Labubu4.0

Search documents

——互联网传媒周报20251222-20251226:字节AI春晚合作,游戏潮玩视频消费旺季来临-20251228

Shenwan Hongyuan Securities· 2025-12-28 12:20

Investment Rating - The industry investment rating is "Overweight," indicating that the industry is expected to outperform the overall market [9]. Core Insights - ByteDance's AI collaboration for the Spring Festival is a significant milestone, with its product Doubao achieving over 100 million daily active users. The integration with Douyin's e-commerce platform is expected to enhance monetization through advertising and transaction fees [2]. - Alibaba is focusing on AI advancements, particularly in chip localization and consumer applications, while Tencent is restructuring its AI framework to accelerate the development of large models [2]. - The gaming sector is entering a peak season, with major titles expected to drive user engagement and revenue growth. Notable releases include Giant Network's "Supernatural Action Group" and Tencent's "Delta" [2]. - The collectibles market is also thriving, with Pop Mart's Labubu 4.0 set to launch, reflecting a diverse product range and successful international market expansion [2]. Summary by Sections AI and Technology - ByteDance's AI cloud partnership for the Spring Festival and Doubao's integration with e-commerce are pivotal for future growth [2]. - Alibaba's AI initiatives include the launch of new products and continued growth in cloud services [2]. - Tencent's restructuring aims to enhance its AI capabilities and product offerings [2]. Gaming Industry - The upcoming gaming season is highlighted by major releases that cater to a younger audience, which is crucial for monetization [2]. - Notable games include "Supernatural Action Group" and "Delta," which are expected to perform well during the peak season [2]. Collectibles and Entertainment - Pop Mart's Labubu 4.0 is anticipated to boost sales, supported by a diverse product lineup and international market strategies [2]. - The animation "Chinese Fantasy 2" is set to premiere exclusively on Bilibili, indicating strong collaboration in the entertainment sector [2]. Advertising and Media - Companies like Tencent, Alibaba, and Baidu are expected to benefit from AI product promotions, which will positively impact advertising firms like Focus Media [2]. - The report emphasizes the importance of adapting to AI changes in content production to maintain competitive advantages [2].

互联网传媒周报:字节AI春晚合作,游戏潮玩视频消费旺季来临-20251228

Shenwan Hongyuan Securities· 2025-12-28 10:44

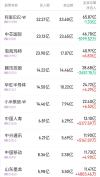

Investment Rating - The report rates the industry as "Overweight," indicating a positive outlook for the sector compared to the overall market performance [2]. Core Insights - ByteDance's AI collaboration for the Spring Festival Gala is expected to significantly enhance user engagement, with Doubao's daily active users surpassing 100 million. This milestone is anticipated to drive commercialization in AI applications in 2026, prompting major internet companies to accelerate their investments and strategies [2]. - Key companies highlighted include Tencent, Alibaba, and Baidu, with a focus on their AI product developments and market strategies. Tencent is restructuring its AI framework to enhance model development, while Alibaba is expanding its AI applications in consumer and enterprise sectors [2]. - The report emphasizes the upcoming peak consumption season in gaming and video content, with significant releases expected to drive user engagement and revenue growth [2]. Summary by Sections AI Developments - ByteDance's Doubao has achieved over 100 million daily active users, with plans for monetization through e-commerce and advertising [2]. - Tencent is reorganizing its AI departments to boost research and development, while Alibaba is focusing on AI applications in cloud services and consumer health [2]. Gaming and Entertainment - The report identifies key gaming titles for the upcoming Spring Festival, including Giant Network's "Supernatural Action Group" and Tencent's "Delta Force," which are expected to perform well during the peak season [2]. - The animation "Chinese Folktales 2" is set to premiere exclusively on Bilibili, highlighting the growing importance of video platforms in content distribution [2]. Company Valuations - The report provides a valuation table for key companies, indicating projected revenue growth and profit margins for firms like Tencent, Alibaba, and Bilibili, with Tencent's market cap at approximately 49.895 billion RMB and expected revenue growth of 14% in 2025 [4].

北水成交净买入11.71亿 泡泡玛特盘后发布盈喜 北水全天抢筹超11亿港元

Zhi Tong Cai Jing· 2025-10-22 17:11

Core Viewpoint - The Hong Kong stock market experienced significant net inflows from northbound trading, with notable buying activity in specific stocks such as Pop Mart and Xiaomi, while other stocks like Alibaba faced substantial net selling [2][6]. Group 1: Stock Performance - Pop Mart (09992) received a net inflow of HKD 11.2 billion, with a projected revenue growth of 245%-250% year-on-year for Q3 2025, driven by strong domestic and international sales [6]. - Xiaomi Group-W (01810) saw a net inflow of HKD 4.81 billion, following a share buyback of 10.7 million shares at prices between HKD 45.9 and HKD 46.76, totaling approximately HKD 4.94 billion [6]. - Semiconductor stocks, including Huahong Semiconductor (01347) and SMIC (00981), attracted net inflows of HKD 4.41 billion and HKD 1.28 billion, respectively, amid positive sentiment regarding the semiconductor industry's growth driven by AI [6]. Group 2: Company Earnings and Projections - China Mobile (00941) reported Q3 service revenue of HKD 216.2 billion, a year-on-year increase of 0.8%, with EBITDA declining by 1.7% to HKD 79.4 billion, slightly below market expectations [7]. - China Life (02628) projected a net profit of approximately HKD 156.79 billion to HKD 177.69 billion for the first three quarters, reflecting a year-on-year growth of 50% to 70% [7]. - The report indicated that the net profit for Q3 could grow by 75% to 106% year-on-year, driven by improved investment returns and optimized asset allocation [7]. Group 3: Market Sentiment and Trends - The overall market sentiment showed a divergence in fund flows, with significant net selling in stocks like Alibaba (09988) and Tencent (00700), indicating cautious investor sentiment amid global economic uncertainties [8]. - The report highlighted that the current market volatility is influenced more by emotional factors rather than fundamental reversals, suggesting a need for careful timing in investment strategies [7].

