CPIC(02601)

Search documents

中国太保:选举路巧玲为副董事长

Cai Jing Wang· 2025-10-31 12:27

Core Viewpoint - China Pacific Insurance (Group) Co., Ltd. has elected Lu Qiaoling as the vice chairman of its 10th board of directors, pending regulatory approval, with a term lasting until the current board's term ends [1] Group 1: Company Announcement - The board of directors of China Pacific Insurance has approved the election of Lu Qiaoling as the vice chairman [1] - The term of the newly elected vice chairman will commence upon the approval of the company's articles of association by regulatory authorities [1] Group 2: Lu Qiaoling's Background - Lu Qiaoling, born in March 1966, is currently a non-executive director at China Pacific Insurance and serves as a director at Huabao (Shanghai) Equity Investment Fund Management Co., Ltd. [2] - Lu has held various significant positions, including chief accountant at Hebei Petroleum and Chemical Supply and Marketing Corporation, and has extensive experience in auditing and finance within major state-owned enterprises [2] - Lu holds a master's degree and possesses senior accountant, certified public accountant, and auditor qualifications [3]

合赚4260亿,五大上市险企三季报详细解读

Xin Lang Cai Jing· 2025-10-31 10:49

Core Insights - The five major listed insurance companies in China reported a total operating income of 23,739.81 billion RMB for the first three quarters of 2025, representing a 13.6% increase compared to the same period in 2024. The net profit reached 4,260.39 billion RMB, a year-on-year growth of 33.54% [1][3] Group 1: Company Performance - China Life Insurance maintained its leading position in the life insurance sector with a premium growth of 25.9%, achieving a net profit of 1,678.04 billion RMB, up 60.5% [3][4] - Ping An Insurance reported an operating income of 8,329.40 billion RMB, with a net profit of 1,328.56 billion RMB, reflecting an 11.5% increase [3][4] - China Pacific Insurance achieved a net profit of 457 billion RMB, a growth of 19.3%, with an operating income of 3,449.04 billion RMB [3][4] - New China Life Insurance saw a significant net profit increase of 58.0%, totaling 328.57 billion RMB, with a premium growth of 28.3% [3][4] - China Property & Casualty Insurance reported a net profit of 468.22 billion RMB, up 28.9%, with an operating income of 5,209.90 billion RMB [3][4] Group 2: Premium Growth and Channels - The life insurance sector is experiencing a recovery, with total premiums and new business premiums showing double-digit growth across multiple companies [4][6] - China Life achieved total premiums of 6,696.45 billion RMB, a 10.1% increase, with renewal premiums growing by 10.0% [4][6] - New China Life reported a 59.8% increase in first-year premiums for long-term insurance [4][6] - The bancassurance channel has become a significant growth driver, with China Pacific Insurance's bancassurance premiums reaching 583.10 billion RMB, up 63.3% [6][7] Group 3: Investment Performance - All five companies highlighted significant increases in investment income as a key driver of profit growth, benefiting from a recovering capital market [10][11] - China Life's total investment income reached 3,685.51 billion RMB, a 41.0% increase, with an investment return rate of 6.42% [10][11] - Ping An's investment portfolio exceeded 6.41 trillion RMB, with a non-annualized comprehensive investment return rate of 5.4% [10][11] - China Property & Casualty Insurance reported total investment income of 862.50 billion RMB, a 35.3% increase [10][11] Group 4: Asset Growth - The total assets of the five major insurance companies reached 27.82 trillion RMB, an 8.3% increase from the end of 2024 [12][13] - Ping An's total assets amounted to 13.65 trillion RMB, a 5.3% increase, while China Life's total assets reached 7.42 trillion RMB, growing by 9.6% [12][13]

中国太保:第三季度净利润178.15亿元,同比增长35.2%

Ge Long Hui A P P· 2025-10-31 10:06

Core Viewpoint - China Pacific Insurance reported strong financial results for the third quarter and the first three quarters of the year, indicating robust growth in both revenue and net profit [1] Group 1: Third Quarter Performance - The company achieved a revenue of 144.408 billion yuan in the third quarter, representing a year-on-year increase of 24.6% [1] - Net profit for the third quarter reached 17.815 billion yuan, showing a year-on-year growth of 35.2% [1] Group 2: Year-to-Date Performance - For the first three quarters, the company reported a total revenue of 344.904 billion yuan, which is an 11.1% increase compared to the same period last year [1] - The net profit for the first three quarters was 45.7 billion yuan, reflecting a year-on-year growth of 19.3% [1]

