HengBao Co.,LTD.(002104)

Search documents

主力资金 | 2股尾盘获主力资金大幅出手

Zheng Quan Shi Bao Wang· 2025-10-27 11:20

Group 1: Market Overview - The A-share market continued its strong performance on October 27, with the Shanghai Composite Index approaching the 4000-point mark [1] - Most industry sectors saw gains, particularly electronic chemicals, small metals, shipbuilding, energy metals, semiconductors, steel, and electronic components [1] - The main funds in the market experienced a net outflow of 7.59 billion yuan, with 10 sectors seeing net inflows, notably electronics and communications [1] Group 2: Fund Inflows - The electronics and communications sectors had significant net inflows of 3.866 billion yuan and 2.25 billion yuan, respectively, far exceeding other sectors [1] - Other sectors with net inflows included non-ferrous metals (0.877 billion yuan), steel (0.44 billion yuan), and pharmaceutical biology (0.39 billion yuan) [1] Group 3: Individual Stock Performance - 12 stocks saw net inflows exceeding 400 million yuan, with Shenghong Technology leading at 0.947 billion yuan, followed by Hengbao Co. at 0.872 billion yuan [2][3] - Shenghong Technology has become one of the few companies globally capable of mass-producing HDI with 6 layers and above, and is actively developing ultra-thick board technology [2] - Hengbao Co. experienced a limit-up increase, with significant net purchases from institutional investors [2] Group 4: Fund Outflows - 40 stocks experienced net outflows exceeding 200 million yuan, with Dongfang Wealth, Kehua Data, and Sanhua Intelligent Control seeing outflows over 700 million yuan [4] - The top outflow stock was Dongfang Wealth with a net outflow of 0.918 billion yuan, followed by Kehua Data at 0.910 billion yuan and Sanhua Intelligent Control at 0.844 billion yuan [5] Group 5: Tail-End Fund Activity - At the end of the trading day, the main funds saw a net inflow of 168 million yuan, with electronics, pharmaceutical biology, and public utilities sectors each exceeding 100 million yuan in inflows [6] - Individual stocks with significant tail-end inflows included Luxshare Precision and Ningde Times, both exceeding 150 million yuan [6][7] - Conversely, stocks like New Yisheng and Chuangjiang New Materials saw tail-end outflows exceeding 100 million yuan [8][9]

恒宝股份涨停,深股通龙虎榜上净买入1.91亿元

Zheng Quan Shi Bao Wang· 2025-10-27 09:37

Group 1 - Hengbao Co., Ltd. experienced a limit-up increase today with a turnover rate of 17.50% and a transaction volume of 2.298 billion yuan, showing a fluctuation of 8.65% [2] - Institutional investors net bought 112 million yuan, while the Shenzhen Stock Connect saw a net purchase of 191 million yuan, and the total net buying from brokerage seats reached 204 million yuan [2] - The stock was listed on the Dragon and Tiger list due to a daily price deviation of 8.74%, with institutional specialized seats net buying 112 million yuan and Shenzhen Stock Connect net buying 191 million yuan [2] Group 2 - The top five trading departments on the Dragon and Tiger list had a total transaction volume of 762 million yuan, with a buying amount of 634 million yuan and a selling amount of 128 million yuan, resulting in a net buying of 506 million yuan [2] - Among the trading departments, one institutional specialized seat appeared, with a buying amount of 118 million yuan and a selling amount of 6.05 million yuan, leading to a net purchase of 112 million yuan [2] - The stock has appeared on the Dragon and Tiger list 49 times in the past six months, with an average price increase of 1.61% the next day and an average increase of 8.24% over the following five days [2] Group 3 - As of October 24, the latest margin trading balance for Hengbao Co., Ltd. was 718 million yuan, with a financing balance of 718 million yuan and a securities lending balance of 200 yuan [3] - In the past five days, the financing balance decreased by 36.02 million yuan, representing a decline of 4.78%, while the securities lending balance decreased by 42 yuan, a decline of 2.02% [3] - On October 27, the top buying departments included Shenzhen Stock Connect with a buying amount of 216.19 million yuan and an institutional specialized seat with a buying amount of 117.70 million yuan [4]

通信行业资金流入榜:恒宝股份、新易盛等净流入资金居前

Zheng Quan Shi Bao Wang· 2025-10-27 09:15

Market Overview - The Shanghai Composite Index rose by 1.18% on October 27, with 28 out of 31 sectors experiencing gains, led by the communication and electronics sectors, which increased by 3.22% and 2.96% respectively [1] - The media, food and beverage, and real estate sectors saw declines of 0.95%, 0.20%, and 0.11% respectively [1] Capital Flow Analysis - The main capital flow showed a net outflow of 136 million yuan across the two markets, with 12 sectors experiencing net inflows [1] - The electronics sector had the highest net inflow of 6.112 billion yuan, followed by the non-ferrous metals sector with a net inflow of 2.529 billion yuan [1] Communication Sector Performance - The communication sector saw a significant increase of 3.22%, with a net inflow of 2.433 billion yuan [2] - Out of 125 stocks in the communication sector, 75 stocks rose, including one that hit the daily limit, while 42 stocks declined [2] - The top three stocks with the highest net inflow in the communication sector were Hengbao Co. with 953 million yuan, followed by Xinyi Technology and Cambridge Technology with 632 million yuan and 500 million yuan respectively [2] Communication Sector Capital Outflow - The communication sector also had stocks with notable capital outflows, with the highest outflow from Hengtong Optic-Electric at 202.51 million yuan, followed by Supercom and China Mobile with outflows of 164.83 million yuan and 135.68 million yuan respectively [4]

