BANK OF CHINA(03988)

Search documents

中资离岸债每日总结(10.21) | 中国银行(03988.HK)、中国能源建设(03996.HK)发行

Sou Hu Cai Jing· 2025-10-22 03:23

Group 1 - Multiple Wall Street analysts predict that the Federal Reserve may announce the termination of its years-long balance sheet reduction plan at the upcoming meeting at the end of October [2] - Observers note that increasing friction in the money market could impact the achievement of inflation and employment dual targets, indicating a significant turning point for the Quantitative Tightening (QT) policy [2] - Analysts believe that halting QT to stop liquidity withdrawal during the Federal Open Market Committee (FOMC) meeting on October 28-29 would help ensure smooth technical operations of monetary policy [2] Group 2 - The rise in repo rates and the Secured Overnight Financing Rate (SOFR) confirms the existence of market friction [2] - The Federal Funds Rate target, which is the core rate of the Federal Reserve, continues to rise within the 4%-4.25% target range [2] - Federal Reserve Chairman Jerome Powell indicated on October 14 that QT might end in the "coming months," while also stating that the financial system still has ample liquidity [2]

港股异动丨内银股普涨,农业银行涨超1%再创新高,录得10连阳

Ge Long Hui· 2025-10-22 01:56

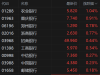

Group 1 - The core viewpoint is that Hong Kong bank stocks are experiencing a bullish trend, with Agricultural Bank of China reaching a new historical high and achieving a 10-day consecutive rise [1] - Morgan Stanley anticipates that after a seasonal adjustment in Q3, there will be good investment opportunities in Q4 and Q1 of the following year for domestic bank stocks [1] - Factors supporting the revaluation of Chinese banking stocks include upcoming dividend distributions, stabilized interest rates, a 500 billion RMB structural financial policy tool, and a more sustainable policy path [1] Group 2 - Agricultural Bank of China saw an increase of 1.04%, reaching a latest price of 5.820 [2] - Other banks also recorded gains, including Chongqing Bank (+0.91%), Zhengzhou Bank (+0.78%), and Zhejiang Bank (+0.77%) [2] - The overall trend indicates a positive performance across various banks, with notable increases in share prices for several institutions [2]

中共广东省委办公厅 广东省人民政府办公厅关于对推进粤港澳大湾区建设表现突出集体和个人给予表扬的通报

Nan Fang Ri Bao Wang Luo Ban· 2025-10-22 01:51

《粤港澳大湾区发展规划纲要》实施以来,全省上下坚持以习近平新时代中国特色社会主义思想为指 导,深入贯彻习近平总书记对广东系列重要讲话和重要指示精神,认真落实省委"1310"具体部署,围绕 做实粤港澳大湾区"一点两地"全新定位,携手港澳加快建设国际一流湾区和世界级城市群,推动粤港澳 大湾区建设迈出坚实步伐,涌现出一大批表现突出、成绩优异的集体和个人。为进一步激发广大党员干 部群众投身粤港澳大湾区建设热情,经省委、省政府同意,对在推进粤港澳大湾区建设工作中表现突出 的100个集体和100名个人给予通报表扬。希望受到表扬的集体和个人再接再厉,进一步发挥模范带头作 用,在新征程中再创佳绩。 大道至简,实干为要。全省各地区各部门要深入学习贯彻党的二十大和二十届历次全会精神,全面贯彻 习近平经济思想,发扬敢闯敢试、敢为人先的改革精神,勇立潮头、干在实处、走在前列,纵深推进粤 港澳大湾区建设,不断夯实广东高质量发展基础,协同港澳加快建设世界级的大湾区、发展最好的湾 区,为广东在推进中国式现代化建设中走在前列作出新的更大贡献! 在推进粤港澳大湾区建设中表现突出的集体名单 广州市委港澳办港澳工作处 广州市天河区委统战部 广州花 ...

鹏华睿享180天持有期债券型证券投资基金基金份额发售公告

Zhong Guo Zheng Quan Bao - Zhong Zheng Wang· 2025-10-22 00:55

Core Points - The article discusses the launch of the Penghua RuiXiang 180-Day Holding Period Bond Fund, which has received regulatory approval and is set to be publicly offered from November 3 to November 21, 2025 [1][4][18]. Fund Overview - The fund is a contract-based open-end bond fund with a minimum holding period of 180 days for each fund share [11][12]. - The fund's initial share value is set at 1.00 RMB [13]. - The maximum fundraising target for the fund is 5 billion RMB, excluding interest accrued during the fundraising period [14][32]. Subscription Details - The fund is open to individual investors, institutional investors, and qualified foreign investors, with specific restrictions on financial institutions' proprietary accounts [3][16]. - The minimum subscription amount for each transaction account is 1 RMB, while the initial subscription through the direct sales center is set at 1 million RMB [29][37]. - Investors can make multiple subscriptions during the fundraising period, but once a subscription application is accepted, it cannot be withdrawn [6][28]. Fund Management and Operations - The fund is managed by Penghua Fund Management Co., Ltd., with Bank of China serving as the custodian [2][3]. - The fund's sales institutions include both direct sales and other sales channels, with specific contact information available in related announcements [17][4]. Fund Contract and Effectiveness - The fund contract will become effective if the total number of shares raised reaches at least 200 million, with a minimum of 2 billion RMB raised by the end of the fundraising period [50]. - If the fundraising conditions are not met, the fund manager will return the raised funds with interest within 30 days [51].

