ACCELINK(002281)

Search documents

光迅科技-买入-2025 年第三季度营收环比增长,利润率上升

2025-10-31 00:59

Summary of Accelink's 3Q25 Earnings Call Company Overview - **Company**: Accelink (Ticker: 002281.SZ) - **Sector**: Technology - **Date of Earnings Report**: 24 October 2025 Key Financial Highlights - **Revenue Growth**: - 3Q25 revenue increased by 45.0% year-over-year (y-y) and 8.9% quarter-over-quarter (q-q) to CNY 3.29 billion - 9M25 revenue growth was 58.65% y-y, with earnings growth at 54.95% y-y [1][2] - **Earnings Performance**: - 3Q25 earnings increased by 35.8% y-y and 56.0% q-q, reaching CNY 347 million - Adjusted operating margin improved by 0.2 percentage points (pp) y-y and 4.8 pp q-q [1][5] - **Gross Margin**: - Gross margin decreased by 1 pp y-y but increased by 3.9 pp q-q due to a better product mix in the optical transceivers sector [1][5] - **Operating Cash Flow**: - Strong performance with operating cash flow reaching CNY 1.08 billion in 9M25, a 206.64% increase y-y [1] Market and Industry Insights - **Demand Trends**: - Notable uptick in demand for optical transceivers in the global Automatic Identification and Data Capture (AIDC) market - Large Chinese Cloud Service Providers (CSPs) are investing in AI infrastructure, positioning Accelink to benefit from this trend [2] - **Future Growth Projections**: - Estimated 53% revenue compound annual growth rate (CAGR) from the optical transceivers segment for FY25-27F, expected to contribute 49% of total revenue by FY27F [2] Investment Outlook - **Rating and Target Price**: - Maintained "Buy" rating with a target price of CNY 80, based on a price-to-earnings (P/E) ratio of 43x FY26F earnings per share (EPS) of CNY 1.87 [2][3] - **Current Stock Valuation**: - Stock trading at 33.8x FY26F EPS, indicating potential upside [2] Risks and Challenges - **Potential Risks**: - Lower-than-expected demand for optical components from the datacom and telecom markets - Slower-than-anticipated R&D progress on optical chipsets - Increased pricing competition leading to margin dilution - Potential sanctions affecting the technology sector [12] Additional Information - **Analysts**: Bing Duan and Ethan Zhang from Nomura International (Hong Kong) Ltd. [4] - **Closing Price on Report Date**: CNY 63.23 [3]

光模块三剑客三季报出炉 中际旭创Q3净利润环比增长30%

Xin Lang Cai Jing· 2025-10-30 13:48

Core Viewpoint - The report highlights the strong financial performance of several optical module companies in their third-quarter results, indicating significant growth in net profits for key players in the industry [1]. Group 1: Company Performance - Zhongji Xuchuang reported a third-quarter net profit of 3.137 billion yuan, representing a quarter-on-quarter increase of 30.06% [1]. - Xinyi Technology achieved a net profit of 6.327 billion yuan in the first three quarters, marking a year-on-year growth of 284.37% [1]. - Shijia Photon recorded a net profit of 300 million yuan for the first three quarters, with a remarkable year-on-year increase of 727.74% [1]. Group 2: Industry Overview - Multiple optical module companies, including Zhongji Xuchuang, Xinyi Technology, and Shijia Photon, have disclosed their third-quarter reports, showcasing robust financial results [1]. - The overall performance of the optical module sector appears to be strong, with significant profit growth across various companies [1].

