HNHS(600156)

Search documents

华升股份(600156) - 华升股份关于召开2025年第三季度业绩说明会的公告

2025-10-31 09:49

证券代码:600156 证券简称:华升股份 公告编号:临 2025-051 会议召开地点:上海证券交易所上证路演中心(网址:https://r oadshow.sseinfo.com/) 会议召开方式:上证路演中心网络互动 投资者可于 2025 年 10 月 28 日(星期二)至 11 月 3 日(星期 一)16:00 前登录上证路演中心网站首页点击"提问预征集"栏目或通 过公司邮箱 hsgfzqswb@163.com 进行提问。公司将在说明会上对投 资者普遍关注的问题进行回答。 湖南华升股份有限公司(以下简称"公司")已于 2025 年 10 月 28 日发布《华升股份 2025 年第三季度报告》,为便于广大投资者更全 面深入地了解公司 2025 年第三季度经营成果、财务状况,公司计划 于 2025 年 11 月 4 日(星期二)10:00-11:00 举行 2025 年第三季度业 绩说明会,就投资者关心的问题进行交流。 一、说明会类型 本次投资者说明会以网络互动形式召开,公司将针对 2025 年第 三季度的经营成果及财务指标的具体情况与投资者进行互动交流和 沟通,在信息披露允许的范围内就投资者普遍关注的问 ...

A股算力租赁跨界:有梦想照进现实也有一戳就破的泡沫|焦点

Tai Mei Ti A P P· 2025-10-31 04:44

Core Insights - The recent failure of Qunxing Toys in the computing power rental sector marks another setback for traditional companies attempting to diversify into this field, highlighting the challenges faced by many A-share companies in pursuing new growth avenues amidst stagnating core businesses [1][2]. Industry Overview - The surge in generative AI since 2024 has led to an exponential increase in demand for computing power, creating a rapidly growing market that many A-share companies are eager to enter as they seek new growth opportunities [2][10]. - A diverse range of companies, from toy manufacturers to construction firms, have announced their entry into the computing power rental business, driven primarily by the need to overcome growth bottlenecks in their core operations [2][3]. Company Examples - Qunxing Toys reported a nearly 500% year-on-year revenue increase in 2024 but still faced significant losses, prompting its entry into the computing power sector through a planned acquisition of a computing service provider [2]. - Hainan Huatie, previously focused on construction equipment rental, announced a significant investment of 10 billion in computing power and secured a contract worth nearly 3.7 billion, indicating a strong push for transformation [3]. - Lianhua Holdings, despite facing losses in its computing power business, managed to achieve a breakeven point in the first half of 2025, although it still contends with rising interest expenses [7]. Market Reactions - The capital market has responded positively to announcements related to computing power, with stock prices of companies involved in this sector experiencing significant increases following such news [4][6]. - However, as the initial excitement wanes, a clear differentiation is emerging among companies based on their actual performance and the sustainability of their computing power ventures [6][11]. Future Outlook - The computing power rental market is projected to grow at a compound annual growth rate of 53% over the next three years, with the market size expected to reach 1,346 EFlops by 2027, supported by national strategic initiatives [10][12]. - Despite the promising outlook, the industry presents high barriers to entry, including the need for stable supply chains, strong operational capabilities, and effective financial management [11][12].

华升股份(600156.SH):前三季度净亏损1544.48万元

Ge Long Hui A P P· 2025-10-27 12:43

Group 1 - The core point of the article is that Huasheng Co., Ltd. (600156.SH) reported a total operating revenue of 657 million yuan for the first three quarters of 2025, representing a year-on-year increase of 32.62% [1] - The net profit attributable to shareholders of the parent company was a loss of 15.44 million yuan, which is a reduction in losses by 6.395 million yuan compared to the same period last year [1] - The basic earnings per share were reported at -0.0384 yuan [1]

华升股份:10月27日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-27 10:17

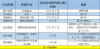

Group 1 - The core point of the article is that Huasheng Co., Ltd. announced the convening of its 23rd meeting of the 9th Board of Directors on October 27, 2025, to discuss the proposal for the 4th extraordinary shareholders' meeting of 2025 [1] - For the year 2024, Huasheng Co., Ltd.'s revenue composition is as follows: trade business accounts for 80.97%, textile production accounts for 16.6%, other businesses account for 2.16%, and pharmaceutical machinery accounts for 0.27% [1] - As of the report date, Huasheng Co., Ltd. has a market capitalization of 3.5 billion yuan [1]

