GuoChuang(300520)

Search documents

科大国创(300520) - 股票交易异常波动公告

2025-10-27 10:36

1、公司前期披露的信息不存在需要更正、补充之处。 证券代码:300520 证券简称:科大国创 公告编号:2025-76 科大国创软件股份有限公司 股票交易异常波动公告 本公司及董事会全体成员保证信息披露的内容真实、准确、完整,没有虚 假记载、误导性陈述或重大遗漏。 一、股票交易异常波动的具体情况 科大国创软件股份有限公司(以下简称"公司")股票于 2025 年 10 月 23 日、 2025 年 10 月 24 日、2025 年 10 月 27 日连续三个交易日收盘价格涨幅偏离值累 计超过 30%,根据《深圳证券交易所交易规则》的相关规定,属于股票交易异常 波动的情况。 二、说明关注、核实情况 针对公司股票交易异常波动情况,公司董事会对公司、控股股东及实际控制 人就相关事项进行了核实,现将有关情况说明如下: 1、经自查,公司不存在违反公平信息披露的情形。公司将继续严格按照有 关法律法规的规定和要求,认真履行信息披露义务,及时做好信息披露工作。 2、公司将于2025年10月29日披露《2025年第三季度报告》,公司未发生未 经披露的业绩信息泄露情形,具体财务数据将在《2025年第三季度报告》中披露。 3、公司郑 ...

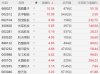

科大国创10月27日龙虎榜数据

Zheng Quan Shi Bao Wang· 2025-10-27 09:17

Group 1 - Keda Guochuang's stock price increased by 8.08% with a turnover rate of 35.90% and a trading volume of 3.622 billion yuan, showing a fluctuation of 16.66% [2] - Institutional investors net sold 44.35 million yuan, while the Shenzhen Stock Connect saw a net purchase of 92.27 million yuan [2] - The top five trading departments accounted for a total transaction of 5.92 billion yuan, with a net purchase of 29.69 million yuan [2] Group 2 - As of October 24, the margin trading balance for Keda Guochuang was 555 million yuan, with a financing balance of 555 million yuan and a securities lending balance of 10,200 yuan [3] - Over the past five days, the financing balance increased by 7.10 million yuan, representing a growth of 1.30%, while the securities lending balance rose by 760 yuan, a significant increase of 293.92% [3] - On October 27, the top buying and selling departments included the Shenzhen Stock Connect, which had a buying amount of 134.03 million yuan and a selling amount of 41.75 million yuan [4]

软件开发板块10月27日涨0.9%,星环科技领涨,主力资金净流出8.14亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-27 08:25

Market Overview - The software development sector increased by 0.9% on October 27, with Xinghuan Technology leading the gains [1] - The Shanghai Composite Index closed at 3996.94, up 1.18%, while the Shenzhen Component Index closed at 13489.4, up 1.51% [1] Top Gainers in Software Development Sector - Xinghuan Technology (688031) closed at 61.39, up 16.47% with a trading volume of 135,400 shares and a turnover of 793 million [1] - Weston (301315) closed at 53.37, up 8.63% with a trading volume of 99,100 shares and a turnover of 547 million [1] - Keda Guochuang (300520) closed at 36.90, up 8.08% with a trading volume of 998,000 shares and a turnover of 3.622 billion [1] - Other notable gainers include Deepin Technology (300454) up 5.08% and Kingsoft Office (688111) up 4.28% [1] Top Losers in Software Development Sector - Jiafa Education (300559) closed at 12.86, down 12.81% with a trading volume of 389,800 shares and a turnover of 522 million [2] - Guotou Intelligent (300188) closed at 14.49, down 3.66% with a trading volume of 309,100 shares and a turnover of 447 million [2] - Other notable losers include Pinming Technology (601889) down 3.06% and Jiuqi Software (002279) down 2.64% [2] Capital Flow Analysis - The software development sector experienced a net outflow of 814 million from institutional investors, while retail investors saw a net inflow of 369 million [2][3] - Notable net inflows from retail investors were observed in stocks like Deepin Technology and Keda Guochuang, while significant outflows were noted in Xinghuan Technology and Kingsoft Office [3]

