VGT(300476)

Search documents

元件板块10月31日跌5.82%,胜宏科技领跌,主力资金净流出62.69亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-31 08:36

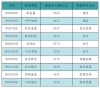

Market Overview - The component sector experienced a decline of 5.82% on October 31, with Shenghong Technology leading the drop [1] - The Shanghai Composite Index closed at 3954.79, down 0.81%, while the Shenzhen Component Index closed at 13378.21, down 1.14% [1] Stock Performance - Notable gainers included: - Jin'an Guoji (Code: 002636) with a closing price of 16.45, up 10.03% on a trading volume of 351,600 shares and a turnover of 578 million [1] - Benchuan Intelligent (Code: 300964) closed at 57.69, up 4.13% with a turnover of 764 million [1] - Major decliners included: - Shenghong Technology (Code: 300476) closed at 294.00, down 10.53% with a trading volume of 634,000 shares and a turnover of 19.314 billion [2] - Chaoying Electronics (Code: 603175) closed at 73.58, down 9.99% with a turnover of 1.412 billion [2] Capital Flow - The component sector saw a net outflow of 6.269 billion from institutional investors, while retail investors contributed a net inflow of 4.649 billion [2] - The table of capital flow indicates varying levels of net inflow and outflow among different stocks, with significant movements in stocks like Sanhuan Group and Jin'an Guoji [3]

算力硬件板块回调

Bei Ke Cai Jing· 2025-10-31 07:52

Core Viewpoint - The computing hardware sector experienced a significant pullback, with notable declines in stock prices of several companies [1] Company Performance - Shenghong Technology saw a drop of over 10% in its stock price [1] - Tianfu Communication's stock fell by more than 8% [1] - Industrial Fulian, Sany Technology, and Zhongji Xuchuang all experienced declines exceeding 7% [1]

胜宏科技跌10.53% 国投证券昨天给予维持买入评级

Zhong Guo Jing Ji Wang· 2025-10-31 07:49

Group 1 - The core viewpoint of the article highlights that Shenghong Technology (300476.SZ) experienced a significant stock price drop of 10.53%, closing at 294.00 yuan [1] - Guotou Securities analysts Ma Liang and Zhu Si published a report on October 30, stating that Shenghong Technology is fully embracing AI, which is expected to lead to substantial growth in performance [1]

A股收评:创业板指跌2.31% 医药板块逆市大涨

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-31 07:29

Market Overview - The three major indices opened slightly lower and maintained a fluctuating adjustment trend, with the ChiNext Index dropping over 2% [1] - By the close, the Shanghai Composite Index fell by 0.81%, the Shenzhen Component Index decreased by 1.14%, and the ChiNext Index declined by 2.31% [1] Sector Performance - The pharmaceutical sector saw significant gains, with companies like Sanofi, Shuyou Shen, and Lianhuan Pharmaceutical hitting the daily limit [1] - Multi-modal AI and Sora concepts rose, with stocks such as Fushi Holdings, Aorui De, and 360 Technology also reaching the daily limit [1] - Short drama game concepts increased, with Bona Film Group, Huanrui Century, and Yue Media hitting the daily limit [1] - The Fujian sector was actively traded, with Pingtan Development and Fujian Jinsen also reaching the daily limit [1] Trading Volume and Activity - The total trading volume of the Shanghai and Shenzhen markets was 2.32 trillion yuan, a decrease of approximately 103.84 billion yuan compared to the previous trading day [1] - The Shanghai market's trading volume was 1.03 trillion yuan, while the Shenzhen market's was 1.29 trillion yuan [1] Top Traded Stocks - The top traded stock was Zhongji Xuchuang, with a trading volume of 273.47 billion yuan, followed by Xinyi Sheng at 205.71 billion yuan, Shenghong Technology at 193.14 billion yuan, Yangguang Electric at 191.37 billion yuan, and Industrial Fulian at 181.81 billion yuan [1][2]

