VGT(300476)

Search documents

主力资金 | 2只机器人热门股获主力大幅抢筹

Zheng Quan Shi Bao Wang· 2025-10-31 11:41

Group 1: Market Overview - On October 31, A-shares experienced a collective pullback with the three major indices declining [1] - The main sectors that saw inflows included biopharmaceuticals, chemical pharmaceuticals, cultural media, internet services, medical services, and software development, while insurance, small metals, and semiconductors faced declines [1] Group 2: Capital Inflows and Outflows - A total of 14 industries saw net inflows of main capital, with the media and biopharmaceutical sectors receiving net inflows of 30.58 billion and 19.71 billion respectively [1] - The public utilities, agriculture, forestry, animal husbandry, and food and beverage sectors also saw net inflows exceeding 4 billion [1] - In contrast, 17 industries experienced net outflows, with electronics and communications leading the outflows at 183.09 billion and 94.37 billion respectively [1] Group 3: Individual Stock Performance - Eight stocks received net inflows exceeding 5 billion, with Dongfang Precision receiving 12.45 billion and Changying Precision receiving 7.19 billion [2][3] - Dongfang Precision reported a total revenue of 3.389 billion for the first three quarters, a year-on-year increase of 2.52%, and a net profit of 510 million, up 54.64% year-on-year [2] - Changying Precision has established a significant position in the North American humanoid robot supply chain, with cumulative deliveries valued at over 80 million [2] Group 4: Notable Outflows - A total of 77 stocks saw net outflows exceeding 2 billion, with Shenghong Technology and Zhongji Xuchuang experiencing outflows over 20 billion [4] - Shenghong Technology had a net outflow of 30.72 billion, while Zhongji Xuchuang saw 25.49 billion [5] Group 5: End-of-Day Capital Movements - At the end of the day, the main capital outflow reached 90.52 billion, with public utilities, petrochemicals, and retail sectors seeing inflows exceeding 500 million [6] - Changying Precision saw a late-session inflow of 1.09 billion, while several other stocks also experienced inflows exceeding 500 million [6][7] Group 6: Late Session Outflows - In the late session, Zhongji Xuchuang, Shenghong Technology, and Heertai saw outflows exceeding 3 billion [8] - Zhongji Xuchuang had a net outflow of 4.47 billion, while Shenghong Technology had 3.90 billion [9]

共封装光学(CPO)概念下跌1.87%,主力资金净流出89股

Zheng Quan Shi Bao Wang· 2025-10-31 10:12

Core Insights - The Co-Packaged Optics (CPO) sector experienced a decline of 1.87%, ranking among the top losers in the market, with notable declines from companies like Dekor, Shenghong Technology, and Pengding Holdings [1][2] Market Performance - The top gainers in the market included Benchuan Intelligent, Aotwei, and Zhongbei Communication, with respective increases of 4.13%, 3.14%, and 2.58% [1][6] - The CPO sector saw a net outflow of 22.72 billion yuan, with 89 stocks experiencing net outflows, and 33 stocks seeing outflows exceeding 1 billion yuan [2] Major Stock Movements - Industrial Fulian led the net outflow with 3.028 billion yuan, followed by Shenghong Technology, Zhongji Xuchuang, and Xinyi Sheng, with outflows of 3.005 billion yuan, 2.489 billion yuan, and 2.151 billion yuan respectively [2][3] - The stocks with the highest declines included Industrial Fulian (-7.66%), Shenghong Technology (-10.53%), and Zhongji Xuchuang (-8.11%) [2][3] Sector Analysis - The CPO sector's performance was contrasted by other sectors such as Recombined Protein and Cell Immunotherapy, which saw gains of 3.72% and 3.58% respectively [2] - The overall market sentiment indicated a significant capital outflow from the CPO sector, reflecting investor caution [2][3]

