休闲零食

Search documents

盐津铺子:第三季度魔芋零食收入实现同比高速增长

Zheng Quan Ri Bao Wang· 2025-10-28 11:41

Core Viewpoint - Yanjinpuzi (002847) has reported significant sales achievements for its innovative product "Big Devil" sesame sauce, which reached over 100 million (including tax) in monthly sales within just 16 months of its launch, setting a record for the fastest monthly sales in the snack industry [1] Group 1 - The company has adopted a big product strategy since 2025, focusing on enhancing brand momentum and product recognition across all channels, which has become a key driver for revenue growth [1] - The revenue from konjac snacks has shown rapid year-on-year growth in Q3, with continuous positive growth on a quarterly basis [1]

看了“非刚需”的休食企业业绩,才知道啥叫生意难做

Xin Lang Cai Jing· 2025-10-28 11:31

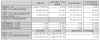

Core Insights - The leisure snack industry is facing significant challenges, with many companies reporting declining performance in their Q3 2025 results, highlighting the impact of macroeconomic uncertainties on consumer spending [1][4][7] Performance Overview - Wanchen Group reported the best performance among listed companies, achieving a revenue of 36.562 billion yuan, a year-on-year increase of 77.37%, and a net profit of 855 million yuan, up 917.04% [1] - Ganyuan Foods experienced a revenue decline of 4.5% to 1.53 billion yuan and a net profit drop of 43.7% to 156 million yuan [1] - Yanjinpuzi achieved a revenue of 4.427 billion yuan, a year-on-year increase of 14.67%, with a net profit of 605 million yuan, up 22.63% [2] - Jinzhai Foods reported a revenue of 1.808 billion yuan, a slight increase of 2.05%, but a net profit decline of 19.51% [2] - Three Squirrels saw a revenue increase of 8.22% to 7.759 billion yuan, but a significant net profit drop of 52.9% to 161 million yuan [3] Market Dynamics - The overall decline in net profits across the leisure snack sector reflects the industry's struggle amid economic downturns, as these products are not considered necessities [4][6] - Analysts suggest that the industry must innovate and adapt to survive, as the "Matthew Effect" will increasingly favor stronger brands while weaker ones may struggle [4][5] - The rise of bulk snack formats has not replaced traditional snack brands but has created opportunities for lesser-known brands, which may eventually be overshadowed by established names [4][5] Consumer Behavior and Pricing - The overall market size for snacks is increasing, but individual companies may experience declining revenues due to price reductions and stable consumer demand [5][6] - Companies are pressured to improve efficiency in their supply chains and marketing strategies to maintain profitability amid shrinking margins [6][7] - The industry is facing a critical juncture where survival is at stake, as highlighted by the challenges faced by major players like Liangpinpuzi [7]

净利腰折!三只松鼠陷现金流困局

Shen Zhen Shang Bao· 2025-10-28 01:03

Core Viewpoint - The company, Three Squirrels, reported an increase in revenue but a significant decline in profit for the first three quarters of 2025, indicating challenges in profitability despite revenue growth [2][3]. Financial Performance - For the first three quarters of 2025, the company's operating revenue reached 7.76 billion yuan, a year-on-year increase of 8.22% [3]. - The net profit attributable to shareholders was 161 million yuan, down 52.9% year-on-year [3]. - The net profit after deducting non-recurring gains and losses was 57.14 million yuan, a decrease of 78.57% year-on-year [3]. - In Q3 alone, operating revenue was 2.28 billion yuan, up 8.91% year-on-year [3]. - The net profit for Q3 was 22.27 million yuan, down 56.79% year-on-year [3]. - The net profit after deducting non-recurring gains and losses for Q3 was 6.31 million yuan, a decline of 83.45% year-on-year [3]. Cash Flow and Financial Health - The company faced a cash flow crisis, with a net cash flow from operating activities of -505 million yuan, a year-on-year decline of 1690.52% [4]. - Cash and cash equivalents dropped from 866 million yuan at the beginning of the year to 242 million yuan, a decrease of 72.06% [4]. - Short-term borrowings surged by 59.87% compared to the end of the previous year due to new borrowings [4]. - Sales expenses reached 1.61 billion yuan, an increase of 24% compared to the beginning of the year, primarily due to higher platform and promotional costs [4]. - Investment income decreased by approximately 30% compared to the previous period, impacting overall profitability [4]. Dependency on Non-Recurring Gains - The company's reliance on non-recurring gains has exceeded 60%, with government subsidies amounting to 98.82 million yuan included in the current period's profit [3].

