ZTE(00763)

Search documents

欧陆通:公司已陆续为浪潮信息等国内知名服务器系统厂商出货

Zheng Quan Ri Bao· 2025-10-21 13:10

Core Viewpoint - The company has established strong partnerships with leading domestic server manufacturers and internet enterprises, enhancing its reputation in the data center business [2] Group 1: Business Partnerships - The company has delivered products to well-known domestic server system manufacturers such as Inspur, Foxconn, Huawei, Lenovo, ZTE, and H3C [2] - The company maintains close cooperation with top domestic internet enterprises, which has led to high recognition from clients [2]

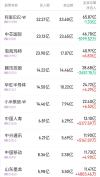

智通港股通活跃成交|10月21日

智通财经网· 2025-10-21 11:03

Group 1 - On October 21, 2025, Alibaba-W (09988), SMIC (00981), and Pop Mart (09992) ranked as the top three companies by trading volume in the Southbound Stock Connect, with transaction amounts of 6.587 billion, 4.678 billion, and 4.097 billion respectively [1] - In the Southbound Stock Connect for the Shenzhen-Hong Kong Stock Connect, Alibaba-W (09988), SMIC (00981), and Pop Mart (09992) also held the top three positions, with transaction amounts of 3.743 billion, 3.127 billion, and 1.800 billion respectively [1] Group 2 - In the Southbound Stock Connect, the top active trading companies included Alibaba-W (09988) with a transaction amount of 6.587 billion and a net buy of -0.133 billion, SMIC (00981) with 4.678 billion and a net buy of -51.9952 million, and Pop Mart (09992) with 4.097 billion and a net buy of +683 million [2] - For the Shenzhen-Hong Kong Stock Connect, the top active trading companies were Alibaba-W (09988) with a transaction amount of 3.743 billion and a net buy of -0.296 billion, SMIC (00981) with 3.127 billion and a net buy of +180 million, and Pop Mart (09992) with 1.800 billion and a net buy of +438 million [2]

北水动向|北水成交净买入11.71亿 泡泡玛特盘后发布盈喜 北水全天抢筹超11亿港元

Zhi Tong Cai Jing· 2025-10-21 10:02

Core Insights - The Hong Kong stock market saw a net inflow of 11.71 billion HKD from northbound trading on October 21, with a net buy of 25.24 billion HKD from the Shanghai Stock Connect and a net sell of 13.53 billion HKD from the Shenzhen Stock Connect [1] Group 1: Stock Performance - The most bought stocks included Pop Mart (09992), Xiaomi Group-W (01810), and Hua Hong Semiconductor (01347) [1] - The most sold stocks included the Tracker Fund of Hong Kong (02800), Alibaba Group-W (09988), and Innovent Biologics (01801) [1] Group 2: Individual Stock Details - Pop Mart (09992) received a net buy of 11.2 billion HKD, with projected revenue growth of 245%-250% year-on-year for Q3 2025 [4] - Xiaomi Group-W (01810) had a net buy of 4.81 billion HKD, with the company repurchasing 10.7 million shares at prices between 45.9 and 46.76 HKD [5] - Hua Hong Semiconductor (01347) saw a net buy of 4.29 billion HKD, supported by positive sentiment around the semiconductor sector driven by AI [5] - China Mobile (00941) received a net buy of 1.77 billion HKD, reporting Q3 service revenue of 216.2 billion HKD, a 0.8% year-on-year increase [5] - China Life (02628) had a net buy of 517.7 million HKD, with expected net profit growth of 50% to 70% year-on-year for the first three quarters [6] Group 3: Market Sentiment - The Tracker Fund of Hong Kong (02800) experienced a net sell of 11.02 billion HKD, attributed to increased market volatility and high valuations of global risk assets [6] - Tencent (00700), Innovent Biologics (01801), and Alibaba Group-W (09988) faced net sells of 318.7 million, 776.4 million, and 4.29 billion HKD respectively [7]

中兴通讯率先完成IMT-2020(5G)推进组5G-A关键技术通感融合测试

Xin Lang Cai Jing· 2025-10-21 05:59

Core Viewpoint - ZTE Corporation has successfully completed the key technology testing for 5G-A sensory integration, leading the way in technology innovation and commercial deployment in the 5G sector [1] Group 1: Company Achievements - ZTE Corporation is the first to complete the 5G-A key technology sensory integration test organized by the IMT-2020 (5G) Promotion Group [1] - The company has initiated over 100 commercial and pilot projects for 5G-A sensory integration across the country [1] Group 2: Technological Focus - The projects cover critical technologies such as AI sensory models and multi-modal perception integration [1] - Value scenarios include low-altitude security, low-altitude logistics, low-altitude inspection, and water area management [1]

