科网

Search documents

海内外多重积极信号来袭,提振市场风险偏好,港股有望重拾上升动力

Sou Hu Cai Jing· 2025-10-28 01:53

Group 1 - The Hong Kong stock market opened higher with the Hang Seng Index rising by 0.28% to 26,508.75 points, the Hang Seng Tech Index up by 0.45%, and the National Enterprises Index increasing by 0.24% [1] - Technology stocks showed mixed performance, with electric equipment stocks generally rising, while gold stocks experienced declines [1] - The China Securities Regulatory Commission indicated that the easing of US-China relations has improved overseas market risk appetite, and the "14th Five-Year Plan" proposals are expected to enhance market clarity and risk appetite in the short term [1] Group 2 - The upcoming "14th Five-Year" policy catalysts, along with events like the APEC summit and potential interest rate cuts by the Federal Reserve, are expected to attract funds back into the market, boosting risk appetite and trading activity [2] - The Hong Kong technology sector is anticipated to benefit from the current trends in AI, with foreign capital inflows potentially exceeding expectations due to the backdrop of interest rate cuts [2] - Investors without a Hong Kong Stock Connect account may consider using the Hang Seng Tech Index ETF (513180) to gain exposure to core Chinese AI assets [2]

A股三大指数集体低开

第一财经· 2025-10-28 01:48

Market Overview - The A-share market opened lower with the Shanghai Composite Index down 0.25%, Shenzhen Component down 0.58%, and ChiNext down 0.9% [3][4]. - The technology sector experienced a general pullback, particularly in storage chips and copper-clad laminate concepts, with Shenghong Technology's Q3 net profit slightly declining [4]. - The Hang Seng Index opened up 0.28%, and the Hang Seng Technology Index rose by 0.45%, with most tech stocks, including Xiaopeng Motors, seeing gains of over 4% [5]. Sector Performance - The technology stocks faced significant declines, with Shenghong Technology dropping nearly 6% post-earnings [4]. - The Fujian sector remained active, with positive performance in rare earths, photovoltaics, and nuclear fusion concepts [4]. - Precious metals saw a general decline, with Shandong Gold and Zhaojin Mining both falling nearly 2% [5]. Notable Events - Baima Tea Industry had a strong debut, opening up 60% on its first trading day [5].

果然大涨!

中国基金报· 2025-10-27 10:14

Core Viewpoint - The Hong Kong stock market experienced a significant rise driven by dual positive factors, with technology stocks leading the gains and certain sectors like pharmaceuticals and finance boosted by better-than-expected earnings reports [2][4]. Market Performance - On October 27, the three major indices in Hong Kong all rose, with the Hang Seng Index increasing by 1.05% to close at 26,433.70 points, the Hang Seng Tech Index up by 1.83% to 6,171.08 points, and the Hang Seng China Enterprises Index rising by 1.10% to 9,467.22 points [4]. - Key sectors that performed well included technology, brokerage, insurance, semiconductors, and pharmaceuticals [4]. Technology Sector - The recent U.S.-China business negotiations reached a basic consensus, which may enhance market risk appetite [6]. - The "14th Five-Year Plan" emphasizes accelerating high-level technological self-reliance, providing policy support for AI and domestic computing power sectors [7]. - Major tech stocks saw significant increases, with Baidu rising by 6.20%, Alibaba by 3.15%, Tencent by 2.90%, and JD.com by 2.33% [7][8]. Financial Sector - The financial sector led the market gains, driven by better-than-expected earnings from several companies. Notably, China Life Insurance expects a year-on-year profit increase of approximately 50% to 70% for the first three quarters [10]. - Several brokerage firms reported strong third-quarter results, with Citic Securities showing a 37.9% year-on-year increase in net profit [10]. Semiconductor Sector - The semiconductor sector received positive news, with companies like Beike Micro, Huahong Semiconductor, and SMIC seeing stock price increases of 5.74%, 4.98%, and 3.50%, respectively [12][13]. - The National Development and Reform Commission emphasized the importance of technological self-reliance, indicating a strategic focus on the sector [12]. Pharmaceutical Sector - The pharmaceutical sector also saw gains, with companies like Rongchang Bio, SiHuan Pharmaceutical, and WuXi AppTec increasing by 5.20%, 4.93%, and 4.18%, respectively [14][15]. - WuXi AppTec reported a net profit increase of 84.84% year-on-year for the first three quarters [14]. Copper Sector - The copper sector led the non-ferrous metals market, with companies like China Daye Nonferrous Metals and Luoyang Molybdenum rising by 11.11% and 5.19%, respectively [16]. - Analysts predict that domestic copper demand will enter a peak season, with expectations of increased production and rising copper prices [16]. Future Outlook - Huatai Securities suggests that the inflow of southbound funds may slow down in the future, having already exceeded HKD 500 billion this half-year [17]. - The market sentiment is currently neutral, indicating balanced risks, while the long-term trend remains positive due to improving industry dynamics and funding conditions [17].

