Boxster

Search documents

保时捷中国总裁及CEO潘励驰:保时捷的“过冬”手册 收缩、重仓与不妥协

2 1 Shi Ji Jing Ji Bao Dao· 2026-02-03 00:16

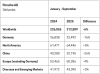

2025年,保时捷全球交付27.94万辆新车,同比下滑10%,创下自2009年以来的最大年度跌幅。而在中 国市场的销量滑坡更为惊人,2025全年仅售出4.19万辆,同比下滑26%,几乎跌回十年前水平。 "这样的结果在我们的预期之内。"保时捷中国总裁及CEO潘励驰在接受21世纪经济报道等媒体采访时表 现得十分理性:"我们不会舍本逐末,竭尽所能地追求销量、追求市场份额,我们要维持供需平衡,保 持品牌和产品的价值。" 这是保时捷的第一"变"。 渠道收缩的目的在于精,优化经销商网络,追求"健康"而非单纯"庞大"。通过"睿境计划",把曾经位于 城郊、规模宏大却略显疏离的4S店,转变为融合新车、易手车、售后服务与社区活动的温暖空间。对 于成本高昂的城市展厅,则代之以灵活、低成本的限时快闪店,像一支精准的轻骑兵,在维系品牌热度 与控制成本间找到新平衡。 在保时捷内部,一场降本增效的行动也正在持续。作为保时捷中国总裁及首席执行官,潘励驰的公务出 行也只选择经济舱。钱要花在刀刃上,保时捷一边缩减行政开支,一边却加大了对中国市场的投资。 为了适应中国市场,保时捷逆势投入在上海设立研发中心。18个月——这是上海保时捷研发中心中德团 ...

对话保时捷中国CEO潘励驰:首度详解如何“赢回中国”

Feng Huang Wang· 2026-01-26 08:26

"保时捷一直深耕赛车运动,我们不是短跑选手,而是耐力赛的参与者。" 保时捷全球销量下降10%,中国区交付量下降26%——这是保时捷在2025年的销量成绩单。 "这样的结果在我们的预期之内。"在包括凤凰网科技在内的一场媒体沟通会上,保时捷中国总裁及CEO 潘励驰(Alexander Pollich)没有回避销量的下滑。但他强调,保时捷始终秉持"质大于量"的原则,"我 们不追逐销量数字"。 金融服务渗透率高。超过一半的保时捷销量通过保时捷金融服务完成。"金融服务能将客户与品牌紧密 联结。例如,当"无忧先享"金融服务合同到期时,我们就能与客户展开新的沟通,探讨后续的购车需 求。" 潘励驰特别强调了车辆残值对豪华品牌的重要性:"如果一款车使用3年后残值仅剩下40%,那它就称不 上真正的豪华产品,也无法支撑品牌的长期发展。而保时捷的残值表现在豪华车领域处于领先地位,这 让我们深感自豪,也进一步巩固了品牌价值。" 在客户满意度方面,JDPower 2025中国车辆可靠性研究显示,卡宴和Macan在各自细分市场的SUV品类 中排名第一。疫情期间及之后,保时捷连续8年蝉联全球最具价值豪华品牌。"我们在中国开展的品牌监 测研究 ...

奥博穆卸任后反思:保时捷第二代Macan全面转型纯电动车是个错误决定

Xin Lang Cai Jing· 2026-01-10 11:13

Core Viewpoint - The former CEO of Porsche, Oliver Blume, publicly acknowledged significant strategic mistakes during his tenure, particularly regarding the decision to transition the Macan model to an all-electric version, which he now admits was a misjudgment [1][3][6]. Group 1: Strategic Missteps - Blume recognized that since Porsche's IPO three years ago, shareholders have suffered losses, and he accepted this criticism [3]. - The decision to design the second-generation Macan as a fully electric vehicle was deemed a mistake due to the inflexibility of the product portfolio at that time [3][6]. - The Macan model has been a crucial revenue pillar for Porsche, achieving a production milestone of one million units in just 12 years, making it the third model in Porsche's history to reach this sales figure [3][5]. Group 2: Market Response and Adjustments - Porsche plans to correct its strategic errors by increasing the production of fuel and hybrid vehicles, acknowledging strong market demand for these models [3][8]. - The first-generation Macan will cease production in mid-2026, leading to a product gap until a new fuel-powered crossover is expected to launch in 2028 [7][8]. - The new fuel-powered crossover will be developed using the Volkswagen Group's Premium Platform Combustion (PPC) platform, which may impact Porsche's brand identity [8]. Group 3: Financial and Operational Challenges - Porsche is facing significant financial pressure due to a sharp decline in the Chinese luxury car market and high tariffs in the U.S., which account for over 50% of its total sales [10][12]. - The company has adjusted its sales expectations in China, reducing its dealer network from 154 to 100 by the end of 2026 to improve operational efficiency [12][13]. - A global cost-cutting plan includes laying off 1,900 permanent positions and not renewing contracts for 2,000 temporary workers [14]. Group 4: Future Strategy - Porsche's future strategy focuses on high-end fuel and hybrid sports cars, as the company believes there will still be a market for fuel vehicles in China for the next 10 to 15 years [15]. - The leadership transition to new CEO Michael Leiters will be crucial in navigating the product gap and reversing market decline [16].

