718 Boxster

Search documents

Porsche weighs scrapping electric models as costs climb

Yahoo Finance· 2026-02-03 12:18

Group 1 - Porsche is considering abandoning electric versions of its 718 Boxster and Cayman due to budget pressures and development delays [1][2] - The petrol-powered Boxster and Cayman, which will be discontinued in 2025, had entry prices around €70,000 ($82,754) and were among Porsche's lower-priced models [2][5] - The company is facing softer demand in China and financial burdens from reversing parts of its EV strategy, alongside technical challenges related to a potential plug-in hybrid alternative [2][4] Group 2 - A decision to scrap the electric models could lead to significant delays in relaunching, risking the introduction of outdated technology at a time when Porsche needs to generate interest in new models [3] - Porsche has lowered its outlook four times last year, shifting focus back to combustion engines and hybrids, which has also affected parent company Volkswagen [4] - The company has warned that its EV strategy correction could reduce operating profit by up to €1.8 billion in 2025, and it has highlighted the impact of US import tariffs in its largest market [4]

Porsche Cars Canada reports its sales results for 2025

Globenewswire· 2026-01-16 14:00

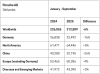

Sales Performance - Porsche Cars Canada, Ltd. reported total sales of 10,010 units for 2025, reflecting a decrease of 3.5% compared to 2024's sales of 10,374 units [1][3] - Porsche Approved Certified Pre-Owned vehicle sales increased to 4,295 units in 2025, marking a growth of 4.7% from 4,101 units in 2024 [1][3] Model-Specific Sales - The 718 Boxster saw sales of 468 units in 2025, up from 451 units in 2024 [3] - The 718 Cayman experienced a significant increase in sales, reaching 506 units in 2025 compared to 379 units in 2024 [3] - The 911 model sold 2,037 units in 2025, down from 2,208 units in the previous year [3] - The Cayenne model's sales decreased to 2,551 units from 2,949 units in 2024 [3] - The Macan model had sales of 3,877 units, an increase from 3,779 units in 2024 [3] - The Panamera model's sales rose to 321 units from 248 units in 2024 [3] - The Taycan model saw a decline in sales, with 250 units sold compared to 360 units in 2024 [3] Brand Development - The opening of the Porsche Experience Centre Toronto in 2025 has enhanced customer engagement and brand presence in Canada, being the first of its kind in the country and the tenth globally [2][4] - Porsche Cars Canada, Ltd. employs over 70 staff members to support various functions including sales, marketing, and public relations, ensuring a high-quality customer experience [4]

Porsche Deliveries Fall on China Woes and Model Gaps

WSJ· 2026-01-16 08:11

Group 1 - Deliveries dropped by 10% in 2025 due to a slowdown in luxury spending in China [1] - The company ceased production of its 718 Boxster and 718 Cayman models, contributing to the decline in deliveries [1]

保时捷闭店、关停充电桩,在中国开始降本求生

3 6 Ke· 2025-12-31 01:00

Core Viewpoint - Porsche is undergoing significant cost-cutting measures in China, including the withdrawal of its self-built charging network and the closure of several dealerships, amid a sharp decline in profits and sales in the region [1][6][10]. Group 1: Cost-Cutting Measures - Porsche has announced the gradual dismantling of its self-built charging network in China, effective from March 1, 2026, while still providing access to third-party charging resources [1][3]. - The company has reportedly closed several dealerships, including the Zhengzhou and Guiyang centers, with concerns raised about customer deposits and service packages [6][8]. - Plans are in place to reduce the number of sales outlets in China from 150 to 80 by 2024, indicating a significant contraction in its operational footprint [8]. Group 2: Financial Performance - Porsche's operating profit plummeted from €4.035 billion (approximately ¥33.395 billion) in the same period last year to just €40 million (around ¥331 million), marking a 99% year-on-year decline [10][11]. - The company reported a net profit drop of 95.9% to €114 million (about ¥943 million) for the first three quarters, with a net loss of €600 million (approximately ¥4.97 billion) in the third quarter alone [10][11]. - Total cash and cash equivalents decreased by €1.591 billion (around ¥13.14 billion) to €5.531 billion (approximately ¥45.7 billion) [11]. Group 3: Sales and Market Dynamics - Global deliveries for Porsche fell by 6% year-on-year, with the Chinese market experiencing a 26% decline, dropping from being the largest market to the third largest [12]. - Despite the downturn, Porsche is not abandoning the Chinese market; instead, it is adjusting its strategy to regain market share, including the establishment of a strategic R&D center in Shanghai [12][15]. - The R&D center aims to develop market-specific technologies, such as infotainment systems and driver assistance solutions, with a focus on accelerating development cycles [15]. Group 4: Strategic Adjustments - Porsche is shifting its approach to electric vehicle production, with plans to modify its electric platform to accommodate internal combustion engine models, indicating a potential return to fuel-powered vehicles [16].