华升股份:2025年前三季度净利润约-1544万元

Mei Ri Jing Ji Xin Wen· 2025-10-27 10:10

Group 1 - The core point of the article is that Huasheng Co., Ltd. reported its third-quarter performance, showing a significant revenue increase but also a net loss [1] - For the first three quarters of 2025, the company's revenue was approximately 657 million yuan, representing a year-on-year increase of 32.62% [1] - The net profit attributable to shareholders was a loss of approximately 15.44 million yuan, with basic earnings per share reflecting a loss of 0.0384 yuan [1] Group 2 - As of the report, Huasheng Co., Ltd. has a market capitalization of 3.5 billion yuan [2]

华升股份(600156) - 华升股份关于续聘会计师事务所的公告

2025-10-27 10:01

湖南华升股份有限公司 关于续聘会计师事务所的公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 重要内容提示: 拟续聘的会计师事务所名称:众华会计师事务所(特殊普通 合伙)(以下简称"众华") 证券代码:600156 证券简称:华升股份 公告编号:临 2025-049 本议案尚需提交公司股东会审议 一、拟续聘会计师事务所的基本情况 (一)机构信息 1.基本信息 众华会计师事务所(特殊普通合伙)的前身是 1985 年成立的上海 社科院会计师事务所,于 2013 年经财政部等部门批准转制成为特殊 普通合伙企业,注册地址为上海市嘉定工业区叶城路1630号5幢1088 室。众华自 1993 年起从事证券服务业务,具有丰富的证券服务业务 经验。 众华的首席合伙人为陆士敏先生,2024 年末合伙人人数为 68 人, 注册会计师共 359 人,其中签署过证券服务业务审计报告的注册会计 师超过 180 人。 众华 2024 年度的上市公司审计客户共 73 家,审计收费总额为人 民币 9,193.46 万元。众华的上市公司审计客户主要涉及行业 ...

华升股份(600156) - 华升股份关于召开2025年第四次临时股东会的通知

2025-10-27 10:00

证券代码:600156 证券简称:华升股份 公告编号:临 2025-050 湖南华升股份有限公司 关于召开2025年第四次临时股东会的通知 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 重要内容提示: 股东会召开日期:2025年11月12日 本次股东会采用的网络投票系统:上海证券交易所股东会网络 投票系统 一、 召开会议的基本情况 (一) 股东会类型和届次 2025年第四次临时股东会 (二) 股东会召集人:董事会 (三) 投票方式:本次股东会所采用的表决方式是现场投票和网 络投票相结合的方式 (四) 现场会议召开的日期、时间和地点 召开的日期时间:2025 年 11 月 12 日 14 点 30 分 召开地点:湖南省长沙市天心区芙蓉中路三段 420 号华升大厦九 楼 (五) 网络投票的系统、起止日期和投票时间。 二、 会议审议事项 本次股东会审议议案及投票股东类型 网络投票系统:上海证券交易所股东会网络投票系统 网络投票起止时间:自2025 年 11 月 12 日 至2025 年 11 月 12 日 采用上海证券交易所网络投 ...

华升股份(600156) - 华升股份第九届董事会第二十三次会议决议公告

2025-10-27 10:00

湖南华升股份有限公司 证券代码:600156 股票简称:华升股份 编号:临2025-048 同意续聘众华会计师事务所(特殊普通合伙)担任公司 2025 年度财 务报表及内部控制的审计机构。 具体内容详见在上海证券交易所网站(www.sse.com.cn)及指定媒体 披露的《华升股份关于续聘会计师事务所的公告》(临 2025-049)。 本议案尚需提交公司股东会审议。 三、以 7 票赞成,0 票反对,0 票弃权,审议通过了《关于召开 2025 年第四次临时股东会的议案》。 第九届董事会第二十三次会议决议公告 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 湖南华升股份有限公司(以下简称"公司")于 2025 年 10 月 27 日以 通讯方式召开第九届董事会第二十三次会议,会议通知于 2025 年 10 月 24 日以邮件方式向全体董事发出。会议应参加表决的董事 7 人,实际参 加表决的董事 7 人,会议由董事长谢平先生主持,会议符合《公司法》和 《公司章程》的有关规定,与会董事经投票表决,形成如下决议: 一、以 7 票赞成,0 ...