“我们犯了大错误”,车企一把手罕见认错

汽车商业评论· 2026-01-08 23:05

Core Viewpoint - The former CEO of Porsche, Oliver Blume, acknowledged significant strategic errors during his tenure, particularly regarding the decision to transition the second-generation Macan to an all-electric vehicle, which he now admits was a mistake [5][20]. Group 1: Strategic Missteps - Porsche's decision to make the second-generation Macan an all-electric vehicle was based on a rigid product portfolio that lacked flexibility, leading to a misjudgment of market readiness for such a transition [5][13]. - The Macan has been a crucial revenue driver for Porsche, achieving a production milestone of one million units in just 12 years, making it the third model in Porsche's history to surpass this figure [7][9]. - The discontinuation of the fuel-powered Macan in Europe due to new safety regulations has created a product gap, with the new electric Macan not fully meeting market demand for a lower-priced fuel-powered crossover [11][13]. Group 2: Adjustments and Future Plans - Porsche is now focusing on correcting its strategic errors by developing a new fuel-powered crossover that will not carry the Macan name, aiming to maintain brand identity while addressing market needs [17][19]. - The company plans to leverage synergies within the Volkswagen Group to expedite the development of this new vehicle, which will share a platform with the new Audi Q5 [15][17]. - Porsche is also reintroducing gasoline-powered models like the Boxster and Cayman, indicating a shift back to high-end fuel and hybrid sports cars, as the luxury electric vehicle market in China is still developing [27]. Group 3: Market Challenges - Porsche is facing significant challenges in its core markets, with the Chinese luxury car market experiencing an over 80% drop and high tariffs in the U.S. impacting profitability [24][27]. - The company has adjusted its sales expectations in China, reducing its dealer network and production capacity to maintain profitability amid declining sales [24][27]. - The leadership transition to new CEO Michael Leiters will be critical in navigating these challenges and addressing the product gap created by the shift in strategy [28].

中年男人最爱的豪车,利润暴跌99%

3 6 Ke· 2025-11-04 05:37

Core Viewpoint - Porsche, once hailed as the "most profitable car company in the world," is facing a severe operational crisis, with profits plummeting by 99% and a significant loss reported in the third quarter of 2025 [1][2]. Financial Performance - In the first three quarters of 2025, Porsche reported a loss of €9.66 billion (approximately ¥80 billion) and a drastic decline in sales profit from €40.35 billion to €40 million year-on-year, marking a 99% drop [1][2]. - The company's operating revenue for the first nine months of 2025 was approximately €26.86 billion, a 6% decrease compared to the previous year [2]. - The gross margin per vehicle fell to 13.2% in Q3 2025, the lowest for the year, indicating a significant erosion of brand value [2][4]. Market Dynamics - The Chinese market, once a key driver for Porsche, has seen a continuous decline in sales, dropping from 95,700 units in 2021 to 32,000 units in the first three quarters of 2025, a 26% year-on-year decrease [4][5]. - While the U.S. market showed some growth with 64,446 units delivered in the first three quarters of 2025, the impact of tariffs has diminished this growth, with additional costs reaching €300 million [4][5]. Strategic Challenges - Porsche's profit collapse is attributed to a combination of strategic missteps, external shocks, and market misjudgments [5][6]. - The company has shifted its strategy from a focus on electric vehicles to a more diversified approach, which has led to significant restructuring costs amounting to €2.7 billion in the first three quarters of 2025 [6][8]. - The management's decision to delay electric vehicle launches and extend the lifecycle of combustion engine models has resulted in a disconnect with market demands [8][10]. Management Changes - The announcement of the end of the "shared CEO" model and the potential appointment of Michael Leiters, who has extensive experience in product development, has raised market expectations for a turnaround [9][10]. Historical Context - Porsche has faced crises before, notably in the 1990s, and successfully revived its brand with the introduction of the Boxster, which attracted younger consumers [10][12]. - The current crisis is seen as a pivotal moment for Porsche, with the need to balance new energy product capabilities, intelligent experiences, and brand value to navigate the evolving market landscape [12][14]. Future Outlook - The company aims to regain its footing in the Chinese market by focusing on younger, digitally-savvy consumers and optimizing its dealer network [12][14]. - The success of Porsche's turnaround efforts will depend on its ability to adapt to changing consumer preferences and market conditions, particularly in the context of increasing competition in the electric vehicle space [12][14].