中兴通讯完成IMT-2020推进组5G-A关键技术通感融合测试

Zheng Quan Shi Bao Wang· 2025-10-21 05:54

Core Insights - The article highlights that ZTE Corporation has successfully completed the key technology testing for 5G-A sensory fusion, becoming the first to do so under the guidelines set by the IMT-2020 (5G) Promotion Group [1] Group 1 - ZTE Corporation achieved a significant milestone by completing the 5G-A key technology sensory fusion test [1] - The testing was conducted in accordance with the "5G-A Technology Research and Development Test 5G-A Key Technology Testing Specification for Sensory Fusion (2025 Edition)" established by the 5G Promotion Group [1]

中国人寿近一个月首次上榜港股通成交活跃榜

Zheng Quan Shi Bao Wang· 2025-10-20 14:41

Core Viewpoint - On October 20, China Life made its first appearance on the Hong Kong Stock Connect active trading list in nearly a month, with a trading volume of 10.41 billion HKD and a net buying amount of 1.37 billion HKD, closing up 2.44% [1] Trading Activity Summary - The total trading volume of active stocks on the Hong Kong Stock Connect on October 20 was 369.37 billion HKD, accounting for 33.62% of the day's total trading amount, with a net selling amount of 21.97 billion HKD [1] - Alibaba-W led the trading volume with 96.98 billion HKD, followed by SMIC and Tencent Holdings with trading amounts of 53.97 billion HKD and 44.91 billion HKD, respectively [1] Frequent Trading Stocks - The stocks that appeared most frequently on the active trading list over the past month were Alibaba-W and Huahong Semiconductor, each appearing 15 times, indicating strong interest from Hong Kong Stock Connect funds [1] - China Life's recent appearance marks its first in nearly a month, highlighting a potential shift in investor interest [1] Individual Stock Performance - Tencent Holdings had a trading amount of 44.91 billion HKD with a net buying amount of 0.97 billion HKD, closing up 3.21% [1] - SMIC recorded a trading amount of 53.97 billion HKD with a net selling amount of 3.25 billion HKD, closing up 3.91% [1] - Alibaba-W had a significant trading amount of 96.98 billion HKD but faced a net selling amount of 17.54 billion HKD, closing up 4.86% [1] - China Life's trading amount was 10.41 billion HKD with a net buying amount of 1.37 billion HKD, closing at 23.520 HKD, up 2.44% [1]

10月20日南向资金净卖出26.70亿港元

Zheng Quan Shi Bao Wang· 2025-10-20 14:32

Group 1 - The Hang Seng Index rose by 2.42% to close at 25,858.83 points on October 20, with a total net sell of 2.67 billion HKD through the southbound trading channel [1] - The total trading volume for the southbound trading on October 20 was 109.87 billion HKD, with a net sell of 2.67 billion HKD [1] - The Shanghai Stock Exchange's southbound trading had a total trading volume of 66.81 billion HKD, resulting in a net sell of 2.29 billion HKD, while the Shenzhen Stock Exchange's southbound trading had a volume of 43.05 billion HKD with a net sell of 0.38 billion HKD [1] Group 2 - In the top ten active stocks for the Shanghai Stock Exchange's southbound trading, Alibaba-W had the highest trading volume at 5.79 billion HKD, followed by SMIC and Tencent Holdings with trading volumes of 3.23 billion HKD and 2.93 billion HKD respectively [2] - In terms of net buying, China National Offshore Oil Corporation had the highest net buy amount of 0.146 billion HKD, with its stock price increasing by 2.31% [2] - Alibaba-W recorded the highest net sell amount of 1.205 billion HKD, while its stock price still rose by 4.86% [2]

中兴通讯上周获融资资金买入近140亿元丨资金流向周报

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-20 02:44

Market Overview - The Shanghai Composite Index fell by 1.47% to 3839.76 points, with a weekly high of 3931.05 points [1] - The Shenzhen Component Index decreased by 4.99% to 12688.94 points, reaching a high of 13405.51 points [1] - The ChiNext Index dropped by 5.71% to 2935.37 points, with a peak of 3124.83 points [1] - In global markets, the Nasdaq Composite rose by 2.14%, the Dow Jones Industrial Average increased by 1.56%, and the S&P 500 gained 1.7% [1] - In the Asia-Pacific region, the Hang Seng Index fell by 3.97%, and the Nikkei 225 decreased by 1.05% [1] New Stock Issuance - Six new stocks were issued last week, with details provided in the table [2] Margin Trading Situation - The total margin trading balance in the Shanghai and Shenzhen markets was 24219.32 billion, with a financing balance of 24053.82 billion and a securities lending balance of 165.5 billion [3] - The margin trading balance decreased by 123.71 billion compared to the previous week [3] - The Shanghai market's margin trading balance was 12355.0 billion, down by 62.59 billion, while the Shenzhen market's balance was 11864.32 billion, down by 61.12 billion [3] - A total of 3450 stocks had financing funds buying in, with 210 stocks having buy amounts exceeding 1 billion [3] Top Margin Buying Stocks - The top three stocks by margin buying amount were: - ZTE Corporation: 138.43 billion [4] - Sungrow Power Supply: 134.01 billion [4] - Zhongji Xuchuang: 111.15 billion [4] Fund Issuance - Two new funds were issued last week, with details provided in the table [5] Share Buyback Announcements - There were 25 new share buyback announcements last week, with the top five by execution amount listed [6] - The highest execution amounts were in the electronic, pharmaceutical, and machinery equipment sectors [6]

