HUA HONG SEMI(01347)

Search documents

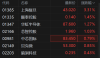

港股通10月28日成交活跃股名单

Zheng Quan Shi Bao Wang· 2025-10-28 15:56

Market Overview - On October 28, the Hang Seng Index fell by 0.33% with a total southbound trading volume of HKD 1,046.44 billion, comprising HKD 534.51 billion in buy transactions and HKD 511.93 billion in sell transactions, resulting in a net buy of HKD 22.58 billion [1] Southbound Trading Activity - The southbound trading through Stock Connect (Shenzhen) recorded a total trading volume of HKD 390.98 billion, with buy transactions at HKD 197.72 billion and sell transactions at HKD 193.26 billion, leading to a net buy of HKD 4.46 billion [1] - The southbound trading through Stock Connect (Shanghai) had a total trading volume of HKD 655.45 billion, with buy transactions at HKD 336.79 billion and sell transactions at HKD 318.67 billion, resulting in a net buy of HKD 18.12 billion [1] Active Stocks - The most actively traded stock by southbound funds was SMIC, with a total trading volume of HKD 88.06 billion, followed by Alibaba-W at HKD 76.62 billion and Xiaomi Group-W at HKD 44.38 billion [1] - In terms of net buying, China Mobile led with a net buy of HKD 5.13 billion, closing up by 0.41%, followed by Huahong Semiconductor with a net buy of HKD 3.96 billion and Pop Mart with HKD 3.23 billion [1] - The stock with the highest net sell was Alibaba-W, with a net sell of HKD 5.23 billion, closing down by 1.50%, followed by Tencent Holdings and Li Auto-W with net sells of HKD 3.56 billion and HKD 2.92 billion respectively [1] Continuous Net Buying - Two stocks, SMIC and Huahong Semiconductor, experienced continuous net buying for more than three days, with SMIC having a net buy of HKD 30.18 billion over six days and Huahong Semiconductor with HKD 14.52 billion over three days [2]

图解丨南下资金连续6日净买入中芯国际,共计30亿港元

Ge Long Hui A P P· 2025-10-28 10:12

Group 1 - Southbound funds net bought Hong Kong stocks worth 2.258 billion HKD today [1] - The top net purchases included China Mobile at 512 million HKD, Hua Hong Semiconductor at 396 million HKD, Pop Mart at 322 million HKD, Meituan-W at 166 million HKD, and Sanhua Intelligent Control at 114 million HKD [1] - The top net sales included Alibaba-W at 522 million HKD, Tencent Holdings at 356 million HKD, and Li Auto-W at 292 million HKD [1] Group 2 - Southbound funds have net bought SMIC for six consecutive days, totaling 3.01773 billion HKD [1]

芯片硬科技港股成南向资金净流入首选!千亿ETF大厂热推首只港股信息科技ETF(159131)火线首发

Sou Hu Cai Jing· 2025-10-28 04:28

Group 1 - The Hang Seng Index rose by 1.05% on October 27, driven by significant breakthroughs in China's technology industry, with southbound funds net buying HK stocks worth HKD 2.873 billion on the same day [1] - The top net bought stocks included SMIC and Hua Hong Semiconductor, with net purchases of HKD 1.143 billion and HKD 0.986 billion, respectively, ranking first and third among the top ten stocks [1] - The launch of the first information technology ETF in the Hong Kong market, tracking the CSI Hong Kong Stock Connect Information Technology Composite Index, is expected to attract significant market attention due to its focus on leading stocks like SMIC and Hua Hong Semiconductor [1] Group 2 - The 20th Central Committee's Fourth Plenary Session emphasized "high-quality development" and "enhancing independent innovation capabilities," positioning these as primary goals in the latest 14th Five-Year Plan [2] - The 2025 Bay Area Semiconductor Industry Ecosystem Expo showcased nearly 2,000 new products from leading Chinese hard technology companies, indicating significant progress in domestic chip technology and core technology sectors [2] Group 3 - The CSI Hong Kong Stock Connect Information Technology Composite Index, which the new ETF tracks, consists of 41 hard technology companies, with a composition of 70% hardware and 30% software, focusing on semiconductors, electronics, and computer software [3] - The index excludes larger internet companies, enhancing its focus on capturing the AI hard technology market trends [3] - As of September 30, 2025, the index's top-weighted stocks include SMIC (19.41%), Xiaomi Group (10.28%), and Hua Hong Semiconductor (5.11%), with the top five stocks accounting for 51% of the index [5]

