银行息差

Search documents

中信证券:银行股低估值隐含的价值空间依旧显著 建议积极布局

智通财经网· 2025-11-17 00:45

Core Viewpoint - The report from CITIC Securities indicates a marginal slowdown in the expansion of bank balance sheets in October, primarily due to early government bond issuance and a continued weak demand for credit from the real economy. The focus on liquidity management will increase as the year-end approaches, while the industry’s interest margins have shown initial stabilization in Q3, with regulatory attention on profitability and pricing factors expected to improve in the future [1][2][4]. Group 1: Financial Data and Trends - In October, the year-on-year growth rate of social financing (社融) was 8.5%, slightly down from 8.7% in September [2]. - Government bonds saw a year-on-year increase of 3.72 trillion yuan in the first ten months, but in October, there was a decrease of 560.2 billion yuan compared to the previous year, attributed to the early issuance this year [2]. - The demand for credit from the real economy remains weak, with a decrease of 154 billion yuan in RMB loans in October, reflecting a year-on-year decline of 311.9 billion yuan [2]. Group 2: Deposit Trends - In October, there was a seasonal shift in deposits, with a decrease of 1.34 trillion yuan in resident deposits and an increase of 1.85 trillion yuan in non-bank deposits, indicating a shift of funds towards non-bank financial institutions [3]. - Corporate deposits also showed weakness, with a decline of 1.09 trillion yuan in October, reflecting a year-on-year decrease of 355.3 billion yuan, primarily due to weak credit generation [3]. Group 3: Regulatory Focus - Regulatory bodies continue to emphasize the importance of stabilizing bank interest margins, with the central bank highlighting the need for a reasonable interest rate relationship to support banks' ability to sustain economic support [4]. - The Deputy Governor of the central bank stressed the need to avoid excessive competition within the financial industry to maintain reasonable profitability, indicating ongoing regulatory scrutiny on banks' interest margins and profit growth [4].

银行25Q3综述:韧性好于预期

HTSC· 2025-11-04 02:19

Investment Rating - The report maintains an "Overweight" rating for the banking sector [2] Core Viewpoints - The banking sector shows resilience better than expected, with a focus on strong fundamentals and quality dividends driving core profit improvement [6][15] - The annualized non-performing loan generation rate for listed banks is 0.55%, down 13 basis points from Q2 2025, indicating a marginal decline in non-performing loan generation across all types of banks [6] - The report suggests focusing on two main directions for investment: high-quality fundamentals that may recover valuation premiums as market risk appetite increases, and stable high-dividend stocks [6][15] Summary by Sections Operating Overview - In the first nine months of 2025, listed banks' revenue and net profit grew by 0.9% and 1.5% year-on-year, respectively, with revenue growth slightly declining due to bond market volatility affecting non-interest income [15][24] - The net interest margin for listed banks was 1.41%, remaining stable compared to the first half of 2025, driven by a continuous decline in funding costs [15][25] Profitability Breakdown - The net interest income of listed banks decreased by 0.6% year-on-year, but various types of banks showed improvement in net interest income, particularly city commercial banks [25] - Non-interest income from wealth management and commission fees increased by 4.6% year-on-year, reflecting a recovery in capital markets [16][25] Asset and Liability Insights - Total assets and liabilities of listed banks grew by 9.3% year-on-year, maintaining steady expansion [17] - Loan growth remained stable, with a year-on-year increase of 7.8%, while deposits grew by 7.8%, indicating a slight decline in deposit growth rate [10][17] Risk Perspective - The overall non-performing loan ratio for listed banks was stable at 1.23%, with a provision coverage ratio of 236%, indicating solid asset quality [11][15] Market Outlook - The report anticipates a gradual recovery in bank performance, with a focus on quality banks that exhibit strong resilience [6][15]

聚焦红利与复苏双主线

HTSC· 2025-11-03 11:10

Group 1 - The report highlights a favorable policy environment expected to support the banking sector's performance recovery in 2026, with a focus on value investment fundamentals [1][15][20] - The current macro policy has shifted from "one-way benefits" to a "two-way balance," which is more conducive to stable banking operations, emphasizing the importance of maintaining bank interest margins while supporting the real economy [2][16][20] - The banking sector is anticipated to see a gradual recovery in performance, driven by stabilizing interest margins and improving core profitability, with quality regional banks showing stronger resilience [3][17][21] Group 2 - The report identifies insurance and industrial capital as significant future incremental funding sources, with insurance companies expected to increase equity market allocations, particularly in banks with stable earnings and high dividend returns [4][18] - Local state-owned enterprises are actively increasing investments in local banks, creating a win-win situation for both parties, while asset management companies are also increasing their stakes in several national banks [4][18] - The report suggests focusing on banks with strong fundamentals and high dividend yields, as the importance of stock selection has increased in the current volatile market environment [5][19] Group 3 - The report recommends specific banks for investment, including Chengdu Bank, Industrial and Commercial Bank of China, Nanjing Bank, Chongqing Rural Commercial Bank, China Construction Bank, Shanghai Bank, Ningbo Bank, and Chongqing Rural Commercial Bank, indicating a positive outlook for these institutions [9][19] - The anticipated stabilization of interest margins and recovery of non-interest income is expected to support the overall performance of listed banks in 2026, with quality banks likely to outperform [3][17][21] - The report emphasizes the need for a strategic focus on banks with quality fundamentals and dividend advantages, as the market shifts from a defensive high-dividend strategy to one that values fundamental quality and profitability elasticity [5][19]