机构称科技或仍为短期市场主线,关注恒生科技、A股算力等低位标的

Mei Ri Jing Ji Xin Wen· 2025-10-27 03:03

Core Viewpoint - The Hong Kong stock market indices collectively rose on October 27, with technology and chip stocks showing significant activity, indicating a positive market sentiment despite macro uncertainties [1] Group 1: Market Performance - The Hang Seng Technology Index ETF (513180) followed the index's upward trend, with major holdings like Baidu, ASMPT, Alibaba, and Tencent showing notable gains [1] - The market is currently in a phase of low trading volume and volatility due to macro uncertainties, but investor sentiment remains relatively stable with a willingness to "bottom-fish" [1] Group 2: Investment Strategy - Short-term market movements are expected to remain volatile, with recommendations for investors to slightly adjust their positions towards a "dumbbell" structure [1] - Key sectors attracting investor attention include low-positioned stocks in the Hang Seng Technology Index, A-share computing, and robotics, which are seen as primary investment targets [1] - Given the uncertainties, there is an opportunity for a rebound in previously underperforming dividend stocks, with suggestions to consider large-cap dividend stocks like banks [1] - Investors are advised to make selective investments in consumer sectors due to weak expectations for fundamentals [1] Group 3: Related ETFs - The Hang Seng Technology Index ETF (513180) supports T+0 trading and is driven by "hard technology + new consumption" [2] - The A-share Sci-Tech Innovation 50 ETF (159783) focuses on high elasticity stocks covering semiconductor, communication equipment, battery, and photovoltaic sectors [2]

A股三大指数集体高开

第一财经· 2025-10-27 01:49

Core Viewpoint - The article highlights a significant rise in the storage chip sector and related stocks, indicating a positive market sentiment and potential investment opportunities in this area [3][6]. Market Opening Summary - The A-share market opened with all three major indices showing gains: Shanghai Composite Index up by 0.48%, Shenzhen Component Index up by 1.20%, and ChiNext Index up by 1.75% [4][5]. - The Hang Seng Index also opened positively, increasing by 1.28%, with the Hang Seng Tech Index rising by 2.06% [7]. Sector Performance - The storage chip sector experienced a collective surge, with companies like Shikong Technology, Dawi Co., and Yingxin Development hitting the daily limit up, while others like Puran Co. and Weic Technology rose over 10% [3][6]. - Breakthroughs in the photolithography adhesive field contributed to the significant rise in related stocks, while the deep earth economy concept saw a notable pullback, with agriculture, retail, and coal sectors experiencing slight declines [6]. Notable Stock Movements - Specific stock movements included a jump in WuXi AppTec's shares by 7% following a third-quarter net profit that exceeded market expectations [7]. - The overall market sentiment was buoyed by strong performances in technology and pharmaceutical sectors, alongside a general rise in precious metals and related industries [7].

港股科网股,集体走强

第一财经· 2025-10-27 01:43

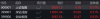

Core Viewpoint - The Hong Kong stock market opened higher on October 27, with technology stocks showing strong performance, particularly in the semiconductor and e-commerce sectors [1]. Group 1: Market Performance - Hong Kong stocks opened strong, with notable gains in technology stocks [1]. - Specific stocks such as Huahong Semiconductor, SMIC, and Alibaba saw increases of over 3%, while Baidu, Bilibili, and Kuaishou rose by more than 2% [1]. Group 2: Stock Price Movements - Huahong Semiconductor: Current price at 85.250 with a rise of 3.46% [2]. - SMIC: Current price at 83.050 with a rise of 3.81% [2]. - XPeng Motors: Current price at 86.050 with a rise of 3.49% [2]. - ASMPT: Current price at 92.850 with a rise of 3.17% [2]. - Horizon Robotics: Current price at 9.150 with a rise of 3.04% [2]. - Alibaba: Current price at 173.400 with a rise of 3.03% [2]. - SenseTime: Current price at 2.500 with a rise of 2.46% [2]. - BYD Electronics: Current price at 39.360 with a rise of 2.77% [2]. - Sunny Optical Technology: Current price at 81.900 with a rise of 2.44% [2].

港股三大指数周内齐升 机构料长期向上逻辑稳固

Zhong Guo Xin Wen Wang· 2025-10-24 21:26

Core Viewpoint - The Hong Kong stock market showed strong performance from October 20 to 24, with all three major indices rising significantly, indicating positive market sentiment and potential investment opportunities in the technology sector [1] Market Performance - The Hang Seng Index increased by 3.62%, closing at 26,160.15 points - The Hang Seng Tech Index rose by 5.2%, closing at 6,059.89 points - The China Enterprises Index gained 3.91%, closing at 9,363.94 points [1] Sector Highlights - Technology-related sectors were the main focus, with notable gains in leading companies such as SenseTime (up 2.95%), Alibaba (up 2.25%), and Kuaishou (up 2.04%) - Semiconductor stocks also performed well, with Hua Hong Semiconductor leading the way with a 13.73% increase, while SMIC, InnoCare, and Shanghai Fudan also saw significant gains [1] Future Outlook - Multiple institutions provided positive forecasts for the Hong Kong stock market - Dongwu Securities indicated that despite potential short-term volatility, the long-term upward trend remains intact, particularly favoring the artificial intelligence (AI) sector - They noted that the Hang Seng Tech Index has shown opportunities for accumulation during its adjustments, with a solid long-term growth logic [1] - China Merchants Securities emphasized that AI continues to be a clear mainline for the Hong Kong stock market, with the internet sector expected to benefit, and highlighted that the current valuations of the tech sector are relatively low historically [1]