双轮驱动 简阳“立园满园”行动激活发展动力

Si Chuan Ri Bao· 2025-10-23 21:57

Core Insights - The article highlights the significant economic development and industrial growth in Jianyang, Sichuan, with a focus on the establishment of specialized industrial parks and the successful participation of local companies in trade exhibitions [7][8]. Economic Performance - Jianyang's foreign trade import and export total reached 641 million yuan from January to August [7]. - Jianyang ranked 79th nationally and 1st in Sichuan in the "2025 Top 100 Counties" list [7]. Industrial Development - The Jianyang Economic Development Zone and Jianyang Airport Economic Industrial Park are central to the city's strategy of enhancing industrial capacity and economic growth [7][8]. - A total investment of 2 billion yuan has been allocated for the Southwest headquarters project of Zhongtong Express, which has commenced operations [8]. - The establishment of the Three Squirrels Southwest headquarters snack industry park aims to create a highland for leisure snack industries [8]. Infrastructure and Projects - Jianyang has introduced five major projects with a total investment of 12.35 billion yuan, leveraging its proximity to Chengdu Tianfu International Airport [9]. - The park has successfully attracted 10 hotels, forming two commercial streets and serving approximately 400,000 international transfer passengers annually [9]. Economic Indicators - The Jianyang Airport Economic Industrial Park reported a revenue of 18.605 billion yuan in the first quarter, with a fixed asset investment growth rate of 309.92% [9]. - The park ranks second and first in revenue and investment growth among six major business parks in Chengdu, respectively [9]. Industry Clusters - The Jianyang Economic Development Zone focuses on project attraction and cluster development, with 45 industrial enterprises in the equipment manufacturing sector [10]. - The establishment of two supercomputing centers has created a collaborative support system for large-scale data and computing needs [10]. Aerospace and Food Industry - Jianyang is developing its aerospace industry with projects related to sustainable biofuels and satellite internet [11]. - The food industry is being strengthened through partnerships with leading brands like Haidilao and Three Squirrels, with an expected annual output value of 3 billion yuan from new food manufacturing enterprises [11]. Service and Support Mechanisms - The establishment of a "cost reduction and efficiency enhancement" task force has expedited project completion, exemplified by the Zhongtong Express project finishing 100 days ahead of schedule [12]. - Jianyang has implemented a "5+N" project task force mechanism to enhance service efficiency and ensure project acceleration [13]. Future Goals - The coordinated development of the Jianyang Economic Development Zone and Jianyang Airport Economic Industrial Park aims to achieve a GDP of over 100 billion yuan by 2026 [13].