中年男人最爱的豪车,利润暴跌99%

3 6 Ke· 2025-11-04 05:37

Core Viewpoint - Porsche, once hailed as the "most profitable car company in the world," is facing a severe operational crisis, with profits plummeting by 99% and a significant loss reported in the third quarter of 2025 [1][2]. Financial Performance - In the first three quarters of 2025, Porsche reported a loss of €9.66 billion (approximately ¥80 billion) and a drastic decline in sales profit from €40.35 billion to €40 million year-on-year, marking a 99% drop [1][2]. - The company's operating revenue for the first nine months of 2025 was approximately €26.86 billion, a 6% decrease compared to the previous year [2]. - The gross margin per vehicle fell to 13.2% in Q3 2025, the lowest for the year, indicating a significant erosion of brand value [2][4]. Market Dynamics - The Chinese market, once a key driver for Porsche, has seen a continuous decline in sales, dropping from 95,700 units in 2021 to 32,000 units in the first three quarters of 2025, a 26% year-on-year decrease [4][5]. - While the U.S. market showed some growth with 64,446 units delivered in the first three quarters of 2025, the impact of tariffs has diminished this growth, with additional costs reaching €300 million [4][5]. Strategic Challenges - Porsche's profit collapse is attributed to a combination of strategic missteps, external shocks, and market misjudgments [5][6]. - The company has shifted its strategy from a focus on electric vehicles to a more diversified approach, which has led to significant restructuring costs amounting to €2.7 billion in the first three quarters of 2025 [6][8]. - The management's decision to delay electric vehicle launches and extend the lifecycle of combustion engine models has resulted in a disconnect with market demands [8][10]. Management Changes - The announcement of the end of the "shared CEO" model and the potential appointment of Michael Leiters, who has extensive experience in product development, has raised market expectations for a turnaround [9][10]. Historical Context - Porsche has faced crises before, notably in the 1990s, and successfully revived its brand with the introduction of the Boxster, which attracted younger consumers [10][12]. - The current crisis is seen as a pivotal moment for Porsche, with the need to balance new energy product capabilities, intelligent experiences, and brand value to navigate the evolving market landscape [12][14]. Future Outlook - The company aims to regain its footing in the Chinese market by focusing on younger, digitally-savvy consumers and optimizing its dealer network [12][14]. - The success of Porsche's turnaround efforts will depend on its ability to adapt to changing consumer preferences and market conditions, particularly in the context of increasing competition in the electric vehicle space [12][14].

产品为王,保时捷也不能例外

Zhong Guo Jing Ji Wang· 2025-10-28 06:10

Core Insights - Porsche reported a significant loss of €966 million (approximately ¥8 billion) in Q3, with profits plummeting 99% from €4 billion in the same period last year to just €40 million [1][3] - The decline in sales and profits has raised concerns about Porsche's market position, leading to discussions about its ability to recover through new product launches [1][3] Financial Performance - Q3 sales revenue was €8.7 billion, below market expectations of €9 billion, with a total revenue of approximately €26.86 billion for the first three quarters, a 6% year-on-year decline [1][3] - Deliveries in the first three quarters totaled 212,509 units, a 6% decrease compared to the previous year, with notable declines in key markets such as China, where sales dropped 26% [2][4] Strategic Challenges - Porsche's losses are attributed to past strategic decisions, including the postponement of electric vehicle launches and the extension of the lifecycle for several fuel and hybrid models, resulting in additional costs of approximately €2.7 billion [3][4] - The U.S. tariff policy has further pressured Porsche's performance, with an estimated additional cost of €300 million in the first three quarters of 2025, leading to a projected total loss of €700 million for the year [4] Market Dynamics - Despite the challenges, Porsche achieved record delivery numbers in the U.S. market, with sales increasing by 5% to 64,446 units, contrasting with a 26% decline in China [4][5] - The company is facing intense competition in the entry-level segment, with competitors offering superior price, quality, and emotional value, leading to a loss of younger customers [7][10] Product Development and Innovation - Porsche has not introduced a new flagship model in over a decade, leading to concerns about its product lineup and market appeal [5][11] - The electric vehicle strategy has been inconsistent, with the flagship electric model Taycan experiencing a 10% decline in sales, and the new electric Macan facing delays and challenges in the competitive Chinese market [8][10] Future Outlook - Porsche plans to optimize its organizational structure, with plans to lay off 1,900 employees and cut 2,000 temporary positions by 2025 [4][11] - The company anticipates that its performance will hit bottom this year, with expectations of significant improvement starting in 2026, although this is still far from its historical profit margins of 15% [4][11]