电子行业今日净流出资金287.62亿元,工业富联等62股净流出资金超亿元

Zheng Quan Shi Bao Wang· 2025-10-31 09:58

Market Overview - The Shanghai Composite Index fell by 0.81% on October 31, with 16 industries rising, led by the pharmaceutical and media sectors, which increased by 2.42% and 2.39% respectively [2] - The electronic industry experienced a decline of 3.06%, ranking second in terms of the largest drop [2] Capital Flow - The net outflow of capital from the two markets reached 629.03 billion yuan, with 13 industries seeing net inflows [2] - The pharmaceutical industry had the highest net inflow of capital, totaling 44.94 billion yuan, while the media sector followed with 40.29 billion yuan [2] - The electronic industry faced the largest net outflow, amounting to 287.62 billion yuan, followed by the communication sector with a net outflow of 111.13 billion yuan [2] Electronic Industry Performance - Within the electronic industry, 470 stocks were tracked, with 209 stocks rising and 254 stocks falling [3] - Notably, 4 stocks hit the daily limit up, while 2 stocks hit the daily limit down [3] - The top three stocks with the highest net inflow were Changying Precision (6.91 billion yuan), O-film (4.12 billion yuan), and Wentai Technology (2.99 billion yuan) [3] Electronic Industry Capital Inflow and Outflow - The top stocks by capital inflow included Changying Precision (4.71% increase), O-film (3.44% increase), and Wentai Technology (3.05% increase) [4] - Conversely, the stocks with the highest capital outflow were Industrial Fulian (-7.66%), Shenghong Technology (-10.53%), and Luxshare Precision (-3.14%) [5]

元件板块10月31日跌5.82%,胜宏科技领跌,主力资金净流出62.69亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-31 08:36

Market Overview - The component sector experienced a decline of 5.82% on October 31, with Shenghong Technology leading the drop [1] - The Shanghai Composite Index closed at 3954.79, down 0.81%, while the Shenzhen Component Index closed at 13378.21, down 1.14% [1] Stock Performance - Notable gainers included: - Jin'an Guoji (Code: 002636) with a closing price of 16.45, up 10.03% on a trading volume of 351,600 shares and a turnover of 578 million [1] - Benchuan Intelligent (Code: 300964) closed at 57.69, up 4.13% with a turnover of 764 million [1] - Major decliners included: - Shenghong Technology (Code: 300476) closed at 294.00, down 10.53% with a trading volume of 634,000 shares and a turnover of 19.314 billion [2] - Chaoying Electronics (Code: 603175) closed at 73.58, down 9.99% with a turnover of 1.412 billion [2] Capital Flow - The component sector saw a net outflow of 6.269 billion from institutional investors, while retail investors contributed a net inflow of 4.649 billion [2] - The table of capital flow indicates varying levels of net inflow and outflow among different stocks, with significant movements in stocks like Sanhuan Group and Jin'an Guoji [3]

算力硬件板块回调

Bei Ke Cai Jing· 2025-10-31 07:52

Core Viewpoint - The computing hardware sector experienced a significant pullback, with notable declines in stock prices of several companies [1] Company Performance - Shenghong Technology saw a drop of over 10% in its stock price [1] - Tianfu Communication's stock fell by more than 8% [1] - Industrial Fulian, Sany Technology, and Zhongji Xuchuang all experienced declines exceeding 7% [1]

胜宏科技跌10.53% 国投证券昨天给予维持买入评级

Zhong Guo Jing Ji Wang· 2025-10-31 07:49

Group 1 - The core viewpoint of the article highlights that Shenghong Technology (300476.SZ) experienced a significant stock price drop of 10.53%, closing at 294.00 yuan [1] - Guotou Securities analysts Ma Liang and Zhu Si published a report on October 30, stating that Shenghong Technology is fully embracing AI, which is expected to lead to substantial growth in performance [1]

A股收评:创业板指跌2.31% 医药板块逆市大涨

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-31 07:29

Market Overview - The three major indices opened slightly lower and maintained a fluctuating adjustment trend, with the ChiNext Index dropping over 2% [1] - By the close, the Shanghai Composite Index fell by 0.81%, the Shenzhen Component Index decreased by 1.14%, and the ChiNext Index declined by 2.31% [1] Sector Performance - The pharmaceutical sector saw significant gains, with companies like Sanofi, Shuyou Shen, and Lianhuan Pharmaceutical hitting the daily limit [1] - Multi-modal AI and Sora concepts rose, with stocks such as Fushi Holdings, Aorui De, and 360 Technology also reaching the daily limit [1] - Short drama game concepts increased, with Bona Film Group, Huanrui Century, and Yue Media hitting the daily limit [1] - The Fujian sector was actively traded, with Pingtan Development and Fujian Jinsen also reaching the daily limit [1] Trading Volume and Activity - The total trading volume of the Shanghai and Shenzhen markets was 2.32 trillion yuan, a decrease of approximately 103.84 billion yuan compared to the previous trading day [1] - The Shanghai market's trading volume was 1.03 trillion yuan, while the Shenzhen market's was 1.29 trillion yuan [1] Top Traded Stocks - The top traded stock was Zhongji Xuchuang, with a trading volume of 273.47 billion yuan, followed by Xinyi Sheng at 205.71 billion yuan, Shenghong Technology at 193.14 billion yuan, Yangguang Electric at 191.37 billion yuan, and Industrial Fulian at 181.81 billion yuan [1][2]

