化学原料及化学制品制造业

Search documents

安纳达:2025年前三季度净利润亏损4636.9万元,同比转亏

Xin Lang Cai Jing· 2025-10-21 08:56

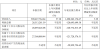

安纳达公告,2025年前三季度营业收入13.1亿元,同比下降6.03%。净利润亏损4636.9万元,上年同期 净利润4082.71万元。 ...

光华科技公告,近日公司及相关人员收到广东证监局出具的警示函。警示函指出,2024年11月19日,公司董事会秘书杨荣政在某券商分析师组织的线上交流会议上,向参会人员透露了公司硫化锂产能、2024年预计业绩情况等未公开信息,且部分信息可能对公司股票交易价格产生较大影响。光华科技未及时披露该信息,直至相关信息通过网络传播后,才于2024年12月6日发布《有关事项的说明公告》进行披露及澄清。此举违反了《上市公司信息披露管理办法》相关规定。

Xin Hua Cai Jing· 2025-10-21 08:55

Core Insights - The article discusses the recent financial performance of a leading technology company, highlighting a significant increase in revenue and net income compared to the previous year [1] Financial Performance - The company reported a revenue of $50 billion, representing a 20% increase year-over-year [1] - Net income reached $10 billion, which is a 25% increase compared to the same period last year [1] - Earnings per share (EPS) rose to $5, up from $4 in the previous year, indicating strong profitability [1] Market Position - The company has strengthened its market position, capturing an additional 5% market share in the last quarter [1] - The growth in market share is attributed to the successful launch of new products and services [1] Future Outlook - Analysts project continued growth, with expected revenue growth of 15% for the next fiscal year [1] - The company plans to invest $2 billion in research and development to drive innovation and maintain competitive advantage [1]

华融化学发布前三季度业绩,归母净利润5311万元,同比下降17.01%

智通财经网· 2025-10-21 08:53

智通财经APP讯,华融化学(301256.SZ)披露2025年第三季度报告,公司前三季度实现营收12.64亿元, 同比增长53.53%;归属于上市公司股东的净利润5311万元,同比下降17.01%;扣非净利润3265万元,同比 下降9.71%;基本每股收益0.1106元。 ...

华鲁恒升(600426):业绩环比增长,项目建设为公司发展奠定基础

环球富盛理财· 2025-10-21 08:50

Investment Rating - The report assigns a "Buy" rating to Shandong Hualu-Hengsheng Chemical, with a target price of 31.32 yuan based on a 14.5x PE for FY26 [3][13]. Core Insights - The company has shown a month-on-month net profit increase of 21.95% in Q2 2025, despite a year-on-year revenue decline of 7.14% [4][15]. - The integrated projects are expected to enhance the product structure, with a total investment of 3.387 billion yuan aimed at producing 200,000 tons of BDO and 160,000 tons of NMP annually [4][15]. - The gasification platform upgrade project is projected to generate an average annual revenue of 3.665 billion yuan post-completion, with a total investment of 3.039 billion yuan [4][15]. Financial Performance Summary - For 2025, the company is forecasted to achieve a net profit of 3.700 billion yuan, with revenues expected to decline by 2.5% to 33.376 billion yuan [5]. - The gross margin for Q2 2025 was reported at 19.63%, showing a month-on-month increase of 3.28 percentage points [4][15]. - The company’s sales volume for chemical fertilizers and organic amines increased by 13.62% and 33.21% respectively in H1 2025 [4][15].

辽宁省沈阳市市场监督管理局发布危险化学品氯碱产品抽查结果

Zhong Guo Zhi Liang Xin Wen Wang· 2025-10-21 08:46

Core Viewpoint - The quality supervision inspection report for chemical products in Shenyang, Liaoning Province indicates that all tested batches of chlor-alkali products are compliant with quality standards [1] Group 1: Inspection Results - Two batches of hazardous chemical chlor-alkali products were inspected, and both were found to be qualified [1] - The inspected products include industrial-grade hydrochloric acid and industrial-grade sodium hydroxide, both produced by Shenyang Chemical Company [1] Group 2: Company Information - Shenyang Chemical Company is located in the Shenyang Economic and Technological Development Zone, specifically at No. 55, East Road, Tiexi District [1] - The production date for the inspected products was June 30, 2025, and no non-conformities were detected during the inspection [1]

氧化铝减产,烧碱承压下行

Zhong Xin Qi Huo· 2025-10-21 07:52

1. Report Industry Investment Rating - No information provided on the industry investment rating 2. Core View of the Report - The caustic soda market is affected by alumina production cuts, with the main contract of caustic soda falling 4.37% to 2,344 yuan/ton today [1]. - In the short - term, upstream maintenance of caustic soda is frequent in mid - October, supply pressure eases, and caustic soda spot stabilizes. In the medium - term, supply and demand of caustic soda both increase, and the spot may be in a volatile state [2]. - Looking ahead, supply and demand of caustic soda will both increase, the futures market may enter a wide - range oscillation, and it is advisable to short on rallies [3]. 3. Summary by Related Catalogs Supply - Caustic soda production starts low and then rises. In mid - October, there are many maintenance activities, and caustic soda production decreases month - on - month; from November to December, there is less maintenance, and production tends to increase. New capacity is concentrated in Q3, and there are still 250,000 tons of capacity to be put into production in Hebei in Q4 [2]. Demand - Alumina production cuts and new production coexist, non - aluminum industry is about to enter the off - season, and exports are average. Specifically: 1) Alumina operating capacity has reached a high level, industry profits are poor, and marginal plants have started to cut production recently; 2) Wenfeng's procurement eases the pressure on 32% caustic soda in Shandong, but Weiqiao's caustic soda receipts are equal to daily consumption, inventory is high, and the purchase price may remain stable; 3) The commissioning of 4.8 million tons of alumina in Guangxi in 2026 will boost caustic soda demand, and some factories have issued caustic soda procurement tenders; 4) Non - aluminum operating rate is stable, restocking willingness is low, and the operating rate will weaken from November to December. There are no large export orders heard [2]. Valuation - Valuing liquid chlorine at 0 yuan/ton, the comprehensive cost of caustic soda is about 2,250 yuan/ton. The probability of liquid chlorine price decline is high, and the cost center of caustic soda is expected to move up [2].