郑智化就“连滚带爬”表述致歉;春秋航空招聘已婚已育空嫂;宗馥莉心腹祝丽丹离职;安徽成汽车产量第一省;长安汽车一4S店起火丨邦早报

创业邦· 2025-10-28 00:10

Group 1 - Zhu Lidan, the legal representative of Hongsheng Group controlled by Zong Fuli, has left the company, with her office now assigned to Kou Jing [3][4] - Zhu Lidan has been a core member of Hongsheng Group and has had a long-standing working relationship with Zong Fuli [3] - There are reports that Zhu Lidan was summoned by relevant authorities twice since September, and her position was previously marked as "to be determined" [4] Group 2 - Changan Automobile confirmed a fire incident at a 4S store in Anhui, but no information on the cause of the fire has been provided [6] - Meituan announced a nationwide rollout of pension insurance subsidies for delivery riders starting in November, marking the first such scheme available to all riders [12][13] - Spring Airlines has launched a recruitment campaign for "air sisters," targeting married women with children and expanding the age limit to 40 years [13] Group 3 - JD.com has been granted an insurance brokerage license in Hong Kong, marking its entry into the financial market [13] - Tesla's board chair warned that if Elon Musk's $1 trillion compensation plan is not approved, the company may face significant value loss [13] - High-profile education company Gaotu is under investigation for allegedly organizing illegal offline subject training in Beijing [13] Group 4 - Amazon plans to invest over €1.4 billion in the Netherlands over the next three years, the largest investment commitment since entering the market [14] - Porsche responded to reports of multiple gasoline vehicle discontinuations, clarifying that the fuel version of Macan is not included in the changes [15] - AI startup Mercor raised $350 million at a valuation of $10 billion, with participation from notable investors [15][16] Group 5 - The global mobile game in-app purchase revenue is expected to increase by 6% to $85.4 billion by 2025 [20] - China is projected to generate over 400 million discarded mobile phones annually, with low recycling prices and privacy concerns hindering recovery efforts [20] - Anhui has become the top province in automobile production, with 15 provinces expected to produce over one million vehicles this year [20]

暴跌99%!传统豪车巨头,发生了什么?

Zheng Quan Shi Bao· 2025-10-27 04:54

Core Viewpoint - Porsche's operating profit has plummeted by 99% to €40 million in the first three quarters of this year, down from €4.035 billion in the same period last year, primarily due to product strategy restructuring, challenges in the Chinese luxury car market, and rising import tariffs in the U.S. [1][3] Financial Performance - Porsche's revenue for the first three quarters of this year was €26.86 billion, a 6% decline year-on-year [3] - The sales return rate dropped to 0.2%, compared to 14.1% in the same period last year [3] - The company reported a total of 212,500 vehicles sold, a 6% decrease, with significant declines in key markets: a 26% drop in China to 32,000 units, a 16% drop in Germany to 22,500 units, and a 4% drop in the rest of Europe to 50,000 units [3] Strategic Adjustments - Porsche announced a delay in the launch of certain electric vehicle models and extended the market lifecycle of several fuel and hybrid models, resulting in an additional €2.7 billion in special expenses [3][4] - The company plans to cut approximately 1,900 jobs at its Stuttgart headquarters by 2029 and is negotiating a new cost-saving plan with labor unions [4] - Porsche's CEO will be replaced at the end of the year, with Michael Leiters set to take over from Oliver Blume [8] Industry Context - Other luxury car manufacturers are also facing challenges, with Mercedes-Benz reporting a 12% decline in global sales in the third quarter and BMW lowering its 2025 performance expectations due to ongoing sales weakness and increased tariff costs [5] - The automotive industry is experiencing significant pressure from rising costs and changing market dynamics, prompting companies to implement cost-cutting measures and strategic shifts [5]

暴跌99%!传统豪车巨头,发生了什么?