A股异动丨中央定调6大未来产业之一!量子科技股走强,国盾量子涨超10%

Ge Long Hui A P P· 2025-10-27 02:53

Core Insights - The A-share market has seen a collective surge in quantum technology stocks, with notable increases in companies such as GuoDun Quantum and DaHua Intelligent [1][2] - The Central Committee of the Communist Party of China has proposed the development of emerging pillar industries, including quantum technology, as part of the 15th Five-Year Plan, which is expected to create several trillion-yuan markets [1] Company Performance - GuoDun Quantum (688027) rose by 10.54%, with a market capitalization of 47.6 billion and a year-to-date increase of 55.18% [2] - DaHua Intelligent (002512) increased by 10.09%, with a market cap of 5.462 billion and a year-to-date rise of 3.59% [2] - HengBao Co. (002104) reached a 9.99% increase, with a market cap of 15.8 billion and a year-to-date surge of 232.75% [2] - Other notable performers include GuangKu Technology (300620) up 5.85%, GuangXun Technology (002281) up 5.19%, and KeDa GuoChuang (300520) up 4.95% [2] Industry Trends - The proposed 15th Five-Year Plan emphasizes the acceleration of strategic emerging industries such as quantum technology, bio-manufacturing, hydrogen energy, and nuclear fusion, which are expected to become new economic growth points [1] - The plan aims to lay a forward-looking foundation for future industries, potentially reshaping China's high-tech sector over the next decade [1]

科大国创10月24日龙虎榜数据

Zheng Quan Shi Bao Wang· 2025-10-24 10:04

Group 1 - The stock of Keda Guochuang increased by 4.44% with a turnover rate of 40.05%, and a trading volume of 3.954 billion yuan, showing a fluctuation of 11.77% [1] - Institutional investors net sold 4.3152 million yuan, while the Shenzhen Stock Connect recorded a net sell of 45.0579 million yuan [2][3] - The main funds saw a net outflow of 593 million yuan, with large orders contributing to a net outflow of 471 million yuan and big orders 122 million yuan [3] Group 2 - The latest margin trading balance for Keda Guochuang is 533 million yuan, with a financing balance of 533 million yuan and a securities lending balance of 0.65 million yuan [3] - Over the past five days, the financing balance decreased by 21.495 million yuan, representing a decline of 3.87% [3] - The top five trading departments accounted for a total transaction of 666 million yuan, with a buying amount of 288 million yuan and a selling amount of 374 million yuan, resulting in a net sell of 86.8694 million yuan [2]

科大国创(300520) - 关于归还暂时补充流动资金的闲置募集资金的公告

2025-10-24 09:46

科大国创软件股份有限公司董事会 科大国创软件股份有限公司 关于归还暂时补充流动资金的闲置募集资金的公告 截至 2025 年 10 月 24 日,公司已将上述用于暂时补充流动资金的闲置募集资金 全部归还至募集资金专用账户,使用期限未超过 12 个月,同时公司已将上述募集资 金的归还情况通知了保荐机构及保荐机构代表人。 特此公告。 本公司及董事会全体成员保证信息披露的内容真实、准确、完整,没有虚假记 载、误导性陈述或重大遗漏。 证券代码:300520 证券简称:科大国创 公告编号:2025-75 科大国创软件股份有限公司(以下简称"公司")于 2024 年 10 月 25 日召开第四 届董事会第二十三次会议,审议通过了《关于继续使用部分闲置募集资金暂时补充 流动资金的议案》,同意公司在保证募集资金投资项目建设正常推进的前提下,继 续使用不超过 2 亿元的闲置募集资金暂时补充流动资金,使用期限自公司董事会审 议通过之日起不超过 12 个月,到期将归还至公司募集资金专户。具体内容详见公司 于 2024 年 10 月 28 日在巨潮资讯网(www.cninfo.com.cn)上披露的相关公告。 在上述授权金额和期限内, ...

