CM BANK(03968)

Search documents

招商银行(03968) - 招商银行股份有限公司监事会决议公告

2025-10-29 10:16

香港交易及結算所有限公司及香港聯合交易所有限公司對本公告的內容概不負責,對其準確性 或完整性亦不發表任何聲明,並明確表示,概不對因本公告全部或任何部份內容而產生或因倚 賴該等內容而引致之任何損失承擔任何責任。 (於中華人民共和國註冊成立的股份有限公司) (H股股票代碼:03968) 海外監管公告 本公告乃根據《香港聯合交易所有限公司證券上市規則》第13.10B條而作出。 招商銀行股份有限公司董事會 招商銀行股份有限公司 CHINA MERCHANTS BANK CO., LTD. 2025年10月29日 於本公告日期,本公司的執行董事為王良及鍾德勝;本公司的股東董事(非執行 董事)為繆建民、石岱、孫雲飛、江朝陽、朱立偉及黃堅;及本公司的獨立非執 行董事為李孟剛、劉俏、田宏啟、李朝鮮、史永東及李健。 A 股简称:招商银行 A 股代码:600036 公告编号:2025-052 招商银行股份有限公司 监事会决议公告 会议审议通过了以下议案: 一、审议通过了 2025 年第三季度报告,并出具如下意见: (一)本公司 2025 年第三季度报告的编制和审议程序符合有关法律法规、 《招商银行股份有限公司章程》和本公司相关内 ...

招商银行(03968.HK):前三季度归母净利润1137.72亿元 同比增长0.52%

Ge Long Hui· 2025-10-29 10:15

截至报告期末,集团资产总额126,440.75亿元,较上年末增长4.05%;贷款和垫款总额71,362.85亿元1, 较上年末增长3.60%;负债总额113,689.39亿元,较上年末增长4.12%;客户存款总额95,186.97亿元,较 上年末增长4.64%。 截至报告期末,集团不良贷款余额674.25亿元,较上年末增加18.15亿元;不良贷款率0.94%,较上年末 下降0.01个百分点;拨备覆盖率405.93%,较上年末下降6.05个百分点;贷款拨备率3.84%,较上年末下 降0.08个百分点;2025年1-9月信用成本(年化)0.67%,较上年全年上升0.02个百分点。 格隆汇10月29日丨招商银行(03968.HK)发布公告,2025年1-9月,集团实现营业净收入2,512.82亿元(人 民币,下同),同比下降0.52%;实现归属于本行股东的净利润1,137.72亿元,同比增长0.52%;实现净利 息收入1,600.42亿元,同比增长1.74%;实现非利息净收入912.40亿元,同比下降4.27%;年化后归属于 本行股东的平均总资产收益率(ROAA)和年化后归属于本行普通股股东的平均净资产收益率(RO ...

招商银行(600036) - 招商银行股份有限公司董事会决议公告

2025-10-29 10:15

A 股简称:招商银行 A 股代码:600036 公告编号:2025-051 招商银行股份有限公司(简称本公司或招商银行)于 2025 年 9 月 30 日以电 子邮件方式发出第十三届董事会第六次会议通知,于 10 月 29 日以书面传签方式 召开会议。会议应参会董事 14 名,实际参会董事 14 名。会议的召开符合《中华 人民共和国公司法》和《招商银行股份有限公司章程》等有关规定。 会议审议通过了以下议案: 一、审议通过了本公司 2025 年第三季度报告。 同意:14 票 反对:0 票 弃权:0 票 本公司董事会审计委员会已审议通过上述议案,并同意将其提交本公司董事 会审议。 二、审议通过了《2025 年第三季度第三支柱报告》。 同意:14 票 反对:0 票 弃权:0 票 招商银行股份有限公司 董事会决议公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 同意:14 票 反对:0 票 弃权:0 票 1 五、审议通过了《招商银行业务连续性管理工作规定(第四版)》。 同意:14 票 反对:0 票 弃权:0 票 六、审议通过了《关 ...