新易盛获融资资金买入近54亿元丨资金流向日报

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-31 04:08

Market Overview - The Shanghai Composite Index fell by 0.73% to close at 3986.9 points, with a daily high of 4025.7 points [1] - The Shenzhen Component Index decreased by 1.16% to 13532.13 points, reaching a maximum of 13700.25 points [1] - The ChiNext Index dropped by 1.84% to 3263.02 points, with a peak of 3331.86 points [1] Margin Trading and Securities Lending - The total margin trading and securities lending balance in the Shanghai and Shenzhen markets was 24911.76 billion yuan, with a financing balance of 24732.7 billion yuan and a securities lending balance of 179.06 billion yuan, reflecting a decrease of 75.56 billion yuan from the previous trading day [2] - The Shanghai market's margin trading balance was 12657.39 billion yuan, down by 39.35 billion yuan, while the Shenzhen market's balance was 12254.37 billion yuan, decreasing by 36.21 billion yuan [2] - A total of 3456 stocks had financing funds for purchase, with the top three being Xinyi Technology (53.65 billion yuan), Zhongji Xuchuang (46.23 billion yuan), and Sunshine Power (36.47 billion yuan) [2] Fund Issuance - Four new funds were issued yesterday, including two mixed funds and two stock funds, all launched on October 30, 2025 [3][4] Top Trading Activities - The top ten net buying amounts on the Dragon and Tiger List included Jiangte Electric (27681.86 million yuan), Tianji Shares (20137.13 million yuan), and Guodun Quantum (16408.1 million yuan) [5] - The highest price increase was seen in Jiangte Electric with a rise of 9.98%, followed by Tianji Shares with a 10.0% increase [5]

算力硬件股多股下挫,中际旭创等股跌超4%

Mei Ri Jing Ji Xin Wen· 2025-10-31 02:12

Group 1 - Multiple stocks in the computing hardware sector experienced declines, with Zhongji Xuchuang, Xinyi Sheng, and Shenghong Technology dropping over 4% [1] - Other companies such as Tianfu Communication, Jianqiao Technology, and Shengyi Electronics also followed the downward trend [1]

AI驱动算力高增长 产业链公司“大丰收”

Shang Hai Zheng Quan Bao· 2025-10-30 18:29

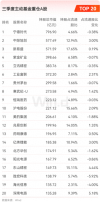

Core Insights - The A-share computing power industry chain is experiencing significant growth, with 143 out of 147 listed companies reporting profits in the first three quarters of the year, driven by the global AI wave and accelerated domestic infrastructure deployment [2][3] Group 1: Company Performance - Among the 143 companies, 118 achieved profitability, with 32 companies doubling their profits year-on-year [2] - Industrial Fulian emerged as the "profit king" with a net profit of 22.487 billion yuan, a year-on-year increase of 48.52% [2][10] - Zhongji Xuchuang reported a net profit of 7.132 billion yuan, marking a remarkable growth of 90.05% [2][10] - Han's Semiconductor turned a loss of 724 million yuan last year into a profit of 1.605 billion yuan, with revenue soaring by 2386.38% to 4.607 billion yuan [4][10] - New Yisheng's revenue reached 16.505 billion yuan, up 221.70%, with a net profit of 6.327 billion yuan, increasing by 284.38% [6][10] Group 2: Sector Analysis - The server sector is the main driver of growth, with Industrial Fulian's revenue reaching 243.172 billion yuan, a 42.81% increase, and a net profit of 10.373 billion yuan, up 62.04% [3][10] - The PCB industry is also witnessing growth, with Shenghong Technology's revenue increasing by 83.40% to 14.117 billion yuan and net profit soaring by 324.38% to 3.245 billion yuan [7][10] - The light module sector is experiencing a positive cycle of "technological breakthroughs, product volume, and performance realization," with Zhongji Xuchuang's revenue growing by 44.43% to 25.005 billion yuan [5][10] Group 3: Market Trends - The demand for AI computing power is expected to remain high, with light module companies like New Yisheng anticipating continued growth in 1.6T products [6][8] - The PCB industry is moving towards high-end products, driven by AI data center construction needs, with increased technical barriers and capital requirements [8]