收盘丨沪指涨0.71%刷新年内新高,半导体产业链全线爆发

Di Yi Cai Jing· 2025-10-24 07:17

Market Overview - The total trading volume in the Shanghai and Shenzhen markets reached 1.97 trillion yuan, an increase of 330.3 billion yuan compared to the previous trading day [1][4] - All three major A-share indices closed higher, with the Shanghai Composite Index rising by 0.71%, the Shenzhen Component Index by 2.02%, and the ChiNext Index by 3.57% [1][2] Sector Performance - The semiconductor industry chain experienced a significant surge, with storage chips and GPU concepts leading the gains. The K-12 education and commercial aerospace sectors also showed strong upward momentum [2] - Notable individual stock performances included Zhongji Xuchuang, which rose over 11% to reach a new historical high [2] Capital Flow - Main capital inflows were observed in the electronics, semiconductor, and communication equipment sectors, while there were net outflows from cultural media, coal, and banking sectors [5] - Specific stocks with significant net inflows included Luxshare Precision, which saw an inflow of 1.885 billion yuan, and Sungrow Power Supply with 1.335 billion yuan [5] Institutional Insights - Jianghai Securities noted that the market is facing previous resistance levels, suggesting a consolidation phase before potential upward movement [6] - Dexun Securities expressed a positive outlook for the A-share market in the medium to long term, anticipating higher index levels [6] - Shenwan Hongyuan maintained that the market's upward trend remains intact [6]

科大国创成交额创2025年3月18日以来新高

Zheng Quan Shi Bao Wang· 2025-10-24 02:52

Core Viewpoint - The trading volume of Keda Guokuan reached 2.15 billion yuan, marking a new high since March 18, 2025, with the latest stock price increasing by 7.37% and a turnover rate of 21.40% [2] Summary by Category - **Trading Performance** - Keda Guokuan's trading volume reached 2.15 billion yuan, the highest since March 18, 2025 [2] - The stock price increased by 7.37% [2] - The turnover rate was recorded at 21.40% [2] - The previous trading day's total volume was 2.10 billion yuan [2]

科大国创成交额创上市以来新高

Zheng Quan Shi Bao Wang· 2025-10-24 02:52

Core Viewpoint - The trading volume of Keda Guokuan reached a new high of 2.589 billion yuan, marking the highest since its listing, with a stock price increase of 7.31% and a turnover rate of 25.92% [2] Summary by Categories - **Trading Performance** - Keda Guokuan's trading volume was 2.589 billion yuan, the highest since its IPO [2] - The stock price increased by 7.31% [2] - The turnover rate was recorded at 25.92% [2] - The previous trading day's total volume was 2.1 billion yuan [2]

这一品种价格创9月以来新高,这些概念股获融资净买入(名单)

Zheng Quan Shi Bao Wang· 2025-10-24 00:54

Group 1: Quantum Technology Sector - The quantum technology sector experienced a significant surge in the last half hour of trading, rising from a slight decline of 0.02% to an increase of 2.51% before closing [3] - Notable stocks in this sector included Keda Technology and Shenzhou Information, which hit the daily limit, while Deep Technology rose by 14.86% [3] - A report from Google's quantum AI lab announced a breakthrough in quantum computing with their "Willow" chip, achieving the first verifiable quantum advantage [3] - A total of 48 quantum technology stocks saw a net inflow of 445 million yuan from major funds, with Keda Technology and Shenzhou Information receiving over 100 million yuan each [3] Group 2: Lithium Carbonate Market - The main contract for lithium carbonate rose over 4%, closing at 79,900 yuan per ton, marking a new high since September [5] - The price of lithium carbonate has increased by over 30% from its low of 58,500 yuan per ton earlier this year, indicating a significant improvement in industry profitability [5] - The Ministry of Industry and Information Technology reported that Chinese companies hold six of the top ten global battery manufacturers, accounting for 69% of total shipments [7] - The lithium mining sector saw a collective rise, with stocks like Shengxin Lithium Energy hitting the daily limit and others like Tianhua New Energy and Rongjie Shares also showing significant gains [7] Group 3: Demand for Lithium Products - The growth in lithium battery demand is primarily driven by the needs of power batteries and energy storage [8] - In the first nine months of 2025, the production and sales of new energy vehicles in China reached 11.24 million and 11.22 million units, respectively, reflecting year-on-year growth of 35.2% and 34.9% [8] - Solid-state battery technology breakthroughs are expected to contribute to new growth in the lithium supply chain, with projected demand for lithium metal reaching between 13,260 to 15,175 tons by 2030 [8] Group 4: Lithium Mining Stocks Performance - Lithium mining stocks have generally risen in October, with an average increase of 2.92%, led by Shengxin Lithium Energy, Salt Lake Shares, and Yahua Group [9] - Financing inflows into the lithium mining sector reached 509 million yuan in October, with four stocks receiving over 100 million yuan each [9] - Yahua Group's earnings forecast indicates a net profit of 320 million to 360 million yuan for the first three quarters, representing a year-on-year increase of 106.97% to 132.84% [9]