证券时报· 2025-10-27 04:14

Core Viewpoint - Porsche's financial performance has drastically declined, with a 99% drop in operating profit for the first three quarters of the year, attributed to strategic restructuring costs, challenges in the luxury car market in China, and increased import tariffs in the U.S. [1][3] Financial Performance - For the first three quarters of the year, Porsche reported revenue of €26.86 billion, a 6% year-on-year decline [3] - Operating profit fell to €40 million, down from €4.035 billion in the same period last year, resulting in a sales return rate of 0.2%, compared to 14.1% last year [3][4] - The company faced approximately €2.7 billion in additional costs due to restructuring measures [4] Market Challenges - Porsche's sales volume decreased by 6% to 212,500 units, with significant declines in key markets: a 26% drop in China (32,000 units) and a 16% drop in Germany (22,500 units) [3][4] - Other luxury car manufacturers, such as Mercedes-Benz and BMW, are also experiencing sales declines and have announced cost-cutting measures [5] Strategic Adjustments - Porsche plans to expand its internal combustion engine and plug-in hybrid model lineup, delaying the launch of some electric models and restructuring its electric vehicle development strategy [7] - The company is also increasing prices in the U.S. market to offset tariff impacts, which have added €300 million in costs in the first nine months of the year [8] Organizational Changes - Porsche is initiating a structural reduction, planning to cut approximately 1,900 jobs at its Stuttgart headquarters by 2029, alongside the expiration of contracts for 2,000 temporary employees [4] - A leadership change is set to occur, with the current CEO stepping down at the end of the year, and a new CEO taking over in January 2026 [8] Future Outlook - Porsche aims to improve its profitability starting in 2026 after a projected bottoming out in 2025, with a target sales return rate of up to 2% [8] - The company emphasizes the importance of long-term resilience and profitability despite short-term financial challenges [9]

暴跌99%,超级巨头,发生了什么?

Zheng Quan Shi Bao· 2025-10-27 02:04

Core Insights - Porsche's operating profit for the first three quarters of this year plummeted by 99% to €40 million (approximately ¥331 million), compared to €4.035 billion (approximately ¥33.4 billion) in the same period last year [1][3] - The company's sales return rate dropped to 0.2%, down from 14.1% year-on-year [1][3] - The significant decline in performance is attributed to special expenses from product strategy restructuring, challenges in the Chinese luxury car market, increased costs from U.S. import tariffs, and one-time impacts related to battery business [1][3][4] Financial Performance - Porsche's revenue for the first three quarters was €26.86 billion, a 6% decline year-on-year [3] - The company sold 212,500 vehicles, a 6% decrease, with notable declines in key markets: a 26% drop in China (32,000 units), a 16% drop in Germany (22,500 units), and a 4% drop in the rest of Europe (50,000 units) [3][4] Strategic Adjustments - Porsche announced a structural contraction, planning to cut approximately 1,900 jobs at its Stuttgart headquarters by 2029, with an additional 2,000 temporary contracts expiring [4] - The company is postponing the launch of certain electric vehicle models and extending the market lifecycle of several fuel and hybrid models, resulting in an additional €2.7 billion in expenses [3][4] - Porsche plans to increase prices in the U.S. market to offset the impact of tariffs, which have cost the company €300 million in the first nine months and are projected to reach €700 million for the year [8] Leadership Changes - Porsche announced a leadership change, with current CEO Oliver Blume set to step down at the end of the year, to be succeeded by Michael Leiters starting January 1, 2026 [8] Industry Context - Other luxury car manufacturers are also facing challenges, with Mercedes-Benz reporting a 12% decline in global sales for Q3 and BMW lowering its 2025 performance expectations due to weak sales and increased tariff costs [5]