浙商证券:25Q3银行营收利润增速韧性强 Q4有望深蹲起跳

智通财经网· 2025-11-03 06:19

Core Viewpoint - The performance of listed banks in Q1-Q3 2025 slightly exceeded expectations, with revenue growth remaining stable and profit growth showing a slight increase [1][2] Performance Overview - Listed banks' revenue growth year-on-year is stable at 0.9%, while profit growth has increased to 1.6%. The weighted revenue and net profit attributable to shareholders increased by 0.9% and 1.6% respectively, with a slight slowdown in growth compared to H1 2025 [2][3] - Large banks showed a comprehensive performance turnaround, while the performance of small and medium-sized banks was mixed. Agricultural Bank, Bank of Communications, China Bank, and Industrial Bank performed better than expected, while China Construction Bank experienced a significant decline in quarterly interest margin [2][3] Driving Factors - Asset scale growth for listed banks in Q1-Q3 2025 was 9.3%, a slowdown of 0.3 percentage points compared to H1 2025. Loan growth decreased while financial investment growth increased [3] - The interest margin stabilized in Q3 2025, with a slight increase of 0.3 basis points to 1.37%. The asset yield decreased by 7 basis points to 2.81%, while the cost of liabilities decreased by 8 basis points to 1.56% [4] Non-Interest Income - Non-interest income for listed banks grew by 5.0% year-on-year, but the growth rate decreased by 2.0 percentage points compared to the previous quarter. Fee and commission income increased by 4.6% year-on-year, indicating some recovery in related business [5][6] - Bond trading income decreased by 0.6% year-on-year, with small and medium-sized banks experiencing a larger decline compared to state-owned banks [5][6] Asset Quality - The average non-performing loan (NPL) ratio remained stable at 1.23%, while the average attention rate increased by 2 basis points to 1.69%. The retail sector continues to face pressure, particularly in small and micro loans [7][8] - The number of banks announcing mid-term dividends has increased, with some banks raising their mid-term dividend rates compared to the previous year [9] Recommended Stocks - Recommended stocks include Shanghai Pudong Development Bank, Nanjing Bank, Shanghai Bank, Jiangsu Bank, Agricultural Bank, and Bank of Communications, with a focus on Qilu Bank and H-share large banks [9]

苏州银行(002966):投资韧性稳定业绩增长预期

Xin Lang Cai Jing· 2025-11-02 08:41

Core Insights - Suzhou Bank reported a year-on-year increase in net profit and operating income of 7.1% and 2.0% respectively for the first nine months of 2025, with growth rates improving compared to the first half of the year [1] - The bank's annualized ROE and ROA decreased by 0.83 percentage points and 0.06 percentage points to 12.03% and 0.84% respectively [1] Group 1: Financial Performance - As of September 2025, Suzhou Bank's total assets, loans, and deposits grew by 14.6%, 11.6%, and 12.9% respectively, showing slight improvements compared to June [2] - The bank's net interest margin for Q3 2025 was 1.34%, a slight increase from the first half of the year, primarily due to improved funding costs [3] - Interest income for the first three quarters of 2025 increased by 8.9% year-on-year, benefiting from the stabilization of the net interest margin [3] Group 2: Asset Quality and Capital - The non-performing loan (NPL) ratio remained stable at 0.83% as of Q3 2025, with a provision coverage ratio of 421%, indicating strong asset quality [4] - The capital adequacy ratio and core tier 1 capital ratio were reported at 13.57% and 9.79% respectively, showing slight declines from June [4] - The bank declared a mid-term dividend of 2.1 yuan per share, totaling 939 million yuan, which represents 32.36% of net profit attributable to ordinary shareholders [4] Group 3: Future Outlook - The bank maintains a profit forecast of 5.4 billion yuan, 5.8 billion yuan, and 6.2 billion yuan for 2025-2027, with a consistent growth rate of approximately 7.1% [5] - The estimated book value per share (BVPS) for 2025 is projected at 10.60 yuan, with a target price of 10.07 yuan based on a price-to-book (PB) ratio of 0.95 [5]

