Bank of America(BAC)

Search documents

欧洲债市将迎“数据革命”,新规或引爆电子交易新浪潮

智通财经网· 2025-10-21 09:24

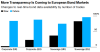

智通财经APP获悉,华尔街的各大银行认为,欧洲债券市场数据的质量和可获取性若能得到改善,将推 动电子交易迎来新的增长浪潮。摩根大通公司、美国银行以及摩根士丹利表示,新的规定要求对债券交 易进行更详细的报告,并建立一个能够追踪实时市场活动的数据池,这将提高透明度,并改善基于计算 机的交易模式。 摩根大通全球固定收益、外汇及大宗商品市场结构与流动性策略主管Kate Finlayson表示:"数据可能是 实现进一步电子化的重要先决条件。它有助于构建交易模型和算法。在交易完成之后,数据也是评估算 法表现所必需的。" 与美国相比,欧洲债券市场在采用某些算法策略方面进展较为缓慢。在美国,债券交易数据早就通过 TRACE 系统进行了整合。 "我们见证了诸多创新,但有时在固定收益领域(尤其是这一领域)的感觉却像是在浓稠的糖浆中艰难前 行。"MarketAxess欧洲、中东及亚太地区交易产品主管Gareth Coltman说道。"准确获取数据至关重 要。" 虽然更优质的债券数据将有助于提高效率,但这也可能会侵蚀银行的利润空间。在美国,引入 TRACE 系统后,交易双方的买卖价差缩小,投资者每年的交易成本降低了近 10 亿美元。 ...

阿根廷200亿美元贷款计划遇阻,多家美国银行要求美财政部明确担保措施

智通财经网· 2025-10-21 03:49

智通财经APP获悉,据知情人士透露,包括摩根大通、美国银行和高盛集团在内的一批美国银行,在缺 乏担保或抵押品的情况下,对向阿根廷提供200亿美元贷款持犹豫态度。 摩根大通、美国银行、高盛和花旗集团未立即回应置评请求。 阿根廷央行周一表示,它已与美国财政部签署了一项200亿美元的汇率稳定协议,这使得美国对这个拉 美第三大经济体的支持总额达到400亿美元。财政部还在公开市场上购买了阿根廷比索。 知情人士指出,美国的这些融资机制也增加了国际货币基金组织与美国财政部之间发生冲突的可能性, 基金组织的官员担心特朗普政府可能向阿根廷施压,要求其将美国债务置于IMF巨额贷款之前。 知情人士透露,银行家们正在等待财政部的指引,明确阿根廷能够提供何种抵押品,或者华盛顿是否计 划自行支持这一融资机制。 知情人士称,该融资机制尚未最终确定,如果银行的抵押品问题得不到解决,可能无法成型。 美国财政部一位发言人表示:"关于该机制的讨论仍在进行中,我们期待在谈判完成后提供更多细节。" 美国财政部长斯科特·贝森特上周表示,该部正与银行和投资基金合作,创建一个200亿美元的融资机 制,用于投资这个南美国家的主权债务。 ...

US banks hunting for collateral to back $20 billion Argentina bailout, WSJ reports

Reuters· 2025-10-21 01:02

Group 1 - A coalition of U.S. banks, including JPMorgan Chase, Bank of America, and Goldman Sachs, is reluctant to extend a $20 billion loan to Argentina without guarantees or collateral [1]

苹果创新高,巴菲特“卖飞”,少赚500亿美元

美股IPO· 2025-10-21 00:41

Core Viewpoint - Berkshire Hathaway's decision to significantly reduce its Apple stock holdings has resulted in a missed opportunity of approximately $50 billion in potential gains as Apple's stock price surged to nearly $262 per share, surpassing the average selling price of Berkshire's shares [1][3][5] Group 1: Apple Stock Holdings - As of June 30, 2023, Berkshire's Apple holdings decreased from 906 million shares at the end of 2022 to 280 million shares, indicating a reduction of two-thirds of its position [1][5] - The recent optimism surrounding iPhone's market prospects has led to a nearly 4% increase in Apple's stock price, raising its market capitalization to $3.89 trillion, making it the second-largest company in the U.S. by market value [3][4] - The average selling price of Berkshire's Apple shares was approximately $185, while the current price is about $262, indicating a missed appreciation of around $50 billion [7] Group 2: Reasons for Selling - Various interpretations exist regarding Buffett's motivation for selling Apple shares, including concerns over a potential increase in corporate tax rates and the need to diversify risk as Apple's holdings once constituted over 40% of Berkshire's portfolio [9] - The reduction in Apple stock has brought its proportion in Berkshire's portfolio down to around 25%, effectively spreading risk [9] - There is speculation that Buffett aims to bolster cash reserves before stepping down as CEO in 2025, with Berkshire holding over $330 billion in cash as of June 30 [9] Group 3: Other Stock Reductions - Berkshire also reduced its stake in Bank of America by approximately 40%, selling around 400 million shares, which has resulted in an unrealized potential gain of about $4 billion due to the stock's recent performance [11][13] - The performance of Berkshire's Class A shares has lagged behind the S&P 500 index, with a year-to-date increase of about 9%, suggesting that the reduction in key holdings like Apple may be a contributing factor [15]