芯片股延续近期涨势 上海复旦(01385.HK)涨超4%

Mei Ri Jing Ji Xin Wen· 2025-10-28 04:11

Core Viewpoint - The semiconductor stocks continue their recent upward trend, with notable increases in share prices for several companies in the sector [1] Group 1: Company Performance - Shanghai Fudan (01385.HK) increased by 4.71%, reaching HKD 43.6 [1] - Huahong Semiconductor (01347.HK) rose by 3.12%, trading at HKD 89.2 [1] - Hongguang Semiconductor (06908.HK) saw a gain of 1.92%, priced at HKD 0.53 [1] - SMIC (00981.HK) experienced a 1.75% increase, with shares at HKD 84.25 [1]

芯片股延续近期涨势 上海复旦涨超4% 华虹半导体涨超3%

Zhi Tong Cai Jing· 2025-10-28 04:00

Core Viewpoint - The semiconductor stocks continue to rise, driven by the rapid appreciation of domestic technology assets, particularly in AI computing power, indicating a significant shift towards domestic AI chip production and a fully integrated domestic AI industry chain [1] Group 1: Stock Performance - Shanghai Fudan (01385) increased by 4.71%, reaching HKD 43.6 - Huahong Semiconductor (01347) rose by 3.12%, reaching HKD 89.2 - Hongguang Semiconductor (06908) gained 1.92%, reaching HKD 0.53 - SMIC (00981) increased by 1.75%, reaching HKD 84.25 [1] Group 2: Industry Insights - Huaxin Securities highlights the rapid value increase of domestic technology assets, especially in AI computing power, which is becoming industrialized and evolving quickly [1] - The domestic AI chip era is emerging, with a complete industry chain established from advanced processes to packaging, and model upgrades by major companies like ByteDance, Alibaba, and Tencent [1] - Minsheng Securities emphasizes the trend towards domestic software and hardware localization amid major power technology competition, suggesting that domestic computing power will resonate with domestic software to build a robust localization ecosystem [1]

港股异动 | 芯片股延续近期涨势 上海复旦(01385)涨超4% 华虹半导体(01347)涨超3%

智通财经网· 2025-10-28 03:56

Group 1 - Chip stocks continue their recent upward trend, with notable increases in Shanghai Fudan (+4.71% to HKD 43.6), Huahong Semiconductor (+3.12% to HKD 89.2), Hongguang Semiconductor (+1.92% to HKD 0.53), and SMIC (+1.75% to HKD 84.25) [1] - Domestic technology assets are rapidly appreciating, particularly in core AI computing power assets, driven by significant investments in high-end AI computing that are becoming industrialized and rapidly iterating [1] - The domestic AI chip era is emerging, with a fully integrated domestic AI industry chain from advanced processes and packaging to model acceleration and upgrades by major companies like ByteDance, Alibaba, and Tencent [1] Group 2 - The trend towards the localization of core software and hardware is becoming increasingly prominent against the backdrop of major power technology competition, with domestic computing power expected to resonate with domestic software [1] - This synergy is anticipated to drive the construction of a localized ecosystem, contributing to the important goal of achieving high-level technological self-reliance and strength [1]

半导体股再度活跃 中芯国际连涨3日 政策叠加行业高景气

Ge Long Hui· 2025-10-28 03:14

Group 1 - Semiconductor stocks in Hong Kong are actively trading, with notable increases in shares such as SMIC rising by 3% and Fudan Microelectronics by 3.3% [1] - The Fourth Plenary Session's communiqué emphasizes high-quality development and significant improvements in technological self-reliance during the 14th Five-Year Plan period [1] - Global memory prices are on the rise, with Samsung and SK Hynix notifying clients of potential increases in DRAM and NAND contract prices by up to 30% in Q4 [1] Group 2 - The core driver for the continuous miniaturization of integrated circuit chips is lithography technology [1] - A research team from Peking University has successfully utilized cryo-electron tomography to analyze the three-dimensional structure and entanglement behavior of photoresist molecules in situ, leading to industrial solutions that significantly reduce lithography defects [1]

