CHINA LONGYUAN(00916)

Search documents

龙源电力(00916)完成发行25亿元超短期融资券

智通财经网· 2025-10-27 15:16

龙源电力(00916)发布公告,公司已于2025年10月24日完成公司超短期融资券发行。本超短期融资券发 行总额为人民币25亿元,期限为179天,单位面值为人民币100元,票面利率为1.67%。利息自2025年10 月27日起开始计算。 本超短期融资券由中国光大银行股份有限公司作为主承销商公开发售。本超短期融资券所募集资金拟用 于置换存量有息债务及补充流动资金。 ...

龙源电力(00916.HK)发布公告,公司已于2025年10月24日完成公司超短期融资券发行

Sou Hu Cai Jing· 2025-10-27 15:05

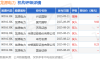

Core Insights - Longyuan Power (00916.HK) has completed the issuance of super short-term financing bonds totaling RMB 2.5 billion with a maturity of 179 days and a coupon rate of 1.67% [1] - The stock closed at HKD 7.57, up 1.34%, with a trading volume of 38.93 million shares and a turnover of HKD 292 million [1] - The stock has received a majority of "Buy" ratings from investment banks, with a target average price of HKD 8.91 over the past 90 days [1] Company Performance - Longyuan Power's market capitalization is HKD 24.785 billion, ranking 7th in the power industry [2] - Key financial metrics include: - Return on Equity (ROE): 8.08%, significantly higher than the industry average of -0.34% [2] - Revenue: RMB 28.143 billion, slightly below the industry average of RMB 29.112 billion [2] - Net Profit Margin: 26.66%, above the industry average of 24.43% [2] - Debt Ratio: 67.27%, higher than the industry average of 61.73% [2]

龙源电力(00916.HK)完成发行25亿元超短期融资券

Ge Long Hui· 2025-10-27 15:04

格隆汇10月27日丨龙源电力(00916.HK)公告,公司已于2025年10月24日完成公司超短期融资券发行。本 超短期融资券发行总额为人民币25亿元,期限为179天,单位面值为人民币100元,票面利率为1.67%。 利息自2025年10月27日起开始计算。 ...

龙源电力完成发行25亿元超短期融资券

Zhi Tong Cai Jing· 2025-10-27 15:02

Core Viewpoint - Longyuan Power (001289)(00916) has successfully completed the issuance of super short-term financing bonds totaling RMB 2.5 billion, with a maturity of 179 days and an interest rate of 1.67% [1] Group 1: Financing Details - The total amount of the super short-term financing bonds issued is RMB 2.5 billion [1] - The bonds have a maturity period of 179 days, with a face value of RMB 100 each [1] - The interest on the bonds will start accruing from October 27, 2025 [1] Group 2: Use of Proceeds - The funds raised from the bond issuance are intended for replacing existing interest-bearing debt and supplementing working capital [1] Group 3: Underwriting Information - China Everbright Bank Co., Ltd. acted as the lead underwriter for the public offering of the super short-term financing bonds [1]

龙源电力(00916) - 公告 - 完成发行超短期融资券

2025-10-27 14:55

公 告 完成發行超短期融資券 本 公 告 乃 由 龍 源 電 力 集 團 股 份 有 限 公 司(「本公司」)根 據《香 港 聯 合 交 易 所 有 限 公 司 證 券 上 市 規 則》第13.09條及香港法例第571章《證 券 及 期 貨 條 例》 第XIVA部 項 下 內 幕 消 息 條 文 作 出。 茲提述本公司日期為2025年6月17日關於本公司股東批准發行債務融資 工具的本公司2024年 度 股 東 大 會 投 票 結 果 的 公 告。 本公司已於2025年10月24日 完 成 本 公 司 超 短 期 融 資 券(「本超短期融資券」) 發 行。本 超 短 期 融 資 券 發 行 總 額 為 人 民 幣25億 元,期 限 為179天,單 位 面 值為人民幣100元,票面利率為1.67%。利息自2025年10月27日起開始計算。 香港交易及結算所有限公司及香港聯合交易所有限公司對本公告之內 容 概 不 負 責,對 其 準 確 性 或 完 整 性 亦 不 發 表 任 何 聲 明,並 明 確 表 示,概 不就因本公告全部或任何部分內容而產生或因倚賴該等內容而引致之 任 何 損 失 承 擔 任 何 責 任。 ...

