业务转型升级

Search documents

时空科技“蛇吞象”!跨界收购存储企业,复牌后一字涨停

Ge Long Hui· 2025-10-23 03:45

Core Viewpoint - Company is attempting to find new growth engines through cross-border acquisitions after four years of losses in its main business of smart lighting engineering [1][8] Group 1: Acquisition Details - Company plans to acquire 100% of Shenzhen Jiahe Jinwei Electronic Technology Co., Ltd. through a combination of issuing shares and cash payment [1][2] - The acquisition involves 19 counterparties, including key individuals and management consulting partnerships [2][4] - Company intends to raise matching funds from its controlling shareholder, Gong Lanhai, not exceeding 100% of the acquisition price, with a maximum issuance of 30% of the total share capital prior to the issuance [2][5] Group 2: Financial Performance - Company reported a cumulative loss of approximately 696 million yuan over four years, with net profits of -17.67 million yuan, -209 million yuan, -207 million yuan, and -262 million yuan from 2021 to 2024 [8][10] - In the first half of 2025, company achieved revenue of 144 million yuan, a year-on-year decline of 10.95%, and a net loss of 66.27 million yuan [10][9] - The financial performance of Jiahe Jinwei shows projected revenues of 854 million yuan, 1.344 billion yuan, and 1.123 billion yuan for 2023, 2024, and the first eight months of 2025, respectively [6][8] Group 3: Strategic Shift - The acquisition is part of a strategic adjustment in response to pressure on the main business, with the company aiming to enhance its asset quality and risk resistance through the integration of semiconductor storage assets [6][8] - Company has been facing intensified competition in the landscape lighting industry, leading to compressed profit margins and increasing accounts receivable issues [10][11] - Company is also focusing on the development of night economy and smart city projects, with revenues from these sectors reported at 87.19 million yuan and 56.21 million yuan, respectively, in the first half of 2025 [10][11]

605178 重大资产重组!周四复牌

Shang Hai Zheng Quan Bao· 2025-10-22 15:17

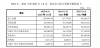

Core Viewpoint - The company, Shikong Technology, plans to acquire 100% equity of Shenzhen Jiahe Jingwei Technology Co., Ltd. to enter the storage sector and create a second growth curve, enhancing its profitability and transforming its production capabilities [1][5]. Group 1: Acquisition Details - The acquisition will be executed through issuing shares and cash payments to 19 parties, with a share price set at 23.08 yuan per share [2]. - The company aims to raise funds not exceeding 100% of the asset purchase price, with a maximum issuance of 30% of the total share capital prior to the issuance [2]. - The raised funds will be allocated for cash payments, intermediary fees, taxes, and to support working capital and debt repayment [2]. Group 2: Target Company Overview - Jiahe Jingwei specializes in the R&D, design, production, and sales of storage products, including memory bars and solid-state drives, with three main product lines [3]. - The company has shown consistent revenue growth, with projected revenues of 854 million yuan in 2023, 1.344 billion yuan in 2024, and 1.123 billion yuan for the first eight months of 2025 [3]. Group 3: Financial Performance - Jiahe Jingwei's financials indicate total assets of approximately 1.299 billion yuan and total liabilities of about 693.5 million yuan as of August 31, 2025 [4]. - The net profit for 2024 is projected at 42.71 million yuan, with a net profit of 42.29 million yuan reported for the first eight months of 2025 [3][4]. Group 4: Strategic Implications - The acquisition is expected to enhance the company's asset quality and risk resilience, facilitating its transition and growth in the information technology sector [5]. - The controlling shareholder, Gong Lanhai, has committed to a 36-month lock-up period for both newly issued and existing shares [6].

广博股份分析师会议-20251021

Dong Jian Yan Bao· 2025-10-21 14:30

Report Summary 1. Report Industry Investment Rating - Not provided in the document 2. Core Viewpoint of the Report - Guangbo Co., Ltd. has achieved business transformation and continuous development from stationery to cultural and creative products, and then to trendy toys, creating new performance growth points [25] 3. Summary by Relevant Catalogs 3.1. Research Basic Information - Research object: Guangbo Co., Ltd. [17] - Industry: Household light industry [17] - Reception time: October 21, 2025 [17] - Company reception staff: Jiang Shuying, the board secretary and deputy general manager, and Wang Xiuna, the securities affairs representative [17] 3.2. Detailed Research Institutions - Reception object type: Securities company [20] - Institution: Southwest Securities [20] - Relevant personnel: Gou Yurui, Cai Xin, Shen Qi [20] 3.3. Research Institution Proportion - Not provided in the document 3.4. Main Content Information - **Company product exhibition**: The company introduced its products in the company showroom [22] - **IP matrix construction**: In the cultural and creative field, the company has launched sub - brands such as "kinbor", "fizz 飞兹", "papiest 派乐时刻", and strengthened IP resource introduction and cooperation, achieving a preliminary transformation from a traditional stationery manufacturer to a cultural and creative enterprise [23] - **Entry into the trendy toy field**: The company has accelerated the incubation of trendy toy categories, built an extreme single - product matrix, and implemented a strategy of coordinated development of head IPs and long - tail IPs to promote the development of trendy toy business [24] - **Exhibition products**: The company's trendy toy brand product matrix includes various categories. The exhibits at the CTE China Toy Fair & Trendy Toy Fair include co - branded products of many IPs, and the "Detective Conan M28: One - Eyed Remnant Image" food toy series was premiered [25] - **Overseas business**: The company is pushing forward overseas layout, targeting the Southeast Asian market, and promoting the large - scale export of products. It currently has production bases in Vietnam, Cambodia, and Malaysia and will expand the Vietnam production base [26]

