储能

Search documents

瑞达期货碳酸锂产业日报-20251021

Rui Da Qi Huo· 2025-10-21 08:32

Report Industry Investment Rating - No relevant information provided Core Viewpoints - The fundamentals of the lithium carbonate industry may be in a situation of increasing supply and demand, with demand growing faster than supply and inventory depletion in the industry. The option market sentiment is bullish, and the implied volatility has slightly decreased. The operation suggestion is to conduct light - position oscillating trading and control risks [2]. Summary by Directory Futures Market - The closing price of the main contract is 75,980 yuan/ton, up 280 yuan; the net position of the top 20 is - 150,100 hands, up 5 hands; the position volume of the main contract is 310,199 hands, up 171,765 hands; the spread between near and far - month contracts is - 380 yuan/ton, up 100 yuan; the warehouse receipts of GZEE are 29,892 hands/ton, down 813 hands [2]. Spot Market - The average price of battery - grade lithium carbonate is 74,100 yuan/ton, up 100 yuan; the average price of industrial - grade lithium carbonate is 71,850 yuan/ton, up 100 yuan; the basis of the Li₂CO₃ main contract is - 1,880 yuan/ton, down 180 yuan [2]. Upstream Situation - The average price of spodumene concentrate (6% CIF China) is 880 US dollars/ton, up 8 US dollars; the average price of amblygonite is 7,520 yuan/ton, down 90 yuan; the price of lithium mica (2 - 2.5%) is 2,723 yuan/ton, unchanged [2]. Industry Situation - The monthly output of lithium carbonate is 47,140 tons, up 1,260 tons; the monthly import volume is 19,596.9 tons, down 2,250.01 tons; the monthly export volume is 150.82 tons, down 218.09 tons; the monthly operating rate of lithium carbonate enterprises is 47%, up 1%; the monthly output of power batteries is 151,200 MWh, up 11,600 MWh; the price of lithium manganate is 32,000 yuan/ton, unchanged; the price of lithium hexafluorophosphate is 85,000 yuan/ton, up 35,000 yuan; the price of lithium cobaltate is 343,500 yuan/ton, up 15,000 yuan; the price of ternary material (811 type): China is 157,000 yuan/ton, up 1,500 yuan; the price of ternary material (622 power type): China is 135,500 yuan/ton, up 1,500 yuan [2]. Downstream and Application Situation - The price of ternary material (523 single - crystal type): China is 146,000 yuan/ton, up 2,000 yuan; the monthly operating rate of ternary cathode materials is 53%, down 2%; the price of lithium iron phosphate is 33,400 yuan/ton, unchanged; the monthly operating rate of lithium iron phosphate cathode is 59%, up 2%; the monthly output of new energy vehicles (CAAM) is 1,617,000 vehicles, up 226,000 vehicles; the monthly sales volume of new energy vehicles (CAAM) is 1,604,000 vehicles, up 209,000 vehicles; the cumulative sales penetration rate of new energy vehicles (CAAM) is 46.09%, up 0.55%; the cumulative sales volume of new energy vehicles and year - on - year is 11,228,000 vehicles, up 2,908,000 vehicles; the monthly export volume of new energy vehicles is 222,000 vehicles, down 20,000 vehicles; the cumulative export volume of new energy vehicles and year - on - year is 1.758 million vehicles, up 830,000 vehicles; the 20 - day average volatility of the underlying is 18.69%, down 1.17%; the 40 - day average volatility of the underlying is 32.46%, down 0.85% [2]. Option Situation - The total subscription position is 103,607 contracts, up 9,728 contracts; the total put position is 38,261 contracts, up 2,829 contracts; the put - call ratio of the total position is 36.93%, down 0.8132%; the implied volatility of at - the - money IV is 0.31%, down 0.0002% [2]. Industry News - In the first three quarters, China's GDP increased by 5.2% year - on - year. In September, the added value of industrial enterprises above designated size increased by 6.5% year - on - year, and the total retail sales of consumer goods increased by 3%. As of the end of September, the total number of electric vehicle charging infrastructure in China reached 18.063 million, a year - on - year increase of 54.5%. In September, China imported 19,597 tons of lithium carbonate, a month - on - month decrease of 10% and a year - on - year increase of 20%. The current external environment is more complex and severe, and the task of stabilizing growth in the industry remains arduous [2].