重磅!陈志能拟任中行上海分行行长,曾掌舵多家一级分行

Xin Lang Cai Jing· 2025-10-22 00:35

Core Viewpoint - Chen Zhinen, the current president of Bank of China Henan Branch, is proposed to be appointed as the president of Bank of China Shanghai Branch, following the previous president Wang Xiao's appointment as vice president of China Export-Import Bank [1][2]. Group 1: Background and Experience - Chen Zhinen, born in November 1972, is a senior manager who has grown within the Bank of China system, having served as the head of four primary branches since 2016, including those in Ningxia, Inner Mongolia, Liaoning, and Henan [3][5]. - He has held various positions within the Bank of China, including assistant general manager and deputy general manager of the Human Resources Department since December 2009 [5]. Group 2: Focus on Local Projects - During his tenure as the head of the Henan Branch, Chen has actively engaged in researching and assessing local key project constructions, advocating for increased financial support [6][7]. - He has conducted site visits to significant projects, such as the Wangguan Yellow River Bridge, emphasizing the importance of financial backing and collaboration with local authorities to enhance project execution [7][8]. Group 3: Strategic Financial Initiatives - Chen has expressed a commitment to leveraging the Bank of China's global presence and comprehensive service advantages to optimize financial product systems and improve service quality [5]. - He has highlighted the importance of supporting major infrastructure projects in Henan, including railway construction and water conservancy projects, by providing tailored financing solutions and fostering partnerships with local enterprises [8].

中国银行股份有限公司关于召开2025年第三季度业绩说明会的公告

Shang Hai Zheng Quan Bao· 2025-10-21 19:24

Core Points - The announcement is regarding the third quarter performance briefing of Bank of China for 2025 [1] - The briefing will be conducted in an interactive online format, allowing for real-time communication with investors [2] Group 1: Meeting Details - The performance briefing is scheduled for October 29, 2025, from 16:30 to 17:30 [6] - Investors can participate via the Shanghai Stock Exchange Roadshow Center website [6] - Questions can be submitted via email to the bank's investor relations team before the meeting [6] Group 2: Participation Information - Investors are encouraged to send their questions to ir@bankofchina.com by October 27, 2025, at 17:00 [4] - The bank will address commonly asked questions during the performance briefing [4][6] - The meeting will be accessible for review after its conclusion on the same website [4]

“举国欢庆享金秋”,中国银行云南省分行消保宣传走深走实暖民心

Zhong Guo Jin Rong Xin Xi Wang· 2025-10-21 11:24

Core Viewpoint - The Bank of China Yunnan Branch is actively promoting consumer rights protection during the 2025 National Day and Mid-Autumn Festival, focusing on enhancing public financial risk awareness and building a secure financial environment in the region [1] Group 1: Consumer Rights Protection Activities - The Yunnan Branch organized various institutions to implement a multi-scenario and multi-form promotional model for consumer rights protection education [1] - The branch's business departments utilized visual and scenario-based methods to disseminate financial knowledge, including risk warnings during key customer interactions [2] - A significant number of promotional materials were distributed, with over a thousand pieces handed out and thousands of financial consultations provided [8] Group 2: Targeted Education for Specific Demographics - The bank focused on educating the elderly about financial safety, including anti-fraud measures and information protection, particularly during the "Respect for the Elderly Month" [3] - For young consumers, the bank conducted on-campus promotions addressing common financial risks such as telecom fraud and irrational spending, using case studies to illustrate risks [4] Group 3: Community Engagement and Outreach - The bank extended its services to communities, markets, and rural areas, providing accessible consumer protection services [6] - Collaborative events with local communities and law enforcement were held to enhance awareness of fraud prevention and financial services [6] - The bank's initiatives received positive feedback from participants, highlighting the effectiveness and warmth of the outreach efforts [8] Group 4: Future Plans - The Bank of China Yunnan Branch plans to continue enhancing consumer rights protection efforts by innovating promotional methods and expanding service coverage [8]

绿色金融丨绿色乡村振兴债发行提速,助力乡村全面振兴——可持续债券季报(2025年三季度)