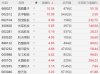

光纤概念下跌2.56%,14股主力资金净流出超亿元

Zheng Quan Shi Bao Wang· 2025-10-30 09:39

Core Insights - The optical fiber sector experienced a decline of 2.56%, ranking among the top losers in the concept sector, with significant drops in stocks such as Hangzhou Dianzi and Tengjing Technology [1][2] - A total of 56 stocks in the optical fiber sector saw net outflows of 7.899 billion yuan, with Tianfu Communication leading the outflow at 2.459 billion yuan [2][4] Sector Performance - The optical fiber concept sector was one of the worst performers, with a decline of 2.56%, while other sectors like the China-Korea Free Trade Zone and Quantum Technology saw gains of 1.45% and 1.27% respectively [2] - The top gainers in the optical fiber sector included stocks like Jieput and Xinyin Electronics, which rose by 5.63% and 3.14% respectively [1][4] Fund Flow Analysis - The optical fiber sector faced a significant net outflow of 7.899 billion yuan, with 14 stocks experiencing outflows exceeding 100 million yuan [2][3] - The stocks with the highest net outflows included Tianfu Communication (-11.56%), ZTE Corporation (-2.97%), and Yongding Co. (-4.99%) [3][4] Stock Performance - Among the optical fiber stocks, Jieput saw the highest net inflow of 1.244 billion yuan, while other notable gainers included Hengtong Optic and Yuanjie Technology [4] - The stock performance varied widely, with some stocks like Tianfu Communication and Tengjing Technology experiencing significant declines of over 11% [3][4]

光迅科技(002281) - 武汉光迅科技股份有限公司关于公司向特定对象发行A股股票获得中国信息通信科技集团有限公司批复的公告

2025-10-30 08:44

证券代码:002281 证券简称:光迅科技 公告编号:(2025)067 武汉光迅科技股份有限公司 关于公司向特定对象发行 A 股股票获得 中国信息通信科技集团有限公司批复的公告 本公司及董事会全体成员保证公告内容真实、准确和完整,没有虚假记载、 误导性陈述或重大遗漏。 武汉光迅科技股份有限公司董事会 二〇二五年十月三十一日 武汉光迅科技股份有限公司(以下简称"公司")于 2025 年 9 月 9 日召开 了第七届董事会第二十八次会议和第七届监事会第二十六次会议,审议通过了公 司向特定对象发行 A 股股票的相关议案。公司于 2025 年 10 月 10 日召开了第七 届董事会第二十九次会议和第七届监事会第二十七次会议,审议通过了关于调整 公司 2025 年度向特定对象发行 A 股股票方案等议案。内容详见巨潮资讯网 (www.cninfo.com.cn)。 公司于日前收到中国信息通信科技集团有限公司(以下简称"中国信科集团") 出具的《关于武汉光迅科技股份有限公司向特定对象发行 A 股股票有关问题的批 复》,同意公司本次向特定对象发行不超过 242,055,525 股(含本数)人民币普 通 股 股 票 的 总 ...

光迅科技前三季营收增长58.65% 聚焦主业光通信领域表现亮眼

Chang Jiang Shang Bao· 2025-10-27 23:52

Core Insights - Guangxun Technology (002281.SZ) has experienced explosive growth in its performance, driven by strong market demand, optimized product structure, and increased R&D investment [1][2]. Financial Performance - For the first three quarters, the company achieved operating revenue of 8.532 billion yuan, a year-on-year increase of 58.65% [2]. - The net profit attributable to shareholders reached 719 million yuan, up 54.95% year-on-year, while the non-recurring net profit was 678 million yuan, reflecting a 49.29% increase [1][2]. - In Q3 alone, the operating revenue was 3.289 billion yuan, marking a 45.01% year-on-year growth, with a net profit of 347 million yuan, up 35.42% [2]. R&D Investment - The company invested 672 million yuan in R&D for the first three quarters, a 31.83% increase, with R&D expenses accounting for over 7.8% of operating revenue [3]. - Significant advancements have been made in high-speed optical modules, silicon photonic chips, and co-packaged optics, with some products entering mass delivery stages [3]. Market Expansion - Guangxun Technology is actively responding to the growing demand for high-speed interconnects driven by global AI infrastructure development, with its optical module products targeting data centers, AI servers, backbone networks, and metropolitan networks [3]. - The company is expanding its overseas market share and maintaining stable partnerships with several international leading clients [3]. Financial Health - As of the end of the reporting period, the total assets of the company stood at 16.366 billion yuan, a year-on-year increase of 10.68%, while equity attributable to shareholders was 9.777 billion yuan, up 7.32% [3]. Strategic Direction - The company aims to deepen its focus on optical communication and high-speed interconnect fields, actively positioning itself in emerging areas such as AI-optical integration, silicon photonic chips, and advanced packaging [3]. - Guangxun Technology plans to leverage national strategies like "East Data West Computing" and "Computing Power Network" to enhance product competitiveness and brand influence [3].