宁德时代电话会:产能处于满负荷状态、涨价不是核心驱动力、数据中心带来的储能需求量可观

Hua Er Jie Jian Wen· 2025-10-21 07:58

Core Viewpoint - CATL reported a Q3 revenue increase of 12.9% year-on-year, with net profit rising by 41.21% to 18.55 billion yuan, significantly outpacing revenue growth [1][3]. Financial Performance - Total revenue for Q3 reached 104.19 billion yuan, a 12.9% increase year-on-year [3]. - Net profit attributable to shareholders was 18.55 billion yuan, reflecting a 41.2% year-on-year growth [3]. - The net profit margin for the period was 19.1%, up by 4.1% year-on-year [3]. - Cash reserves exceeded 360 billion yuan, supporting high R&D investments and large-scale capacity construction [3]. Capacity and Production - The company is experiencing full capacity utilization, with ongoing global capacity expansion to meet increasing order demands [4][9]. - Significant expansions are underway in various domestic bases, with the Jining base expected to add over 100 GWh of energy storage capacity by 2026 [4]. - The overseas factory in Germany has become profitable since its launch in 2024, and the Hungarian factory is expected to start production by the end of 2025 [4][22]. R&D and Innovation - R&D expenses for the first three quarters of 2025 totaled 15.07 billion yuan, a 15.3% increase year-on-year, leading the industry [3]. - The company introduced the NP3.0 technology, enhancing battery system safety for advanced driving levels [5]. - Sodium-ion batteries have been piloted in commercial vehicles, with products expected to launch by the end of this year [5][18]. Market Outlook - The energy storage market is anticipated to continue its growth trajectory, driven by increasing demand from renewable energy installations and AI data centers [6][19]. - The company expects a sustained growth momentum in energy storage for the coming year, supported by a well-established business model [4][17]. - The competitive landscape for energy storage is complex, with high safety and quality standards required, which may deter new entrants [20]. Strategic Partnerships - CATL has formed strategic partnerships with major industry players, including JD.com and Sinopec, to enhance its green energy ecosystem [6][7]. - The company is focused on creating a collaborative network for battery recycling and sustainable practices [7]. Supply Chain Management - The company has a robust supply chain strategy to mitigate the impact of raw material price fluctuations, ensuring competitive product offerings [14]. - The impact of China's lithium battery export controls is minimal, with effective communication with the government facilitating overseas operations [13]. Product Segmentation - Energy storage systems account for approximately 20% of total shipments, with a gradual increase in the proportion of system-side products contributing to net profit [11][17]. - The company anticipates that the demand for data center energy storage solutions will grow significantly, providing substantial market opportunities [26]. Future Projections - The company expects to maintain a strong growth trajectory in both energy storage and power battery sectors, with clear demand forecasts extending to 2030 [19][27]. - The introduction of new battery products is expected to enhance customer acceptance and market share [23].

华宝新能涨0.05%,成交额1.13亿元,近5日主力净流入-1997.52万

Xin Lang Cai Jing· 2025-10-21 07:32

Core Viewpoint - The company, Huabao New Energy, is focused on lithium battery energy storage products and has shown significant growth in revenue and net profit, benefiting from the depreciation of the RMB and strategic partnerships in battery technology [4][8]. Company Overview - Huabao New Energy was established on July 25, 2011, and listed on September 19, 2022. The company specializes in the research, production, and sales of lithium battery energy storage products, with portable energy storage products being its core offering [8]. - The revenue composition of the company includes 77.46% from portable energy storage products, 20.84% from photovoltaic solar panels, and 1.37% from other products [8]. Financial Performance - For the first half of 2025, the company achieved a revenue of 1.637 billion yuan, representing a year-on-year growth of 43.32%. The net profit attributable to the parent company was 123 million yuan, with a year-on-year increase of 68.31% [8]. - The overseas revenue accounted for 95.09% of total revenue, benefiting from the depreciation of the RMB [4]. Strategic Partnerships and Technology - The company has adopted advanced IBC battery technology, achieving a conversion efficiency of up to 25% in its portable solar products [2]. - A strategic partnership was established with Zhongbi New Energy to jointly develop sodium-ion batteries and explore their applications in end products [2]. Market Activity - On October 21, the stock price of Huabao New Energy increased by 0.05%, with a trading volume of 113 million yuan and a turnover rate of 2.32%, leading to a total market capitalization of 11.148 billion yuan [1].