Xin Lang Cai Jing· 2025-10-21 10:14

Core Insights - The total issuance of various sustainable bonds in China's domestic market reached approximately 10.07 trillion yuan by the end of Q3 2025, with a total issuance of 337.6 billion yuan in Q3, reflecting a quarter-on-quarter decrease of 11.83% [4][7][10]. Sustainable Bonds Overview - The cumulative issuance of labeled green bonds in China reached 4.93 trillion yuan by the end of Q3 2025, with an outstanding balance of 2.32 trillion yuan. In Q3 2025, the issuance of green bonds totaled 257.69 billion yuan, down 18.03% quarter-on-quarter but up 17.24% year-on-year [7][10][11]. - Green financial bonds were the most significant category, accounting for 50.49% of the total green bond issuance in Q3 2025 [10]. - The primary funding targets for green bonds were the clean energy industry (54.06%) and infrastructure green upgrades (26.88%) [21]. Transition Bonds - By the end of Q3 2025, the cumulative issuance of transition bonds in China was 273.13 billion yuan, with a balance of 171.88 billion yuan. In Q3 2025, the issuance of transition bonds totaled 22.88 billion yuan, representing a quarter-on-quarter increase of 43.9% [2][42]. - The issuance included 20 sustainable-linked bonds totaling 16.37 billion yuan and 8 low-carbon transition-linked bonds totaling 5.4 billion yuan [42]. Other Sustainable Development Bonds - Other sustainable development-themed bonds reached a cumulative issuance of approximately 4.87 trillion yuan by the end of Q3 2025, with a total issuance of 57.03 billion yuan in Q3, reflecting a quarter-on-quarter increase of 8.4% [2][47]. - This category included 73 regional development bonds totaling 47.17 billion yuan and 4 social project bonds totaling 2.53 billion yuan [47]. Innovation Practices - The first sustainable bond from a local state-owned enterprise was successfully issued on the London Stock Exchange, marking a significant milestone for cross-border financing [50]. - The first dual-labeled credit bond in the rail industry, combining "carbon-neutral green" and "rural revitalization," was issued by the Jinhua Rail Transit Group [51]. - The first low-carbon transition-linked bond supporting small and micro enterprises was successfully issued on the Shenzhen Stock Exchange [53]. Policy Developments - The People's Bank of China and other regulatory bodies released the "Green Finance Support Project Directory (2025 Edition)," which standardizes the recognition criteria for various green financial products [54][55]. - A joint opinion was issued to enhance financial support for new industrialization, emphasizing the role of green finance in promoting low-carbon transitions in manufacturing [57]. - The Green Bond Standards Committee published a notification regarding the application of the new project directory for green bonds, ensuring a smooth transition from the previous standards [56].

中国银行(601988) - 中国银行股份有限公司关于召开2025年第三季度业绩说明会的公告

2025-10-21 09:30

证券代码:601988 证券简称:中国银行 公告编号:临 2025-076 中国银行股份有限公司 关于召开2025年第三季度业绩说明会的公告 中国银行股份有限公司董事会及全体董事保证本公告内容不存在任何虚 假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性 承担法律责任。 重要内容提示: 一、业绩说明会类型 业绩说明会通过网络文字互动方式召开,本行将针对 2025 年第 三季度业绩和经营等情况与投资者进行交流,并对投资者普遍关注的 问题进行回答。 二、业绩说明会召开的时间、方式和参会网址 (一)会议召开时间:2025 年 10 月 29 日 16:30-17:30 1 (三)参会网址:上证路演中心(https://roadshow.sseinfo.com) 三、参加人员 董事会秘书及相关业务部门负责人。 四、投资者参加方式 (一)投资者可于 2025 年 10 月 29 日 16:30-17:30 登录上证路演 中心(https://roadshow.sseinfo.com)参会。 (二)投资者可于 2025 年 10 月 27 日 17:00 前将相关问题通过 电子邮件的形式发送至本行邮箱 ...

中国银行(03988) - 关於召开2025年第三季度业绩说明会的公告

2025-10-21 08:53

香港交易及結算所有限公司及香港聯合交易所有限公司對本公告的內容概不負責,對其準確性 或完整性亦不發表任何聲明,並明確表示,概不對因本公告全部或任何部分內容而產生或因倚 賴該等內容而引致之任何損失承擔任何責任。 中國銀行股份有限公司 BANK OF CHINA LIMITED (於中華人民共和國註冊成立的股份有限公司) (「本行」) (股份代號:3988) 關於召開2025年第三季度業績說明會的公告 重要內容提示: 一、業績說明會類型 業績說明會通過網絡文字互動方式召開,本行將針對2025年第三季度業績和 經營等情況與投資者進行交流,並對投資者普遍關注的問題進行回答。 1 • 會議召開時間:2025年10月29日16:30-17:30 • 會議召開方式:網絡文字互動 • 參會網址:上證路演中心( https://roadshow.sseinfo.com ) • 投資者可於2025年10月27日17:00前將相關問題通過電子郵件的形式發送至 本行郵箱 ir@bankofchina.com ,或在會議召開時提問。本行將於2025年第三 季度業績說明會(「業績說明會」)上對投資者普遍關注的問題進行回答。 二、業績說明 ...