Azure云计算

Search documents

【财闻联播】白银基金重大宣布:对基金资产进行重估!沪市首份年报出炉

券商中国· 2026-02-02 14:43

Macro Dynamics - The Central Committee of the Communist Party of China and the State Council approved the "Modern Capital Metropolitan Area Spatial Coordination Plan (2023-2035)", aiming to cultivate an innovation triangle in the Beijing-Tianjin-Hebei region, enhancing collaboration and resource flow [2] Housing Market - Shanghai has initiated a program to purchase second-hand housing for affordable rental housing, targeting new citizens, young people, and graduates to meet their rental needs [3] - The first batch of housing to be acquired will focus on matching housing types, layout, and transportation convenience to support talent in the city [3] Energy Sector - The China Electricity Council reported that by 2025, the country will add 550 million kilowatts of new power generation capacity, with wind and solar power accounting for 440 million kilowatts, representing 80.2% of the total [4] Financial Institutions - Citigroup warned that gold valuations have reached extreme levels, with global gold expenditure as a percentage of GDP hitting 0.7%, the highest in 55 years, indicating potential risks for gold prices [7] - Deutsche Bank remains bullish on gold, maintaining a target price of $6,000 per ounce despite recent price drops, citing ongoing positive factors for gold investment [8] Market Data - On February 2, A-shares experienced a significant decline, with all three major indices dropping over 2%, and more than 4,600 stocks falling, including 123 hitting the daily limit down [12] - The Hong Kong Hang Seng Index fell by 2.23%, with the technology index down 3.36%, and significant declines in precious metals and semiconductor stocks [13] Company Dynamics - Midea Group announced a share buyback of 26.94 million shares, representing 0.35% of its total share capital, at a total cost of 1.998 billion yuan [17] - Chip-on-Board Technology reported a revenue of 394 million yuan for 2025, a year-on-year increase of 11.52%, but a net profit decrease of 4.91% [18] - GoerTek has repurchased 40.54 million shares, amounting to 1.14% of its total shares, for a total expenditure of 1.108 billion yuan [19] - Microsoft saw a market value drop of $381 billion following disappointing earnings and forecasts, indicating a shift in investor sentiment towards tech stocks [20] - Amazon is expected to report strong fourth-quarter earnings, with analysts predicting over 28% upside potential in the next 12 months [21]

Meta涨超7%,微软跌超5%;停产两款车型为机器人让路,特斯拉涨近3%;英伟达、微软、亚马逊正洽谈向OpenAI投资600亿美元【美股盘前】

Mei Ri Jing Ji Xin Wen· 2026-01-29 11:35

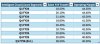

Group 1 - Major stock indices futures showed slight increases, with Dow futures up 0.08%, S&P 500 futures up 0.17%, and Nasdaq futures up 0.23% [1] - Meta's Q4 2025 earnings exceeded expectations, reporting revenue of $59.893 billion, a 24% year-over-year increase, and a net profit of $22.768 billion, a 9% increase, leading to a stock rise of 7.81% [2] Group 2 - Microsoft's Q2 2026 earnings surpassed expectations, with Azure cloud revenue growing 38% year-over-year, but the growth rate slowed by 1 percentage point from the previous quarter. Capital expenditures reached $37.5 billion, a 66% increase, causing a stock decline of 5.77% [3] - Tesla's Q4 2025 revenue fell approximately 3% to $24.901 billion, marking the first annual revenue decline in the company's history. The company plans to halt production of Model S and Model X to make way for Optimus robot production, resulting in a stock increase of 2.92% [4] Group 3 - IBM reported Q4 2025 revenue of $19.69 billion, a 12% year-over-year increase, with software revenue up 14% and consulting revenue up 3.4%. Free cash flow grew by 23%, leading to a stock increase of 7.88% [5] Group 4 - Nvidia, Microsoft, and Amazon are reportedly negotiating to invest up to $60 billion in OpenAI, with Nvidia considering an investment of up to $30 billion, Microsoft planning under $10 billion, and Amazon potentially exceeding $10 billion [6] - Deutsche Bank's Frankfurt office was raided by prosecutors in connection with a money laundering investigation, resulting in a stock decline of 2.38% [7] Group 5 - Amazon confirmed a layoff of approximately 16,000 corporate positions, marking the second round of significant layoffs since October, totaling 30,000 positions, which is about 10% of its corporate and technology workforce [8] - Nvidia's CEO Jensen Huang announced collaboration with Intel to develop a custom X86 processor, highlighting strong demand for Nvidia's next-generation product, Rubin, which is crucial for maintaining its leadership in the AI chip market [9]

【美股盘前】Meta涨超7%,微软跌超5%;停产两款车型为机器人让路,特斯拉涨近3%;英伟达、微软、亚马逊正洽谈向OpenAI投资600亿美元;苹果将在...