智通港股通占比异动统计|10月20日

Zhi Tong Cai Jing· 2025-10-20 01:07

Core Insights - The report highlights the changes in the Hong Kong Stock Connect holdings, indicating significant increases and decreases in ownership percentages for various companies [1][2]. Group 1: Increased Holdings - The companies with the largest increases in Hong Kong Stock Connect holdings include: - Ying En Bio-B (09606) with an increase of 3.48%, bringing the total holding to 12.00% [1] - Sanhua Intelligent Control (02050) with an increase of 1.68%, totaling 13.67% [1] - Anjoy Foods (02648) with an increase of 0.74%, totaling 25.90% [1] - In the last five trading days, the top three companies with the largest increases in holdings are: - Jinli Permanent Magnet (06680) with an increase of 8.03%, totaling 30.03% [2] - Ying En Bio-B (09606) with an increase of 4.60%, totaling 12.00% [2] - ZTE Corporation (00763) with an increase of 3.55%, totaling 55.04% [2] Group 2: Decreased Holdings - The companies with the largest decreases in Hong Kong Stock Connect holdings include: - Hang Seng China Enterprises (02828) with a decrease of 10.52%, bringing the total holding to 0.96% [1] - Tracker Fund of Hong Kong (02800) with a decrease of 5.76%, totaling 0.93% [1] - Longi Green Energy (06869) with a decrease of 2.05%, totaling 63.46% [1] - In the last five trading days, the top three companies with the largest decreases in holdings are: - Longi Green Energy (06869) with a decrease of 5.78%, totaling 63.46% [2] - Jihong Co., Ltd. (02603) with a decrease of 2.74%, totaling 34.06% [2] - Chongqing Steel (01053) with a decrease of 2.18%, totaling 27.24% [2] Group 3: Long-term Trends - Over the last 20 days, the companies with the largest increases in holdings include: - Dazhong Public Utilities (01635) with an increase of 33.41%, totaling 66.40% [2] - Canggang Railway (02169) with an increase of 31.40%, totaling 43.06% [2] - Shankou Holdings (00412) with an increase of 15.66%, totaling 17.10% [2] - The companies with the largest decreases in holdings over the last 20 days include: - Hang Seng China Enterprises (02828) with a decrease of 5.89%, bringing the total holding to 0.96% [4] - Baiguoyuan Group (02411) with a decrease of 4.60%, totaling 6.81% [4] - Huizhong Network (09878) with a decrease of 4.11%, totaling 21.70% [4]

品牌工程指数 上周收报1956.62点

Zhong Guo Zheng Quan Bao· 2025-10-19 22:33

Core Viewpoint - The market experienced a correction last week, but certain stocks within the brand index showed resilience, indicating potential investment opportunities in sectors like electronics, new energy, new consumption, and real estate as uncertainties ease [1][4]. Market Performance - The market indices saw declines: Shanghai Composite Index down 1.47%, Shenzhen Component down 4.99%, ChiNext down 5.71%, and CSI 300 down 2.22%. The brand index fell 3.58% to 1956.62 points [2]. - Notable gainers in the brand index included Shanghai Jahwa up 9.42%, Changbai Mountain up 7.19%, and Darentang up 5.34%. Other stocks like Luzhou Laojiao and Yiling Pharmaceutical also saw gains exceeding 4% [2]. Stock Performance Since H2 - Since the beginning of the second half of the year, Zhongji Xuchuang has surged 156.40%, leading the gains, followed by Sunshine Power at 114.27%. Other significant performers include Lanke Technology and Yiwei Lithium Energy, both up over 60% [3]. Market Outlook - Looking ahead, the market is expected to maintain upward momentum as uncertainties gradually diminish. Liquidity is anticipated to remain supportive, with domestic interest rates low and overseas liquidity remaining loose, encouraging investment in Chinese equity assets [4][5]. - The current market environment is characterized by a shift in investment styles, with a focus on sectors that offer higher investment certainty, particularly in electronics, new energy, new consumption, and real estate [5].