用周期x组织,读懂经营的本质

Sou Hu Cai Jing· 2025-10-22 17:22

Core Insights - The article emphasizes the importance of both external cycles and internal organization in determining a company's success, suggesting that understanding past actions is crucial for defining future outcomes [2][19] Group 1: Successful Companies in Favorable Conditions - Companies like Mixue Ice City thrive in a favorable environment characterized by industry benefits, strategic accuracy, and efficient execution, often referred to as "the right time, the right place, and the right people" [4] - Mixue Ice City's business model focuses on selling raw materials rather than franchise fees, resulting in the lowest opening costs among chain brands and achieving a gross margin and net margin that are among the highest in the new tea beverage industry [4] - The company's revenue is equivalent to the combined total of the second to fourth ranked competitors in the same sector, showcasing its unique profit model [4] Group 2: Companies Adapting to Market Changes - Pop Mart represents a contrasting approach, expanding globally rather than focusing on domestic market penetration, demonstrating a strong organizational capability to adapt to market demands [7] - The concept of "retail entertainment" is highlighted, indicating that companies must continuously innovate to remain relevant and capitalize on market opportunities [7] Group 3: Companies Facing Internal Challenges - Companies like Bottle Planet, known for its brand Jiangxiaobai, faced significant challenges due to a declining traditional liquor market but successfully pivoted to a "new liquor" strategy, launching new products to regain growth [8][9] - The implementation of the Danaher DBS model has been crucial for Bottle Planet's transformation, focusing on systematic improvements across various operational aspects [9][11] Group 4: Companies Struggling with Market Dynamics - Companies like Master Kong are experiencing external pressures from the rise of the takeout market, which has negatively impacted instant noodle sales, highlighting the challenges of adapting to changing consumer behaviors [16] - Three Squirrels, a former leader in the snack industry, struggles with an outdated business model and quality control issues, leading to significant revenue losses and a decline in market position [18]

经营的本质是什么?

Hu Xiu· 2025-10-22 13:24

Core Insights - The article discusses the importance of both external cycles and internal organization in determining a company's success or failure during different market conditions [1][2][3] - It presents a four-quadrant model to categorize companies based on their organizational strength and market cycles, illustrating how these factors interact to shape business outcomes [3][4] Quadrant Analysis Quadrant 1: Upward Cycle + Organizational Evolution - Companies like Mixue Ice City and Pop Mart thrive during industry booms due to strategic accuracy and efficient execution, benefiting from favorable market conditions [6][7] - Mixue Ice City's success is attributed to its low-cost model and 100% self-sourced supply chain, achieving high gross and net profit margins in the new tea beverage sector [10][11][12] - Pop Mart capitalizes on global expansion and market adaptability, demonstrating a keen understanding of market dynamics despite periods of lower visibility [14][15][16] Quadrant 2: Downward Cycle + Organizational Evolution - Companies such as Bottle Planet and Midea exemplify resilience in challenging environments, adapting their strategies to align with market demands [17][18] - Bottle Planet, known for its brand Jiangxiaobai, pivoted to a "new liquor" strategy to counteract declining traditional liquor sales, leading to renewed growth [20][21][24] - Midea's transformation into a technology ecosystem company, driven by a focus on organizational strength over individual leadership, has resulted in significant market value growth [26][27] Quadrant 3: Upward Cycle + Organizational Degeneration - Wahaha and Li Ning illustrate how poor organizational management can squander opportunities during favorable market conditions [28][29] - Wahaha's leadership struggles have hindered its ability to capitalize on the bottled water market, while Li Ning's missteps in brand strategy have led to significant market value decline [30][34][35] Quadrant 4: Downward Cycle + Organizational Degeneration - Companies like Master Kong and Three Squirrels face compounded challenges from external market pressures and internal management issues [37][38] - Master Kong's sales have declined due to the rise of food delivery services, while its strategies have failed to adapt effectively to changing consumer preferences [39][41] - Three Squirrels struggles with maintaining quality and adapting to market changes, resulting in significant revenue losses and competitive disadvantages [43][44] Conclusion - The analysis emphasizes that while market cycles are constant, the organizational structure and adaptability of a company are crucial for long-term survival and success [45][46][47]