中国太保(02601) - 2025 Q3 - 季度业绩

2025-10-31 09:50

Financial Performance - For Q3 2025, the company reported operating revenue of RMB 144,408 million, an increase of 24.6% compared to Q3 2024[6] - The total profit for Q3 2025 reached RMB 27,887 million, reflecting a significant growth of 85.7% year-over-year[6] - Net profit for Q3 2025 was RMB 17,815 million, up by 35.2% from the same period last year[6] - The net profit excluding non-recurring gains and losses for Q3 2025 was RMB 17,868 million, representing a 35.6% increase year-over-year[6] - The basic earnings per share for Q3 2025 was RMB 1.85, up by 35.2% compared to Q3 2024[6] - The company reported a net profit of RMB 34.57 billion, reflecting a year-on-year growth of 19.3%[14] - Net profit attributable to shareholders of the parent company was RMB 45,700 million, up 19% from RMB 38,310 million in the previous year[31] - Net profit for the first nine months of 2025 was RMB 11,875 million, up 12.94% compared to RMB 10,514 million in the same period of 2024[38] Revenue and Premiums - In the first three quarters of 2025, the company achieved insurance service revenue of RMB 216.894 billion, a year-on-year increase of 3.6%[14] - The scale premium for the life insurance segment reached RMB 263.863 billion, up 14.2% year-on-year[19] - The bancassurance channel achieved scale premiums of RMB 58.310 billion, a significant increase of 63.3% year-on-year[19] - The company’s property insurance segment reported a premium income of RMB 160.206 billion, a slight increase of 0.1% year-on-year[22] - The motor vehicle insurance premium income was RMB 80.461 billion, reflecting a year-on-year growth of 2.9%[22] Assets and Liabilities - The company's total assets as of September 30, 2025, were RMB 3,077,640 million, an increase of 8.6% from the end of 2024[6] - Total assets as of September 30, 2025, amount to RMB 3,077,640 million, up from RMB 2,834,907 million as of December 31, 2024[30] - Total liabilities as of September 30, 2025, are RMB 2,761,927 million, compared to RMB 2,516,426 million at the end of 2024[30] - Insurance contract liabilities rose to RMB 2,463,651 million from RMB 2,229,514 million year-over-year[30] - The company's equity attributable to shareholders decreased to RMB 284,185 million from RMB 291,417 million as of December 31, 2024[30] Cash Flow and Investments - The net cash flow from operating activities for the first nine months of 2025 was RMB 169,397 million, a 31.6% increase year-over-year[9] - Cash inflow from investment activities totaled RMB 570,493 million, while cash outflow was RMB 729,181 million, resulting in a net cash flow of RMB -158,688 million from investment activities[34] - The company issued bonds, generating cash inflow of RMB 14,242 million, contributing to its financing activities[34] - Cash flow from investing activities generated a net inflow of RMB 13,295 million in the first nine months of 2025, compared to RMB 10,339 million in the same period of 2024[40] Investment Performance - The company’s investment assets totaled RMB 2,974.784 billion, an increase of 8.8% from the previous year[23] - The total investment return rate was 5.2%, up 0.5 percentage points year-on-year[23] - Net investment return rate for the nine months ended September 30, 2025, is 2.6%, a decrease of 0.3 percentage points compared to 2024[24] - Investment income surged to RMB 39,228 million, a significant increase from RMB 14,595 million in the same period last year[31] - Investment income increased to RMB 11,242 million in the first nine months of 2025, a 16.86% rise from RMB 9,617 million in the same period of 2024[38] Shareholder Information - The company recorded a total of 102,000 shareholders at the end of the reporting period, with 98,287 being A-share shareholders[11] Other Financial Metrics - The weighted average return on equity for Q3 2025 was 6.3%, an increase of 1.4 percentage points compared to the previous year[6] - The company maintained a comprehensive underwriting cost ratio of 97.6%, a decrease of 1.0 percentage point year-on-year[20] - The company reported a fair value change gain of RMB 870 million in the first nine months of 2025, compared to RMB 790 million in the same period of 2024[38] - The company experienced a decrease in foreign exchange losses, reporting a loss of RMB 111 million compared to RMB 254 million in the previous year[31] - The company emphasizes the importance of monitoring solvency information, which is available on various stock exchange websites[25]