新易盛获融资资金买入近54亿元丨资金流向日报

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-31 04:08

Market Overview - The Shanghai Composite Index fell by 0.73% to close at 3986.9 points, with a daily high of 4025.7 points [1] - The Shenzhen Component Index decreased by 1.16% to 13532.13 points, reaching a maximum of 13700.25 points [1] - The ChiNext Index dropped by 1.84% to 3263.02 points, with a peak of 3331.86 points [1] Margin Trading and Securities Lending - The total margin trading and securities lending balance in the Shanghai and Shenzhen markets was 24911.76 billion yuan, with a financing balance of 24732.7 billion yuan and a securities lending balance of 179.06 billion yuan, reflecting a decrease of 75.56 billion yuan from the previous trading day [2] - The Shanghai market's margin trading balance was 12657.39 billion yuan, down by 39.35 billion yuan, while the Shenzhen market's balance was 12254.37 billion yuan, decreasing by 36.21 billion yuan [2] - A total of 3456 stocks had financing funds for purchase, with the top three being Xinyi Technology (53.65 billion yuan), Zhongji Xuchuang (46.23 billion yuan), and Sunshine Power (36.47 billion yuan) [2] Fund Issuance - Four new funds were issued yesterday, including two mixed funds and two stock funds, all launched on October 30, 2025 [3][4] Top Trading Activities - The top ten net buying amounts on the Dragon and Tiger List included Jiangte Electric (27681.86 million yuan), Tianji Shares (20137.13 million yuan), and Guodun Quantum (16408.1 million yuan) [5] - The highest price increase was seen in Jiangte Electric with a rise of 9.98%, followed by Tianji Shares with a 10.0% increase [5]

算力硬件股多股下挫,中际旭创等股跌超4%

Mei Ri Jing Ji Xin Wen· 2025-10-31 02:12

Group 1 - Multiple stocks in the computing hardware sector experienced declines, with Zhongji Xuchuang, Xinyi Sheng, and Shenghong Technology dropping over 4% [1] - Other companies such as Tianfu Communication, Jianqiao Technology, and Shengyi Electronics also followed the downward trend [1]

AI驱动算力高增长 产业链公司“大丰收”

Shang Hai Zheng Quan Bao· 2025-10-30 18:29

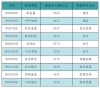

Core Insights - The A-share computing power industry chain is experiencing significant growth, with 143 out of 147 listed companies reporting profits in the first three quarters of the year, driven by the global AI wave and accelerated domestic infrastructure deployment [2][3] Group 1: Company Performance - Among the 143 companies, 118 achieved profitability, with 32 companies doubling their profits year-on-year [2] - Industrial Fulian emerged as the "profit king" with a net profit of 22.487 billion yuan, a year-on-year increase of 48.52% [2][10] - Zhongji Xuchuang reported a net profit of 7.132 billion yuan, marking a remarkable growth of 90.05% [2][10] - Han's Semiconductor turned a loss of 724 million yuan last year into a profit of 1.605 billion yuan, with revenue soaring by 2386.38% to 4.607 billion yuan [4][10] - New Yisheng's revenue reached 16.505 billion yuan, up 221.70%, with a net profit of 6.327 billion yuan, increasing by 284.38% [6][10] Group 2: Sector Analysis - The server sector is the main driver of growth, with Industrial Fulian's revenue reaching 243.172 billion yuan, a 42.81% increase, and a net profit of 10.373 billion yuan, up 62.04% [3][10] - The PCB industry is also witnessing growth, with Shenghong Technology's revenue increasing by 83.40% to 14.117 billion yuan and net profit soaring by 324.38% to 3.245 billion yuan [7][10] - The light module sector is experiencing a positive cycle of "technological breakthroughs, product volume, and performance realization," with Zhongji Xuchuang's revenue growing by 44.43% to 25.005 billion yuan [5][10] Group 3: Market Trends - The demand for AI computing power is expected to remain high, with light module companies like New Yisheng anticipating continued growth in 1.6T products [6][8] - The PCB industry is moving towards high-end products, driven by AI data center construction needs, with increased technical barriers and capital requirements [8]