美银预警:若信贷风暴升级,养老金被迫清仓指数基金或成美股下一颗雷

Zhi Tong Cai Jing· 2025-10-21 00:07

Group 1 - The credit market is showing signs of tightening, which may trigger a new round of declines in the U.S. stock market, as institutional investors like pension funds may be forced to sell assets [1][3] - If private lending remains weak, pension funds may have to sell index funds to avoid punitive losses from declining private asset valuations and to meet ongoing funding obligations [1] - Passive investment has dominated the S&P 500 index, meaning an economic downturn could lead to collective selling by funds tracking this index [1] Group 2 - Concerns are rising that bad loans from small banks may spread to other sectors of the stock market, with regional bank composite stock index in the U.S. dropping over 6% in a single day, marking the longest consecutive decline of the year [1] - Other institutions, such as Miller Tabak + Co., have also warned about the potential for sustained selling pressure from index-tracking funds, particularly in bank ETFs, which have shown significant weakness [3] - The S&P 500 index is statistically overvalued on 20 valuation metrics, and the ongoing three-year bull market is facing valuation risks, with the probability of a market decline increasing [3] Group 3 - Six out of ten bear market warning signals tracked by the team have already been triggered, with historical data indicating that an average of 70% of bear market signals are triggered before a market peak and subsequent decline [3] - The current bear market signals suggest that caution is warranted in investment decisions [3]

Global Markets React to Policy Shifts, Trade Tensions, and Commodity Gains

Stock Market News· 2025-10-20 23:38

Group 1: Energy Sector Developments - The Canada Energy Regulator (CER) is implementing new exemption orders effective December 1, aimed at simplifying the approval process for "negligible-risk" oil and gas projects, which are defined as projects with existing authorization that do not cover certain additions like storage facilities [3][7] - BHP Group reported a 4% increase in first-quarter copper production, primarily due to an accelerated ramp-up at its Escondida project in Chile, while maintaining steady iron ore output and unchanged full-year guidance [6][7] Group 2: Market Movements and Economic Policies - Japanese equities have reached record highs, with the Nikkei 225 surging 2.9% to 48,970.40, driven by expectations of fiscal expansion under the anticipated premiership of Sanae Takaichi [4][7] - Major U.S. banks, including JPMorgan, Bank of America, and Goldman Sachs, are facing challenges in structuring a $20 billion loan for Argentina, highlighting concerns about the country's economic stability [8][7] Group 3: U.S. Housing Finance and Regulatory Changes - The Trump administration is evaluating a public offering for Fannie Mae and Freddie Mac, potentially by the end of 2025, with the aim of ending their government conservatorship established after the 2008 subprime mortgage crisis [5][7] - In the United Kingdom, Chancellor Rachel Reeves is set to announce regulatory cuts to boost economic growth, which could save businesses billions by streamlining processes [9] Group 4: International Trade and Investment Initiatives - The U.S. is considering new tariffs or restrictions on Nicaragua's benefits under the CAFTA-DR free trade pact due to concerns over human rights abuses, with proposed tariffs potentially reaching up to 100% on imports [10] - The European Investment Bank is seeking critical minerals investments in Australia to diversify supply chains and reduce dependence on single-country suppliers, particularly China [11]

X @🚨BSC Gems Alert🚨

🚨BSC Gems Alert🚨· 2025-10-20 19:44

Crypto Adoption - Bank of America's CEO predicts the US banking industry will soon adopt crypto for payments [1] - The industry's embrace of crypto for payments is imminent [1] Financial Context - Bank of America manages $1.6 trillion [1]

Big Banks Report a Resilient US Economy | Presented by CME Group

Bloomberg Television· 2025-10-20 18:39

Bank earnings can be a crucial indicator of the economy's trajectory and America's biggest banks are off to a steady start to earnings season. Results from JP Morgan, Wells Fargo, Black Rockck Bank of America and Morgan Stanley show, as expected, gains coming from trading activity and dealmaking. At the same time, blowout numbers mostly failed to materialize.Spending stayed solid while showing some signs of deceleration. Bank CEOs have been mostly upbeat in recent weeks, however. They've cited continued spe ...

X @Bloomberg

Bloomberg· 2025-10-20 18:34

Further signs of strain in the credit market risks provoking another broad equities rout as long-only investors, including pension funds, will be compelled to sell, according to strategists at Bank of America Corp https://t.co/SHRarfo7hB ...

Wall Street Surges on Tech Optimism, Congressional Stock Ban Heats Up, and Fed Signals Balance Sheet Shift

Stock Market News· 2025-10-20 17:08

Market Performance - Wall Street's major indexes rebounded on October 20, with the S&P 500 gaining 0.99% to 6,730.02, the Dow Jones Industrial Average rising 0.80% to 46,560.52, and the Nasdaq Composite advancing 1.37% to 22,990.00, driven by a "buy the dip" strategy in mega-cap technology stocks [2][9] - The Nasdaq Composite achieved a year-to-date return of 16.9% [9] Technology Sector - Optimism surrounding AI continues to drive market performance, with the Philadelphia Semiconductor Index reaching an all-time high, supported by strong performances from Micron (up 3.6%), ON Semiconductor (up 5.6%), and KLA (up 4.8%) [3] - Apple shares rose 4.3% to a record high, while Meta and Netflix each gained over 2% [2] Earnings Outlook - S&P 500 companies are projected to report a 9.3% year-on-year increase in third-quarter profits, with investors closely monitoring earnings reports from major companies like Tesla, Ford, GM, and Netflix [4] Federal Reserve Insights - Bank of America indicated a higher risk of Federal Reserve balance sheet runoff in October, coinciding with signals from Fed Chair Jerome Powell suggesting an end to the quantitative tightening program [10][11] - The Fed's balance sheet has been reduced from a peak of nearly $9 trillion to approximately $6.6-$7 trillion [10] - The CME FedWatch Tool predicts a 25 basis point rate cut at the upcoming October 28-29 FOMC meeting, with another reduction expected in December [11]