美银证券:升中国太保目标价至41.2港元 重申“买入”评级

Zhi Tong Cai Jing· 2025-10-31 09:13

Core Viewpoint - Bank of America Securities has raised its earnings forecast for China Pacific Insurance (601601) by 12% for this year, citing an increase in investment return predictions [1] Summary by Sections Earnings Forecast - The earnings estimates for 2026 to 2027 have been adjusted upward by 1% to 4% [1] - The target price for Hong Kong stocks has been increased from HKD 40.4 to HKD 41.2, maintaining a "Buy" rating [1] - The target price for A-shares has been raised from RMB 35.2 to RMB 35.9, continuing a "Underperform" rating [1] Financial Performance - China Pacific Insurance reported a 19% year-on-year increase in net profit for the first nine months [1] - The profit for the third quarter alone saw a year-on-year growth of 35% [1] - The after-tax operating profit reached RMB 28.5 billion, reflecting a 7% year-on-year increase [1] Dividend Expectations - The company's dividend is expected to increase by 12% year-on-year, as it is dependent on profit and after-tax operating profit [1]

美银证券:升中国太保(02601)目标价至41.2港元 重申“买入”评级

智通财经网· 2025-10-31 09:12

Core Viewpoint - Bank of America Securities has raised its earnings forecast for China Pacific Insurance (02601, 601601.SH) by 12% for this year, citing an increase in investment return predictions [1] Summary by Category Earnings Forecast - The earnings estimates for 2026 to 2027 have been increased by 1% to 4% [1] - The target price for Hong Kong shares has been adjusted from HKD 40.4 to HKD 41.2, maintaining a "Buy" rating [1] - The target price for A-shares has been raised from RMB 35.2 to RMB 35.9, continuing a "Underperform" rating [1] Financial Performance - China Pacific Insurance reported a 19% year-on-year increase in net profit for the first nine months [1] - The profit for the third quarter alone saw a year-on-year growth of 35% [1] - The after-tax operating profit reached RMB 28.5 billion, reflecting a 7% year-on-year increase [1] Dividend Expectations - The company's dividend is expected to increase by 12% year-on-year, as it is dependent on profit and after-tax operating profit [1]

中国太保(601601):投资驱动业绩增长

HTSC· 2025-10-31 08:48

Investment Rating - The report maintains a "Buy" rating for the company [7][5] Core Insights - The company achieved a net profit of RMB 17.815 billion in Q3 2025, representing a year-on-year growth of 35%, driven by strong equity investment performance and significant growth in insurance service performance [1] - The annualized total investment return for the first three quarters was 5.2%, an increase of 0.5 percentage points year-on-year, while the operating profit after tax (OPAT) for Q3 increased by 8.2% year-on-year, showing an improvement from the first half of the year [1][4] - The new business value (NBV) for life insurance increased by 29.4% year-on-year in Q3, indicating robust growth, while the combined ratio (COR) for property insurance improved to 97.6%, a decrease of 1 percentage point year-on-year [1][2][3] Summary by Sections Life Insurance - The NBV for life insurance showed a year-on-year increase of 29.4% in Q3, slightly down from 32.3% in the first half of 2025. New single premiums decreased by 3.7%, but the NBV profit margin improved by approximately 7.2 percentage points [2] - The agent channel saw a 13.5% year-on-year growth in new single premiums, indicating a recovery from previous declines. The company expects a 32% year-on-year growth in NBV for 2025 [2] Property Insurance - Property insurance premiums decreased by 1.2% year-on-year, primarily due to the company's strategic reduction of high COR businesses. The COR for the first three quarters was 97.6%, reflecting improved underwriting performance [3] - The company anticipates a COR of 97.7% for 2025, with expectations of further improvements following the implementation of a new non-auto insurance policy [3] Investment Performance - The report highlights a significant increase in investment performance, with insurance service performance rising by 54% year-on-year and investment performance increasing by 84% year-on-year in Q3 [4] - The non-annualized net investment return for the first three quarters was 2.6%, a decrease of 0.3 percentage points year-on-year, while the total investment return was 5.2%, reflecting favorable equity investments [4] Profit Forecast and Valuation - The earnings per share (EPS) forecasts for 2025, 2026, and 2027 have been adjusted to RMB 5.50, RMB 5.64, and RMB 6.20 respectively, reflecting increases of 13%, 14%, and 15% [5] - The target price remains unchanged at RMB 47 for A-shares and HKD 42 for H-shares, based on discounted cash flow (DCF) valuation methods [5]