港股开盘丨恒指高开0.81% 科网股延续反弹势头

Di Yi Cai Jing· 2025-10-24 03:48

Group 1 - The Hang Seng Index rose by 0.81%, while the Hang Seng Tech Index increased by 1.36% [1] - Technology stocks continued their rebound, with Alibaba rising over 2% as it launched pre-sales for its first self-developed AI glasses [1] - The non-ferrous metal industry showed signs of recovery, with Luoyang Molybdenum Co. increasing by over 4% [1] Group 2 - Wisco Real Estate resumed trading and surged over 90%, planning to privatize and delist for HKD 12.76 billion [1]

港股开盘 | 港股主要指数高开 机构:采用兼顾科技与红利的“哑铃策略”

智通财经网· 2025-10-24 01:43

Market Overview - The Hong Kong stock market opened higher on October 24, with the Hang Seng Index rising by 0.81% and the Hang Seng Tech Index increasing by 1.36% [1] - Technology stocks continued their rebound, with Alibaba rising over 2% and launching its first self-developed AI glasses for pre-sale [1] - Semiconductor stocks showed recovery, with Huahong Semiconductor up 2.83% and SMIC up 2.23% [1] - The non-ferrous metals sector also saw a rebound, with Luoyang Molybdenum rising over 4% [1] Individual Stock Movements - Wisco Real Estate resumed trading and surged over 90%, planning to privatize and delist for HKD 1.276 billion [2] Market Sentiment and Predictions - Recent fluctuations in the Hong Kong stock market reflect macroeconomic uncertainties and changing international capital flows, showcasing resilience and structural opportunities [3] - Analysts from Everbright Securities suggest that in the face of external uncertainties, investors may focus on defensive sectors such as Chinese financials, consumer stocks, and high-yield stocks in the short term [3] - The Hang Seng Index's recent low of 25,300 points may serve as a short-term support level, with resistance between 26,000 and 26,300 points [3] - Galaxy Securities notes that the outcome of US-China trade negotiations remains uncertain, which may keep market risk appetite low [3] Investment Strategies - Various institutions recommend a balanced approach to asset allocation, including both risk and safe-haven assets [4][5] - The "barbell strategy" is suggested, combining aggressive investments in technology stocks with stable investments in dividend-paying central enterprise stocks [5] - Focus on sectors benefiting from policy support and low interest rates, such as insurance stocks and essential consumer goods [6][7] Sector Focus - The upcoming Fourth Plenary Session of the 20th Central Committee is expected to enhance market focus on sectors highlighted in the "14th Five-Year Plan" [3][4] - Analysts emphasize the importance of structural themes rather than index levels, particularly in light of the anticipated policies from the Fourth Plenary Session [4] Company News - China Railway Construction signed new contracts totaling CNY 1,518.765 billion in the first three quarters, a year-on-year increase of 3.08% [13] - Zhibo City Technology expects social business revenue of CNY 4.38-4.44 billion for the first nine months, a growth of approximately 34.5%-36.4% [13] - Ping An Good Doctor reported total revenue of CNY 3.725 billion for the first three quarters, a year-on-year increase of 13.6% [13] - Mongolian Energy's total revenue is expected to decrease significantly due to global economic downturns and weak demand in the steel market [13]

滚动更新丨A股三大指数集体高开,量子科技概念延续强势

Di Yi Cai Jing· 2025-10-24 01:36

Group 1 - The storage chip concept is gaining momentum again, with Samsung and SK Hynix both raising prices by 30%, leading to a resurgence in related stocks [3][1] - The commercial aerospace, quantum technology, and GPU concepts are among the top gainers in the market [1] - The Hong Kong stock market saw a significant rise, with Kanda Foods surging 163.16% after a major acquisition [4] Group 2 - The A-share market opened with all three major indices rising: the Shanghai Composite Index up 0.17%, the Shenzhen Component Index up 0.51%, and the ChiNext Index up 0.83% [2][3] - The Hang Seng Index opened up 0.81%, with the Hang Seng Tech Index increasing by 1.36%, indicating a continued rebound in tech stocks [4][5] - The central bank conducted a 168 billion yuan reverse repurchase operation with a rate of 1.40%, indicating ongoing liquidity management [5]