光模块大涨,AI人工智能ETF(512930)涨超2.6%,近3月跟踪精度同类第1

Sou Hu Cai Jing· 2025-10-27 06:28

Core Insights - The China Securities Artificial Intelligence Theme Index (930713) has shown a strong increase of 2.54% as of October 27, 2025, with notable gains in constituent stocks such as Xinyi Sheng (300502) up 9.18% and Dahua Technology (002236) up 8.07% [1] - The AI Artificial Intelligence ETF (512930) has also risen by 2.60%, with a recent price of 2.25 yuan, and has accumulated a weekly increase of 10.84% as of October 24, 2025 [1] - The ETF has a low management fee rate of 0.15% and a custody fee rate of 0.05%, making it one of the most cost-effective options in its category [1] - The tracking error for the AI Artificial Intelligence ETF over the past three months is 0.009%, indicating the highest tracking precision among comparable funds [1] Index Composition - As of September 30, 2025, the top ten weighted stocks in the China Securities Artificial Intelligence Theme Index account for 61.36% of the index, with Xinyi Sheng (300502) and Zhongji Xuchuang (300308) being the top two [2] - The top ten stocks by weight include: - Xinyi Sheng (300502) - 11.87% - Zhongji Xuchuang (300308) - 11.73% - Cambricon (688256) - 9.08% - Lianqi Technology (688008) - 5.80% - Zhongke Shuguang (603019) - 5.71% - iFlytek (002230) - 4.24% - OmniVision Technologies (603501) - 4.21% - Hikvision (002415) - 3.81% - Inspur Information (000977) - 2.51% - Kingsoft Office (688111) - 2.40% [4]

商业航天活跃,产业拐点已至!卫星ETF(159206)连续四天资金净流入,成分股航天智装领涨

Xin Lang Cai Jing· 2025-10-27 06:20

Core Viewpoint - The recent acceleration in China's satellite internet construction is driving significant growth in related stocks, particularly in the satellite ETF sector, with notable increases in stock prices of key companies involved in this industry [2][5][6]. Group 1: Market Performance - The satellite ETF (159206) has risen by 1.89%, with significant gains in constituent stocks such as Aerospace Zhizhuang up over 11% and Guodun Quantum up over 8% [2][3]. - Other stocks showing strong performance include Alliance Electronics, XW Communication, and Guoke Micro, with increases ranging from approximately 5% to 8.5% [3]. Group 2: Industry Developments - China has recently accelerated its satellite internet initiatives, with three successful satellite launches in October, including the sixth batch of the "Thousand Sails Constellation" network [5]. - The successful launch of 12 low-orbit satellites using the Long March 8 rocket and the deployment of 18 satellites in one launch using the Long March 6 rocket highlight advancements in China's satellite capabilities [5]. - The successful launch of the 20th communication technology test satellite marks a significant milestone in satellite communication technology verification [5]. Group 3: Strategic Importance - The recent Fourth Plenary Session emphasized the strategic importance of the aerospace industry, positioning it as a core frontier industry amid international competition [6]. - The recognition of commercial aerospace as a "new growth engine" in the government work report further underscores the industry's elevated status and potential for accelerated development during the 14th Five-Year Plan period [6].