苏农银行(603323):成本改善助力利润稳健增长

HTSC· 2025-10-30 08:56

Investment Rating - The report maintains a "Buy" rating for the company with a target price of RMB 6.33 [7][5]. Core Insights - The company has shown steady profit growth driven by cost improvements, with a 5.0% year-on-year increase in net profit and a 0.1% increase in revenue for the first nine months of 2025 [1]. - Credit growth has accelerated, with total assets, loans, and deposits growing by 7.9%, 8.7%, and 7.3% respectively at the end of Q3 2025, indicating a strong expansion strategy [2]. - The narrowing decline in net interest margin, which stands at 1.35%, is attributed to improved funding costs, despite a 3.8% year-on-year decrease in net interest income [3]. - The non-performing loan (NPL) ratio remains stable at 0.90%, with a significant reduction in asset impairment losses by 61.2% year-on-year, contributing positively to profit growth [4]. Summary by Sections Financial Performance - For the first nine months of 2025, the company reported a net profit of RMB 2,043 million, with a year-on-year growth of 5.1% projected for 2025 [10][29]. - The cost-to-income ratio improved to 29.9%, down 3.0 percentage points year-on-year, reflecting effective cost management [3]. Credit and Asset Quality - The company issued new loans totaling RMB 16 billion in Q3 2025, with a focus on corporate lending, while retail demand is still recovering [2]. - The NPL generation rate for Q3 2025 was measured at 0.45%, down 52 basis points from Q2, indicating improved asset quality [4]. Valuation Metrics - The estimated price-to-book (PB) ratio for 2026 is set at 0.60, with a target price of RMB 6.33, reflecting a premium valuation due to the company's clear development strategy and expansion potential [5][24].

两家股份行率先披露三季报

Huan Qiu Wang· 2025-10-26 01:43

Core Insights - The financial reports for the third quarter of 2025 from Huaxia Bank and Ping An Bank indicate a decline in revenue and net profit, attributed to various market factors and operational challenges [1][4]. Group 1: Huaxia Bank - Huaxia Bank reported a revenue of 648.81 billion yuan for the first three quarters, a year-on-year decrease of 8.79%, and a net profit of 179.82 billion yuan, down 2.86% [1][3]. - The bank's non-performing loan (NPL) ratio decreased by 0.02 percentage points to 1.58%, while the provision coverage ratio fell to 149.33% and the loan provision ratio decreased to 2.36% [1][3]. - The CEO attributed the revenue decline primarily to fluctuations in the bond market, which affected fair value changes, while net interest income remained stable [3]. Group 2: Ping An Bank - Ping An Bank achieved a revenue of 1006.68 billion yuan in the first three quarters, a year-on-year decline of 9.8%, with a net profit of 383.39 billion yuan, down 3.5% [4][5]. - The bank cited two main factors for the revenue drop: a decrease in loan interest rates and market volatility affecting non-interest income [4]. - The NPL ratio for Ping An Bank decreased by 0.01 percentage points to 1.05%, with a provision coverage ratio of 229.60% [5].