招商银行(03968) - 招商银行股份有限公司董事会决议公告

2025-10-29 10:13

招商銀行股份有限公司 CHINA MERCHANTS BANK CO., LTD. (於中華人民共和國註冊成立的股份有限公司) (H股股票代碼:03968) 海外監管公告 本公告乃根據《香港聯合交易所有限公司證券上市規則》第13.10B條而作出。 香港交易及結算所有限公司及香港聯合交易所有限公司對本公告的內容概不負責,對其準確性 或完整性亦不發表任何聲明,並明確表示,概不對因本公告全部或任何部份內容而產生或因倚 賴該等內容而引致之任何損失承擔任何責任。 招商銀行股份有限公司董事會 2025年10月29日 於本公告日期,本公司的執行董事為王良及鍾德勝;本公司的股東董事(非執行 董事)為繆建民、石岱、孫雲飛、江朝陽、朱立偉及黃堅;及本公司的獨立非執 行董事為李孟剛、劉俏、田宏啟、李朝鮮、史永東及李健。 A 股简称:招商银行 A 股代码:600036 公告编号:2025-051 招商银行股份有限公司 董事会决议公告 会议审议通过了以下议案: 一、审议通过了本公司 2025 年第三季度报告。 同意:14 票 反对:0 票 弃权:0 票 本公司董事会审计委员会已审议通过上述议案,并同意将其提交本公司董事 会审议。 二、 ...

招商银行(03968) - 2025 Q3 - 季度业绩

2025-10-29 10:06

Financial Performance - Net profit attributable to shareholders rose by 0.52% year-on-year to RMB 113,772 million for the first nine months of 2025[6]. - Operating income for Q3 2025 was RMB 81,359 million, reflecting a 2.11% increase compared to the same period last year[6]. - Basic earnings per share for Q3 2025 was RMB 1.54, up from RMB 1.32 in the same period last year, representing a 16.67% increase[6]. - The company's pre-tax profit for the first nine months of 2025 was RMB 135,089 million, reflecting a 0.76% increase year-on-year[6]. - The net profit for the nine months ended September 30, 2025, is RMB 114,537 million, slightly up from RMB 114,039 million in the same period last year[48]. - The net profit attributable to shareholders for the nine months ended September 30, 2025, is RMB 113,772 million, compared to RMB 113,184 million in the same period last year[48]. Asset and Liability Management - Total assets increased by 4.05% year-on-year to RMB 12,644,075 million as of September 30, 2025[6]. - Total liabilities increased by 4.12% to RMB 11,368.94 billion, primarily due to growth in customer deposits[25]. - The total number of ordinary shareholders reached 498,392, with 471,874 being A-share shareholders and 26,518 being H-share shareholders[8]. - The company's net assets per share increased by 4.22% year-on-year to RMB 43.21 as of September 30, 2025[6]. - The group's equity attributable to shareholders reached RMB 1,267.285 billion, an increase of 3.37% compared to the end of the previous year[26]. Customer Deposits and Loans - Customer deposits totaled RMB 9,518.70 billion, reflecting a 4.64% increase year-on-year, with retail customer deposits growing by 6.88%[25]. - The total loans and advances amounted to CNY 7,136.285 billion, growing by 3.60% from the end of the previous year[13]. - The average balance of loans and advances increased by 3.60% to RMB 71,362.85 billion, with corporate loans growing by 10.01%[24]. - The total customer deposits reached CNY 9,518.697 billion, an increase of 4.64% from the end of the previous year[13]. Non-Performing Loans and Credit Risk - The non-performing loan balance was CNY 67.425 billion, with a non-performing loan ratio of 0.94%, a decrease of 0.01 percentage points from the end of the previous year[14]. - The company's loan loss provision balance was RMB 262.123 billion, with a provision coverage ratio of 426.89%, an increase of 1.66 percentage points from the previous year[35]. - The company generated new non-performing loans of RMB 48.003 billion from January to September 2025, with an annualized NPL generation rate of 0.96%, a decrease of 0.06 percentage points year-on-year[34]. - The non-performing loan (NPL) ratio for the real estate sector was 4.24%, a decrease of 0.50 percentage points from the end of the previous year[27]. Income and Expense Management - The company's net interest income for the period was CNY 160.042 billion, representing a year-on-year increase of 1.74% and accounting for 63.69% of total operating income[16]. - Non-interest net income for the first nine months of 2025 was RMB 91.24 billion, a year-on-year decline of 4.27%, accounting for 36.31% of total operating income[19]. - The group maintained a cost-to-income ratio of 29.86%, an increase of 0.27 percentage points year-on-year, while focusing on lean management and cost control[21]. Risk Management and Compliance - The company will continue to enhance risk management and support compliance projects to stabilize the quality of real estate assets[28]. - The company is actively monitoring industry risks and implementing post-loan management to maintain overall asset quality stability[31]. - The company plans to enhance risk compliance management and adjust operational strategies in response to macroeconomic changes[36]. Capital Adequacy - The core tier 1 capital adequacy ratio was 13.93% as of September 30, 2025, a decrease of 0.93 percentage points from the end of the previous year[38]. - The total capital adequacy ratio is 17.40%, down 1.77 percentage points from the end of the previous year[41]. - The Tier 1 capital adequacy ratio under the weighted method is 13.99%, down 0.64 percentage points from the end of the previous year[43]. Customer Growth and Wealth Management - The number of retail customers increased to 220 million, representing a growth of 4.76% year-over-year[45]. - The number of high-net-worth clients (with average total assets of RMB 1 million or more) increased by 10.42% to 5.78 million[45]. - Wealth management fees and commissions increased by 18.76% to RMB 20.67 billion, driven by growth in distribution scale and product structure optimization[20].