A股CPO概念继续强势,新易盛、中际旭创均再创新高!仕佳光子涨超12%,景旺电子逼近涨停,汇绿生态涨超6%,长芯博创涨5%

Ge Long Hui· 2025-10-27 03:45

Group 1 - The CPO concept stocks in the A-share market continue to rise, with notable increases in several companies [1] - Shijia Photon has risen over 12%, while Jingwang Electronics is approaching the daily limit increase [1] - New Yisheng and Huilv Ecology have both increased by over 6%, and Changxin Bochuang has risen over 5% [1] Group 2 - Companies such as New Yisheng, Huilv Ecology, Sry New Materials, and Zhongji Xuchuang have all reached historical highs [1]

A股异动丨中央定调6大未来产业之一!量子科技股走强,国盾量子涨超10%

Ge Long Hui A P P· 2025-10-27 02:53

Core Insights - The A-share market has seen a collective surge in quantum technology stocks, with notable increases in companies such as GuoDun Quantum and DaHua Intelligent [1][2] - The Central Committee of the Communist Party of China has proposed the development of emerging pillar industries, including quantum technology, as part of the 15th Five-Year Plan, which is expected to create several trillion-yuan markets [1] Company Performance - GuoDun Quantum (688027) rose by 10.54%, with a market capitalization of 47.6 billion and a year-to-date increase of 55.18% [2] - DaHua Intelligent (002512) increased by 10.09%, with a market cap of 5.462 billion and a year-to-date rise of 3.59% [2] - HengBao Co. (002104) reached a 9.99% increase, with a market cap of 15.8 billion and a year-to-date surge of 232.75% [2] - Other notable performers include GuangKu Technology (300620) up 5.85%, GuangXun Technology (002281) up 5.19%, and KeDa GuoChuang (300520) up 4.95% [2] Industry Trends - The proposed 15th Five-Year Plan emphasizes the acceleration of strategic emerging industries such as quantum technology, bio-manufacturing, hydrogen energy, and nuclear fusion, which are expected to become new economic growth points [1] - The plan aims to lay a forward-looking foundation for future industries, potentially reshaping China's high-tech sector over the next decade [1]

报喜!两家公司业绩增超7000%

Shang Hai Zheng Quan Bao· 2025-10-26 15:16

Group 1: Company Performance Highlights - Ecovacs Robotics reported a significant increase in Q3 2025 revenue of 4.201 billion yuan, up 29.26% year-on-year, and a net profit of 438 million yuan, up 7160.87% [1] - Deep South Housing A achieved a revenue of approximately 898.85 million yuan in the first three quarters of 2025, a year-on-year increase of 331.66%, with a net profit of about 145.12 million yuan, up 2791.57% [1] - Antong Holdings reported Q3 2025 revenue of 2.152 billion yuan, an 18.85% increase year-on-year, and a net profit of 152 million yuan, up 2155.18% [2] - Sichuan Changhong's Q3 2025 revenue was 25.184 billion yuan, down 2.69% year-on-year, but net profit increased to 507 million yuan, up 690.83% [2] - Zhenghai Magnetic Materials reported a revenue of approximately 4.973 billion yuan for the first three quarters of 2025, a 30.54% increase, with a net profit of about 228 million yuan, up 20.46% [3] - Gold Mountain reported Q3 2025 revenue of 3.372 billion yuan, up 66.39% year-on-year, and a net profit of 951 million yuan, up 140.98% [4] Group 2: Corporate Actions and Strategic Moves - Yiyi Co. plans to acquire 100% equity of Gao Ye Jia, with the stock resuming trading on October 27 [6][8] - Ying Tang Zhi Kong is planning to issue shares to acquire assets, leading to a stock suspension starting October 27 [18][35] - Dream Jie Co. faced dissent from board member Chen Jie regarding the Q3 2025 report, raising concerns about its accuracy and completeness [9] - Drugmaker WuXi AppTec intends to sell 100% equity of two subsidiaries for 2.8 billion yuan to focus on its CRDMO business model [20][21] - Huayi Technology is planning to invest in a new project with a budget of approximately 266.65 million yuan for advanced manufacturing capabilities [22]