龙虎榜丨恒宝股份涨停,深股通净买入1.91亿元,二游资净买入1.57亿元

Ge Long Hui A P P· 2025-10-27 08:56

格隆汇10月27日|恒宝股份(维权)(002104.SZ)今日涨停,换手率17.5%,成交额22.98亿元。龙虎榜数据显示,深股通买入2.16亿元,卖出2553万元,净买 入1.91亿元;一机构买入1.18亿元,卖出605万元,净买入1.12亿元;游资"中山东路"位列买四席位,净买入8046万元;"量化打板"位列买五席位,净买入 7702万元。上榜席位全天买入6.34亿元,卖出1.28亿元,合计净买入5.06亿元。(格隆汇) | 序号 | 交易营业部名称 | | | 买入金额(万) | 占总成交比例 | | --- | --- | --- | --- | --- | --- | | 1 | 深股通专用 | 765次 46.14% | 2 | 21619.01 | 9.41% | | 2 | 国泰海通证券股份有限公司上海静安区新闻路证券营业部 | 141次 60.28% | ▶ | 11985.74 | 5.22% | | 3 | 机构专用 | 1607次 42.25% | A | 11769.65 | 5.12% | | 4 | 国泰海通证券股份有限公司上海松江区中山东路证券营业部 | 93次 58.06% ...

恒宝股份今日涨停,1家机构专用席位净买入1.12亿元

Xin Lang Cai Jing· 2025-10-27 08:29

恒宝股份今日涨停,成交额22.98亿元,换手率17.50%,盘后龙虎榜数据显示,深股通专用席位买入 2.16亿元并卖出2552.86万元,1家机构专用席位净买入1.12亿元。 ...

通信设备板块10月27日涨3.81%,仕佳光子领涨,主力资金净流入26.01亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-27 08:25

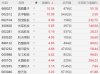

证券之星消息,10月27日通信设备板块较上一交易日上涨3.81%,仕佳光子领涨。当日上证指数报收于 3996.94,上涨1.18%。深证成指报收于13489.4,上涨1.51%。通信设备板块个股涨跌见下表: | 代码 | 名称 | 收盘价 | 涨跌幅 | 成交量(手) | 成交额(元) | | | --- | --- | --- | --- | --- | --- | --- | | 688313 | 仕佳光子 | 75.95 | 11.94% | 50.98万 | | 38.85 Z | | 002104 | 恒宝股份 | 22.36 | 9.99% | 104.97万 | | 22.98亿 | | 300689 | 澄天伟业 | 56.51 | 9.98% | 7.41万 | | 4.15 乙 | | 300502 | 新易盛 > | 403.95 | 8.31% | 1 58.16万 | | 231.83亿 | | 688027 | 国盾量子 | 450.41 | 7.53% | 8.25万 | | 37.66亿 | | 300394 | 天孚通信 | 190.06 | 6.78% | 48.10万 | ...

A股异动丨中央定调6大未来产业之一!量子科技股走强,国盾量子涨超10%

Ge Long Hui A P P· 2025-10-27 02:53

Core Insights - The A-share market has seen a collective surge in quantum technology stocks, with notable increases in companies such as GuoDun Quantum and DaHua Intelligent [1][2] - The Central Committee of the Communist Party of China has proposed the development of emerging pillar industries, including quantum technology, as part of the 15th Five-Year Plan, which is expected to create several trillion-yuan markets [1] Company Performance - GuoDun Quantum (688027) rose by 10.54%, with a market capitalization of 47.6 billion and a year-to-date increase of 55.18% [2] - DaHua Intelligent (002512) increased by 10.09%, with a market cap of 5.462 billion and a year-to-date rise of 3.59% [2] - HengBao Co. (002104) reached a 9.99% increase, with a market cap of 15.8 billion and a year-to-date surge of 232.75% [2] - Other notable performers include GuangKu Technology (300620) up 5.85%, GuangXun Technology (002281) up 5.19%, and KeDa GuoChuang (300520) up 4.95% [2] Industry Trends - The proposed 15th Five-Year Plan emphasizes the acceleration of strategic emerging industries such as quantum technology, bio-manufacturing, hydrogen energy, and nuclear fusion, which are expected to become new economic growth points [1] - The plan aims to lay a forward-looking foundation for future industries, potentially reshaping China's high-tech sector over the next decade [1]