ESG解读|治理失序引发股权冻结,良品铺子自断国资救援路

Sou Hu Cai Jing· 2025-10-22 08:46

Core Viewpoint - The termination of the control transfer of Liangpinpuzi has raised concerns about the company's governance and operational challenges, particularly due to unresolved equity disputes and the failure to secure state-owned capital investment [2][12]. Group 1: Control Transfer Termination - The control transfer agreement initiated on July 17 involved the transfer of 21% of shares to Wuhan Changjiang International Trade Group for approximately 1.046 billion yuan [3][4]. - The termination was due to the failure to meet the condition that the transferred shares must be free of rights defects, as a court froze 19.89% of shares held by the controlling shareholder due to a dispute with Guangzhou Light Industry [5][6]. - The dispute arose from a prior agreement granting Guangzhou Light Industry a right of first refusal, which was not honored by the controlling shareholder, leading to legal action [9][11]. Group 2: Governance Issues - The "one share, two sales" incident highlights significant governance shortcomings within Liangpinpuzi, as the board failed to intervene in the controlling shareholder's breach of contract [8][11]. - The company did not disclose the key agreement with Guangzhou Light Industry in a timely manner, leading to market information asymmetry and raising questions about compliance with disclosure obligations [11][12]. - The failure to manage the risks associated with the controlling shareholder's actions indicates a breakdown in the company's risk management framework [11][12]. Group 3: Operational Challenges - Liangpinpuzi has faced deeper operational challenges, including a significant decline in net profit since 2020, attributed to aggressive pricing strategies and a reduction in store numbers [13][15]. - The failed introduction of state-owned capital was seen as a critical opportunity for the company to enhance its supply chain and financial support, which is now lost [15][16]. - The company has experienced frequent share reductions by major shareholders, indicating instability in its ownership structure [15][16].

食品饮料2025年三季报前瞻:白酒逐渐筑底,大众品茶咖连锁、量贩零食景气度延续,乳制品、餐饮供应链景气度改善

2025-10-21 15:00

Summary of Key Points from the Conference Call Industry Overview - The food and beverage sector is experiencing mixed performance, with the liquor segment under pressure due to regulatory impacts and overall market conditions [2][8] - The overall performance of the food and beverage sector has been below market expectations, particularly in the liquor category, which is still in a phase of pressure release [2][8] Key Insights on Specific Companies and Segments General Food and Beverage - The dining supply chain has shown improvement compared to Q2, with companies like Anjuke Food expecting single-digit revenue growth and profit growth outpacing revenue [1][3] - Q3 performance for Qianwei Central Kitchen remains stable, but profit pressures are significant due to high channel costs [3] Bakery Supply Chain - Angel Yeast is projected to achieve double-digit revenue growth in Q3, benefiting from reduced shipping costs that enhance profit margins [4] - Lihigh Food is expected to maintain double-digit growth despite a slowdown in the second half of the year [4] Snack Industry - Wancheng Group is experiencing increased same-store sales and store openings, with expectations for high revenue and profit growth [5] - Yanjin Pouch continues to grow steadily, with Q3 revenue expected to show double-digit growth and profit growth exceeding revenue growth [6] Pet Sector - Zhongchong reported strong Q3 results, with significant expectations for its self-owned brand during the upcoming Double Eleven shopping festival [7] - Peidi's export business remains stable, with plans for increased product launches in Q4 [7] Liquor Industry - The liquor industry is facing challenges due to a ban on alcohol sales, with sales declining in September but showing signs of recovery during the National Day holiday [8] - High-end and mid-low price segments are stable, while the sub-high-end segment is under pressure, with Moutai's price below 1,800 yuan and other brands like Wuliangye and Guojiao around 850 yuan [8][9] - Most liquor companies are expected to report declines in Q3 performance, with Moutai and Fenjiu being exceptions with slight revenue increases [8][9] Beer Industry - Qingdao Beer reported slight volume growth in Q3, benefiting from a low base last year, while Yanjing Beer faced revenue pressure but maintained good profit growth [10] Dairy Industry - Yili's ambient liquid milk continues to face pressure, while milk powder and cold drinks show growth [11] - Miaokelando is performing well in both B-end and C-end markets, with expectations for a 30% profit growth due to cost advantages [11] Beverage Industry - Dongpeng energy drinks continue to grow steadily, with overall revenue expected to increase by about 30% [12] Recent Investments - Yeyuan Holdings has made significant investments in the pet food and veterinary sectors, indicating a strategic move towards diversifying its business [13] - Mixue Ice City plans to acquire a majority stake in Fulujia, leveraging synergies to enhance brand value and operational efficiency [14][15] Additional Insights - The overall sentiment in the food and beverage sector suggests cautious optimism, with certain segments showing resilience and potential for growth despite broader market challenges [2][8]