招商银行:第三季度净利润为388.42亿元,同比增长1.04%

Zheng Quan Shi Bao Wang· 2025-10-29 10:05

人民财讯10月29日电,招商银行(600036)10月29日发布2025年第三季度报告,第三季度营收为814.51亿 元,同比增长2.11%;净利润为388.42亿元,同比增长1.04%。前三季度营收为2514.2亿元,同比下降 0.51%;净利润为1137.72亿元,同比增长0.52%。截至报告期末,集团不良贷款余额674.25亿元,较上 年末增加18.15亿元;不良贷款率0.94%,较上年末下降0.01个百分点;拨备覆盖率405.93%,较上年末 下降6.05个百分点;贷款拨备率3.84%,较上年末下降0.08个百分点。 转自:证券时报 ...

招商银行(600036) - 2025 Q3 - 季度财报

2025-10-29 10:05

A 股简称:招商银行 A 股代码:600036 公告编号:2025-053 招商银行股份有限公司 CHINAMERCHANTSBANKCO.,LTD. 二○二五年第三季度报告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容 的真实性、准确性和完整性承担法律责任。 1 重要提示 本公司董事会、监事会及董事、监事、高级管理人员保证本报告内容的真实、准确、完整,不存在虚假 记载、误导性陈述或者重大遗漏,并承担个别和连带的法律责任。 本公司董事长缪建民,行长兼首席执行官王良,副行长、财务负责人和董事会秘书彭家文及会计机构负 责人孙智华声明:保证本报告中财务信息的真实、准确、完整。 本公司董事会审计委员会已审阅本报告并同意将本报告提交本公司董事会审议。本公司第十三届董事会 第六次会议和第十二届监事会第四十五次会议分别审议并全票通过了本公司2025年第三季度报告。 本报告中的财务报表按中国会计准则编制且未经审计,本公司按国际财务报告会计准则编制且未经审计 的季报详见香港交易及结算所有限公司网站。本报告中金额币种除特别说明外,均以人民币列示。 本报告中"招商银行""本公司""本行 ...

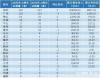

智通AH统计|10月29日

Zhi Tong Cai Jing· 2025-10-29 08:41

Core Insights - The top three companies with the highest AH premium rates are Northeast Electric (00042) at 900.00%, Sinopec Oilfield Service (01033) at 246.25%, and Hongye Futures (03678) at 245.50% [1][2] - The bottom three companies with the lowest AH premium rates are CATL (03750) at -14.52%, China Merchants Bank (03968) at -1.95%, and Heng Rui Medicine (01276) at 1.24% [1][2] - The companies with the highest deviation values are Northeast Electric (00042) at 73.25%, Shandong Molong (00568) at 39.97%, and Changfei Optical Fiber (06869) at 27.40% [1][3] - The companies with the lowest deviation values are Shanghai Electric (02727) at -16.60%, Tianjin Chuangye Environmental Protection (01065) at -16.50%, and First Tractor Company (00038) at -14.81% [1][3] Summary of Top AH Premium Rates - Northeast Electric (00042): H-share at 0.270, A-share at 2.25, premium rate at 900.00%, deviation at 73.25% [2] - Sinopec Oilfield Service (01033): H-share at 0.800, A-share at 2.31, premium rate at 246.25%, deviation at 17.04% [2] - Hongye Futures (03678): H-share at 4.000, A-share at 11.54, premium rate at 245.50%, deviation at 14.12% [2] Summary of Bottom AH Premium Rates - CATL (03750): H-share at 560.500, A-share at 400, premium rate at -14.52%, deviation at 1.38% [2] - China Merchants Bank (03968): H-share at 49.800, A-share at 40.77, premium rate at -1.95%, deviation at -5.47% [2] - Heng Rui Medicine (01276): H-share at 75.600, A-share at 63.9, premium rate at 1.24%, deviation at 3.98% [2] Summary of Top Deviation Values - Northeast Electric (00042): H-share at 0.270, A-share at 2.25, premium rate at 900.00%, deviation at 73.25% [3] - Shandong Molong (00568): H-share at 4.200, A-share at 7.92, premium rate at 125.95%, deviation at 39.97% [3] - Changfei Optical Fiber (06869): H-share at 40.040, A-share at 92.92, premium rate at 177.97%, deviation at 27.40% [3] Summary of Bottom Deviation Values - Shanghai Electric (02727): H-share at 4.780, A-share at 9.63, premium rate at 141.21%, deviation at -16.60% [3] - Tianjin Chuangye Environmental Protection (01065): H-share at 4.490, A-share at 6.32, premium rate at 68.60%, deviation at -16.50% [3] - First Tractor Company (00038): H-share at 7.940, A-share at 13.07, premium rate at 97.23%, deviation at -14.81% [3]