华升股份(600156) - 2025 Q3 - 季度财报

2025-10-27 09:55

Financial Performance - The company's operating revenue for Q3 2025 reached ¥223,456,215.91, representing a year-on-year increase of 35.30%[4] - The total profit for the period was a loss of ¥5,163,047.49, a decrease of 167.90% compared to the same period last year[4] - The net profit attributable to shareholders was a loss of ¥1,889,742.42, down 149.96% year-on-year[4] - Basic earnings per share for the period were -¥0.0047, a decline of 150.00% compared to the previous year[5] - Total operating revenue for the first three quarters of 2025 reached ¥656,601,683.12, a significant increase of 32.5% compared to ¥495,105,293.74 in the same period of 2024[17] - Net profit for the first three quarters of 2025 was a loss of ¥20,964,511.16, an improvement from a loss of ¥26,318,992.73 in the same period of 2024[18] - The company reported a basic and diluted earnings per share of -¥0.0384 for the first three quarters of 2025, compared to -¥0.0543 in 2024[18] Cash Flow - The net cash flow from operating activities for the year-to-date was a negative ¥76,918,416.00, indicating cash outflow pressures[4] - Cash flow from operating activities showed a net outflow of ¥76,918,416.00 in the first three quarters of 2025, compared to a net outflow of ¥53,278,331.55 in 2024[19] - The company’s cash inflow from operating activities was ¥766,733,791.43, compared to ¥548,512,967.32 in the previous year[19] - Net cash flow from investment activities amounted to $105,144,931.91, a significant increase compared to a net outflow of $20,289,507.43 in the previous period[20] - Total cash inflow from financing activities was $80,480,000.00, while cash outflow totaled $97,052,793.38, resulting in a net cash flow of -$16,572,793.38[20] - The ending balance of cash and cash equivalents increased to $117,895,376.59 from an initial balance of $106,241,654.06, reflecting a net increase of $11,653,722.53[20] - Cash received from investment income was $48,462,498.71, contributing to the overall positive cash flow from investment activities[20] - Cash paid for the acquisition of fixed assets and other long-term assets was $8,629,872.22, indicating ongoing investment in company infrastructure[20] - Cash received from borrowings was $80,300,000.00, highlighting the company's reliance on debt financing during the period[20] - Cash paid for debt repayment was $87,292,013.89, demonstrating the company's commitment to managing its liabilities[20] - The company received $180,000.00 in other financing-related cash, which supplements its overall cash inflow[20] - The cash flow from investment activities was primarily driven by cash recovered from investments totaling $67,171,516.77[20] Assets and Liabilities - Total assets at the end of the reporting period were ¥824,608,289.19, down 8.05% from the end of the previous year[5] - The company's total assets decreased to ¥824,608,289.19 as of September 30, 2025, from ¥896,803,901.26 at the end of 2024[15] - Current assets totaled ¥343,027,062.90, down from ¥377,956,150.33 at the end of 2024[14] - Total liabilities amounted to ¥439,354,404.73, a decrease from ¥486,564,398.62 in 2024[15] Shareholder Information - The number of ordinary shareholders at the end of the reporting period was 29,669[10] - The largest shareholder, Hunan Xingxiang Investment Holding Group Co., Ltd., holds 40.31% of the shares[10] Operational Challenges - The company faced challenges due to rising raw material costs and declining product sales prices, impacting gross margins[8] Future Outlook - The company plans to adopt new accounting standards starting in 2025, which may impact future financial reporting[21]

A股上市公司纷纷实物回馈股东 创新互动模式激活资本市场生态

Zheng Quan Shi Bao Wang· 2025-10-21 03:50

Core Insights - The article highlights the increasing trend of A-share listed companies in China engaging in physical rewards for shareholders, enhancing investor relations and creating a unique investment-consumption ecosystem [1][4]. Group 1: Company Activities - Over 30 listed companies have participated in shareholder reward activities since 2025, offering products, discount coupons, and tourism rights to investors [1][4]. - Companies like Tianyu Bio, Huasheng Co., and Beiqing Song have announced various forms of physical rewards, aiming to deepen shareholder experience with core products and strengthen their value recognition [2][3]. - The second "Listed Company Shareholder Festival" organized by Tonghuashun attracted nearly 100 companies, providing a wide range of gifts including electronics, food, and cosmetics to shareholders [3]. Group 2: Policy and Market Trends - The trend of physical rewards aligns with the China Securities Regulatory Commission's policy to enhance investor protection and improve returns for shareholders [4]. - The increasing participation of companies in physical reward activities indicates a shift from individual cases to a systematic approach in investor relations management [4]. - The practice of physical rewards is expected to become a significant indicator of corporate governance and market competitiveness in the future [4].