靠奥特曼、小马宝莉年入8亿,毛利超3成,零食界泡泡玛特冲刺港股

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-21 12:44

Core Viewpoint - The company, Guangdong Jintian Animation Co., Ltd., is preparing for an IPO on the Hong Kong Stock Exchange, aiming to become a significant player in the IP food market, similar to brands like Pop Mart and Miniso [1][12]. Company Overview - Jintian Animation specializes in children's snacks that incorporate popular IP elements, such as toys and badges, targeting a young audience [3][6]. - The company's revenue heavily relies on key IPs like Ultraman, My Little Pony, and Crayon Shin-chan, with the top five IPs contributing 90% of total revenue in 2022 [5][12]. Market Position - By 2024, Jintian Animation is projected to be the largest IP fun food company in China, holding a market share of 7.6% [13]. - The overall IP food market in China is expected to grow from RMB 354 billion in 2024 to RMB 849 billion by 2029, with a compound annual growth rate of 18.5% [12]. Financial Performance - The company has shown consistent revenue growth, with revenues of RMB 5.96 billion in 2022, RMB 6.64 billion in 2023, and projected RMB 8.77 billion in 2024 [14]. - Jintian Animation's gross margin is notably higher than other snack brands, reaching 33.7% in 2024, compared to 24.3% for Three Squirrels and 26.1% for Bestore [14][15]. Strategic Initiatives - The company plans to diversify its IP portfolio and enhance its product development capabilities through the IPO proceeds, which will also be used to expand sales networks and improve supply chain infrastructure [17]. - Jintian Animation aims to mitigate risks associated with reliance on external IPs by developing its own IPs and enhancing its design capabilities [9][8]. Sales Channels - The company has established a strong sales network, particularly in lower-tier cities, collaborating with various retail outlets, including supermarkets and convenience stores [10].

良品铺子控股权转让终止,武汉国资入主计划流产

Sou Hu Cai Jing· 2025-10-20 05:37

Core Viewpoint - The plan for the sale of the snack company, Liangpinpuzi, to Wuhan state-owned assets has been terminated due to ongoing litigation and failure to meet conditions for the transfer of control [1][3]. Group 1: Company Situation - Liangpinpuzi has faced operational difficulties in recent years, including shrinking scale and financial losses, exacerbated by market environment changes and competition from new snack models [1][10]. - The company announced a significant price reduction across 300 products, averaging a 22% decrease, to combat declining sales and competition from low-cost snack models [12][16]. - In 2023, Liangpinpuzi's revenue dropped by 14.76% to 8.046 billion, with net profit declining by 46.26% to 180 million [16]. Group 2: Control Transfer Attempt - The control transfer plan to Wuhan state-owned assets was initially seen as a positive move for the company, potentially providing financial support and boosting market confidence [4][5]. - The transfer agreement involved significant share sales, with a total transaction value of 10.46 billion for 18.01% of shares at 12.42 yuan per share [5]. - The transfer was halted due to a lawsuit from Guangzhou state-owned enterprise, which accused the controlling shareholder of "selling the same share twice" [6][7]. Group 3: Market Dynamics - The snack market in China is highly fragmented, with intense competition leading to price wars and a trend towards low-cost products [10][11]. - Liangpinpuzi has attempted to position itself in the high-end snack segment but faces challenges from the rising popularity of bulk snack models [10][12]. - The company has made strategic investments in other snack brands but has not successfully leveraged these to enhance its competitive position [12][14].