广博股份(002103) - 002103广博股份投资者关系管理信息20251021

2025-10-21 09:28

Group 1: Company Overview and Strategy - Guangbo Group is transitioning from a traditional stationery manufacturer to a cultural creative enterprise, establishing a diverse brand matrix with sub-brands like "kinbor," "fizz," and "papiest" to cater to various consumer needs [3] - The company is focusing on the explosive growth of the trendy toy market, expanding its product offerings to include badges, cards, and plush toys, aligning with current market trends [3][4] - Guangbo aims to enhance its product competitiveness in the trendy toy segment through a well-structured product matrix that emphasizes design and quality [4] Group 2: Product Development and IP Strategy - The company is deepening its strategy of synergistic development between leading IPs and niche IPs, leveraging both to attract different consumer segments and enhance product value [4] - Recent participation in the "CTE China Toy & Trendy Play Expo" showcased a diverse range of trendy toy products, including collaborations with popular IPs like "Detective Conan" and "HUNTER×HUNTER" [6] - The launch of the "Detective Conan M28: The One-Eyed Phantom" food play series exemplifies the company's innovative approach, integrating content, product, and experience to engage Gen Z consumers [6] Group 3: International Expansion and Production - Guangbo is increasing its overseas presence, particularly in Southeast Asia, where there is a growing demand for culturally rich and creatively designed trendy toys [7] - The company currently operates production bases in Vietnam, Cambodia, and Malaysia, with plans to expand the Vietnam facility to enhance its global supply chain resilience [8] - This multi-regional production strategy aims to mitigate operational risks and optimize cost structures, strengthening the company's competitive edge in international markets [8]

短视频东风带来业务新突破 磨铁集团南下大湾区“觅知音”

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-17 23:15

Core Insights - The rapid development of short videos is significantly impacting the book industry, prompting companies like Motie Group to embrace change and innovate their business models [1][2] - Motie Group aims to leverage short video platforms for book sales and content production, enhancing their market presence and operational efficiency [2][3] Company Strategy - Motie Group has transitioned from a traditional book company to a comprehensive cultural and creative industry group, focusing on a full-spectrum content product offering and a complete copyright operation capability [2] - Since 2020, the company has increased its investment in online sales, establishing a multi-channel sales network that effectively reaches readers [2][3] - The company has developed a user base of over 28 million across platforms like Douyin, Xiaohongshu, Bilibili, and Kuaishou, with nearly 30% of book sales revenue coming from online channels [2][3] Product Focus - The company has identified youth literature and ACG (Anime, Comic, and Games) as high-performing categories, aligning well with the demographics of short video platform users [3] - Approximately 80% of the books produced by Motie are original content from China, with a focus on leveraging short video content for innovative book production methods [3][4] Business Segments - Motie Group operates three major business segments: Motie Entertainment, Motie Literature, and Motie Animation, all of which extend from its core book business [5] - The growth of the book business provides a strong foundation for the development of these innovative segments, which in turn support the book business's continued growth [5] Investment and Development - The 2025 Guangdong-Hong Kong-Macao Greater Bay Area Cultural Industry Investment Conference is anticipated to foster connections between cultural projects and capital, benefiting the cultural industry [1][6] - The Greater Bay Area is seen as a crucial development area for Motie Group due to its large consumer base and creative talent pool [6]

南山控股:公司坚持“稳中求进”的基本原则

Zheng Quan Ri Bao Wang· 2025-09-26 08:15

Core Viewpoint - The company emphasizes a principle of "seeking progress while maintaining stability," focusing on its core business and optimizing its layout to enhance asset operation management capabilities and competitive advantages in real estate sectors such as logistics parks, industrial parks, and residential development [1] Group 1 - The company aims to promote the transformation and upgrading of its business model and development approach to achieve high-quality and sustainable business growth [1] - The company plans to increase exploration and investment in new energy and high-end manufacturing sectors to support business development and model innovation [1] - The company is committed to optimizing its business structure through these initiatives [1]