Mei Ri Jing Ji Xin Wen· 2026-01-29 10:29

Group 1: Market Performance - Major indices futures showed positive movement with Dow futures up 0.08%, S&P 500 futures up 0.17%, and Nasdaq futures up 0.23% [1] Group 2: Company Earnings Reports - Meta reported Q4 2025 revenue of $59.893 billion, a 24% year-over-year increase, exceeding analyst expectations of $58.42 billion; net profit was $22.768 billion, up 9%, with diluted EPS of $8.88, up 11% [2] - Microsoft reported Q2 2026 revenue and profit above expectations, with Azure cloud revenue growing 38% year-over-year, matching analyst forecasts; however, growth slowed by 1 percentage point from the previous quarter [3] - IBM's Q4 2025 revenue was $19.69 billion, a 12% increase year-over-year, with software revenue at $9.03 billion, up 14%, and consulting revenue at $5.35 billion, up 3.4%; free cash flow grew 23% to $7.55 billion [5] Group 3: Strategic Changes and Investments - Tesla announced plans to halt production of Model S and Model X to make way for Optimus robot production lines, despite a 3% year-over-year revenue decline to $24.901 billion in Q4 2025 [4] - Amazon confirmed layoffs of approximately 16,000 corporate positions, marking the second round of significant layoffs since October, totaling 30,000 positions or about 10% of its corporate and tech workforce [6] - Nvidia, Microsoft, and Amazon are reportedly in discussions to invest up to $60 billion in OpenAI, with Nvidia considering up to $30 billion, Microsoft planning under $10 billion, and Amazon potentially exceeding $10 billion [7] Group 4: Regulatory Issues - Deutsche Bank's Frankfurt office was raided by German prosecutors in connection with a money laundering investigation, with the bank cooperating with authorities [8]

微软股价盘后大跌,支出创纪录新高且云业务增长放缓

Sou Hu Cai Jing· 2026-01-29 00:31

钛媒体App 1月29日消息, 微软股价大幅下跌,该公司支出飙升至历史新高,而云业务销售额增长放 缓,投资者担心其人工智能投资可能需要比预期更长的时间才能获得回报。第二财季资本支出达到375 亿美元,比上年同期增长66%,超过分析师预期的362亿美元。经汇率波动调整后,Azure云计算部门当 季营收增长38%,勉强符合分析师预期。但这一增速较上一季度放缓。该公司预计当前财季Azure销售 额将增长37%至38%。微软股价在盘后交易中下跌约7%,纽约常规交易时段收于481.63美元。(广角观 察) ...

微软股价盘后大跌 支出创纪录新高且云业务增长放缓

Xin Lang Cai Jing· 2026-01-28 23:56

微软股价大幅下跌,该公司支出飙升至历史新高,而云业务销售额增长放缓,投资者担心其人工智能投 资可能需要比预期更长的时间才能获得回报。 第二财季资本支出达到375亿美元,比上年同期增长66%,超过分析师预期的362亿美元。 经汇率波动调整后,Azure云计算部门当季营收增长38%,勉强符合分析师预期。但这一增速较上一季 度放缓。该公司预计当前财季Azure销售额将增长37%至38%。 微软股价在盘后交易中下跌约7%,纽约常规交易时段收于481.63美元。 该公司周三发布称,季度总销售额增长17%至813亿美元,每股收益为5.16美元。净利润增长主要得益 于微软对OpenAI的投资收益,该投资使每股收益增加了1.02美元。 分析师此前预计销售额为803亿美元,每股收益为3.92美元。 责任编辑:王永生 微软股价大幅下跌,该公司支出飙升至历史新高,而云业务销售额增长放缓,投资者担心其人工智能投 资可能需要比预期更长的时间才能获得回报。 第二财季资本支出达到375亿美元,比上年同期增长66%,超过分析师预期的362亿美元。 经汇率波动调整后,Azure云计算部门当季营收增长38%,勉强符合分析师预期。但这一增速较上一 ...

