds would see their risk levels increased, with 20 funds moving from R2 to R3 and 8 from R3 to R4 [3][5]. Involvement of Sales Channels - The adjustments are not limited to fund companies; banks and third-party sales channels are also involved. For example, CITIC Bank adjusted the risk ratings of 17 asset management products, with some being downgraded and others upgraded [5][6]. - Other banks, such as Agricultural Bank and Construction Bank, have also made similar adjustments to their sold public fund products [6]. Regulatory and Market Drivers - The core drivers of these risk level adjustments are regulatory requirements and market changes. The implementation of the "Commercial Bank Agency Sales Business Management Measures" in October 2025 has been a direct catalyst for banks to adjust risk levels [7][8]. - Market volatility has also played a role, with some thematic funds showing significant performance but increased net value volatility, prompting a reassessment of risk levels [8]. Dynamic Risk Assessment Process - The process for adjusting risk levels involves a combination of third-party evaluations and the fund managers' assessments, with a tendency to adopt the higher of the two ratings. This dynamic assessment is crucial for accurately reflecting the risk characteristics of the funds [9]. - The adjustments are characterized by a "higher not lower" principle, driven by regulatory mandates, with banks, fund companies, and third-party sales channels working in coordination [9]. Impact on Investors - The adjustments have direct implications for fund investors, who will receive notifications about changes in risk levels. Investors are encouraged to reassess their risk tolerance in light of these changes [11][12]. - New investors may face restrictions on purchasing funds if the adjusted risk level exceeds their assessed risk tolerance, serving as a protective measure against taking on excessive risk [11][12].

投资者适配为先 多机构调整基金风险等级

Zhong Guo Zheng Quan Bao· 2025-10-21 21:46

Core Viewpoint - The recent adjustment of risk levels for various fund products in the Chinese market indicates a significant shift in the investment landscape, driven by increased volatility and changes in asset allocation strategies [1][4][6]. Fund Risk Level Adjustments - Multiple fund companies and distribution institutions have announced adjustments to the risk levels of their funds, with a notable increase in risk ratings for many products [2][3]. - Specifically, Citic Bank adjusted the risk levels of 17 asset management products starting October 15, raising the risk levels of 15 funds while only lowering 2 [2][3]. - High-performing funds, such as the Huatai-PB North Exchange Innovation Selected Two-Year Open Fund, saw their risk levels raised from "Medium-High Risk" (PR4) to "High Risk" (PR5) due to significant returns [2][3]. Underlying Causes of Adjustments - The primary reasons for the risk level increases include rising volatility, increased maximum drawdown multiples, and changes in fund scale [1][4][5]. - For bond funds, heightened market volatility and increased equity allocations have contributed to the adjustments in risk ratings [5]. Impact on Fund Sales and Investor Behavior - The adjustments in risk levels will directly affect investor behavior, particularly in systematic investment plans (SIPs), as banks will automatically intercept plans that do not match the new risk levels [1][6]. - Investors are likely to become more cautious regarding high-risk products, especially in light of recent market fluctuations, which may lead to a decline in purchase intentions for these products [6]. Market Dynamics and Investor Considerations - The adjustments reflect a broader trend where high returns are often accompanied by higher volatility, particularly for funds targeting innovative and less liquid companies [4][5]. - Investors are encouraged to regularly review the risk ratings and adjust their investment strategies accordingly, as the risk-return characteristics of funds are subject to change over time [6].

投资者适配为先多机构调整基金风险等级

Zhong Guo Zheng Quan Bao· 2025-10-21 20:18

Core Insights - The recent adjustment of risk levels for various fund products indicates a significant shift in the fund industry, with many funds experiencing an increase in their risk ratings, particularly those with strong performance this year [1][2]. Fund Risk Level Adjustments - Starting from October 15, Citic Bank adjusted the risk levels of 17 asset management products, raising the risk rating of 15 funds while only lowering 2 [2]. - Notably, high-performing funds, such as the Huatai-PineBridge North Exchange Innovation Selected Fund, saw their risk rating increase from "Medium-High Risk" (PR4) to "High Risk" (PR5) due to a return rate exceeding 76% this year [2]. - Other fund companies, including Fortune Fund and Tianhong Fund, have also announced similar risk level adjustments, with a majority of their products experiencing an increase in risk ratings [3]. Underlying Factors for Adjustments - The primary reasons for the increase in risk ratings include rising volatility, increased maximum drawdown multiples, and changes in asset allocation, particularly in bond funds [3][4]. - The bond market's increased volatility and the rising equity allocation in some bond funds have contributed to the adjustments in risk ratings [4][5]. Impact on Fund Sales and Investor Behavior - The adjustments in risk ratings will have a tangible impact on fund sales, as banks will automatically intercept investment plans that do not match the new risk levels [1][5]. - Investors, particularly those purchasing funds through banks, tend to be cautious about high-risk products, especially after recent market fluctuations, leading to a potential decrease in the willingness to invest in products with higher risk ratings [6]. - The adjustments also signal to investors the need to regularly review their fund holdings and risk profiles, as the risk-return characteristics of products are subject to change [6].