北水动向|北水成交净买入11.71亿 泡泡玛特盘后发布盈喜 北水全天抢筹超11亿港元

Zhi Tong Cai Jing· 2025-10-21 10:02

Core Insights - The Hong Kong stock market saw a net inflow of 11.71 billion HKD from northbound trading on October 21, with a net buy of 25.24 billion HKD from the Shanghai Stock Connect and a net sell of 13.53 billion HKD from the Shenzhen Stock Connect [1] Group 1: Stock Performance - The most bought stocks included Pop Mart (09992), Xiaomi Group-W (01810), and Hua Hong Semiconductor (01347) [1] - The most sold stocks included the Tracker Fund of Hong Kong (02800), Alibaba Group-W (09988), and Innovent Biologics (01801) [1] Group 2: Individual Stock Details - Pop Mart (09992) received a net buy of 11.2 billion HKD, with projected revenue growth of 245%-250% year-on-year for Q3 2025 [4] - Xiaomi Group-W (01810) had a net buy of 4.81 billion HKD, with the company repurchasing 10.7 million shares at prices between 45.9 and 46.76 HKD [5] - Hua Hong Semiconductor (01347) saw a net buy of 4.29 billion HKD, supported by positive sentiment around the semiconductor sector driven by AI [5] - China Mobile (00941) received a net buy of 1.77 billion HKD, reporting Q3 service revenue of 216.2 billion HKD, a 0.8% year-on-year increase [5] - China Life (02628) had a net buy of 517.7 million HKD, with expected net profit growth of 50% to 70% year-on-year for the first three quarters [6] Group 3: Market Sentiment - The Tracker Fund of Hong Kong (02800) experienced a net sell of 11.02 billion HKD, attributed to increased market volatility and high valuations of global risk assets [6] - Tencent (00700), Innovent Biologics (01801), and Alibaba Group-W (09988) faced net sells of 318.7 million, 776.4 million, and 4.29 billion HKD respectively [7]

北水动向|北水成交净买入11.71亿 泡泡玛特(09992)盘后发布盈喜 北水全天抢筹超11亿港元

智通财经网· 2025-10-21 09:59

智通财经APP获悉,10月21日港股市场,北水成交净买入11.71港元,其中港股通(沪)成交净买入25.24亿港元,港股通(深)成 交净卖出13.53亿港元。 港股通(深)活跃成交股 泡泡玛特(09992)获净买入11.2亿港元。消息面上,今日盘后,泡泡玛特发布三季度最新业务状况公告,2025年第三季度整体 收益同比增长245%-250%。其中,中国收益同比增长185%-190%,海外收益同比增长365%-370%。小摩预计,泡泡玛特未来 催化剂包括:圣诞强劲销售,"Labubu&Friends"动画预期在12月发布,Labubu4.0料在明年3至4月出炉。 小米集团-W(01810)获净买入4.81亿港元。消息面上,小米集团披露,10月17日,公司回购1070万股,每股作价45.9港元至 46.76港元,涉及总额约4.94亿港元。今年以来该股累计进行12次回购,合计回购3412.52万股,累计回购金额15.37亿港元。 内资重新加仓芯片股,华虹半导体(01347)、中芯国际(00981)分别获净买入4.41亿、1.28亿港元。消息面上,华金证券表示, 持续看好人工智能推动半导体超级周期,建议关注半导体全产业 ...

小摩:升泡泡玛特评级至“增持” 目标价上调至320港元

Zhi Tong Cai Jing· 2025-10-16 03:35

Core Viewpoint - Morgan Stanley has upgraded Pop Mart (09992) investment rating to "Overweight" and raised the target price from HKD 300 to HKD 320, following a 5% to 7% increase in earnings estimates for 2025 to 2027 [1] Financial Performance - The bank forecasts that Pop Mart's sales and adjusted profit will increase by 165% and 276% year-on-year, respectively, for this year [1] - For the next year, sales and adjusted profit are expected to rise by 28% and 29% year-on-year, respectively [1] Valuation and Market Outlook - The company is currently trading at a forecasted price-to-earnings ratio of 20 times for the next year, which is considered attractive [1] - Future catalysts for growth include: 1. Third-quarter operational data to be released at the end of October [1] 2. Strong sales expected during Halloween and Christmas [1] 3. Anticipated release of the "Labubu & Friends" animation in December [1] 4. Expected launch of Labubu 4.0 in March to April next year [1]