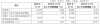

中资&香港银行3Q25业绩预览

2025-10-22 14:56

Summary of Key Points from the Conference Call Records Industry Overview - The banking industry in China and Hong Kong showed steady revenue and profit growth in Q3 2025, although the revenue growth of the four major banks declined sequentially due to an unexpected increase in non-interest income in Q2 [1][2][3]. - As of the end of September, overall loan growth slowed to 6.8%, with limited credit demand, leading to a potential increase in the allocation of financial and interbank assets [1][5]. - The net interest margin (NIM) decline narrowed to 13 basis points year-on-year, with expectations for future improvement due to decreasing funding costs and the repricing of time deposits [1][9]. Company-Specific Insights Chinese Banks - Revenue for Chinese banks is expected to remain flat year-on-year, with net profit growth around 1% for Q3 2025. Asset quality remains stable, with non-performing loans primarily concentrated in retail lending [1][14][15]. - Regional banks, particularly city commercial banks and rural commercial banks in economically developed areas, continue to experience rapid growth [1][3]. Hong Kong Banks - Profit growth for Hong Kong banks is projected to slow to 3% in Q3 2025, but the overall return on total capital (ROT) remains attractive, estimated between 11% and 17% for the year [1][18]. - Non-interest income is expected to maintain double-digit growth, despite fluctuations in net interest income due to global interest rate changes [1][4][18]. Key Financial Metrics - The asset growth rate for banking financial institutions was approximately 8.4% year-on-year as of the end of August, with large banks and city commercial banks being the main contributors [5]. - New loan structures show that large banks continue to lead in new loan volumes, with significant demand concentrated in corporate business, infrastructure, and green-related sectors [6][7]. Market Dynamics - The anticipated interest rate cuts by the Federal Reserve are expected to impact net interest income for Hong Kong banks, but structural hedging measures and an increase in CASA (current account savings account) deposits are expected to mitigate these effects [4][22]. - Credit demand in Hong Kong remains weak, with total loans declining in July and August, although deposits have increased due to active capital markets and wealth management needs [21]. Investment Considerations - The acquisition of Hang Seng Bank by HSBC aims to enhance synergy and simplify operations, with completion expected by mid-2026. This move is anticipated to improve earnings per share (EPS) and dividends, despite a temporary suspension of share buybacks [4][28][29]. - The investment appeal of dividend and high-yield stocks is increasing, with several Chinese banks offering dividend yields above 5% [17]. Risks and Challenges - Concerns regarding commercial real estate risks in Hong Kong have emerged, with some banks increasing provisions due to rising exposure. The market is closely monitoring the impact of these risks on overall asset quality [27]. - The overall economic environment and regulatory measures are expected to influence the banking sector's performance, particularly regarding non-performing loans and credit growth [15][16]. This summary encapsulates the essential insights and data from the conference call records, providing a comprehensive overview of the banking industry's current state and future outlook.

LPR连续5个月“按兵不动”,降息窗口仍需等待

Di Yi Cai Jing· 2025-10-20 05:38

Core Viewpoint - The Loan Prime Rate (LPR) remains unchanged for October, reflecting stable policy rates and ongoing pressure on bank interest margins, indicating limited room for LPR reduction in the near term [1][2][3]. Group 1: LPR Stability - The LPR for both 1-year and 5-year terms remains at 3.0% and 3.5% respectively, unchanged for five consecutive months, aligning with market expectations [1][2]. - The stability of the central bank's 7-day reverse repurchase rate at 1.40% since May limits the basis for LPR reduction, as it has not changed [2]. - Bank interest margin pressures are increasing due to ongoing efforts to reduce costs for the real economy, with the net interest margin of commercial banks dropping to 1.42% by Q2 2025, down 10 basis points from the previous year [2]. Group 2: Economic Context - The need for stable growth has increased due to external pressures, such as high tariffs from the U.S. affecting global trade and domestic investment and consumption slowing down [4]. - The People's Bank of China (PBOC) has indicated a commitment to maintaining a moderately loose monetary policy to support consumption and effective investment [4]. Group 3: Future Monetary Policy Directions - Experts suggest that there is potential for targeted LPR reductions before the end of the year to stimulate domestic demand and stabilize the real estate market [5][6]. - The PBOC may utilize various monetary policy tools, including reverse repos and MLF operations, to enhance liquidity and support key sectors [6]. - External factors, such as the potential for continued interest rate cuts by the Federal Reserve, may provide a conducive environment for domestic monetary easing [6][7].

LPR已连续4个月持平 10月会变吗?

财联社· 2025-10-18 07:55

Core Viewpoint - The expectation is that the LPR (Loan Prime Rate) will remain unchanged in October, as various analysts believe there is no urgent need for a reduction given the current economic conditions and credit data [1][5][6]. Group 1: LPR Stability - Analysts predict that both the one-year and five-year LPR will hold steady in October due to stable policy interest rates and positive credit data [1][2]. - The current low levels of corporate and personal loan rates suggest that lowering the LPR is not a priority at this time [3][6]. - The pressure on bank interest margins and the need to meet year-end credit targets are factors contributing to the expectation of no change in the LPR [5][6]. Group 2: Future Rate Adjustments - Some analysts anticipate a potential reduction of 10 to 30 basis points in the LPR by the end of the year, particularly if external economic pressures, such as U.S. tariff policies, continue to impact global trade [4][10]. - The possibility of a rate cut is also supported by the need to stimulate credit demand and stabilize the real estate market [10][11]. - The recent actions of the People's Bank of China, including significant reverse repurchase operations, indicate a cautious approach to interest rate adjustments, aiming to avoid excessive pressure on bank margins [6][8]. Group 3: External Influences - The recent 25 basis point rate cut by the Federal Reserve is seen as a factor that could influence future LPR adjustments, although its immediate impact is limited [7][8]. - Analysts note that the domestic banking sector's pressure on interest margins may necessitate a prior reduction in deposit rates before any LPR cuts can effectively lower loan rates [8][10]. - The overall economic environment, including inflation levels and credit demand, will play a crucial role in determining the timing and extent of any future LPR adjustments [9][11].