晶科能源涨0.18%,成交额4.14亿元,近5日主力净流入-9028.56万

Xin Lang Cai Jing· 2025-10-21 07:30

Core Viewpoint - JinkoSolar is focusing on N-type TOPCon technology for high-efficiency solar cells, with significant production capacity and technological advancements in the solar energy sector [2]. Company Overview - JinkoSolar, established on December 13, 2006, is headquartered in Shanghai and specializes in the research, production, and sales of solar photovoltaic modules, cells, and wafers [6]. - The company aims to provide high-quality solar energy products globally, with 100% of its revenue derived from product sales [6]. Production and Technology - The company has successfully mass-produced high-efficiency N-type TOPCon cells, with a production capacity of 16GW in Hefei and Haining, achieving a testing efficiency of 24.7% [2]. - JinkoSolar is also developing IBC and perovskite solar cell technologies, indicating a strong commitment to innovation in solar technology [2]. Financial Performance - For the first half of 2025, JinkoSolar reported a revenue of 31.83 billion yuan, a year-on-year decrease of 32.63%, and a net loss of 2.91 billion yuan, a significant decline of 342.38% compared to the previous year [6]. - The company has distributed a total of 3.355 billion yuan in dividends since its A-share listing, with 3.125 billion yuan distributed over the last three years [7]. Market Activity - On October 21, JinkoSolar's stock price increased by 0.18%, with a trading volume of 414 million yuan and a market capitalization of 54.628 billion yuan [1]. - The stock has shown signs of accumulation, but the buying pressure is not strong, with the average trading cost at 5.93 yuan and the stock price near a resistance level of 5.54 yuan [5]. Institutional Holdings - As of June 30, 2025, the second-largest shareholder is Hong Kong Central Clearing Limited, holding 438 million shares, an increase of 57.21 million shares from the previous period [8]. - Other notable institutional investors include Huaxia SSE Sci-Tech 50 ETF and E Fund SSE Sci-Tech 50 ETF, with varying changes in their holdings [8].

禾迈股份跌0.06%,成交额7393.31万元,近3日主力净流入-146.12万

Xin Lang Cai Jing· 2025-10-21 07:29

Core Viewpoint - The company, Hema Electric Power Electronics Co., Ltd., is experiencing fluctuations in stock performance and is involved in the photovoltaic and energy storage sectors, benefiting from the depreciation of the RMB and plans for share repurchase and increase in holdings by major shareholders [1][3]. Company Overview - Hema Electric Power Electronics Co., Ltd. specializes in the research, manufacturing, and sales of photovoltaic inverters, energy storage products, and electrical equipment [2][7]. - The company's main products include micro-inverters, monitoring equipment, distributed photovoltaic systems, modular inverters, and energy storage systems [2][7]. - The company has been recognized as a "specialized, refined, distinctive, and innovative" small giant enterprise, indicating its strong market position and innovation capabilities [2]. Financial Performance - For the first half of 2025, the company achieved a revenue of 1.005 billion yuan, representing a year-on-year growth of 10.78%, while the net profit attributable to shareholders decreased by 91.33% to 16.27 million yuan [8]. - As of June 30, the company had 9,849 shareholders, a decrease of 5.73% from the previous period, with an average of 12,597 circulating shares per person, an increase of 6.08% [8]. Market Position and Trends - The company has a significant overseas revenue share of 64.25%, benefiting from the depreciation of the RMB [3]. - The stock has shown a slight decline of 0.06% recently, with a trading volume of 73.93 million yuan and a turnover rate of 0.56%, leading to a total market capitalization of 13.273 billion yuan [1]. Shareholder Activity - On March 5, 2025, Hangkai Holdings Group announced plans to increase its holdings in Hema Electric, with an investment amount between 111.5 million yuan and 223 million yuan, funded by self-owned capital and special loans [3].

宁德时代Q3储能出货约36GWh,587Ah产品出货占比将提升

鑫椤储能· 2025-10-21 07:15

Core Viewpoint - CATL reported strong financial performance in Q3 2025, with significant year-on-year growth in both revenue and net profit, indicating robust demand and operational efficiency in the energy storage and battery sectors [1][2]. Financial Performance - In Q3 2025, CATL achieved revenue of 104.19 billion yuan, a year-on-year increase of 12.9% [2]. - The net profit attributable to shareholders reached 18.55 billion yuan, reflecting a growth of 41.21% compared to the same period last year [2]. - For the first three quarters of the year, total revenue was 283.07 billion yuan, up 9.28%, while net profit was 49.03 billion yuan, an increase of 36.20% [1][2]. Product Shipment and Market Dynamics - In Q3, CATL's total shipment of power and energy storage batteries approached 180 GWh, with energy storage accounting for approximately 20% (around 36 GWh) [2]. - The company noted that overseas exports constituted about 30% of total shipments, while the domestic market represented nearly 70% [2]. Capacity Expansion and Market Trends - Following the issuance of Document No. 136 on domestic energy storage, CATL is experiencing rapid growth in the domestic energy storage market, with plans for significant capacity expansion [3]. - The company is currently facing capacity constraints but anticipates improved delivery capabilities as production capacity is gradually released [5]. - CATL is accelerating the mass production of its 587Ah energy storage cells, which are designed to balance energy density, safety, and longevity [5]. Global Expansion Efforts - CATL is actively expanding its global production capacity, with significant expansions planned in various domestic locations, including Shandong, Guangdong, Jiangxi, Fujian, and Qinghai [5]. - The company’s overseas facilities are also progressing, with the German factory expected to achieve mass production in 2024, and the Hungarian factory's first phase projected to be completed by the end of 2025 [5]. Market Demand and Future Outlook - The energy storage business model is maturing, with increasing economic viability and rapid growth in both domestic and international demand [6]. - The expansion of global AI data centers is driving substantial electricity demand, positioning solar storage systems as a primary power source for these facilities [6].