产品为王,保时捷也不能例外

Zhong Guo Jing Ji Wang· 2025-10-28 06:10

Core Insights - Porsche reported a significant loss of €966 million (approximately ¥8 billion) in Q3, with profits plummeting 99% from €4 billion in the same period last year to just €40 million [1][3] - The decline in sales and profits has raised concerns about Porsche's market position, leading to discussions about its ability to recover through new product launches [1][3] Financial Performance - Q3 sales revenue was €8.7 billion, below market expectations of €9 billion, with a total revenue of approximately €26.86 billion for the first three quarters, a 6% year-on-year decline [1][3] - Deliveries in the first three quarters totaled 212,509 units, a 6% decrease compared to the previous year, with notable declines in key markets such as China, where sales dropped 26% [2][4] Strategic Challenges - Porsche's losses are attributed to past strategic decisions, including the postponement of electric vehicle launches and the extension of the lifecycle for several fuel and hybrid models, resulting in additional costs of approximately €2.7 billion [3][4] - The U.S. tariff policy has further pressured Porsche's performance, with an estimated additional cost of €300 million in the first three quarters of 2025, leading to a projected total loss of €700 million for the year [4] Market Dynamics - Despite the challenges, Porsche achieved record delivery numbers in the U.S. market, with sales increasing by 5% to 64,446 units, contrasting with a 26% decline in China [4][5] - The company is facing intense competition in the entry-level segment, with competitors offering superior price, quality, and emotional value, leading to a loss of younger customers [7][10] Product Development and Innovation - Porsche has not introduced a new flagship model in over a decade, leading to concerns about its product lineup and market appeal [5][11] - The electric vehicle strategy has been inconsistent, with the flagship electric model Taycan experiencing a 10% decline in sales, and the new electric Macan facing delays and challenges in the competitive Chinese market [8][10] Future Outlook - Porsche plans to optimize its organizational structure, with plans to lay off 1,900 employees and cut 2,000 temporary positions by 2025 [4][11] - The company anticipates that its performance will hit bottom this year, with expectations of significant improvement starting in 2026, although this is still far from its historical profit margins of 15% [4][11]

保时捷停售燃油版Boxster和Cayman,电动版2026年亮相

Cai Jing Wang· 2025-09-04 07:18

Core Viewpoint - Porsche has officially discontinued the fuel-powered versions of the Boxster and Cayman, closing global order channels for these models, while the exact production cessation date remains unannounced [1] Group 1 - Porsche has not disclosed the official production end date for the Boxster and Cayman models [1] - There are rumors suggesting that Porsche may take until 2026 to fulfill all existing orders for the 718 Cayman and Boxster [1] - The company is actively developing electric versions of these models, with mass production expected to begin in 2026 [1]

汽车早餐 | 安徽将免收高速清障服务费;通用汽车CEO抛售其所持公司股票的40%;保时捷停售燃油版Boxster和Cayman

Zhong Guo Qi Che Bao Wang· 2025-09-04 01:11

Domestic News - Anhui Province will waive towing and lifting fees for highway rescue services starting September 20, 2025, to enhance road network efficiency and public satisfaction [2] - Chongqing City has allocated an additional budget of 135 million yuan for vehicle and electric bicycle trade-in subsidies, with specific allocations for scrapping and replacing vehicles [3] - In August, China's new energy vehicle retail sales reached 1.079 million units, a year-on-year increase of 5% and a cumulative retail of 7.535 million units for the year, up 25% [4] International News - The labor committee of Volkswagen Group is pressuring CEO Oliver Blume to relinquish his dual leadership role as both CEO of Volkswagen and Porsche, a concern since Porsche's IPO in 2022 [5] - General Motors CEO Mary Barra sold 370,000 shares of the company, cashing out approximately $21.67 million, which represents 40% of her holdings, raising investor concerns about the company's future performance [6] - The Korea Exchange reported that all top ten corporate groups in South Korea, including Samsung and Hyundai, have submitted plans to enhance corporate value [7] Corporate News - Wang Xiaofei has been appointed as the new Executive Vice President of Changan Ford, succeeding Yang Dayong [12] - NIO's CEO Li Bin announced a target of 50,000 monthly deliveries in Q4 2025, with specific production targets for the L90 and new ES8 models [13] - China Export & Credit Insurance Corporation has insured a $285 million project for a nickel material production line in Morocco, marking the successful launch of Africa's first new energy materials base [14] - EVE Energy has officially opened its solid-state battery production base in Chengdu, with an annual capacity of nearly 500,000 cells, targeting high-end applications [15]