龙源电力(001289) - 龙源电力集团股份有限公司关于公司2025年第七期超短期融资券发行的公告

2025-10-27 11:32

证券代码:001289 证券简称:龙源电力 公告编号:2025-058 龙源电力集团股份有限公司 关于公司 2025 年第七期超短期融资券发行的公告 公司已于 2025 年 10 月 24 日发行了 2025 年度第七期超短期融资券,所募集 资金拟用于置换存量有息债务及补充流动资金。相关发行情况如下: | 超短期融资券全称 | 龙源电力集团股份有限公司 | | 2025 | | 年度第七期超短期融资券 | | | | | | --- | --- | --- | --- | --- | --- | --- | --- | --- | --- | | 主承销商 | 中国光大银行股份有限公司 | | | | | | | | | | 超短期融资券简称 | 龙源电力 25 | SCP007 | 期限 | 天 179 | | | | | | | 超短期融资券代码 | 012582597 | | 发行日 | 2025 | 年 10 | 月 | 日 | 24 | | | 起息日 | 2025 年 10 月 | 27 日 | 兑付日 | 2026 | 年 4 | 月 | 日 | | 24 | | 计划发行总额 | 25 亿元人 ...

加快建设新型能源体系,2025M1-9用电量同增4.6%

Soochow Securities· 2025-10-27 09:57

Investment Rating - The report maintains an "Overweight" rating for the utility sector [1] Core Insights - The construction of a new energy system is accelerating, with a focus on achieving carbon peak and promoting a green lifestyle [4] - In the first nine months of 2025, total electricity consumption increased by 4.6% year-on-year, totaling 77,675 billion kWh [4] - The electricity spot market is rapidly starting continuous settlement trials, with several provinces transitioning to formal operations [4] Summary by Sections 1. Industry Overview - The report highlights the importance of accelerating the construction of a new energy system as outlined in the recent Communist Party meeting [4] 2. Electricity Consumption - Total electricity consumption for January to September 2025 reached 77,675 billion kWh, reflecting a year-on-year growth of 4.6% [15] - Breakdown of consumption growth: - Primary industry: +10.2% - Secondary industry: +3.4% - Tertiary industry: +7.5% - Urban and rural residential consumption: +5.6% [4][15] 3. Power Generation - Cumulative power generation for January to September 2025 was 72,600 billion kWh, with a year-on-year increase of 1.6% [22] - Specific generation changes: - Thermal power: -1.2% - Hydropower: -1.1% - Nuclear power: +9.2% - Wind power: +10.1% - Solar power: +24.2% [22] 4. Electricity Prices - The average electricity purchase price in June 2025 was 389 RMB/MWh, down 1% year-on-year and 1.3% month-on-month [38] 5. Coal Prices - As of October 24, 2025, the price of thermal coal at Qinhuangdao port was 770 RMB/ton, up 9.07% year-on-year and increased by 22 RMB/ton week-on-week [45] 6. Hydropower Conditions - As of October 24, 2025, the water level at the Three Gorges Reservoir was 175 meters, with inflow and outflow rates increasing by 92% and 70% year-on-year, respectively [54] 7. Investment Recommendations - Focus on investment opportunities in hydropower and thermal power during peak summer demand [4] - Recommended companies include: - Thermal Power: JianTou Energy, Huadian International, Huaneng International, Guodian Power, Sheneng Shares, and Waneng Power [4] - Hydropower: Yangtze Power [4] - Nuclear Power: China National Nuclear Power and China General Nuclear Power [4] - Green Energy: Longi Green Energy and others [4]