降低AI销售增长目标?微软辟谣

3 6 Ke· 2025-12-05 02:05

Core Insights - Microsoft has reportedly lowered sales growth targets for certain AI products, leading to a decline in its stock price despite a quick response from the company [1][2] - The decline in stock price reflects investor concerns over high expectations and the slower-than-expected pace of AI application [1][2] Group 1: Company Response and Market Reaction - Microsoft quickly responded to the news, clarifying that the report inaccurately conflated growth with sales targets, asserting that overall sales goals for AI products remain unchanged [1] - Despite the clarification, Microsoft's stock fell by 2.5%, indicating that investor sentiment has not fully recovered [1][2] - The core issue lies in the mismatch between high expectations for AI and the actual pace of its commercial application, which has heightened market concerns [1][2] Group 2: Industry Challenges and Trends - Reports indicate that multiple departments within Microsoft have lowered sales quotas for AI products due to underperformance in meeting sales targets [2] - A study from MIT found that only about 5% of AI projects successfully progress beyond the pilot stage, highlighting the challenges faced by companies in AI adoption [2] - The decline in Microsoft's stock is not solely due to lowered sales targets but also reflects growing concerns about the AI narrative and a reassessment of Microsoft's high valuation [2] - Other companies in the software sector, such as Salesforce and ServiceNow, are offering significant discounts on their AI products to attract customers, indicating ongoing challenges in scaling AI applications [1][2]

奥特曼和纳德拉,艰难重组后首次对谈:「我们是天作之合」

3 6 Ke· 2025-11-03 00:23

Group 1 - The core of the article revolves around the significant partnership between Microsoft and OpenAI, which aims to reshape the future of AI through a newly established agreement [3][8][60] - The partnership began in 2019 when Microsoft invested $1 billion in OpenAI, providing essential funding and cloud computing resources to support AI model training [5][7] - The recent agreement marks a new phase in their relationship, with OpenAI restructuring to create a Public Benefit Corporation (PBC) under its non-profit foundation, allowing for both profit and public good [8][10] Group 2 - OpenAI's foundation now holds shares valued at $130 billion, making it one of the largest charitable foundations globally, with plans to invest $25 billion in healthcare and AI safety [10][12] - Microsoft holds approximately 32.5% of OpenAI's shares, valued at around $135 billion, binding the fates of both companies together [15][16] - The partnership has evolved into one of the most successful collaborations in the industry, with both leaders expressing optimism about the future value of OpenAI [17][18] Group 3 - The new agreement includes exclusive deployment of OpenAI's advanced AI models on Microsoft's Azure cloud platform for the next seven years, making Azure a central hub for AI development [19][20] - Microsoft reported a 27% year-over-year revenue increase in its intelligent cloud segment, driven by Azure's growth, particularly in AI-related contracts [20][23] - OpenAI has committed to a $250 billion pre-purchase contract for Azure resources, ensuring ample computing power for its AI model training [20][22] Group 4 - Both companies face challenges related to computing power shortages, which have limited OpenAI's ability to onboard new users and expand its models [24][26] - Microsoft has significantly increased its capital expenditures to build data centers and acquire AI chips, yet still struggles to meet the soaring demand for computing resources [26][27] - The leaders predict that AI computing power will remain tight for the next few years, despite potential future advancements in technology [28][29] Group 5 - The partnership is also driving a transformation in software paradigms, with AI changing how users interact with applications, moving from traditional interfaces to conversational agents [33][34] - Microsoft is integrating AI capabilities into its Office products, enhancing their value and user engagement, while also exploring new business models for AI assistants [36][39] - The collaboration is expected to boost productivity and economic growth, with predictions of a potential return to 4% annual growth in the U.S. economy due to AI advancements [52][53] Group 6 - The partnership between Microsoft and OpenAI is not just about profit but also focuses on ensuring that AI benefits humanity as a whole [64][65] - Both companies are actively involved in shaping regulations and standards for AI to promote safe and responsible development [62][64] - The collaboration exemplifies a blend of idealism and pragmatism, aiming to harness technological innovation for the greater good [64]