永泰能源涨2.40%,成交额14.09亿元,主力资金净流入3967.64万元

Xin Lang Cai Jing· 2025-10-21 06:59

Core Viewpoint - Yongtai Energy's stock has shown a slight increase in recent trading sessions, with a current price of 1.71 CNY per share and a market capitalization of 37.308 billion CNY, indicating a stable performance in the coal and power sectors [1]. Financial Performance - For the first half of 2025, Yongtai Energy reported a revenue of 10.676 billion CNY, a year-on-year decrease of 26.44%, and a net profit attributable to shareholders of 126 million CNY, down 89.41% compared to the previous year [2]. - The company has cumulatively distributed 1.741 billion CNY in dividends since its A-share listing, with 122 million CNY distributed over the last three years [3]. Stock Market Activity - As of October 21, Yongtai Energy's stock price has remained unchanged year-to-date, with a 5-day increase of 0.59%, a 20-day increase of 11.76%, and a 60-day increase of 19.58% [1]. - The stock has appeared on the trading leaderboard once this year, with a net buy of 286 million CNY on September 18, accounting for 14.40% of total trading volume [1]. Shareholder Structure - As of June 30, 2025, Yongtai Energy had 561,600 shareholders, a decrease of 3.76% from the previous period, with an average of 39,563 shares held per shareholder, an increase of 3.91% [2]. - The top shareholders include Southern CSI 500 ETF, holding 330 million shares, and Hong Kong Central Clearing Limited, holding 195 million shares, with notable changes in their holdings [3].

每天净赚约1.8亿元!宁德时代三季报出炉:储能需求旺盛,新能源商用车业务增速明显

Mei Ri Jing Ji Xin Wen· 2025-10-21 06:57

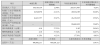

Core Insights - Ningde Times reported a strong performance in Q3, with a revenue of 104.19 billion yuan, a year-on-year increase of 12.9%, and a net profit of 18.55 billion yuan, up 41.21% [1][2] - For the first three quarters, the company achieved a total revenue of 283.07 billion yuan, a 9.28% increase, and a net profit of 49.03 billion yuan, growing by 36.2% [1][2] - The company generated a net cash flow from operating activities of 80.66 billion yuan, reflecting a 19.6% increase year-on-year [1][2] Financial Performance - Q3 revenue: 104.19 billion yuan, up 12.9% YoY [2] - Net profit for Q3: 18.55 billion yuan, up 41.21% YoY [2] - Revenue for the first three quarters: 283.07 billion yuan, up 9.28% YoY [2] - Net profit for the first three quarters: 49.03 billion yuan, up 36.2% YoY [2] - Basic earnings per share: 4.10 yuan, up 37.23% YoY [2] - Total assets at the end of the reporting period: 896.08 billion yuan, a 13.91% increase from the previous year [2] Business Segments - The energy storage business is a significant growth area, with approximately 20% of Q3 shipments being energy storage products [4] - The company is expanding its energy storage capacity across multiple locations, with a projected increase of over 100 GWh in the Jining base by 2026 [4] - The commercial vehicle battery segment has seen rapid growth, with nearly 20% of total shipments attributed to this sector [9] Market Trends - The energy storage market is experiencing substantial growth, with a reported 115.2% increase in global energy storage battery shipments in the first half of 2025 [4][5] - The Chinese government has implemented policies to support the profitability of energy storage, which is expected to drive market expansion [5] - The commercial vehicle market for new energy trucks is at a turning point, with a projected penetration rate exceeding 60% by 2030 [9]