公募三季报持仓洗牌:科技股“七雄”霸榜,茅台失宠,ST华通成黑马

Hua Xia Shi Bao· 2025-10-30 13:16

Core Viewpoint - The report highlights significant shifts in the holdings of actively managed equity funds in the third quarter of 2025, with a notable rise in technology stocks and a decline in traditional consumer stocks like Kweichow Moutai [3][4][6]. Group 1: Fund Holdings Overview - As of September 2025, the total assets under management in the public fund industry reached 35.85 trillion yuan, a quarter-on-quarter increase of 6.30% [3]. - The top three holdings of actively managed equity funds are dominated by technology companies, with CATL reclaiming the top position, surpassing Tencent Holdings [3][4]. - Kweichow Moutai's total market value held by active equity funds decreased to 29.958 billion yuan, down from 30.616 billion yuan in the previous quarter, dropping from third to seventh place among top holdings [3][6]. Group 2: Technology Sector Performance - The technology sector emerged as the primary focus for public fund investments, with seven out of the top ten holdings being technology-related companies [4]. - Notable performers include Xinyi Technology and Zhongji Xuchuang, both of which ranked among the top three heavyweights [4]. - The current market trend indicates a strong and sustained interest in technology stocks, driven by China's economic transformation towards a hard-tech model [4][5]. Group 3: Challenges in Traditional Consumer Sector - The traditional consumer sector, particularly the liquor industry, is facing significant challenges, with 59.7% of liquor companies reporting a decrease in operating profits [6][7]. - The white liquor market is undergoing a deep adjustment phase due to policy changes, consumption structure transformation, and intense competition [6][7]. - The overall sales volume in the liquor industry is expected to decline by over 20% year-on-year, reflecting macroeconomic fluctuations and slow recovery in consumer spending [7][8]. Group 4: Fund Manager Strategies - The top five stocks with increased holdings include Zhongji Xuchuang, Industrial Fulian, ST Huatuo, Dongshan Precision, and Hanwha Technology, all of which are technology companies [9][10]. - Conversely, the top stocks with reduced holdings include Shenghong Technology and Haiguang Information, with significant sell-offs attributed to internal management's actions [11]. - Despite CATL being the top holding, it also appears on the list of reduced holdings, indicating a complex strategy among institutional investors [11].

胜宏科技:已向港交所递交H股上市申请并刊登申请资料

Xin Lang Cai Jing· 2025-10-30 12:49

Core Viewpoint - The company has submitted an application for issuing H-shares and listing on the Hong Kong Stock Exchange as of August 20, 2025 [1]. Group 1 - The company confirmed that it has submitted the necessary materials to the Hong Kong Stock Exchange for its H-share issuance [1]. - The application details were published on the Hong Kong Stock Exchange website on the same day [1]. - Investors are directed to check the relevant announcements on the designated information disclosure website for further details [1].

胜宏科技(300476):全面拥抱AI,业绩大幅增长

Guotou Securities· 2025-10-30 06:36

Investment Rating - The report maintains a "Buy-A" investment rating with a target price of 403.42 CNY for the next six months [4][7]. Core Insights - The company has significantly embraced AI technology, resulting in substantial growth in performance, with a reported revenue of 14.117 billion CNY for Q3 2025, representing an 83.4% year-on-year increase, and a net profit of 3.245 billion CNY, reflecting a 324.38% year-on-year growth [2][4]. - The demand growth in downstream industries such as high-speed networks, artificial intelligence, and data storage drives the company's performance, with AI-related PCB boards expected to grow at a compound annual growth rate (CAGR) of 20.6% from 2024 to 2029, significantly outpacing the industry average [2][3]. Summary by Sections Financial Performance - For the years 2025 to 2027, the company is projected to achieve revenues of 20.218 billion CNY, 33.966 billion CNY, and 55.026 billion CNY, respectively, with net profits of 5.014 billion CNY, 10.394 billion CNY, and 17.356 billion CNY [4][11]. Market Position and Strategy - The company has made significant investments in high-end product research and development, achieving breakthroughs in core technologies for high-layer and HDI products, and is positioned as a core partner for leading technology firms in AI computing cards and data center markets [3][4]. - The company is implementing a "China + N" globalization strategy, utilizing both domestic and international factory construction and mergers to build a comprehensive operational network [3]. Growth Projections - The report anticipates a robust growth trajectory, with revenue growth rates projected at 88.4% for 2025, 68.0% for 2026, and 62.0% for 2027, alongside net profit growth rates of 334.3%, 107.3%, and 67.0% for the same years [11][12].