巨额AI投资何时见回报?三大科技巨头考验投资者耐心

Zhi Tong Cai Jing· 2025-10-30 03:49

Core Insights - Major tech companies are heavily investing in AI-driven data centers, with a combined capital expenditure of approximately $78 billion, a year-on-year increase of 89% [1] - Concerns are rising among investors regarding the sustainability and potential bubble of the AI investment trend, especially after Meta and Microsoft's recent financial disclosures [1][2] - Microsoft reported record capital expenditures of $34.9 billion for the quarter ending in September, emphasizing the ongoing demand for AI services [1][2] Group 1: Company Performance - Microsoft's Azure cloud computing division continues to grow rapidly, but its growth rate has stabilized compared to the previous quarter [2] - Alphabet's Google reported a significant increase in its Gemini AI assistant's active users, reaching 650 million, a 44% increase over three months [2] - Google's cloud revenue grew by 34% to $15.2 billion, exceeding market expectations, while the company anticipates capital expenditures to reach up to $93 billion this year [2] Group 2: Investment Risks and Strategies - Meta's investment strategy is riskier as it does not serve external clients like Microsoft and Google, which can sell excess computing capacity [3] - Meta's CEO Mark Zuckerberg indicated that if the company over-invests in infrastructure, it could sell computing power to others as a fallback option [3] - Meta's Reality Labs division reported a loss of $4.4 billion in Q3, raising concerns about its investment in AI and wearable technology [4]

财报前瞻 | 微软(MSFT.US)能否“云”开见日,借AI重燃股价?

智通财经网· 2025-10-27 09:33

Core Viewpoint - Microsoft is expected to report strong earnings driven by its cloud segment, particularly Azure, which is projected to show significant growth, potentially revitalizing its stock price after a period of stagnation [1][7]. Group 1: Financial Performance Expectations - Microsoft will announce its Q1 FY2026 earnings on October 29, with investors anticipating a strong performance that exceeds expectations [1]. - Analysts predict a nearly 11% profit growth for Microsoft, primarily attributed to Azure's robust performance, with revenue expected to surge over 30% year-over-year [1]. - The Intelligent Cloud segment's year-over-year growth rates are projected to be around 26.5% for Q1 FY2026, with operating margins expected to be around 40% [3][4]. Group 2: Analyst Insights - UBS analyst Karl Keirstead notes an improvement in enterprise customer sentiment and expects Azure's growth trend to accelerate, setting a target price of $650, which is 25% above the current stock price [2]. - CFRA Research analyst Angelo Zino maintains a "strong buy" rating with a target price of $620, suggesting that capital expenditure growth will slow and shift towards more profitable AI growth [4]. - Allspring LT Growth ETF manager Jack Selz believes Microsoft's recent underperformance is unjustified given its dominance in Azure and cloud computing [6]. Group 3: Valuation Analysis - Despite Microsoft's stock nearing historical highs and having risen nearly 25% year-to-date, its valuation remains reasonable with a price-to-earnings ratio of about 28 times expected earnings for the next fiscal year, consistent with its five-year average [5].

“AI+医疗”新范例!传微软(MSFT.US)与哈佛大学合作,Copilot接入权威医典数据

智通财经网· 2025-10-09 11:32

Core Insights - Microsoft is set to launch a significant update for its AI tool "Copilot" this month, marking its first collaboration with Harvard Medical School, which will provide healthcare information for the tool [1] - The updated "Copilot" aims to deliver more accurate and user-friendly healthcare information, particularly for complex conditions like diabetes, emphasizing the importance of reliable sources [1][2] - Microsoft is focusing on developing its own AI capabilities to reduce reliance on OpenAI, with plans to establish a dedicated consumer AI department and train its models independently [3][4] Group 1: Collaboration and Updates - The new version of "Copilot" will source information from Harvard Health Publishing to enhance its healthcare-related responses [1] - Microsoft will pay a fee to Harvard for the use of this information, although specific details on how the system will handle mental health queries remain undisclosed [2] - The update is part of a broader strategy to ensure users receive trustworthy health information tailored to their literacy and language needs [1][2] Group 2: AI Development and Market Position - Microsoft has reported that its AI tool's diagnostic accuracy is four times that of a team of doctors, with significantly lower costs [2] - The company is actively recruiting for its internal AI lab to compete with OpenAI, indicating a strategic shift towards building independent AI capabilities [3] - Despite the success of the "Copilot" app, which has reached 95 million downloads, it still lags behind ChatGPT, which has surpassed 1 billion downloads [3][4] Group 3: Financial and Strategic Implications - AI has become a major revenue source for Microsoft, particularly through its Azure cloud computing division, which supports AI computing tasks for various companies [4] - The collaboration with OpenAI is being redefined, with Microsoft indicating that OpenAI will continue to be a partner for cutting-edge models while it develops its own capabilities [3][4]