龙源电力涨1.44%,成交额1.02亿元,近3日主力净流入687.86万

Xin Lang Cai Jing· 2025-10-27 07:34

Core Viewpoint - Longyuan Power Group Co., Ltd. is actively expanding its renewable energy projects, particularly in wind and solar power, and has signed a significant cooperation agreement for a large-scale pumped storage project in Heilongjiang Province [2][9]. Company Overview - Longyuan Power primarily engages in wind and solar power generation, with its main products being electricity and heat [2]. - The company is involved in the design, development, construction, management, and operation of wind farms [4]. - As of June 30, 2025, Longyuan Power reported a revenue of 15.657 billion yuan, a year-on-year decrease of 17.09%, and a net profit of 3.375 billion yuan, down 11.82% year-on-year [9]. Recent Developments - Longyuan Power signed a framework agreement with the People's Government of Tieli City, Heilongjiang Province, to develop a 3.53 million kilowatt renewable energy project, including a 3 million kilowatt pumped storage project [2]. - The company has an operational wind power capacity of 1.5908 million kilowatts in Xinjiang [3]. Financial Performance - The company has distributed a total of 5.978 billion yuan in dividends since its A-share listing, with 4.746 billion yuan distributed over the past three years [10]. - As of June 30, 2025, the number of shareholders increased to 41,000, reflecting a growth of 1.18% [9]. Market Activity - On October 27, Longyuan Power's stock rose by 1.44%, with a trading volume of 102 million yuan and a turnover rate of 0.12%, bringing the total market capitalization to 147.133 billion yuan [1]. - The stock's average trading cost is 16.71 yuan, with the current price approaching a resistance level of 17.92 yuan, indicating potential for upward movement if the resistance is broken [7].

龙源电力涨2.02%,成交额5866.86万元,主力资金净流入213.35万元

Xin Lang Cai Jing· 2025-10-27 02:50

Core Viewpoint - Longyuan Power has shown a mixed performance in stock price and financial metrics, with a notable increase in stock price year-to-date but a decline in revenue and net profit for the first half of 2025 [1][3]. Stock Performance - As of October 27, Longyuan Power's stock price increased by 2.02%, reaching 17.70 CNY per share, with a total market capitalization of 147.969 billion CNY [1]. - Year-to-date, the stock price has risen by 14.33%, while it has decreased by 0.73% over the last five trading days [1]. Financial Metrics - For the first half of 2025, Longyuan Power reported a revenue of 15.657 billion CNY, a year-on-year decrease of 17.09%, and a net profit attributable to shareholders of 3.375 billion CNY, down 11.82% year-on-year [3]. - Cumulative cash dividends since the A-share listing amount to 5.978 billion CNY, with 4.746 billion CNY distributed over the last three years [4]. Shareholder Information - As of June 30, 2025, Longyuan Power had 41,000 shareholders, an increase of 1.18% from the previous period [3]. - The top ten circulating shareholders include significant institutional investors, with notable increases in holdings from several ETFs [4]. Company Overview - Longyuan Power, established on January 27, 1993, and listed on January 24, 2022, is primarily engaged in power system and electrical equipment technology services, new energy development, and project management [2]. - The company's main revenue source is from power products, accounting for 99.22% of total revenue, with the remaining 0.78% from other sources [2].

申万公用环保周报:第二产业用电回暖,冷冬预期有望提升销气增速-20251026

Shenwan Hongyuan Securities· 2025-10-26 13:13

Investment Rating - The report maintains a positive outlook on the power and gas sectors, indicating a "Buy" recommendation for several companies within these industries [3][4]. Core Insights - The second industry is the main driver of electricity consumption growth, with a notable increase in electricity demand due to seasonal factors and high temperatures in Q3 [4][9]. - Global gas prices are rebounding, and expectations of a cold winter may enhance gas sales growth [18][19]. - The report highlights various investment opportunities across different energy sectors, including hydropower, green energy, nuclear power, thermal power, and gas [16][40]. Summary by Sections 1. Electricity: Q3 Second Industry Drives National Electricity Consumption - In September, total electricity consumption reached 888.6 billion kWh, a year-on-year increase of 4.5% [10]. - The second industry contributed significantly to this growth, with a 5.1% increase in electricity consumption, accounting for 51% of the total growth [4][9]. - The cumulative electricity consumption from January to September was 7767.5 billion kWh, reflecting a 4.6% year-on-year growth [13]. 2. Gas: Global Gas Price Rebound and Cold Winter Expectations - As of October 24, the Henry Hub spot price was $3.21/mmBtu, showing a weekly increase of 13.96% [19][20]. - The report notes a seasonal demand increase and geopolitical factors supporting gas prices, particularly in Europe [25][37]. - The anticipated La Niña phenomenon may lead to colder winter conditions, potentially boosting gas consumption [37]. 3. Weekly Market Review - The report indicates that the power equipment sector outperformed the Shanghai and Shenzhen 300 index, while the public utility, gas, and environmental protection sectors lagged [42]. 4. Company and Industry Dynamics - The report discusses significant developments in the energy sector, including the launch of innovative products in wind energy and updates on national energy policies [50][51]. - It highlights the performance of major companies, such as Huadian International, which reported a decrease in electricity generation due to increased renewable energy capacity [57].