智通港股通持股解析|10月28日

智通财经网· 2025-10-28 00:32

Core Insights - The top three companies by Hong Kong Stock Connect holding ratios are China Telecom (71.16%), Gree Power Environmental (70.40%), and COSCO Shipping Energy (70.32%) [1] - In the last five trading days, the largest increases in holding amounts were seen in CNOOC (+2.948 billion), Pop Mart (+2.005 billion), and SMIC (+1.319 billion) [1] - The largest decreases in holding amounts were recorded for Hua Hong Semiconductor (-1.093 billion), Hang Seng China Enterprises (-603 million), and CSPC Pharmaceutical (-596 million) [2] Group 1: Hong Kong Stock Connect Holding Ratios - China Telecom (00728) has a holding ratio of 71.16% with 9.876 billion shares [1] - Gree Power Environmental (01330) has a holding ratio of 70.40% with 285 million shares [1] - COSCO Shipping Energy (01138) has a holding ratio of 70.32% with 911 million shares [1] Group 2: Recent Increases in Holdings - CNOOC (00883) saw an increase of 2.948 billion in holding amount, with a change of 14.69495 million shares [1] - Pop Mart (09992) experienced an increase of 2.005 billion in holding amount, with a change of 8.5892 million shares [1] - SMIC (00981) had an increase of 1.319 billion in holding amount, with a change of 1.59294 million shares [1] Group 3: Recent Decreases in Holdings - Hua Hong Semiconductor (01347) had a decrease of 1.093 billion in holding amount, with a change of -12.6364 million shares [2] - Hang Seng China Enterprises (02828) saw a decrease of 603 million in holding amount, with a change of -6.2396 million shares [2] - CSPC Pharmaceutical (01093) experienced a decrease of 596 million in holding amount, with a change of -7.65722 million shares [2]

智通港股通资金流向统计(T+2)|10月28日

智通财经网· 2025-10-27 23:34

Core Insights - The article highlights the net inflow and outflow of funds for various companies in the Hong Kong stock market, indicating significant movements in capital investment [1][2]. Net Inflow Summary - China Mobile (00941) leads with a net inflow of 1.131 billion, representing a 42.43% increase in investment [2]. - China National Offshore Oil Corporation (00883) follows with a net inflow of 979 million, showing a 28.62% increase [2]. - Pop Mart (09992) ranks third with a net inflow of 782 million, but its share price decreased by 9.36% [2]. Net Outflow Summary - Hua Hong Semiconductor (01347) experiences the highest net outflow at -1.018 billion, with a decrease of 22.36% [2]. - The iShares Asia 50 ETF (02800) has a net outflow of -795 million, reflecting a 6.53% decrease [2]. - Stone Pharmaceutical Group (01093) sees a net outflow of -488 million, with a 26.11% drop in investment [2]. Net Inflow Ratio Summary - GX Hangseng Technology (02837) has the highest net inflow ratio at 67.25%, with a net inflow of 14.7513 million [3]. - Tong Ren Tang (03613) follows with a net inflow ratio of 65.42%, amounting to 4.8958 million [3]. - Shenwei Pharmaceutical (02877) ranks third with a net inflow ratio of 54.29%, totaling 3.1420 million [3]. Net Outflow Ratio Summary - The Wisdom Hong Kong 100 ETF (02825) shows a net outflow ratio of -100.00%, with a total outflow of -5.972 million [3]. - China International Marine Containers (02039) has a net outflow ratio of -63.47%, amounting to -19.7122 million [3]. - Eagle Holdings (00041) follows with a net outflow ratio of -60.44%, totaling -5.7119 million [3].

港股通净买入28.73亿港元

Zheng Quan Shi Bao Wang· 2025-10-27 13:53

Core Points - The Hang Seng Index rose by 1.05% to close at 26,433.70 points on October 27, with a net inflow of HKD 2.873 billion through the southbound trading channel [1] - The total trading volume for the southbound trading was HKD 129.766 billion, with a net buy of HKD 2.873 billion [1] - In the Shanghai-Hong Kong Stock Connect, the trading volume was HKD 79.878 billion with a net buy of HKD 1.646 billion, while in the Shenzhen-Hong Kong Stock Connect, the trading volume was HKD 49.887 billion with a net buy of HKD 1.227 billion [1] Trading Activity - In the Shanghai-Hong Kong Stock Connect, the most actively traded stock was SMIC, with a trading volume of HKD 6.595 billion, followed by Alibaba and Xiaomi, with trading volumes of HKD 5.869 billion and HKD 4.542 billion respectively [1] - Tencent Holdings had the highest net buy amount of HKD 1.256 billion, closing with a price increase of 2.90% [1] - Alibaba had the highest net sell amount of HKD 1.204 billion, but its stock price still increased by 3.15% [1] Shenzhen-Hong Kong Stock Connect - In the Shenzhen-Hong Kong Stock Connect, Alibaba was also the most actively traded stock with a trading volume of HKD 4.648 billion, followed by SMIC and Xiaomi with trading volumes of HKD 4.008 billion and HKD 3.210 billion respectively [2] - The highest net buy was for Huahong Semiconductor at HKD 1.162 billion, with a closing price increase of 4.98% [2] - Alibaba again had the highest net sell amount of HKD 0.781 billion, with a closing price increase of 3.15% [2] ETF and Fund Activity - The Hang Seng Dividend ETF (Product Code: 159726) tracks the Hang Seng China Mainland Enterprises High Dividend Yield Index and has seen a 5-day increase of 2.76% [4] - The latest share count for the ETF is 28 million, with a net inflow of HKD 1.387 million [4]