芳源股份前三季度亏1.2亿元 2021年上市两募资共10亿

Zhong Guo Jing Ji Wang· 2025-10-21 06:59

Core Insights - Fangyuan Co., Ltd. (688148.SH) reported its Q3 2025 financial results, showing a revenue of 1.49 billion RMB, a year-on-year increase of 5.29% [1] - The company recorded a net loss attributable to shareholders of 121 million RMB, slightly worsening from a loss of 119 million RMB in the same period last year [1][3] - The net cash flow from operating activities was -59.83 million RMB, compared to -27.99 million RMB in the previous year [1] Financial Performance - For the first three quarters of 2025, the company achieved a revenue of 1.49 billion RMB, reflecting a growth of 5.29% year-on-year [1][3] - The total profit for the period was -120.70 million RMB, with a net profit attributable to shareholders also at -120.77 million RMB [3] - The net profit excluding non-recurring gains and losses was -121.73 million RMB, an improvement from -141 million RMB in the previous year [1][3] Cash Flow Analysis - The net cash flow from operating activities for the first three quarters was -59.83 million RMB, compared to -27.99 million RMB in the same period last year [1][3] - In 2024, the company reported a net cash flow from operating activities of 73.91 million RMB, a significant recovery from -326.17 million RMB in 2023 [4] Capital Raising and Financial Strategy - Fangyuan Co., Ltd. raised a total of 366 million RMB through its initial public offering, with a net amount of 301 million RMB after deducting issuance costs [5] - The company initially planned to raise 1.05 billion RMB for projects related to high-end lithium battery precursors and lithium hydroxide production [5] - The company has conducted two fundraising rounds since its listing, totaling 1.008 billion RMB [7]

突发公告:上市公司董事长被采取刑事强制措施,43岁妻子紧急补位

Sou Hu Cai Jing· 2025-10-21 06:37

Core Viewpoint - The company, Shan Shui Technology, announced that its actual controller, chairman, and general manager, Huang Guorong, has been subjected to criminal coercive measures due to personal reasons, leading to an emergency board meeting to appoint Wu Xinyan as acting chairman and legal representative [1][4]. Company Management Changes - Huang Guorong's absence from the board meeting resulted in the unanimous decision by other directors to have Wu Xinyan assume his responsibilities [1]. - Wu Xinyan is the spouse of Huang Guorong and has held various positions within the company since 2012, currently serving as a director and head of the comprehensive center [3]. Company Operations and Financial Performance - Shan Shui Technology maintains a stable management system and mature governance structure, ensuring normal operations despite the recent developments [4]. - For the first half of 2025, the company reported a revenue of 305 million yuan, representing a year-on-year increase of 23.08%, while the net profit attributable to shareholders decreased by 11.77% to 47.77 million yuan [4].

A股异动 | 提示风险,三孚股份大跌7.5%,此前连续4日涨停

Ge Long Hui A P P· 2025-10-21 04:11

Core Viewpoint - Sanfu Co., Ltd. (603938.SH) experienced a decline of 7.5% after four consecutive days of trading limit increases, with its stock price falling below the 20 yuan mark and a total market value of 7.534 billion yuan [1] Company Overview - Sanfu Co., Ltd. primarily produces trichlorosilane, silicon tetrachloride, high-purity silicon tetrachloride, silane coupling agents, potassium hydroxide, potassium sulfate, electronic special gases, and vapor-phase silica [1] - The company's products are widely used in various sectors, including photovoltaic, optical fiber, fine chemicals, fertilizers, and electronic chips [1] Financial Impact - Revenue from storage chips accounts for less than 1% of the company's total operating income, indicating that it will not have a significant impact on the company's overall performance [1]

世龙实业股价涨5.24%,招商基金旗下1只基金位居十大流通股东,持有159.29万股浮盈赚取87.61万元

Xin Lang Cai Jing· 2025-10-21 02:55

Group 1 - The core viewpoint of the news is that Shilong Industrial has seen a significant increase in its stock price, rising by 5.24% to reach 11.05 CNY per share, with a total market capitalization of 2.652 billion CNY [1] - Shilong Industrial, established on December 2, 2003, and listed on March 19, 2015, specializes in the research, production, and sales of chemical products, including AC foaming agents, thionyl chloride, and chlor-alkali products [1] - The main revenue composition of Shilong Industrial includes AC series products at 58.76%, chlor-alkali series products at 28.73%, thionyl chloride series products at 5.40%, intermediates for medicine and pesticides at 3.30%, new material additives at 3.18%, other products at 0.46%, and steam at 0.16% [1] Group 2 - From the perspective of the top ten circulating shareholders, a fund under China Merchants Fund has entered the top ten shareholders of Shilong Industrial, holding 1.5929 million shares, which accounts for 0.66% of the circulating shares [2] - The fund, China Merchants Quantitative Selected Stock Initiation A (001917), has achieved a year-to-date return of 38.72% and a one-year return of 47.62%, ranking 862 out of 4218 and 410 out of 3868 respectively [2] - The fund manager, Wang Ping, has a tenure of 15 years and 126 days, with the fund's total asset size at 16.687 billion CNY and a best return of 268.16% during his tenure [3]