恒宝股份股价跌5.01%,华泰柏瑞基金旗下1只基金重仓,持有27.29万股浮亏损失28.93万元

Xin Lang Cai Jing· 2025-10-23 06:06

Core Viewpoint - Hengbao Co., Ltd. experienced a 5.01% decline in stock price, closing at 20.11 CNY per share, with a trading volume of 834 million CNY and a turnover rate of 6.83%, resulting in a total market capitalization of 14.244 billion CNY [1]. Company Overview - Hengbao Co., Ltd. is located in the Hongtang Industrial Zone of Danyang City, Jiangsu Province, and was established on September 24, 1996. The company was listed on January 10, 2007. Its main business involves the research, development, production, and sales of card products such as magnetic stripe cards and password cards, as well as related operating systems (COS) and ticket products [1]. - The revenue composition of Hengbao Co., Ltd. is as follows: card products account for 78.19%, module products for 21.27%, ticket products for 0.31%, and other supplementary products for 0.24% [1]. Fund Holdings - From the perspective of major fund holdings, one fund under Huatai-PB holds a significant position in Hengbao Co., Ltd. The Zhongzheng 2000 fund (563300) held 272,900 shares in the second quarter, representing 0.27% of the fund's net asset value, ranking as the tenth largest holding. The estimated floating loss today is approximately 289,300 CNY [2]. - The Zhongzheng 2000 fund was established on September 6, 2023, with a latest scale of 1.984 billion CNY. Year-to-date returns are 27.85%, ranking 1711 out of 4218 in its category; one-year returns are 33.95%, ranking 1191 out of 3875; and since inception, returns are 29.86% [2]. - The fund managers, Liu Jun and Li Mu Yang, have cumulative management tenures of 16 years and 146 days, and 4 years and 292 days, respectively. Liu Jun manages assets totaling 466.972 billion CNY, with the best fund return during his tenure being 143.37% and the worst being -45.64%. Li Mu Yang manages assets of 21.183 billion CNY, with the best return of 140.75% and the worst of -43.44% during his tenure [2].

深圳锚定“三年千亿”并购目标,加速产业整合升级,金融科技ETF(516860)盘中探底回升

Xin Lang Cai Jing· 2025-10-23 03:16

Group 1: Financial Technology Sector Performance - The China Securities Financial Technology Theme Index decreased by 0.91% as of October 23, 2025, with mixed performance among constituent stocks [3] - Geer Software led the gains with an increase of 10.03%, while Dongxin Peace experienced the largest decline at 6.52% [3] - The Financial Technology ETF (516860) fell by 0.88%, with a latest price of 1.46 yuan, but showed a cumulative increase of 2.94% over the past three months, ranking 2nd out of 6 comparable funds [3] Group 2: Market Liquidity and Trading Activity - The Financial Technology ETF had a turnover rate of 1.8% during the trading session, with a transaction volume of 42.15 million yuan [3] - Over the past month, the average daily trading volume of the Financial Technology ETF was 208 million yuan, placing it in the top 2 among comparable funds [3] Group 3: Strategic Development Initiatives - Shenzhen is promoting high-quality development of mergers and acquisitions (M&A) from 2025 to 2027, focusing on strategic emerging industries such as integrated circuits, artificial intelligence, new energy, and biomedicine [4] - The action plan aims for a comprehensive improvement in the quality of listed companies in Shenzhen by the end of 2027, targeting a total market capitalization of over 20 trillion yuan and the cultivation of 20 companies with a market value of over 100 billion yuan [4] Group 4: Financial Technology ETF Growth Metrics - The Financial Technology ETF saw a significant growth of 9.78 billion yuan in scale over the past three months, ranking 2nd among comparable funds [5] - The ETF also experienced an increase of 6.38 billion shares in the same period, again ranking 2nd among comparable funds [5] - The index closely tracks the performance of listed companies involved in financial technology, with the top ten weighted stocks accounting for 55.55% of the index as of September 30, 2025 [5]

上海“AI-FI”实验室宣告成立,金融科技ETF(516860)涨超1%,连续3日获资金净流入

Sou Hu Cai Jing· 2025-10-20 02:56

Group 1 - The core viewpoint of the news highlights the strong performance of the financial technology sector, with the China Securities Financial Technology Theme Index rising by 1.52% and the Financial Technology ETF increasing by 1.38% as of October 20, 2025 [2][3] - The Financial Technology ETF has shown a significant increase of 26.79% over the past six months, ranking 3rd out of 6 comparable funds [2] - The trading volume of the Financial Technology ETF reached 43.1491 million yuan, with a turnover rate of 1.79% [2] Group 2 - The establishment of the "Shanghai AI-Financial Laboratory" during the Global Wealth Management Forum aims to promote the integration of AI technology with the financial industry, marking a significant step in Shanghai's financial technology ecosystem [3] - The Vice President of the People's Bank of China emphasized the need for countries to develop financial systems that align with their technological development stages [3] - The Financial Technology ETF's latest scale reached 2.376 billion yuan, ranking 2nd out of 6 comparable funds [3] Group 3 - The Financial Technology ETF has seen a net inflow of 28.4017 million yuan over the past three days, with a maximum single-day net inflow of 20.9822 million yuan [4] - The index closely tracks companies involved in financial technology, with the top ten weighted stocks accounting for 55.55% of the index [4]