山东国信分别与鲁信创投及山东高新技术订立母基金转让协议及皖禾基金转让协议

Zhi Tong Cai Jing· 2025-09-12 10:37

Group 1 - The company Shandong Guoxin (01697) announced the conditional sale of fund shares to Lushin Chuangtou and Shandong High-tech, with total consideration amounting to RMB 166 million and RMB 37.1588 million respectively, resulting in a total expected proceeds of RMB 204 million [1] - The net proceeds from the fund share transfer, after deducting relevant transaction costs and taxes, are expected to be approximately RMB 196 million, which will be used to supplement the company's operating capital and optimize financial and regulatory indicators [1] - The fund share transfer is part of the company's key stage of deepening reform and promoting business transformation, effectively converting existing equity assets into cash, thereby improving overall financial status and optimizing asset structure [1] Group 2 - Following the fund share transfer, the company will effectively complete the rectification requirements as mandated by the China Banking and Insurance Regulatory Commission, aligning its inherent asset investment direction with regulatory guidance [2] - The company will further focus on the development of its trust main business and accelerate its return to core operations [2]

新金路(000510) - 000510新金路投资者关系管理信息20250912

2025-09-12 09:33

Group 1: Company Operations and Projects - The company has made significant progress in the resumption of operations at Limi Mining, including completion of underground dredging and road repairs, with ongoing drainage work [2] - The quartz sand project is currently in limited sales, with ongoing R&D to enhance product quality and market competitiveness, aiming to become a new profit growth point [2] - The company is focused on comprehensive planning and coordination to expedite the resumption of operations at Limi Mining [2] Group 2: Financial Performance and Strategy - The PVC segment reported a gross margin of -33%, indicating that increased production leads to greater losses; however, the overall gross margin for chlor-alkali products remains at 10.70% [3] - The company is committed to enhancing operational efficiency and profitability despite ongoing losses, with a focus on high-value specialty resin production [3] - The company plans to adapt to market conditions and improve operational effectiveness to maximize profitability [4] Group 3: Future Outlook and Risk Management - The company acknowledges the risk of potential closure if new projects do not generate revenue in a timely manner, emphasizing the need for strategic planning and market responsiveness [3] - The company aims to accelerate transformation and seek new profit growth points to ensure sustainable and healthy development [4]

朗科科技:公司将持续努力提升盈利能力和治理水平

Zheng Quan Ri Bao Wang· 2025-09-10 10:18

Core Viewpoint - The company is actively pursuing project collaborations and order opportunities, indicating a positive outlook for business development and operational improvement [1] Group 1: Business Performance - In the first half of 2025, the company has seen improvements in its overall business operations and sales scale [1] - Measures taken to stabilize the main business and enhance sales have yielded certain positive results [1] Group 2: Strategic Initiatives - The company is engaging in extensive communication and negotiations with relevant enterprises, local governments, and industry research institutions to explore collaboration opportunities [1] - There is a focus on planning for business transformation and upgrading [1] Group 3: Commitment to Stakeholders - The company is committed to continuously improving its profitability and governance standards [1] - There is an emphasis on actively returning value to investors [1]

南网能源2025年中报简析:营收净利润同比双双增长,公司应收账款体量较大

Zheng Quan Zhi Xing· 2025-08-29 22:59

Core Viewpoint - The recent financial report of Southern Power Grid Energy (003035) shows a significant increase in revenue and net profit, indicating a positive growth trajectory for the company [1] Financial Performance - Total revenue for the first half of 2025 reached 1.603 billion yuan, a year-on-year increase of 21.13% compared to 1.324 billion yuan in 2024 [1] - Net profit attributable to shareholders was 214 million yuan, up 4.48% from 205 million yuan in the previous year [1] - In Q2 2025, total revenue was 910 million yuan, reflecting a 21.73% increase year-on-year, while net profit for the quarter was 122 million yuan, a 6.7% increase [1] - The company's gross margin improved to 35.08%, up 7.38% year-on-year, while the net margin decreased to 15.49%, down 8.04% [1] - Accounts receivable accounted for 97.06% of total revenue, indicating a large volume of receivables [1] Business Model and Strategy - The company is transitioning its business model from "investment holding" to a dual focus on "investment holding + high-end services," expanding its service offerings to include energy conservation and carbon reduction [4] - Key initiatives include the implementation of energy-saving business plans and the establishment of a digital services company to support the transition [4] - The organizational structure is being optimized to enhance management efficiency across the entire business chain, from market development to customer service [4] Investment Metrics - The company's return on invested capital (ROIC) was reported at 1.38%, indicating a relatively weak capital return [3] - The net profit margin was -2.17% last year, suggesting low added value in products or services [3] - Analysts project that the company's performance for 2025 will reach 479 million yuan, with an average earnings per share of 0.13 yuan [3]