2025广东企业500强名单公布!腾讯、比亚迪等上榜前10名

Nan Fang Du Shi Bao· 2025-10-29 08:16

Core Insights - The Guangdong Enterprise 500 Strong list for 2025 has been released, showcasing significant changes in rankings and performance metrics of leading companies in the region [1][2]. Group 1: Rankings and Performance - The total revenue of the Guangdong Enterprise 500 Strong reached 19.36 trillion yuan, with a growth rate of 3.36% compared to the previous year [2]. - The top 10 companies in the 2025 Guangdong Enterprise 500 Strong are: Ping An Insurance, China Resources Group, Huawei, Southern Power Grid, BYD, Tencent, Foxconn, China Merchants Bank, Midea Group, and GAC Group [2]. - Huawei moved up one position to rank third, while Southern Power Grid dropped to fourth. BYD and Tencent swapped places, with BYD at fifth and Tencent at sixth. Vanke fell out of the top 10, now ranked eleventh, while Midea Group entered the top 10 at ninth [1][2]. Group 2: Regional Distribution - Shenzhen leads with 216 companies on the list, achieving a cumulative revenue exceeding 1 trillion yuan and a net profit of 863.7 billion yuan [4]. - Guangzhou follows with 120 companies, including major firms like Southern Power Grid and GAC Group, reflecting a balanced presence of service and manufacturing sectors [4]. - Other cities like Foshan, Dongguan, and Huizhou also show stable performances with notable companies in manufacturing [5]. Group 3: Profit Trends - The total net profit of the Guangdong Enterprise 500 Strong shows a trend of recovery and stabilization, reversing a two-year decline, with a growth rate of 2.06% for 2025 [6]. Group 4: Industry Insights - The service and manufacturing sectors remain the dual engines of Guangdong's economy, with strong performances in finance, insurance, supply chain, and real estate [9]. - The manufacturing sector is concentrated in electronics, automotive, home appliances, and new energy, with companies like Huawei, BYD, and Foxconn demonstrating Guangdong's strength in high-end and smart manufacturing [9]. - There is a notable increase in companies within the new energy and electronic information sectors, indicating ongoing investment in green transformation and technological innovation [9]. Group 5: R&D Investment - The scientific research and technical services industry leads in R&D investment, accounting for 18.99% of its revenue, followed by the manufacturing sector with a 4.08% R&D investment ratio [10].

招商银行跌2.02%,成交额29.42亿元,主力资金净流出5.80亿元

Xin Lang Cai Jing· 2025-10-29 06:53

Core Viewpoint - The stock price of China Merchants Bank has experienced a decline of 2.02% on October 29, with significant net outflows of capital, indicating potential investor concerns about the bank's performance and market conditions [1]. Group 1: Stock Performance - As of October 29, the stock price is reported at 40.76 CNY per share, with a total market capitalization of 1,027.96 billion CNY [1]. - Year-to-date, the stock has increased by 9.28%, but it has seen declines of 2.84% over the last five trading days, 1.90% over the last twenty days, and 7.66% over the last sixty days [1]. Group 2: Financial Metrics - For the first half of 2025, the bank reported a net profit attributable to shareholders of 749.30 billion CNY, reflecting a year-on-year growth of 0.25% [2]. - The bank's cumulative cash dividends since its A-share listing amount to 403.70 billion CNY, with 144.00 billion CNY distributed over the past three years [3]. Group 3: Shareholder Information - As of June 30, 2025, the number of shareholders is reported at 410,400, a decrease of 5.65% from the previous period [2]. - The average number of circulating shares per shareholder has increased by 6.35% to 53,781 shares [2]. - Hong Kong Central Clearing Limited is the fourth largest circulating shareholder, holding 1.366 billion shares, which is a decrease of 33.10 million shares from the previous period [3]. Group 4: Business Overview - China Merchants Bank, established on March 31, 1987, and listed on April 9, 2002, primarily engages in retail financial services (56.59% of revenue), wholesale financial services (41.37%), and other business activities (2.03%) [1]. - The bank operates in the banking sector, specifically categorized under joint-stock commercial banks [1].