宁德时代(300750):Q3盈利超预期

HTSC· 2025-10-21 05:53

Investment Rating - The report maintains a "Buy" rating for the company with a target price of RMB 566.18 [7]. Core Insights - The company reported Q3 earnings that exceeded expectations, with revenue of RMB 104.19 billion, a year-on-year increase of 12.90%, and a quarter-on-quarter increase of 10.62%. The net profit attributable to shareholders was RMB 18.55 billion, up 41.21% year-on-year and 12.26% quarter-on-quarter [1][2]. - The company is expected to benefit from increasing demand in various sectors, including passenger vehicles, commercial vehicles, and energy storage, as well as from the development of new products and expansion into overseas markets [1]. - The company has a strong cash flow position, with operating cash flow of RMB 806.60 billion for the first three quarters, a year-on-year increase of 19.6%, and cash reserves totaling RMB 367.5 billion at the end of Q3, up 28% year-on-year [2]. Summary by Sections Q3 Performance - Q3 revenue reached RMB 104.19 billion, a 12.90% increase year-on-year and a 10.62% increase quarter-on-quarter. The net profit attributable to shareholders was RMB 18.55 billion, reflecting a 41.21% year-on-year increase [1]. - For the first three quarters, total revenue was RMB 283.07 billion, up 9.28% year-on-year, and net profit was RMB 49.03 billion, up 36.20% year-on-year [1]. Profitability Metrics - The company's gross margin for Q3 was 25.80%, down 5.37 percentage points year-on-year but up 0.23 percentage points quarter-on-quarter. The net margin improved to 19.13%, an increase of 4.12 percentage points year-on-year [2]. - The increase in net margin is attributed to improved capacity utilization and a higher proportion of high-margin products [2]. Market Position and Product Development - The company maintained its leading position in the global power battery market, with a market share of 36.8% in global installations and 42.75% in domestic installations for the first nine months of the year [3]. - The company is actively expanding into sodium batteries and solid-state batteries, with pilot projects underway for commercial vehicles and collaborations for passenger vehicles [3]. Energy Storage Market - The company estimated Q3 energy storage battery shipments at approximately 36 GWh, benefiting from strong global demand in the energy storage market, which saw a year-on-year increase of 65% in Q3 [4]. - The company is expanding production capacity to meet the growing demand and is expected to continue increasing its market share in the energy storage sector [4]. Earnings Forecast and Valuation - The report raises the company's net profit forecasts for 2025-2027 by 5.86%, 15.03%, and 20.96%, respectively, leading to projected net profits of RMB 705.34 billion, RMB 922.65 billion, and RMB 1,119.33 billion [5]. - The target price is adjusted to RMB 566.18, based on a 28x PE ratio for 2026, reflecting the company's strong earnings resilience and ongoing technological advancements [5].

全面拉产能,宁王终于熬出头了?

Tai Mei Ti A P P· 2025-10-21 04:33

Core Viewpoint - The third-quarter performance of CATL (宁德时代) did not meet market expectations, with revenue of 104.2 billion yuan falling short of the anticipated 120 billion yuan, indicating a discrepancy of over 10% [1][2][14]. Revenue and Profitability - The company's revenue for Q3 was 104.2 billion yuan, showing a year-on-year growth of 13% but not reaching the levels of the same period in 2023, with a quarter-on-quarter increase of 11% [14][16]. - The core operating profit, which reflects the company's true profit-generating ability, grew by 30% year-on-year, primarily due to last year's significant asset impairment [4][30]. - The net profit attributable to shareholders was 18.55 billion yuan, aligning closely with market expectations and representing a 42% year-on-year increase [2][30]. Shipment and Inventory - The total shipment volume for Q3 was 180 GWh, with a recognized revenue volume of 165 GWh, which is in line with market expectations for the year [2][16]. - Inventory reached a record high of 80.2 billion yuan, indicating a buildup of stock in anticipation of the fourth quarter's peak season and reflecting a significant amount of shipped but unrecognized revenue [5][32]. Cost and Margin Analysis - The battery unit price remained stable at approximately 0.56 yuan/Wh, despite an increase in lithium carbonate prices, suggesting a shift in product mix towards lower-priced lithium iron phosphate batteries [2][23]. - The overall gross margin improved slightly from 25.6% to 25.8%, indicating a gradual recovery in profitability [2][25]. Capacity and Expansion - The company is operating at near full capacity and has plans for significant domestic and overseas capacity expansion to meet rising demand [5][36]. - Capital expenditures are expected to accelerate, with major production bases in China expanding and new facilities in Europe and Indonesia being developed [36][38]. Market Position and Future Outlook - CATL's market share in domestic battery installations is declining, but the company is well-positioned to benefit from the growing demand for energy storage solutions, particularly in overseas markets [17][21]. - The company has set a production target of over 1 TWh for 2026, with expectations of achieving a net profit of approximately 69 billion yuan for the year [9][11].