保险板块10月31日跌2.14%,中国太保领跌,主力资金净流出4.98亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-31 08:42

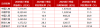

Core Points - The insurance sector experienced a decline of 2.14% on October 31, with China Pacific Insurance leading the drop [1] - The Shanghai Composite Index closed at 3954.79, down 0.81%, while the Shenzhen Component Index closed at 13378.21, down 1.14% [1] Insurance Sector Performance - China Life Insurance (601628) closed at 43.97, down 0.92%, with a trading volume of 218,700 shares and a transaction value of 970 million [1] - Ping An Insurance (601318) closed at 57.83, down 1.40%, with a trading volume of 572,500 shares and a transaction value of 3.33 billion [1] - China Property & Casualty Insurance (616109) closed at 8.44, down 2.99%, with a trading volume of 1,056,100 shares and a transaction value of 902 million [1] - New China Life Insurance (601336) closed at 67.81, down 4.36%, with a trading volume of 323,900 shares and a transaction value of 2.23 billion [1] - China Pacific Insurance (601601) closed at 35.50, down 5.96%, with a trading volume of 861,600 shares and a transaction value of 3.10 billion [1] Fund Flow Analysis - The insurance sector saw a net outflow of 498 million from main funds, while retail funds experienced a net inflow of 231 million [1] - Speculative funds had a net inflow of 267 million [1]

中国太保(601601):个险新单增速逐季改善,分红险占比持续提升

KAIYUAN SECURITIES· 2025-10-31 06:19

Investment Rating - The investment rating for China Pacific Insurance (601601.SH) is maintained at "Buy" [2][6] Core Insights - The report highlights a sequential improvement in the growth rate of individual insurance new policies, with the proportion of participating insurance continuing to rise [1][7] - For the first three quarters of 2025, the company's net profit attributable to shareholders reached 45.7 billion, a year-on-year increase of 19.3%, significantly expanding from the mid-year growth rate of 11.0% [6][8] - The report predicts that the new business value (NBV) will grow by 30.3%, 16.8%, and 15.2% for the years 2025-2027, with corresponding embedded value (EV) growth rates of 7.1%, 9.7%, and 10.6% [6][9] Financial Performance Summary - The total market capitalization of China Pacific Insurance is approximately 363.17 billion, with a circulating market capitalization of 258.4 billion [3] - The company achieved a scale premium of 263.9 billion in life insurance, a year-on-year increase of 14.2%, and an NBV of 15.4 billion, a year-on-year increase of 31.2% [7] - The investment assets of the group reached 2.97 trillion at the end of the third quarter, with a net investment yield of 2.6% and a total investment yield of 5.2% [8][9] Valuation Metrics - The current price-to-embedded value (P/EV) ratios for 2025-2027 are projected to be 0.60, 0.55, and 0.50 respectively [6][9] - The report also indicates a current dividend yield of 2.86% [6]

中国太保前三季总投资收益率5.2% 管理层:抓住了成长股机会

Di Yi Cai Jing· 2025-10-31 04:38

Core Viewpoint - China Pacific Insurance (CPIC) reported a significant increase in net profit for the first three quarters of the year, driven by favorable capital market conditions and growth in insurance services [1][2]. Financial Performance - CPIC's net profit attributable to shareholders grew by 19.3% year-on-year in the first three quarters, with a remarkable 35.2% increase in the third quarter [1]. - The annualized net investment return rate for CPIC was 2.6%, a decrease of 0.3 percentage points year-on-year, while the annualized total investment return rate improved to 5.2%, an increase of 0.5 percentage points [2]. - The comprehensive cost ratio for CPIC's property insurance segment was 97.6%, down by 1.0 percentage point year-on-year [3]. Business Segments - CPIC's life insurance segment achieved a premium income of 263.863 billion yuan, reflecting a year-on-year growth of 14.2%, with new business value increasing by 7.7% [3]. - The bank insurance channel saw a substantial growth of 63.3% in premiums, significantly outperforming the agency channel, which grew by only 2.9% [3]. - The contribution of state-owned banks to CPIC's bank insurance premiums increased from 22% last year to 36% this year, indicating a strategic shift towards collaboration with state-owned banks [3].